FX Exchange Rate Forecast for August 1, 2024

★ Goto Day Tokyo OTC Mid-Point Slicing EA

CyberGotobi is here

Today’s FX Outlook

Market Expectations

| Yen | Dollar | Euro | Pound | Australian Dollar | Stocks | Gold | Crude Oil |

|---|---|---|---|---|---|---|---|

- BOJ raises policy rate from 0.1% to 0.25%

- Reduces government bond purchases by about 400 billion yen each quarter

- USD/JPY breaks through the 150 level in one move

- Cross-yen also falls by more than 1%

- After the FOMC, US equities are pressured by selling

- Commodity markets see solid buying

Forecast by CyberSignal

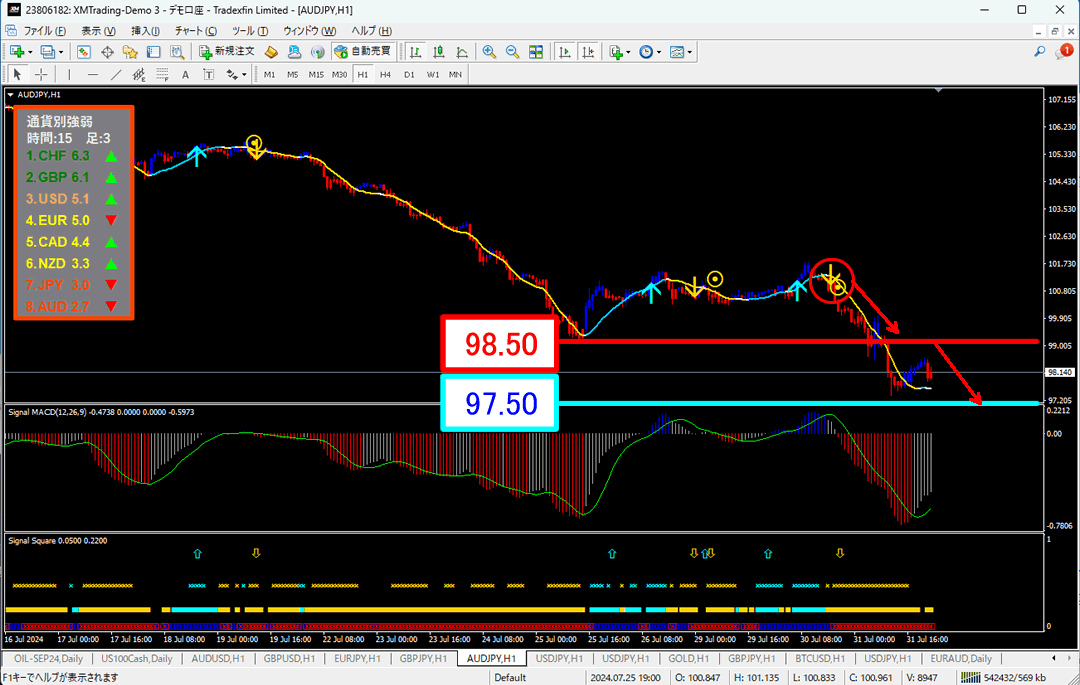

AUD/JPY 98.14 Down ↓

Forecast range 97.50–98.50

Sell signal has triggered, indicating a downward trend.

Expected continuation of the decline.

