FX Forex Forecast for July 30, 2024

★ Goto Day Tokyo Bank Rate Cut EA

“CyberGotobi-CyberGotobi” is here

Today's FX Forecast

Market Expectations

| Yen | Dollar | Euro | Pound | Australian Dollar | Stocks | Gold | Crude Oil |

|---|---|---|---|---|---|---|---|

- USD/JPY rising toward around 154

- Cross yen moves mixed

- US stocks stay cautious ahead of key events

- Commodity prices retreat

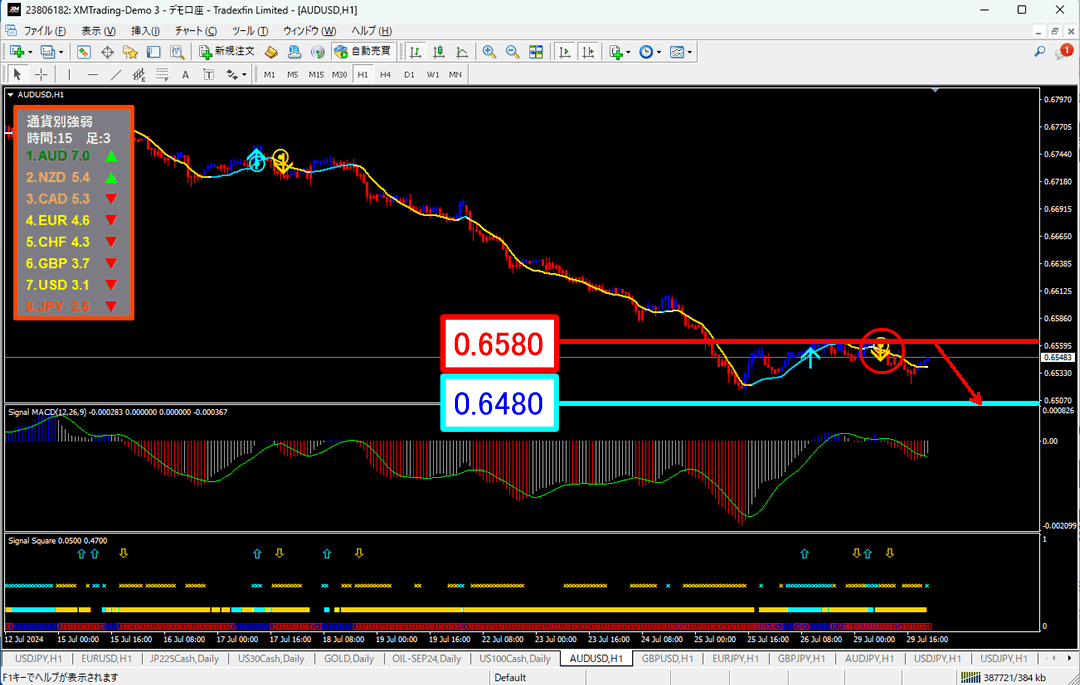

Forecast from CyberSignal

AUD/USD 0.6548 Down ↓

Forecast range 0.6480–0.6580

Sell signal has appeared, indicating a downtrend.

Continuation of selling is expected.

Overview of the Previous Day

Dow Jones rose 654 points, Nikkei rose 801 yen to 38,468, and rose as well.

USD/JPY rose toward around 154,Cross yen moved mixed.

Yesterday's Results

・Dow40540.13 (-49.21 -0.12%)

・Nikkei38420.00 (-48 -0.13%)

・Gold2380.90 (-4.67 -0.19%)

・WTI Crude75.88 (-1.28 -1.66%)

