EA Development Procedure ~ Build logic with the superiority of indicators ~ Part 2

The parameter settings configured last time are as follows.

Take profit and stop loss TP/SL are fixed at 1000 pips

Time frame is 5 minutes (we will test various aspects on this time frame later)

Configured to randomly take profit with a 4% probability when a new bar is generated for held positions

Repeat this test 10,000 times

Calculation period of Bollinger Bands ranges from 5 periods in increments of 5 up to 100 periods, totaling 20 options

Band deviation from 0.5σ in increments of 0.5σ up to 3σ for 6 options

Thus backtesting is performed on 120 different conditions

Test period is a short-cut for time, using the most recent 5 years (January 2019 to March 2024) for provisional testing

※ To reduce insolvency risk, the lot size has been reduced from 0.1 to 0.01

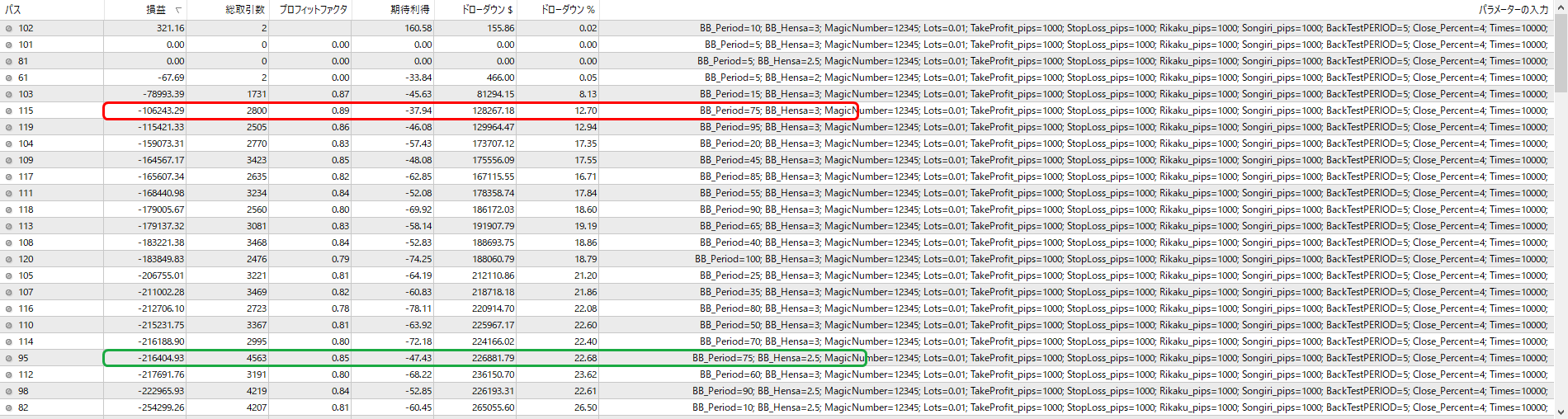

The following are the results of the first test.

Since the results vary slightly due to random settlements, let's run it about three times in total.

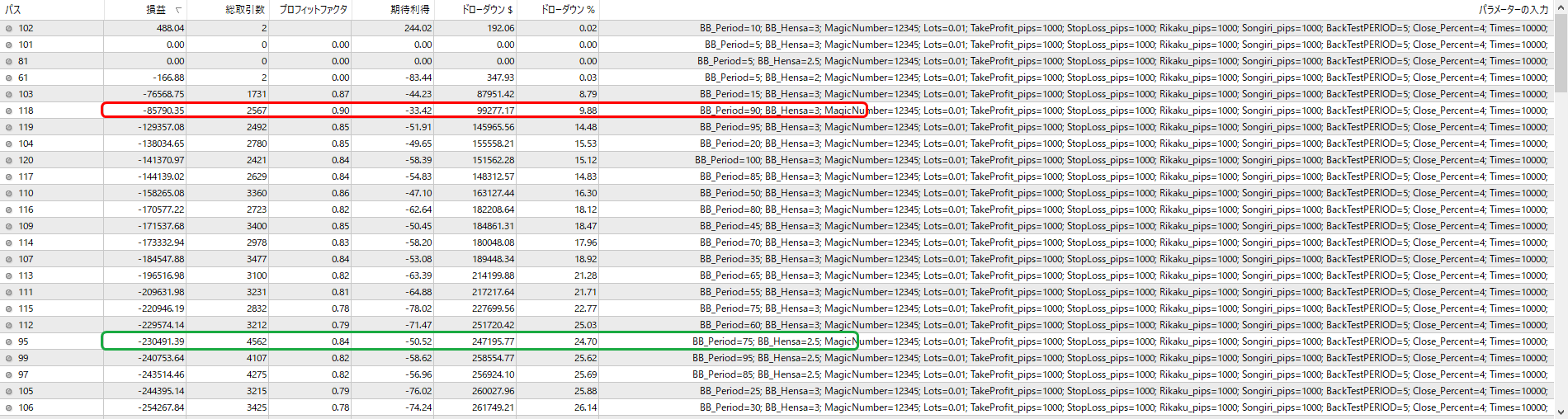

This is the second time.

Let's also look at the third and final run.

When comparing, 99% end in the negative, but near the parameters encircled in red, PF remains above 0.85 in every run.

Additionally, near the parameters encircled in green, PF is above 0.8, but since the annual trading average is close to 1000 trades, it is a noteworthy figure.

Also, although this looks like a very demanding task,the required time is about 5 minutes.

By incorporating a program that randomizes settlements, it becomes easy to examine the advantage focused only on entries.

Next time, let's actually backtest using the values around this red and green frame.