Overview of the Previous Day

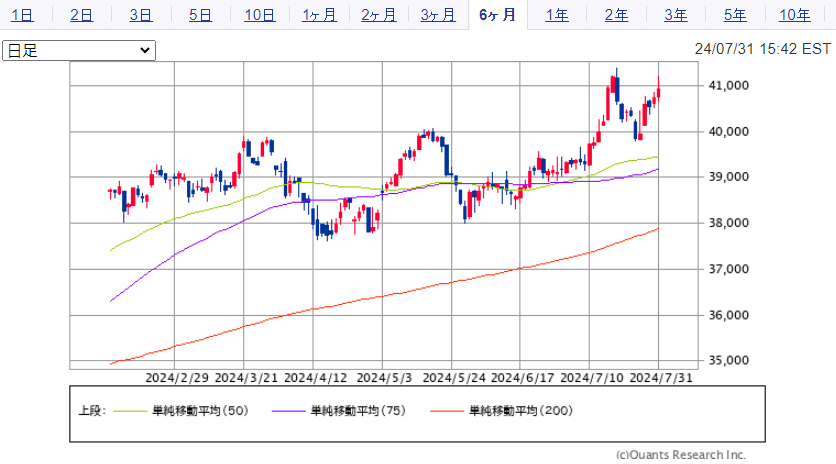

Dow Jones +203 points, Nikkei Stock Average +575 yen to 39,101, rosetoday.

USD/JPY slid to 149.62, cross-yen all fell by more than 1%and broadly declined.

Previous Day Results

• Dow Average40842.79(+99.46 +0.24%)

• Nikkei Average38705.00(-396 -1.03%)

• Gold2447.51(+39.08 +1.62%)

• WTI Crude78.34(+3.61 +4.83%)

Economic Indicators

★★★★★

BOJ Policy Meeting, policy rate announcement after conclusion

★★★★★

15:30 Press conference with BOJ Governor Ueda

★★★

21:15 (US) July ADP Employment Change (m/m)

Previous: +150k Forecast: +175k Actual: +122k

★★★★★

27:00 (US) FOMC Policy Rate Announcement

Previous: 5.25–5.50% Forecast: 5.25–5.50% Actual: 5.25–5.50%

Today’s FX Strategy

Market Focus

▽ Bearish factor: Additional BOJ rate hikes

△ Bullish factor: Rise in Dow and crude oil

◆ USD/JPY to push down to 149.62

◆ Cross-yen also broadly weaker by over 1%

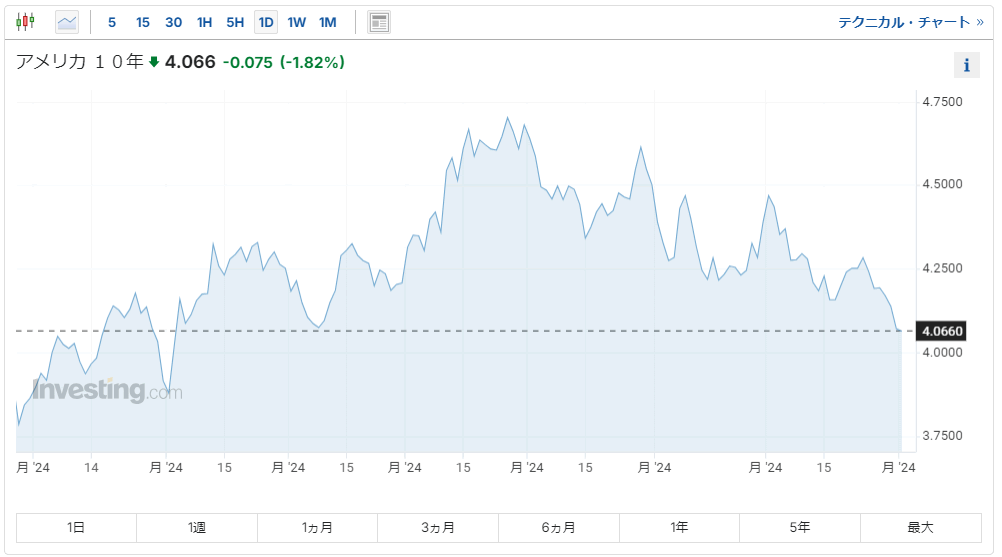

◆ US 10-year yield falls to 4.066%

◆ Dollar pairs rise slightly

◆ US stocks slow toward the back half

◆ Gold up by $39

◆ Crude oil up 4.83% with a strong rebound

◆ 21:30 US initial jobless claims for prior week released

◆ 23:00 US July ISM Manufacturing Index released

◆ Nikkei futures down 396 points to 38,705

☆ Expect a yen-strengthening and stock-weakening market

Dow Jones Chart (Daily)

