"The Appeal of Diversified FX Investment: Profit Seeking and Risk Diversification (Leverage Part 3: Strategy and Risk Management)"

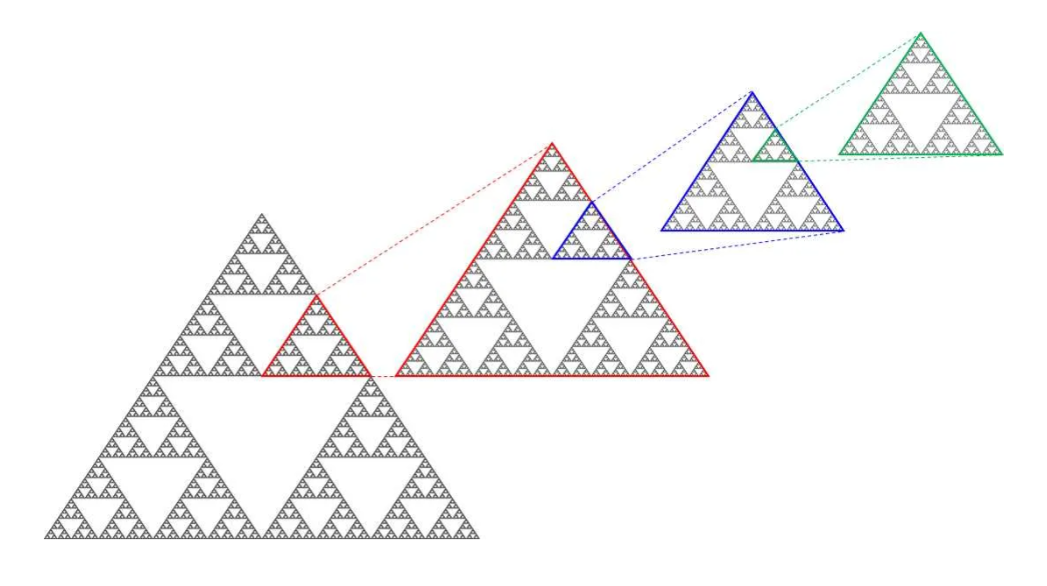

Hello, this is Black Cat 5×5.At the end of the previous article, I explained the relationship between fractal structure and volatility. This time, I will actually verify it.

*What we will verify is the height of volatility, focusing only on the width during sharp rises and falls.

First, a recap of what I wrote last time.

On short timeframes such as 1-minute and 5-minute charts, observing fast-moving movements is common. Also, moves of 300-400 pips on the 1-hour chart are not rare.

Furthermore, when a major crash occurs and the downward trend continues on the 4-hour and daily charts, that movement is predicted to go strongly in one direction.(It is possible that 1000 pips can vanish in an instant due to geopolitical risks or natural disasters, though).

