EA Development Procedure ~ Build logic with the advantages of indicators ~ Part 6

Previously we tested a breakout method of Bollinger Bands, but on the 5-minute chart we could not find an edge with the logic alone.

From here, let's verify the edge of the Bollinger Bands reversal strategy.

The entry logic is“A reversal trading method that buys or sells when the candlestick breaks through the Bollinger Band on the opposite side”.

Exit is described as before“randomly close under certain conditions”.

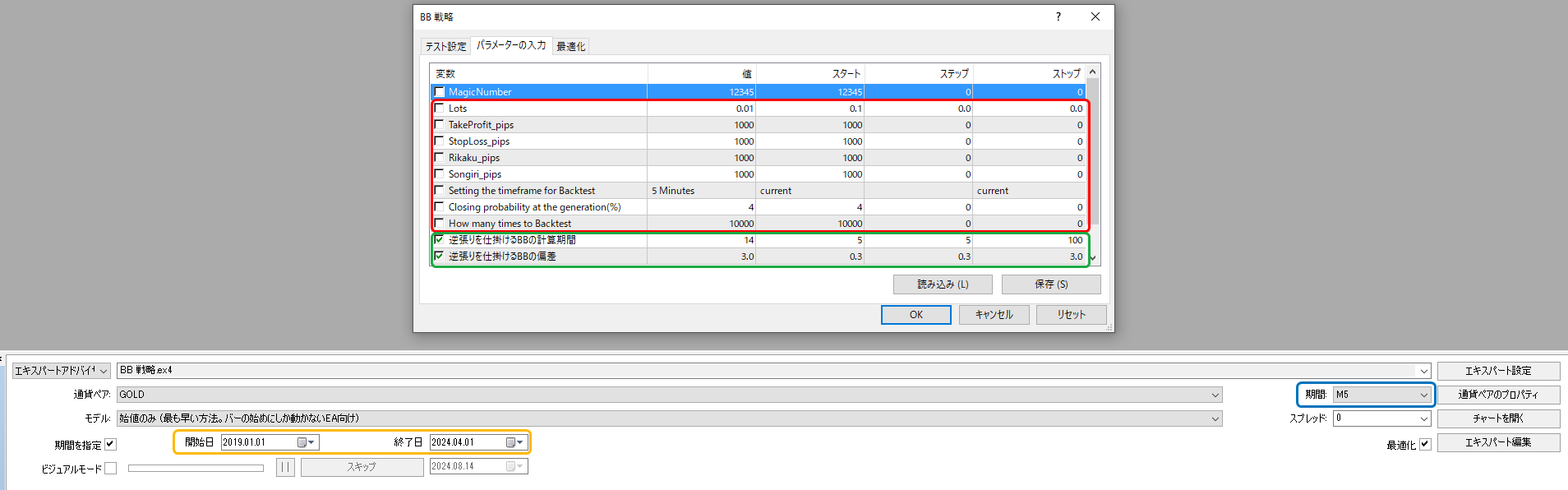

The parameters are as follows.

Take profit and stop loss are fixed at 1000 pips

Timeframe is the 5-minute chart (we will test various timeframes later)

Set to randomly close with a 4% probability when a new bar is generated for an open position

Repeat this test 10,000 times

Bollinger calculation period ranges from 5 periods up to 20 periods in steps of 5

Band deviation from 0.5σ to 3σ in 3 steps of 0.5σ each, totaling 6 options

In total, backtesting under 120 condition combinations

Testing period is the recent 5 years for a quick mock test (January 2019 to March 2024)

Spread is set to 0 for now as the aim is to confirm the strategy’s edge

We will run the test with this.