Economic Indicators

Nothing notable

Today's FX Strategy

Market Points

▽ Bearish factors: US yields and oil decline

△ Bullish factor: Nasdaq rise

◆ USD/JPY rises toward around 154

◆ Cross-yen mixed

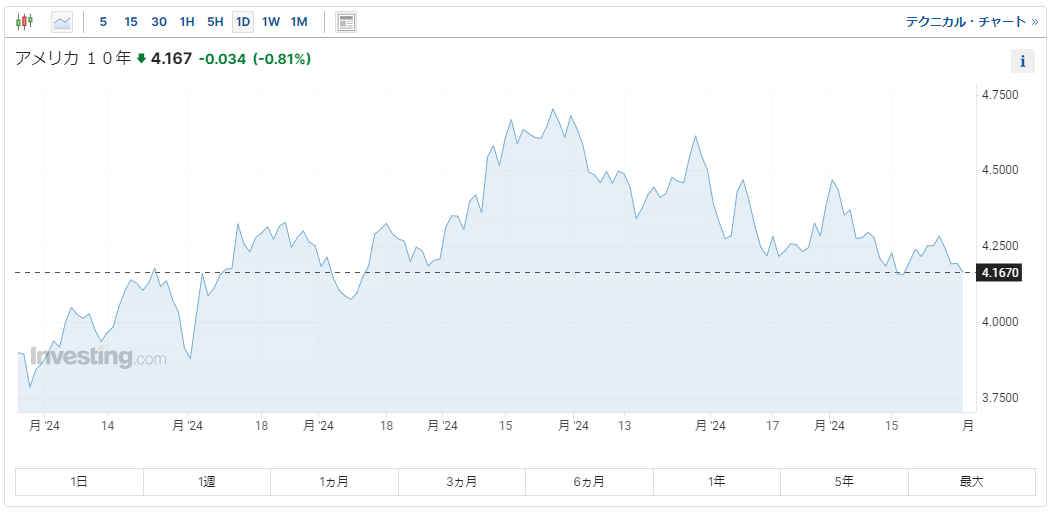

◆ US 10-year yield falls to 4.167%

◆ Dollar crosses drift lower

◆ US stocks mixed

◆ Gold down about 4 dollars

◆ Oil down 1.66% and retreating

◆ 11 PM: US July Consumer Confidence Index released

◆ Nikkei futures down 48 yen to 38,420

☆ Expect a strong yen and weak stocks condition

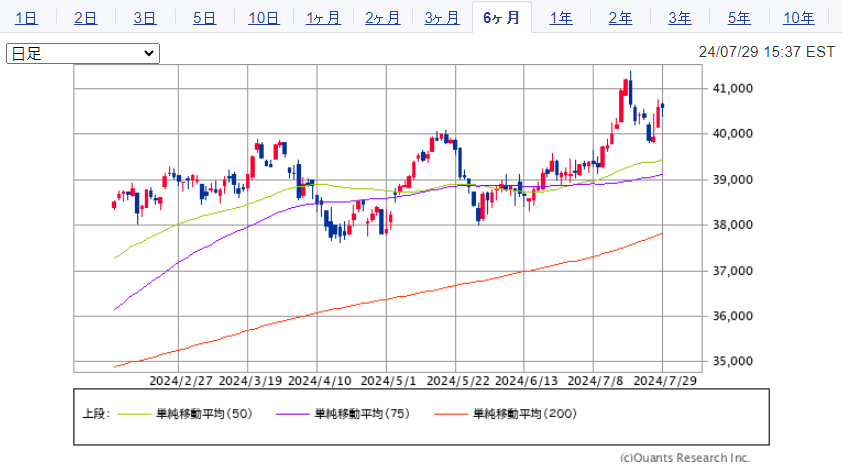

Dow Jones Chart (Daily)

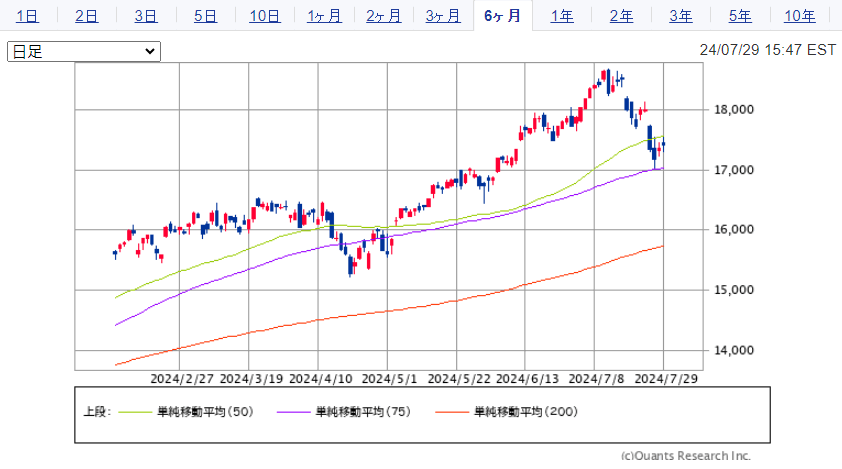

Nasdaq Chart (Daily)

Cautious ahead of Important Events

Last night, Dow fell before the close, down 49 points.

Nasdaq remains in positive territory, up modestly by +0.07%.

With FOMC, US jobs data, and earnings ahead, the mood is largely cautious.

Buybacks in Tesla, which had tumbled, surged +5.36%.McDonald's, whose results topped expectations, saw a slight decline early but recovered to +3.64%.

In contrast,Banking stocks fell: Citigroup -1.40%, Bank of America -1.31%, Wells Fargo -1.24%, JPMorgan Chase -0.56%.Micron -1.28%, Intel -1.20%, Nvidia -1.16%, Broadcom -0.58% also declined.

Overall, 1,476 stocks advanced and 3,032 declined, with 65.4% of all stocks falling.