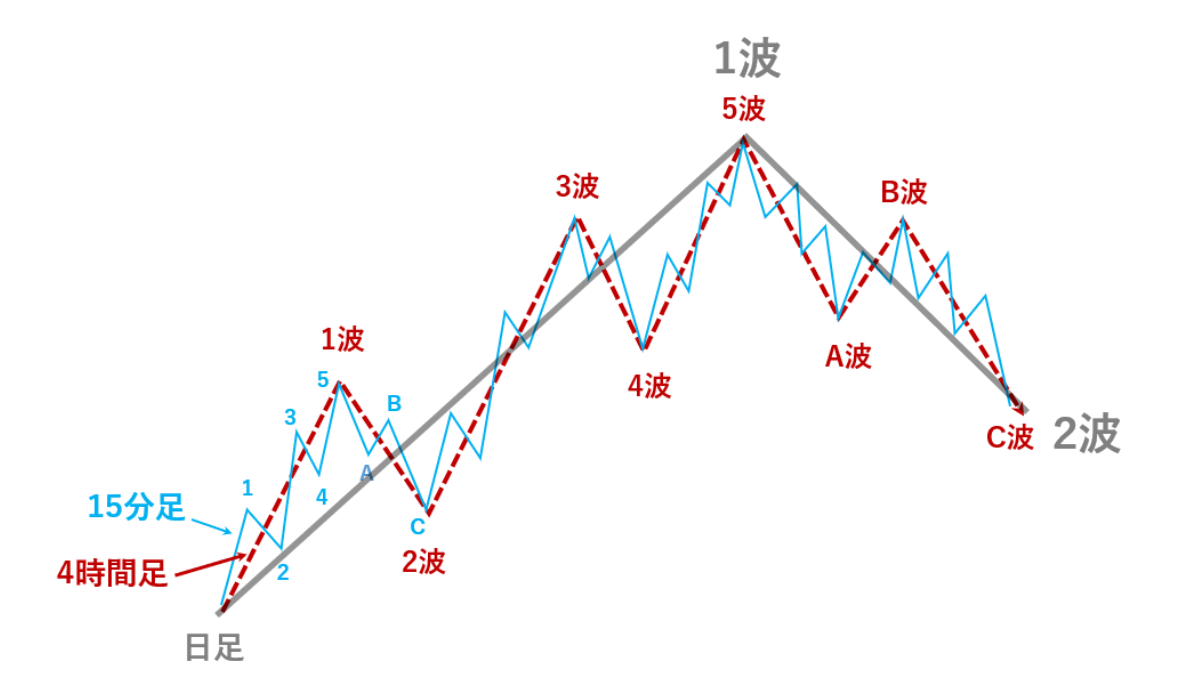

*For example,rapid fluctuations on the 1-minute or 5-minute charts may appear in the same pattern on the 1-hour or 4-hour charts, so it is possible to predict long-term movements from short-term movements.

We found that fractal structure is very effective in explaining volatility, so we would like to actually verify that fractal structure.

Actual:(The images were gathered from the internet.)We are grateful.Thank you.)

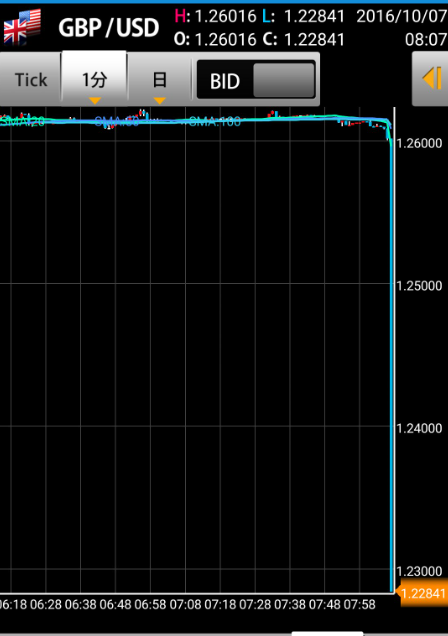

On July 12, 2024, movement from around 159.400 to around 157.700 was recorded on the 1-minute chart.

Also, on May 2, 2024, movement from around 153.200 to around 151.100 occurred.

Furthermore, there was a price swing of about 300 pips in a single move.

On the 5-minute chart,

In short, I think 1-minute and 5-minute charts can be considered similar.

This time, on the 1-hour chart, we could see volatility where the dollar/yen moved as much as 400 pips, and since on the 1-minute chart it occasionally moves about 300 pips in an instant,the fractal structure has been proven.

With the 1-hour chart, it seems possible to move even more. If we go back in history, we should be able to know how far it could move in an instant. Haha.(For those who scalp on 1-minute or 5-minute charts, I also considered how to handle stop losses, which I will include at the end.)

*Generally, knowing in advance the typical price range on 1-minute and 5-minute charts, and the amount of price movement when breaking above or below typical moving averages on 10- and 15-minute charts plus 30-minute charts, can be a strong ally for strategy.This time, on the 1-minute chart, we can foresee that300 pips or more can occurso,the importance of stop-losses is clear for risk management in all-axis trading.I think.

--------------------------------------------------------------

「If you cannot manage risk properly,the effect of diversificationwill not be fully realized. For example, you might bear a loss of 500 pips without setting a stop, or require a margin call.

Leverage10,000 times can enable trading of 1,000,000 yen with 1,000 yen of margin. In other words, there is a large cushion, so proper stop losses should be employed, right? (It means you could deposit 5000 yen or 10,000 yen as well.)

Also, even with a 25x leverage, since there is margin cushion, it is important to implement proper stops. (It means depositing 50k or 100k as well.)」

【In FX, you deposit a small amount (margin) into an account, use it as collateral,use leverage for large trades, and trade large amounts.