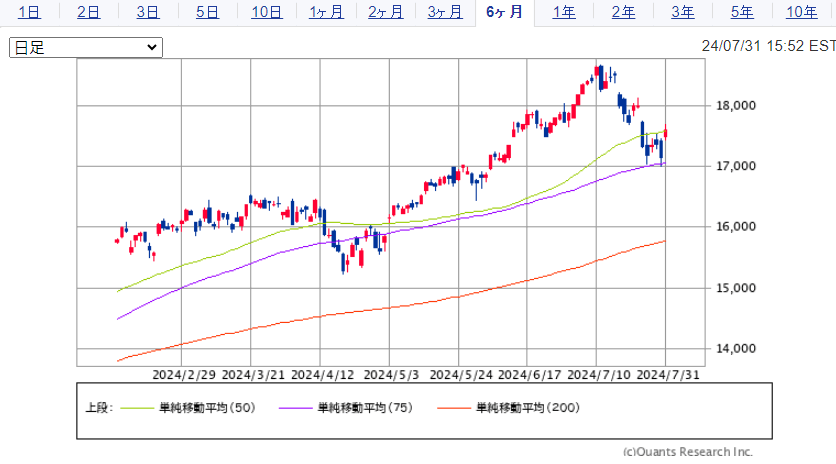

Nasdaq Chart (Daily)

Strong Rebound in IT & Tech Stocks

Last night, Dow extended gains, up +99today.

Nasdaq saw solid buying, jumping +2.64%.

Buying returned to previously sold IT & Tech stocks, led by earnings names.

NVIDIA +12.90%, Broadcom +11.96%, Qualcomm +8.39%, Micron +7.08%, AMD +4.40% — semiconductors broadly higher. Tesla +4.25%, Amazon +2.90%, Meta +2.51% also bought in IT/Tech

In contrast,Bank of America -2.35%, Wells Fargo -1.12%, JPMorgan Chase -1.11%, Bank of America -0.63% as bank stocks fall. Pfizer -2.71%, J&J -2.16%, Merck -1.84% also sold in healthcare.

Overall, advancers 2,664 vs. decliners 1,812, with 57.5% of all issues higher.

Stock Price Changes by Theme

Semiconductors+4.21%

Generative AI+3.55%

Oil & Energy+1.31%

Grain-related-0.39%

Cryptocurrencies+2.61%

Paris Olympics-related-0.22%

USD/JPY Breaks Below 150

US 10-year Yield

In the much-watched BOJ meeting, policy rate raised from 0.10% to 0.25%, and government bond purchases reduced by about 400 billion yen each quartertoday.

Because much information was already known beforehand, prices initially rose after the announcement, but in the subsequent press conference with BOJ Governor Ueda, comments about possible future rate hikes caused a rapid yen appreciation.

There were moments when the 151 yen level was rebounded, butafter the FOMC, Powell said that easing is drawing closer and a cut could be an option in September, causing another drop.

The yen moved down to around 149.62, and the early morning yen strength continued. US 10-year yield fell to 4.066%, and a continued dollar weakness is expected.

On the other hand,Cross-yen also fell broadly by more than 1%. Among currencies, AUD remained weak as CPI trimmed the trimmed mean fell below 4%, reducing expectations for additional rate hikes.

Overall, the trend is likely to see rallies met with selling on the way back down.

