FX Exchange Rate Forecast for July 31, 2024

★ Goto’s Tokyo FX mid-rate breakout EA

“CyberGotobi” is here

Today’s FX Forecast

Market Outlook

| Yen | Dollar | Euro | Pound | Australian Dollar | Stocks | Gold | Crude Oil |

|---|---|---|---|---|---|---|---|

- BOJ considers a further 0.25% rate hike

- USD/JPY plunges to the early 153s

- Crosses also slide

- Big selling in Nasdaq

- Gold recovers to the 2400s

- Continued selling in crude

Forecast by CyberSignal

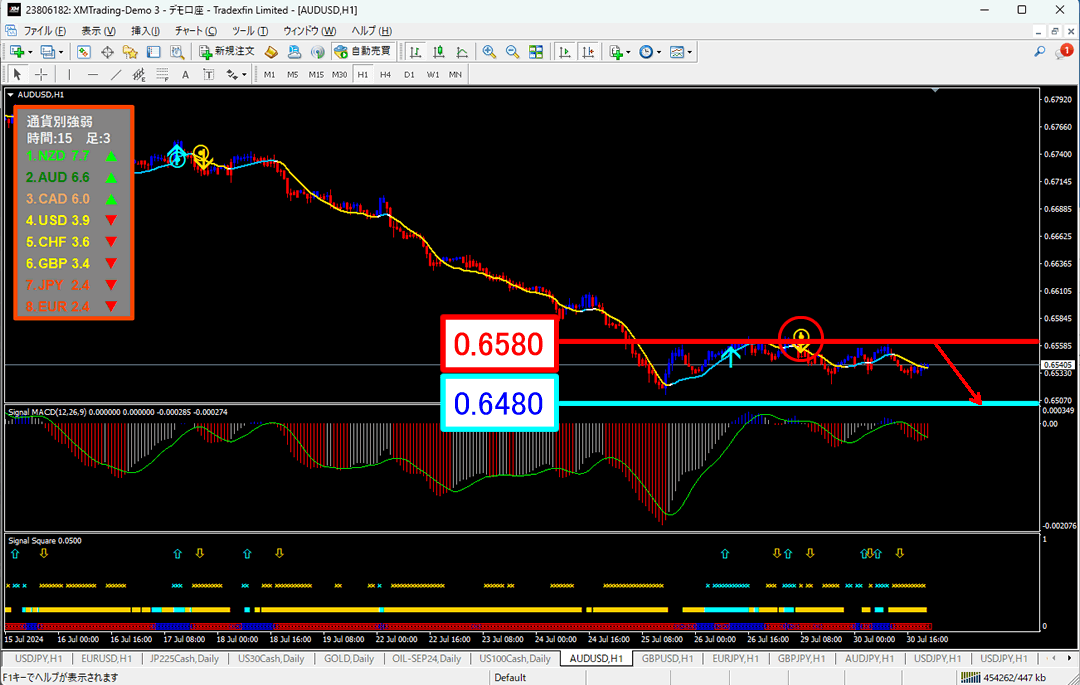

AUDUSD 0.6540 decline ↓

Forecast range 0.6480–0.6580

Sell signal appears, in a downward trend.

Expect further declines.

Overview of the Previous Day

Dow Jones fell 49 points、Nikkei Stock Average rose 57 points to 38,525,

.

Previous Day’s Results

・Dow Jones40,743.33 (+203.40 +0.50%)

・Nikkei Average 381,25.00 (-395 -1.03%)

・Gold2,405.38 (+21.84 +0.91%)

・WTI Crude75.00 (-0.81 -1.07%)

Economic Indicators

★★★

23:00 (US) July Consumer Confidence Index (Conference Board)