For example,If you deposit 1000 yen and use leverage of 1000x,you can trade 100,000 yen (0.01 lots = 1,000 units), butforced stop-out occurs within 100 pips, making it very risky. Therefore, many people trade with at least 5,000 yen, if not 10,000 yen.

That is why“capital management” and making stops is important. If you have a trading volume of 1,000,000 yen, you should“stop out appropriately before losing everything”.

(Holding 1 lot (= 100,000 units)

→you can trade 1,000,000 yen with 1000x leverage

However,the stop-out occurs within less than 1 pip, so funds can disappear almost instantly. It is practically impossible to trade with such a position.)

If you cannot do that, you probably cannot manage your account.

In fact, I think your mind is focused only on profit.

And the moment you incur a loss, you stop managing (on social media you see images of accounts going from 100,000 to zero with 25x leverage, and now 500,000 went to zero, etc.). When it declines, you do nothing—there is no point in trading FX like that.

Placing stop losses can prevent forced liquidations or margin calls.

If you cannot manage, the issue may be the trade size. If you have 100,000 yen, plan for profits of around 10,000–30,000 yen and switch to a method that allows a stop loss around 3–5,000 yen.

Diversification also allows you to distribute currency pairs. You can add positions at 5 pips after a turning point (both profit-taking can be diversified).

If you have two currency pairs you want to hold, say USDJPY and GBPUSD, you might not know which is long or short, or whether to keep them in the same direction, but distributing across multiple currency pairs reduces risk. It is preferable to diversify by keeping smaller lot sizes.

If you choose USDJPY and EURUSD, you would normally hold both long and short, but by trading around events and not entering at the same time, you can diversify risk.

FX also has a swap threefold day. Do not ride it blindly; instead, observe the chart direction and aim to hold positions when the crowd is in the other direction.If you want to ride swaps, you should consider the market’s direction and time your entries when the crowd has moved into a position that becomes unprofitable.

Movements at Economic Indicator Releases and Trading Strategies

Price fluctuations at economic indicator releases are often contained within the one-hour or four-hour Bollinger bands. Therefore, it is important to anticipate the Bollinger band range on the hourly chart in advance.

If the price breaks the Bollinger band, a practical rule is to anticipate moves within the four-hour Bollinger band range as the next target. Checking these points in advance helps you respond calmly to sharp moves and makes entry, take-profit, and stop-loss judgments easier.

Thus, it is crucial to prepare multiple scenarios in advance and have flexible responses to market movements.

Smart trading strategies using swap points

When considering trading costs, spreads and swap points are also important. On days like Swap Point Triples Day, there is a marked skew in market positions. For example, long positions usually gain triple swaps, while short positions incur triple negative swaps, so many traders tend to position in one direction to chase swaps.

However, if you want to hold that currency pair long, you should think about moving against the crowd. Look at the chart first, and after many have taken swaps positions, wait for a timing when those positions turn unfavorable. The key is to time your entry in the same direction as the crowd after it has moved, or to anticipate a reversal and take the opposite position early.In practice, “enter in the same direction after the crowd has moved in” or “predict a reversal and take the crowd’s opposite position first” is critical to judge calmly.

This is exactly a strategy akin to playing catch-up and winning, leading to smarter trades.Rather than chasing swaps, prioritize chart movements and take the opposite position when the crowd has moved in, so you can still profit even if swap points aren’t favorable. This is the exact strategy of “winning by waiting,” and leads to smart trading that follows the market flow.

When divergences occur, you often see a slowdown in momentum and a sign of trend change or reversal. My analysis suggests the main guide for USDJPY’s pullbacks on the hourly chart is about 38 pips–45 pips.

A Comprehensive Guide to FX Strategies

In FX trading, where to enter and where to take profit or place a stop-loss are the core of the strategy. To succeed in FX, it is important to identify the strategy that fits you best. There are many trading strategies devised by various traders, but there is no universal strategy that fits everyone.

For example, when aiming for scalping, waiting for the New York market open can be effective. Conversely, for swing trading, you should follow the major trend and use technical analysis to identify proper entry points.

Characteristics of markets and strategies

✅

When the NY market opens, many traders participate and liquidity increases. In particular, immediately after the market opens, liquidity is high and prices move significantly, making it a good time for scalping.

✅

The Tokyo market has relatively lower liquidity, but prices move in a stable manner. Pairs related to the Japanese Yen (USD/JPY, EUR/JPY, etc.) are considered suitable for scalping.