Sector Stock Price Changes

Semiconductors-0.12%

Artificial Intelligence-0.12%

Oil & Energy-0.94%

Grains-0.70%

European-linked-0.31%

Crypto assets-1.40%

USD/JPY rises toward around 154

US 10-year Yield

USD/JPY begins the week with continued buying, rising toward around 154to as high as 154.36, then consolidating near 154.

However, US 10-year yields have fallen to 4.167%, so the dollar is likely to remain slightly heavy for now.

Meanwhile,Cross-yen mixed, overall steady.

Among currencies, the pound remains solid, with intermittent buybacks on dips. The UK policy rate is expected to cut by 0.25% on Thursday, but ongoing high services inflation could lead to cautious stance on further cuts.

Commodity Markets Decline

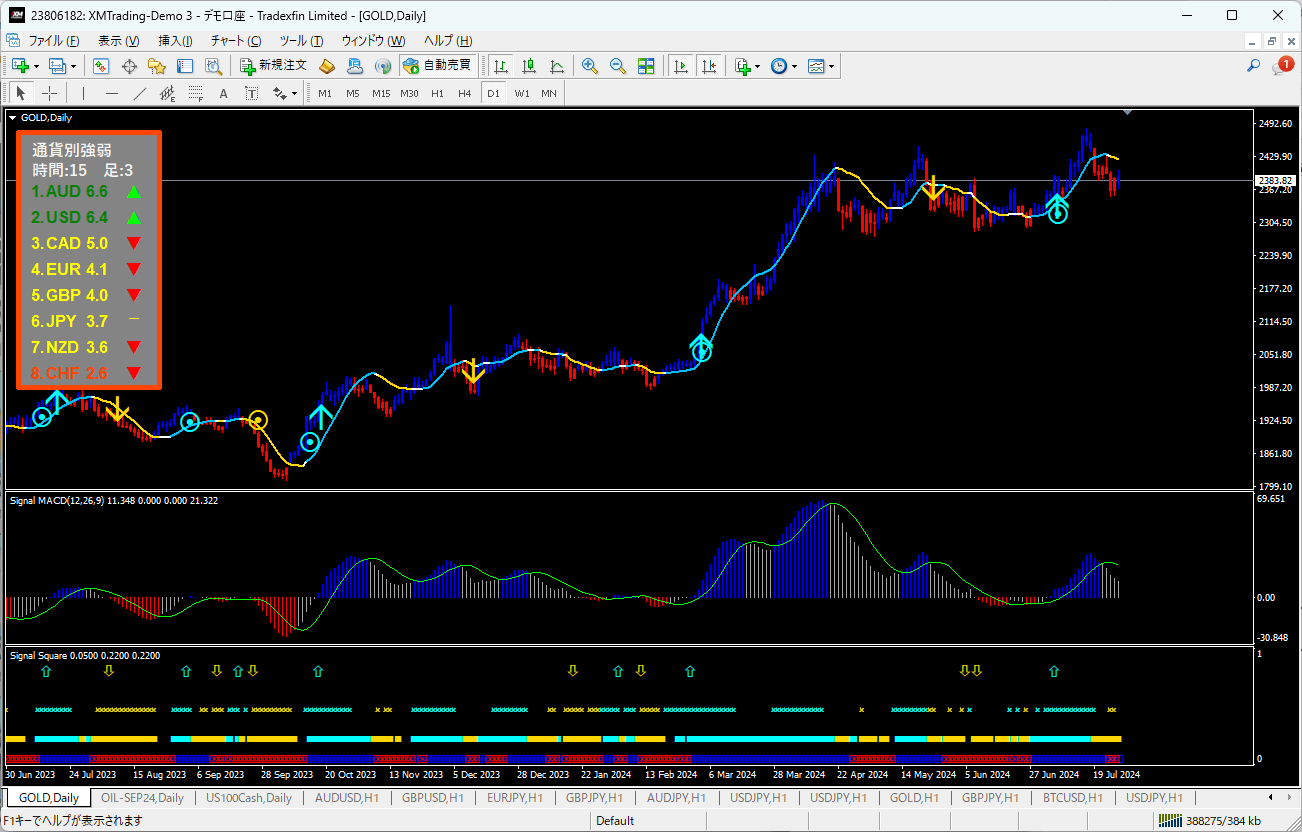

Gold Chart (Daily)