Previous: 100.4 Forecast: 99.8 Result: 100.3

Today’s FX Strategy

Market Highlights

▽ Bearish catalysts: Nasdaq decline and US yields fall

△ Bullish catalyst: Dow rebound

◆ USD/JPY falls to early 153s

◆ Crosses also slide

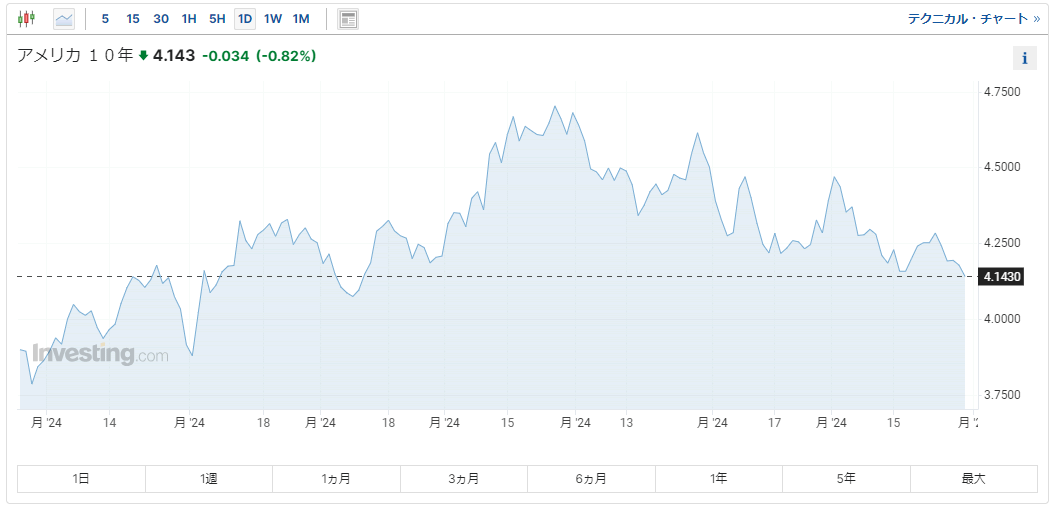

◆ US 10-year yield falls to 4.143%

◆ Dollar-street declines slightly

◆ US stocks mixed

◆ Gold up by $21

◆ Crude down about 1.07% and continues to fall

◆ BOJ meeting results and policy rate announcement

◆ 15:30 BOJ Governor Ueda’s regular press conference

◆ 21:15 US July ADP Employment Report

◆ Early next morning 3:00 FOMC rate decision

◆ Nikkei futures at -395 yen to 38,125

☆ Expect a strong yen, weak stock market climate

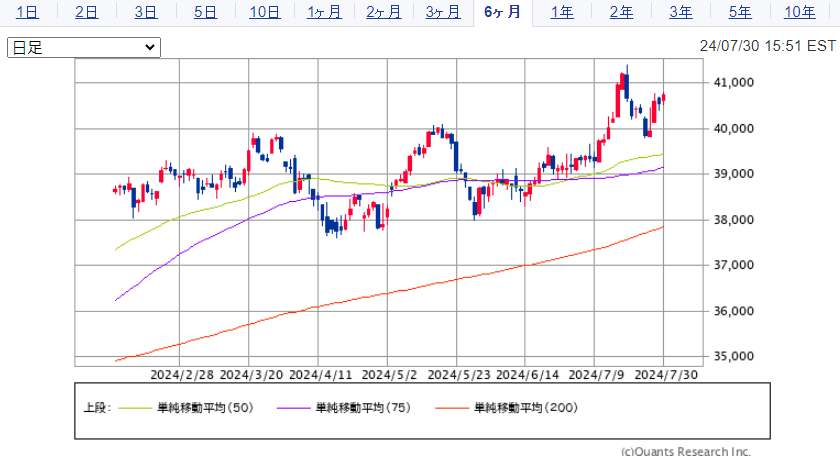

Dow Jones Chart (Daily)