Depending on your trading style, your preferred time frame and position size will differ, so it is important to find a strategy that suits you.

Representative Trading Strategies

1. Scalping

- Uses mainly 1-minute and 5-minute chartsand trades it many times in a short period

- Requires quick decision-making and instant judgment

- Suitable for traders who can focus on short-term price movements

2. Candlestick-based Trading

Trading based on candlestick shapes and wicks uses specific patterns to determine entry points and price direction.Representative patterns

- Representative chart patterns

Using these patterns helps identify market flows and signs of reversals, enabling more precise entries.

3. Line Trading

In line trading, strategies often aim at channel or horizontal line breaks. Many traders seek entry when key price levels break.

Points traders should consider

When building FX strategies, three points are especially important:

★ Time of trading (time)

★ Frequency of trading opportunities

★ Distance to take profits (risk-reward ratio)

Summary

FX strategies depend on the market, time, and method you trade; the key is to choose what suits you.Every trading style has its own advantages and disadvantages, so it is important to establish your own strengths.

How to construct a trading strategy with an “equal thinking” approach

Finally, I would like to discuss the concept of equality in relationships.

Simply connect things with “= (equals)” and think about them.

Using this approach, I will continue the discussion.

If you have been trading FX for 20 years, what would you equate as equal?

✅20 years in FX = you know methods = your trading accuracy is high

✅Having traded for a long time = you have not exited due to large losses = you can manage funds

✅Veterantrader = risk management is thorough = low bankruptcy risk

There are endless equalities you can connect.

On FX strategies and risk management, consider the equivalence.

□ “Not cutting losses” = “risk management is not done”(Risk concept)

□ “Using high leverage and increasing position size” = “risk also increases”(Impact of leverage and risk management)

□ “Trends are strong” = “tend to move in one direction”(Market characteristics)

□ “Doubling down” = “losses can grow like a snowball”(Risk management)

□ “Low margin maintenance” = “more likely to be liquidated”(Capital management)

□ “Clearly defined take-profit lines” = “protects capital long term” (risk management)

□ “Keep margin maintenance high” = “less likely to be liquidated”(capital cushion)

□“Clearly defined take-profit lines” = “consistently secure profits”(profit management)

□ “Enter on different timeframes” = “avoid short-term noise and target big trends”(timeframe diversification)

□“Take-profit with risk-reward in mind” = “increase profits efficiently”(trading strategy)

There are endless such equalities you can connect.

I believe these align with the content published so far.

✙Importance of stop-lossKey to trading success: why professionals strictly implement stop-losses

☆魅力 of FX diversification investment (leverage edition)

Part 1: Fundamentals“Attractiveness of FX diversification investment: safety and profit expansion (Leverage Edition Part 1: Fundamentals)”

Part 2: Practical Application“FX diversification investment: stable income and risk control (Leverage Edition Part 2: Practical Application)”

Part 3: Strategy and Risk Management“FX diversification investment’s appeal: pursuing profits and risk diversification (Leverage Edition Part 3: Strategy and Risk Management)”

One more time, I’d like to emphasize.

To succeed in FX,identify a strategy that suits you. Different traders require different methods, and there is no universal method that fits all.

Deciding trading strategies

- Trading times (market liquidity)(Consider liquidity)

- Frequency of trading opportunities(Scalping vs. Swing)

- Profit and loss balance(Manage risk-reward)

Build the foundation of your strategy

Not only FX techniques, but also the overall strategy of your account is important. Currency pair selection, understanding correlations, and proper risk management all contribute to effective trading as part of the strategy.

Putting labels like “(Leverage Edition)” on each topic reflects how appealing and essential leverage is in FX trading.It is indispensable. Without it, starting with FX is difficult. Leverage allows start with less capital, and increasing leverage expands trading tolerance and makes it easier to adjust position sizes (and stop losses as well).With high leverage, you can maintain more flexible exposures. Even trailing take-profit can be used.

(Opening accounts with and without leverage and actually testing what amount of funds is easier for you is important. If you continue with profitable trades, your capital will gradually grow. However, since leverage changes risk management and capital growth dynamics, you should understand how strategic approaches vary.) Understood.

*Details

↑ ↑ ↑ ↑ ↑

That covers Part 3.

At the very end, I think the “equal thinking” is important, so I’ll emphasize it once more.