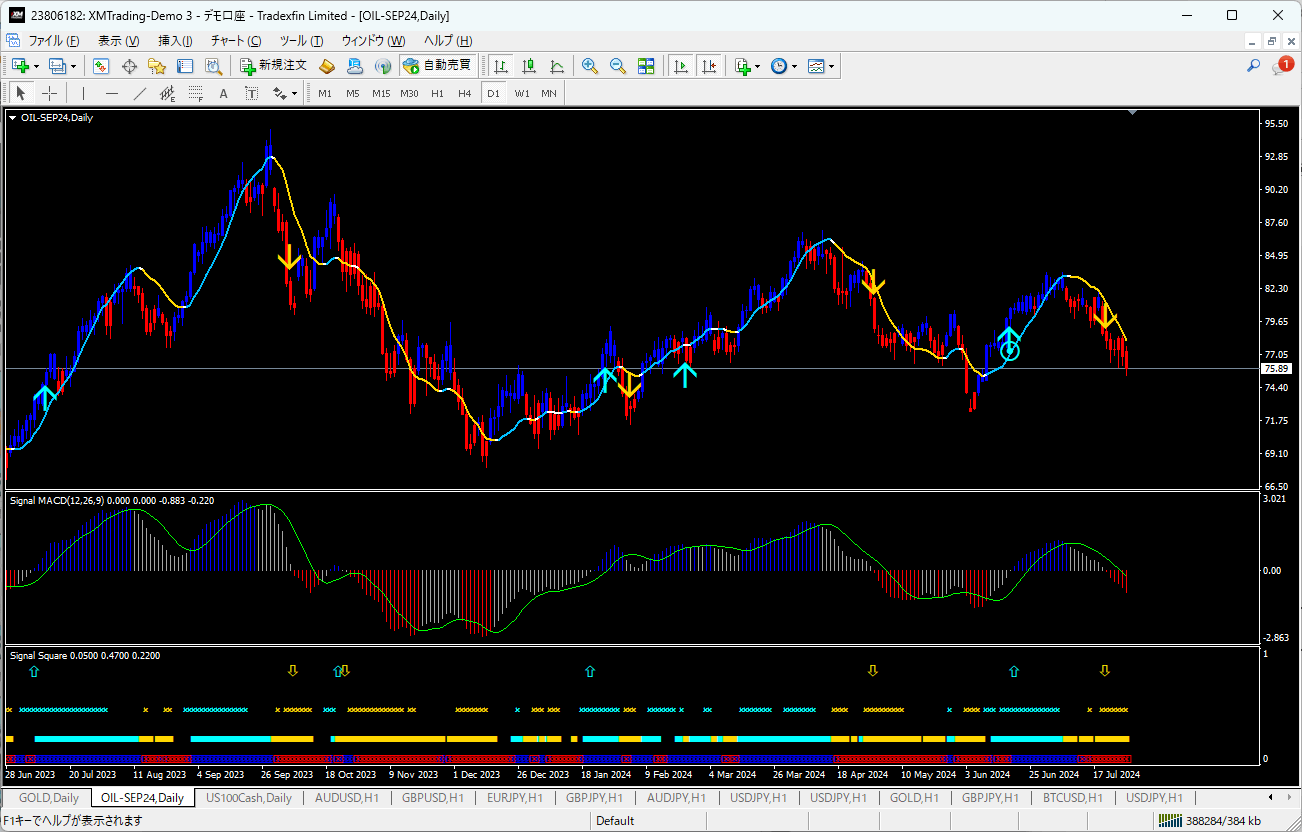

Oil/WTI Chart (Daily)

Gold down about 4 dollars, slight decline. According to statistics from the China Gold Association, gold consumption in the first half of 2024 fell 5.61% year-on-year, contributing to selling pressure.

Demand for gold jewelry has dropped sharply, leading to slight oversupply.

Crude oil down 1.66% and retreating to the $75 range. Reports suggest countries are working to avoid a full-scale war in response to Israel-Hizbollah tensions, which is a selling factor.

Geopolitical risks are easing, and oil is expected to stay under pressure.

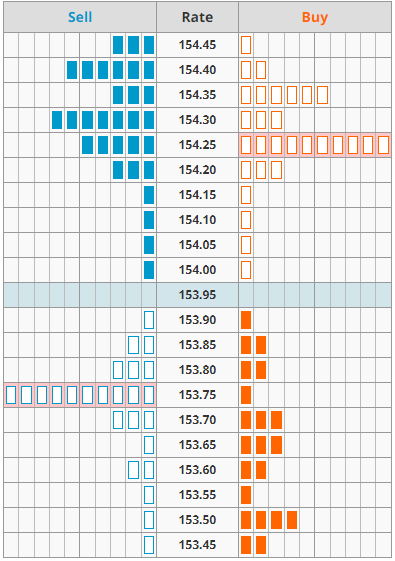

USD/JPY Order Flow

USD/JPY Board Information

Nikkei futures fell by 48 yen in after-hours to 38,420, modest decline. After yesterday's sharp rise, today is expected to be a consolidation phase.

Support for USD/JPY is around 153.75, with resistance at 145.25. As US 10-year yields decline, expect consolidations near 154 for a while.

Economic Indicators

★★★

23:00 (US) July Consumer Confidence Index (Conference Board)

Previous: 100.4 Forecast: 99.8