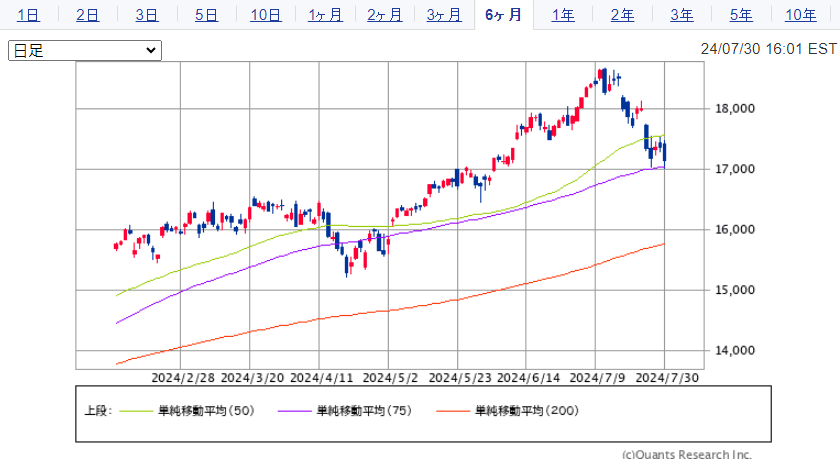

Nasdaq Chart (Daily)

Nasdaq Shows Broad Selling

Last night, Dow rebounded with +203 points.

Nasdaq fell -1.28% on broad selling.

Ahead of FOMC and major US company earnings, a mood of slight consolidation persists.

Merk’s downward revision of full-year earnings per share led to a -9.23% plunge。NVIDIA -7.32%, Micron -4.65%, Qualcomm -5.98%, Broadcom -4.04% led semiconductor losses.

In contrast,Citi Group +2.54%, JPMorgan Chase +2.05%, Wells Fargo +0.92%, Bank of America +0.54% gained in banks. Mastercard +1.55%, Visa +0.71% showed solid credit services.

Overall, 2,275 advancers vs 2,202 decliners, with 49.1% of all issues rising.

Sector-by-Sector Stock Price Changes

Semiconductors-2.34%

Artificial Intelligence-2.11%

Oil & Energy+0.82%

Grains+0.11%

Europe-related-0.23%

Cryptocurrency Related-1.31%

Slowed by reports of BOJ added rate hike consideration

US 10-Year Yield

Dollar-yen continued to rise, hitting a high of 155.22 briefly. However, following reports that the BOJ is considering an additional 0.25% rate hike, it has slipped to the early 153s..

US 10-year yield fell to 4.143%, with expectations for more dollar selling.

Meanwhile,Crosses slide together with the overall decline. Like USD/JPY, crosses also drop following the reports of BOJ rate hike consideration.

Actual additional hikes are expected around September or October, but staying cautious until BOJ meeting results are released is prudent.