Commodity Markets See Solid Buying

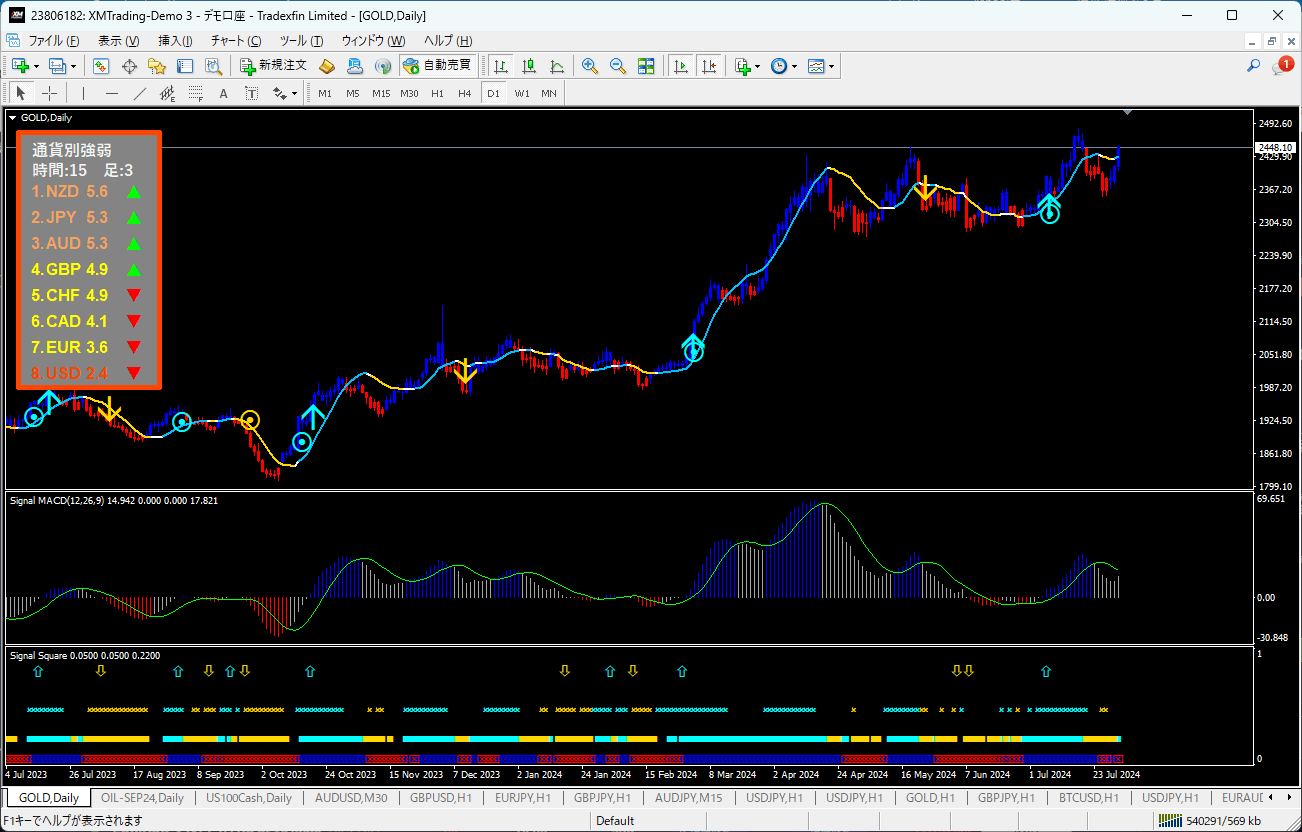

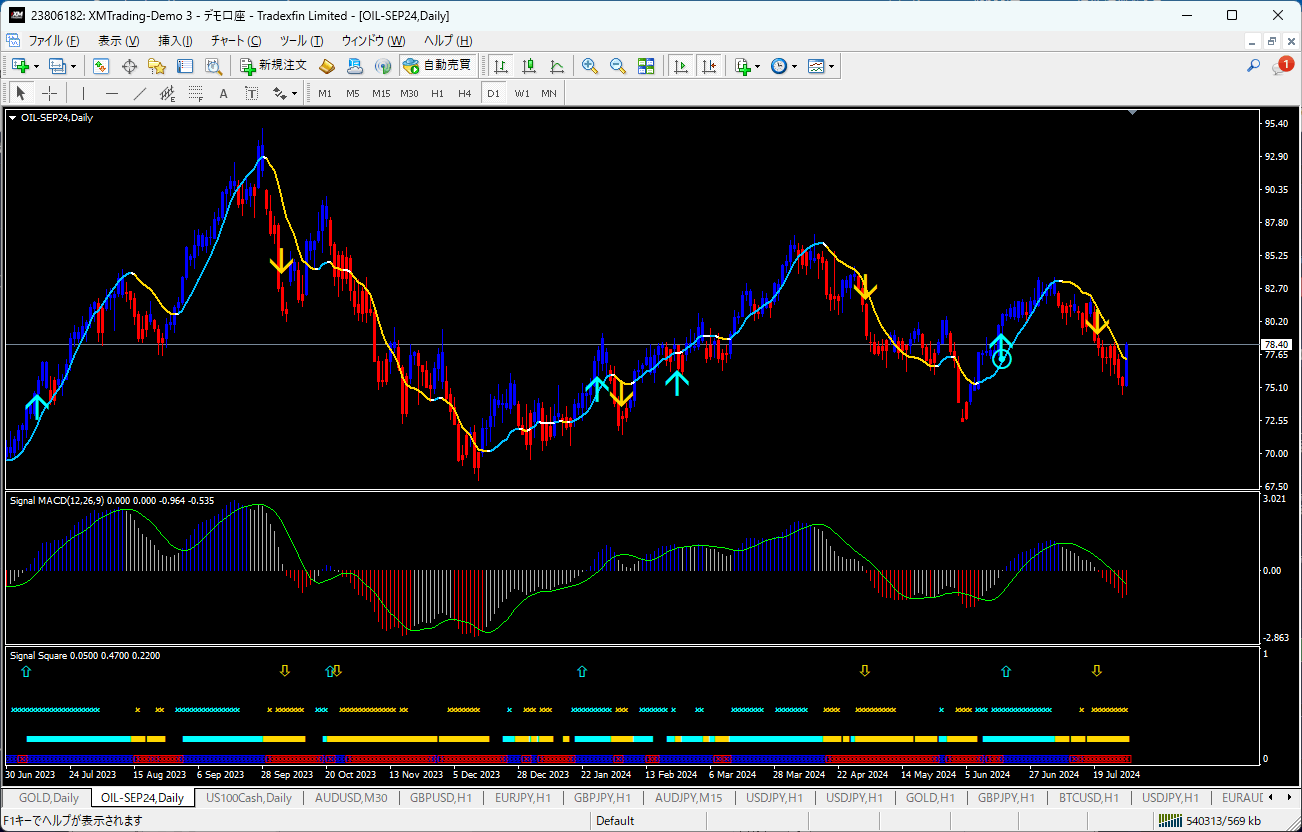

Gold Chart (Daily)

Crude Oil WTI Chart (Daily)

Gold up by $39, driven by falling US yields and concerns over Middle East tensions, seen as a safe-haven bid. It could test higher toward the mid-$2400s.

Crude Oil up 4.83% and rebounded to the $78 area. EIA weekly oil stock data showed a draw of 3.436 million barrels, aiding the rally.

With stockpiles shrinking, buying in oil is expected to continue.