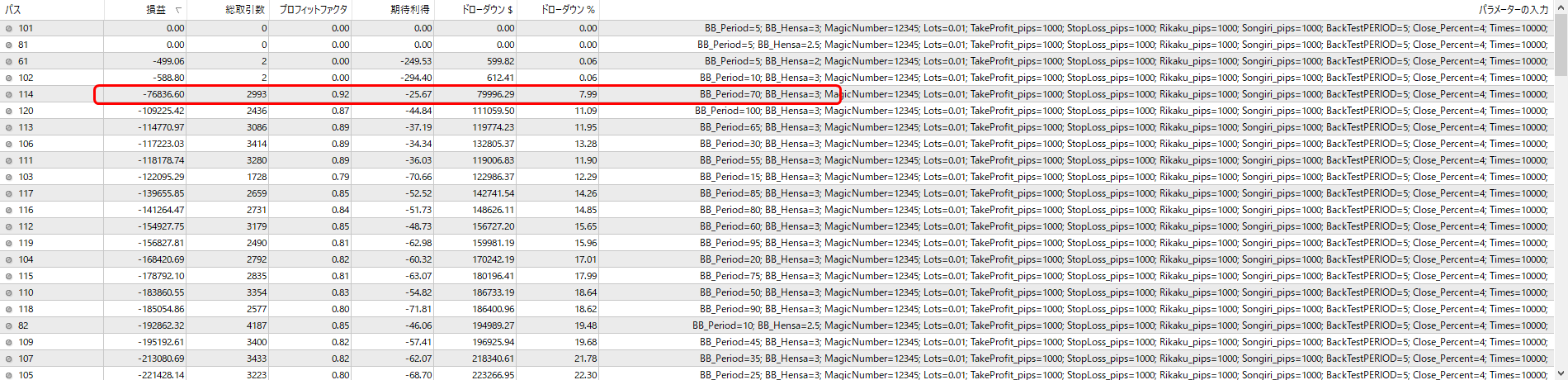

First backtest result

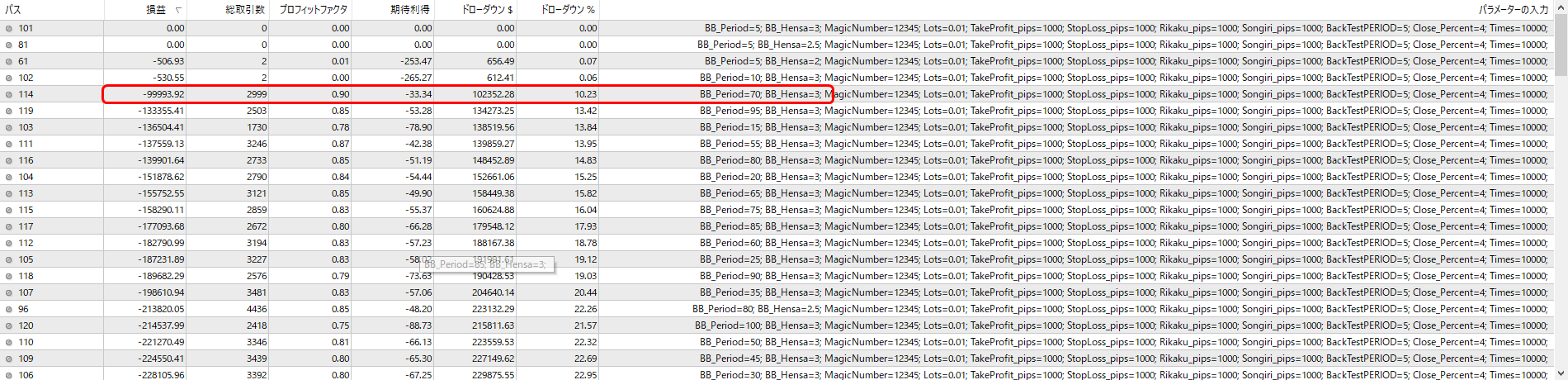

Second day backtest result

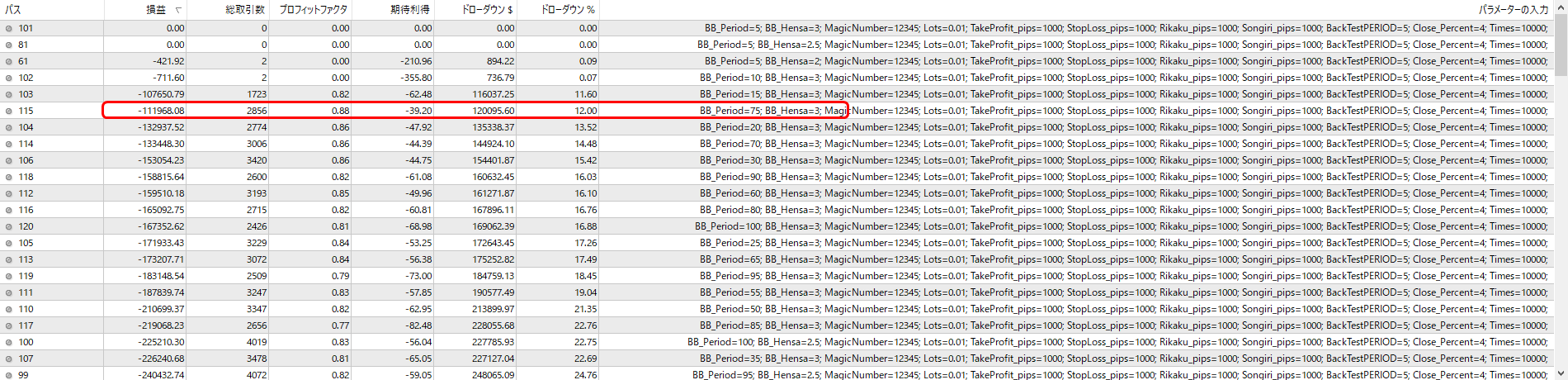

Third backtest result

In all scenarios the reversal is repeated, so results are mostly negative, but some relatively good numbers appear.

Periods with around 70–75 and deviation of 3 show favorable trade counts and profit, so next time I will chase those figures.