Continued selling in Crude Oil

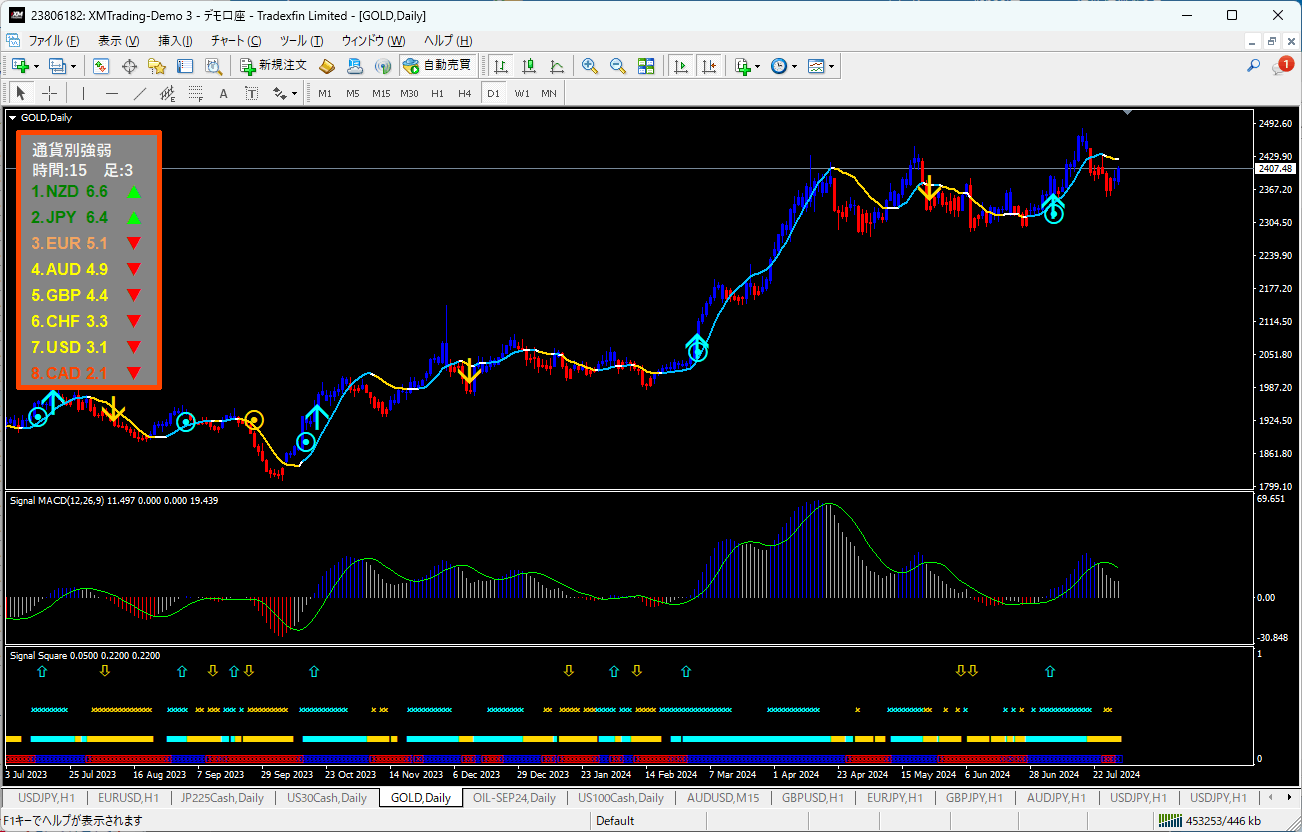

Gold Chart (Daily)