The essence of FX

1. The importance of having a proven trading logic (including probabilities)

The most important thing in learning FX isto have a proven (probabilistic) trading logic.

For example, the probability of rolling a 1 with a die is 1/6. Sometimes 1s come in succession, but in the long run, it converges to the probability.

*Similarly, if a trading method, based on past data, has an 85% chance of profitability, repeating this method increases the likelihood of long-term profits.

Probabilityis the degree to which a particular event is likely to occur.

Establishmentmeans building something solid.

Trading based on a proven logic allows you to trade objectively without being swayed by emotions. When combined with risk management and stop-loss, you can minimize losses and systematically accumulate advantageous trades.

For example, recall the mountaineering analogy from Part 1. While walking a trail, you don’t forcedly take a shortcut up a steep slope just because it’s shorter.

Similarly, someone who has only basic English knowledge should not try the advanced English exam. The equivalent in FX is placing overly large lots in a volatile market.

If a market suddenly moves 10 yen due to a geopolitical event, the rate will fluctuate greatly. Holding a position in such a situation is extremely risky and should be avoided.In a condition of low liquidity and slippage, entries, take-profits, and stops may not execute as intended.There is no reason to hold a position in such a market. If you remained unscathed, wait for the movement to settle and resume trading when participants return. Notably, during Obon, Christmas, or New Year holidays, market participants drop, and sudden moves are more likely, so be careful.

2. The importance of environmental awareness

Environmental awareness is crucial to determine the success of trading, and it is not an exaggeration to say so.

Having standardized environmental recognition helps increase trading success probability.

Survival allows you to continue seeking the next opportunity.

Even FX beginners typically look at charts to perform environmental recognition. Whatever method you use, entering in an appropriate environment is critical.

It’s rare for someone to decide up or down without looking at the chart.

Typically you determine entry points and target pips before trading. If the market moves contrary to expectations, you perform environmental recognition again and decide whether to re-enter.

To perform environmental recognition, you must understand how to read charts.

Basic steps of environmental recognition

Long-term charts (big charts) should be checked in order.

Monthly → Weekly → Daily → (8-hour) → 4-hour → (3-hour) → 1-hour → 30-minute → 15-minute → (10-minute) → 5-minute → (1-minute)

First, understand the big trend to confirm the overall direction (from larger charts).

Use the long-term chart trend to inform short-term trades

Identify major turning points and support/resistance

Look for timing on the short-term charts for entries

*By applying this to short-term trades, you can determine which direction to break and where the price may extend.

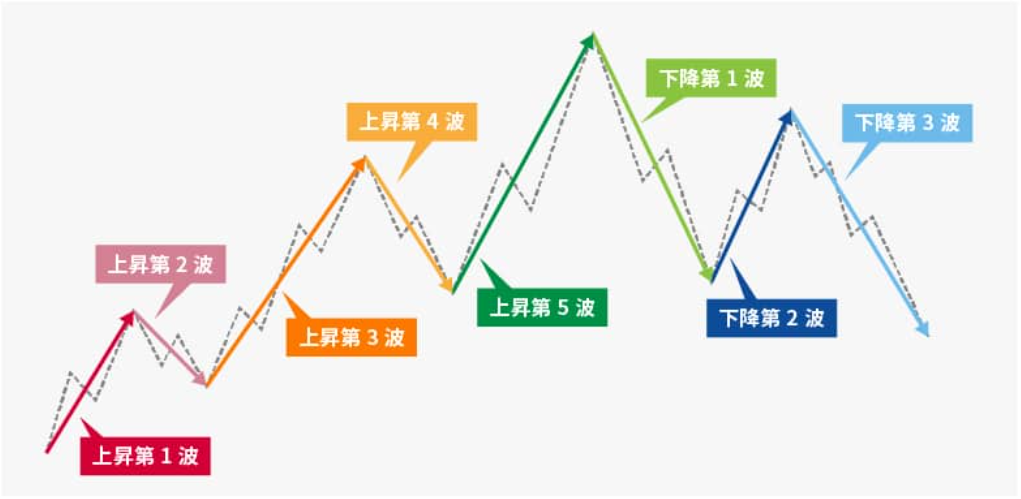

Fractal structure and environmental recognition

As mentioned before, FX charts have a fractal structure.