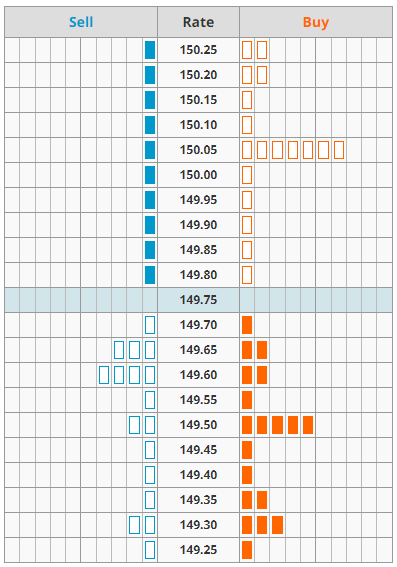

USD/JPY Order Flow

USD/JPY Board Information

Nikkei futures during after-hours down 396 points to 38,705today. US stocks are higher, but rapid yen strength is expected to weigh on export-oriented stocks.

Support for USD/JPY is at 149.50–149.60; resistance at 150.05. Order flow is thin, so volatility is likely to remain elevated.

Economic Indicators

★★★

21:30 (US) Weekly Initial Jobless Claims

Previous: 235k Forecast: 236k

★★★★

23:00 (US) July ISM Manufacturing Index

Previous: 48.5 Forecast: 48.8