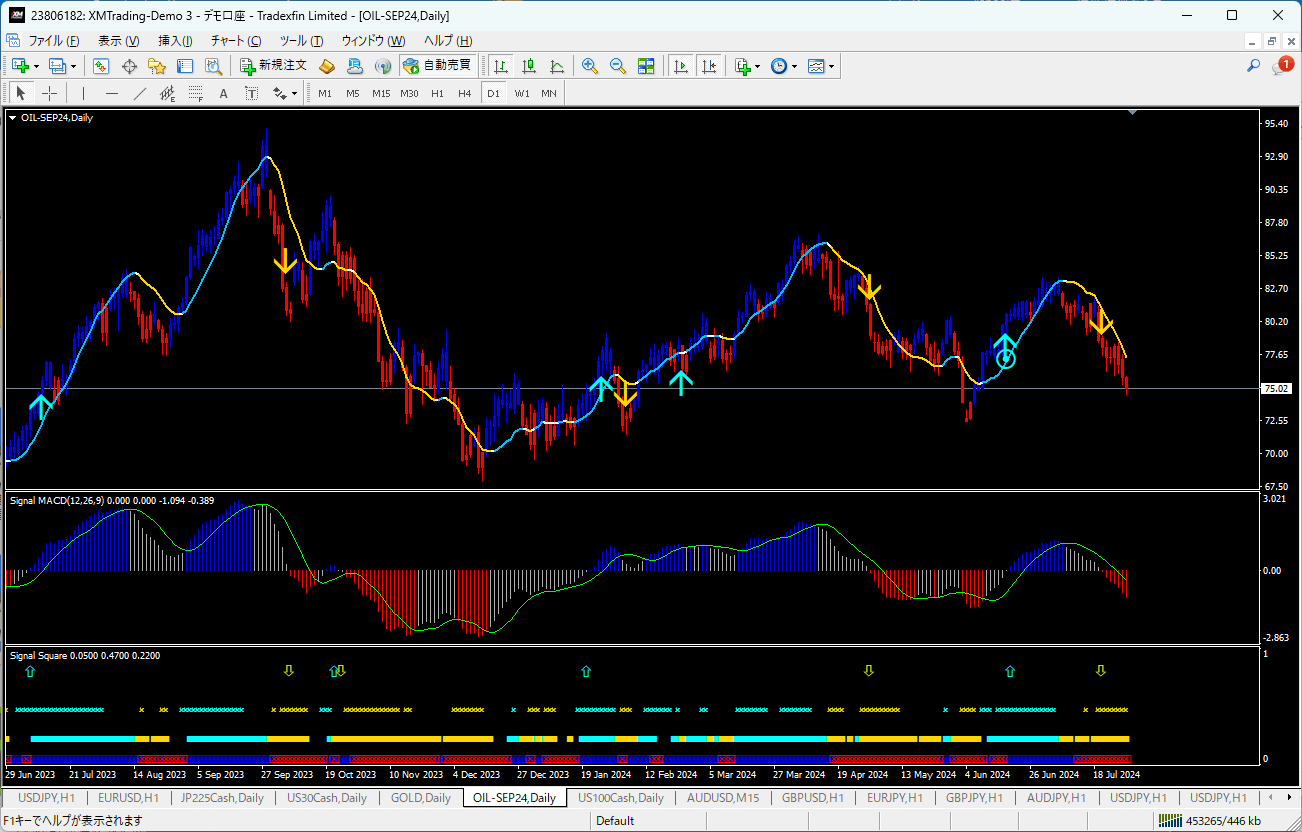

Crude Oil - WTI Chart (Daily)

Gold up by $21, returning to the 2400s。Decline in US yields and pre-FOMC position adjustments are driving activity.

We expect stabilizing around 2400 for a while.

Crude down 1.07%, continuing to fall near $75。Concerns about Europe and China’s economy and position adjustments contribute to the decline.

With ongoing uncertainty in Middle East tensions, oil may remain vulnerable to further declines.

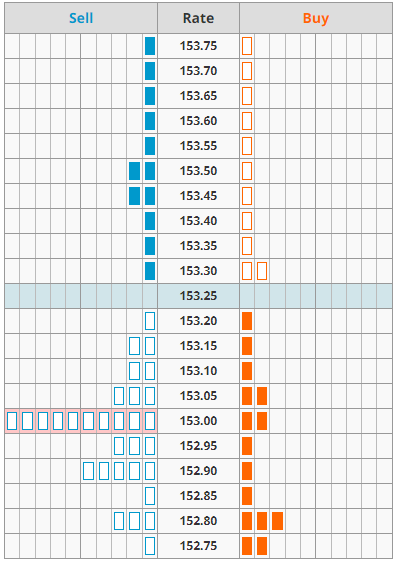

USD/JPY Order Status

USD/JPY Board Information

Nikkei futures fell 395 points in after-hours to 38,125, following a Nasdaq slide and yen strength. Expect selling mainly in export-oriented stocks.

Support for USD/JPY is 153.00, resistance around 153.45–153.50. There may be moments of dipping below 153, with a gradual decline likely to continue.

Until BOJ meeting results are released, aggressive buying is unlikely.

Economic Indicators

★★★★★

BOJ Policy Meeting, rate decision after ending

★★★★★

15:30 Japan BOJ Governor Kazuo Ueda’s regular press conference

★★★

21:15 (US) July ADP Employment Change

Previous: 150k, Forecast: 175k

★★★★★

27:00 (US) FOMC Rate Decision

Previous: 5.25-5.50%, Forecast: 5.25-5.50%