Same patterns repeat on any timeframe

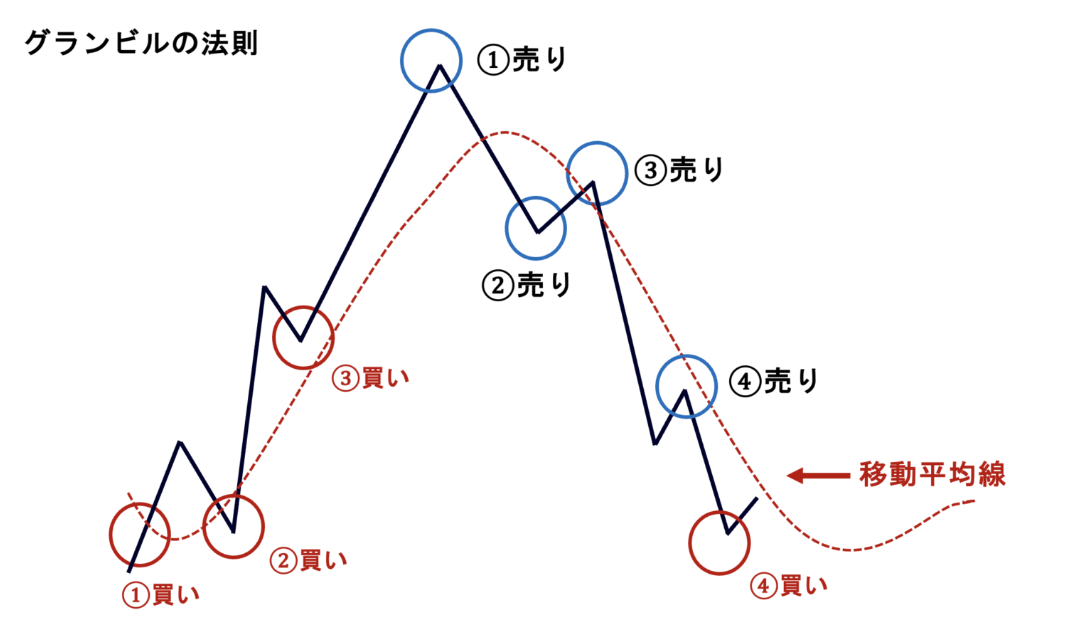

Dow theory, Grandville’s law, and Elliott wave rules are applicable

By conducting solid environmental recognition and entering at appropriate times,you increase chances of success in FX.

To continue winning in FX,you need a proven logic and thorough environmental recognition. By trading without letting emotions sway you, and by implementing probabilistic strategic trades, you can aim for long-term stable profits.

Here,the fractal structure mentioned at the beginning of the articleshows its true power.

Because chart formation patterns are common across timeframes,Dow theory, Grandville’s law, Elliott wave principles, or chart-pattern analyses can verify that the chart movements follow consistent rules. As a result, the predicted directions largely agree.

However, you don’t need to be bound by any single theory or rule.Take a broad view of the entire chart and confirm that similar phenomena recur.

There are many pieces of information you can glean from chart analysis, but here I want to emphasize the importance of environmental recognition.Trading without environmental recognition is like ignoring the technique and its rules—so this is a crucial process.

I use only technical analysis. Becausethe chart prices all events in the market and can be judged sufficiently by the charts, I am confident that chart-based decisions suffice.Fundamentals and external shocks, and changes driven by policies, will reflect in charts if they diverge from Grandville’s law. Yet, in practice, charts have followed certain regularities for decades, and things progress according to the chart.

For example, on the day of the 2011 Tohoku earthquake, I looked at the chart and felt something was going to happen, and I could be confident.

Continuing to read the chart allows you to grasp general price movements in advance.

(Even so, you can still lose in FX because when the market suddenly moves up or down, you might be too early or too late. In particular, in times of expected large volatility, you must consider moves in the Bollinger Band range to the opposite direction as well.)

Before a big move, high and low prices often reach their limits. Therefore, it’s important to observe whether they can reach the Bollinger Band range or whether they will reverse around halfway of the band.

--------------------------------------------------------

When I analyze charts, I first identify the primary timeframes that influence market movements.

--------------------------------------------------------

FX Trading Strategy Summary

In short, to summarize Part 1, Part 2, Part 3,

what I discussed in Part 1 and Part 2 isto create a trading plan.

Contents of a Trading Plan