A profitable EA has a high risk-reward ratio

“Smart Choice for FX Automated Trading (EA)”

== Choose EA with High Risk-Return Ratio! ==

1. Overview

From various metrics that appear in the Strategy Tester results, I will explain what those metrics mean and

which metrics should be used as judgment criteria to select an EA, and what lot size should be set.

I will explain these points.

2. Backtest Settings

My developed EA, “Yamabuki-Suimei”

・EURJPY M5

・Lot: 100,000 currency units

・Period: 2006.10.01 - 2018.10.01

・Initial Margin: 10,000 (US$)

・Spread: 20

・Lot Size: 0.16

・Maximum Positions: 4

3. Backtest Results

・Net Profit: 23,336

・Total Profit: 40,496

・Total Loss: -17,160

・Profit Factor (PF): 2.36

・Expected Gain: 9.82

・Maximum Drawdown: 947

・Maximum Drawdown Rate: 5.77%

・Total Trades: 2376

・Win Rate: 79.92%

・Risk-Return Ratio: 26.8

・Annual Return: 19.4%

4. Meanings of Each Item

① Net Profit = Total Profit − Total Loss

② Profit Factor = Total Profit ÷ Total Loss

③ Expected Gain = Net Profit ÷ Total Trades

When the lot size is 0.1, if the spread increases from 20 to 30, it drops from 9.12 to 8.12.

When the lot size is 1.0, if the spread increases from 20 to 30, it drops from 91.2 to 81.2.

④ Maximum Drawdown: the maximum drop from the peak of the equity curve

Multiplying the lot size by 10 scales it by 10 as well.

⑤ Maximum Drawdown Rate: Maximum Drawdown ÷ Balance at that time

Multiplying the lot size by 10 scales it by 10 as well.

⑥ Risk-Return Ratio = Net Profit ÷ Maximum Drawdown

⑦ Annual Return = Net Profit ÷ Initial Margin ÷ Years of Backtest × 100 (%)

Changes with lot size and initial margin.

⑧ Win Rate = Number of Wins ÷ Total Trades × 100 (%)

5. Common Mistakes in Judgment Criteria

× High Annual Return

Increasing lot size and decreasing initial margin makes it higher.

× Small Maximum Drawdown

Lowering lot size makes it smaller.

× Small Maximum Drawdown Rate

Lowering lot size and increasing initial margin makes it smaller.

6. Correct Judgment Criteria

〇 High Risk-Return Ratio

Changing lot size and initial margin does not significantly affect it.

It reflects the size of net profit relative to maximum drawdown. A higher risk-return ratio allows increasing the lot size, enabling greater profits.

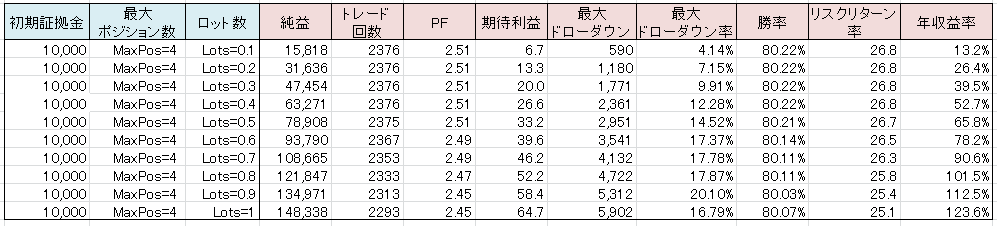

7. Metrics When Changing Lot Size

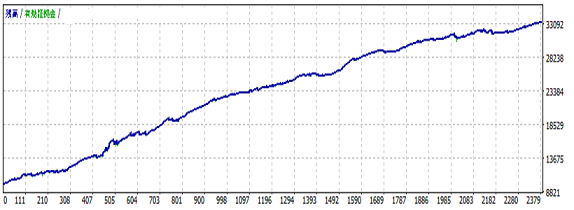

Look at the figure below.

As you increase the lot size, the annual return rises, and the maximum drawdown also increases.

However, PF, win rate, and risk-return ratio hardly change.

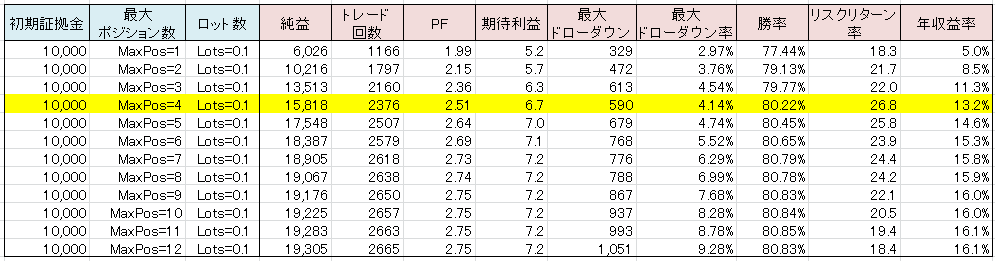

8. Metrics When Changing Maximum Positions (MaxPos)

Which one would you choose from the figures below?

I recommend 4, which has the highest risk-return ratio.

9. Lot Size Calculation

With initial margin of $10,000 and MaxPos = 4, the maximum drawdown for a lot size of 0.1 is $590.

If you can tolerate a maximum drawdown of $3,000,

set 0.1 × 3000 ÷ 590 = 0.5 for a suitable value.

10. Selection Priority

1st: Highest risk-return ratio

2nd: Asset curve as linear as possible

3rd: High expected gain (compare with the same lot size)

4th: Higher total number of trades

5th: Higher profit factor

6th: Higher win rate

End.