FX currency forecast for July 29, 2024

★ GOTO Day Tokyo Overnight Mid-rate Shocker EA

CyberGotobi is here

Forecast for tomorrow's FX

Market expectations

| Yen | Dollar | Euro | Pound | Australian Dollar | Stocks | Gold | Crude |

|---|---|---|---|---|---|---|---|

- U.S. June PCE deflator came in as expected

- USD/JPY rises toward the upper 153s

- NY Dow reverses higher

- Gold experiences a bounce

- Crude continues to fall

Analysis by Cyber Signal

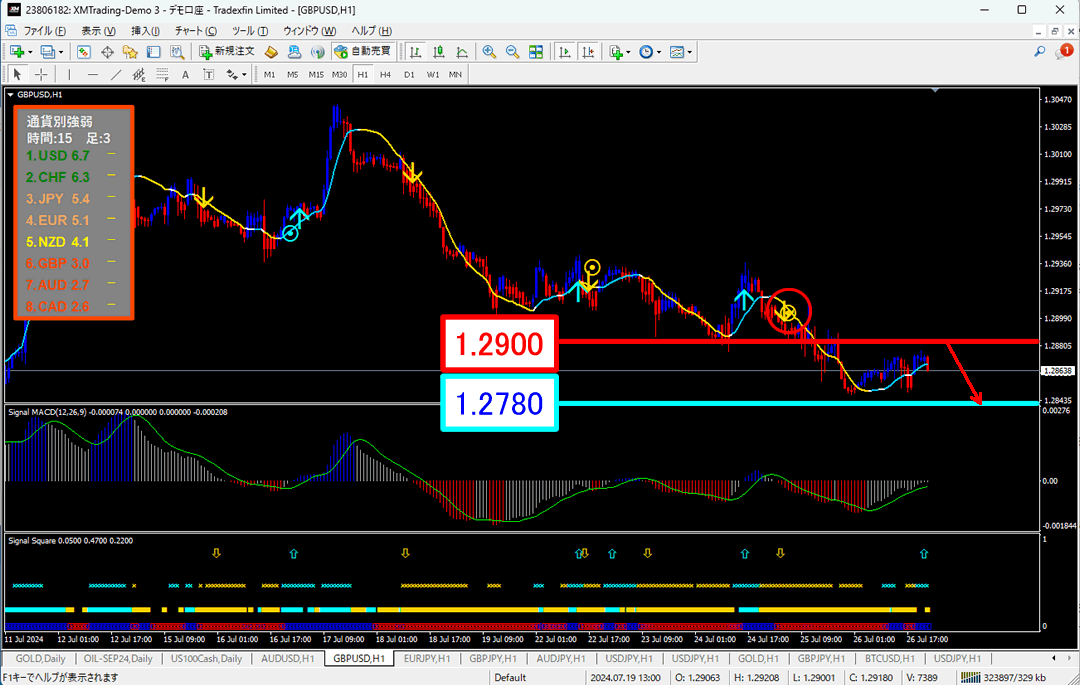

GBP/USD 1.2863 declines (1-hour chart) ↓

Forecast range 12780–1.2900

Sell signal has appeared, indicating a downtrend.

Continued selling is expected.

Overview of the previous day

NYSE Dow up by 81 points、Nikkei Stock Average falls 202 points to 37,667.

USD/JPY falls toward the upper 153s、Cross-yen pairs mixedin movement.

Results from the previous day

・Dow Jones40589.34 (+654.27 +1.64%)

・Nikkei Average38205.00 (+537 +1.43%)

・Gold2385.57 (+21.07 +0.88%)

・Crude Oil WTI76.44 (-1.84 -2.35%)

Economic indicators

★★★

21:30 (U.S.) June PCE Deflator (YoY)

Previous: 2.6% Forecast: 2.5% Actual: 2.5%

★★★

21:30 (U.S.) June PCE Core Deflator (MoM)

Previous: 0.1% Forecast: 0.1% Actual: 0.2%

★★★

21:30 (U.S.) June PCE Core Deflator (YoY)

Previous: 2.6% Forecast: 2.5% Actual: 2.6%

★★★★

23:00 (U.S.) July University of Michigan Consumer Confidence Final

Previous: 66.0 Forecast: 66.0 Actual: 66.4

Strategy for tomorrow

Key points for the market

△ Bullish factors: Continued Dow gains

▽ Bearish factors: Decline in U.S. yields and crude oil weakness

◆ USD/JPY declines toward the upper 153s

◆ Cross-yen moves are mixed

◆ U.S. 10-year yield falls to 4.1697%

◆ Dollar crosses remain gradually softer

◆ U.S. stocks see bargain buying

◆ Gold rebounds by about +$21

◆ Crude falls further by about -2.35%

◆ At 23:00, U.S. July Consumer Confidence index to be released

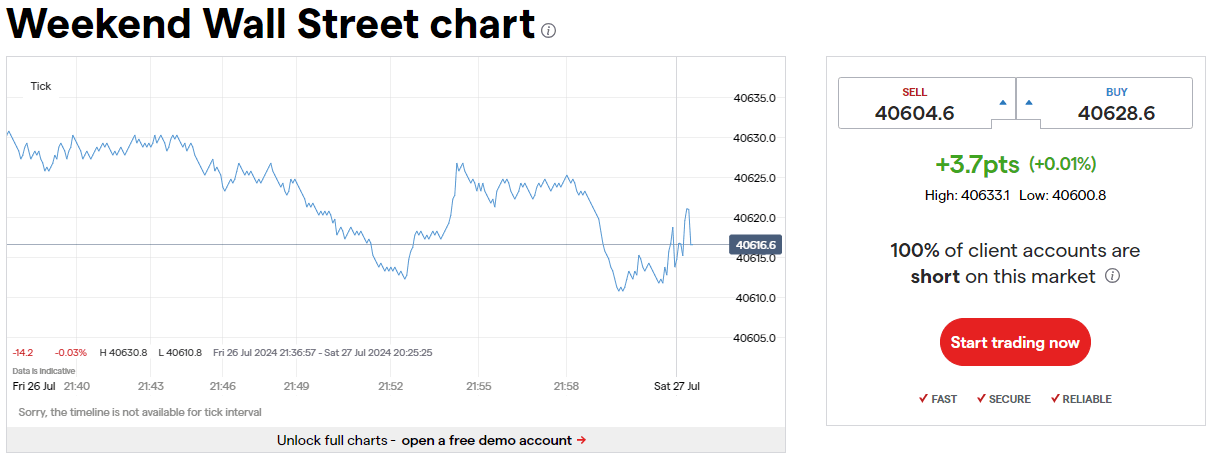

◆ Sunday Dow Jones

◆ Nikkei 225 futures up +537 points to 38,205

☆ Expect a weak yen and strong stock market environment

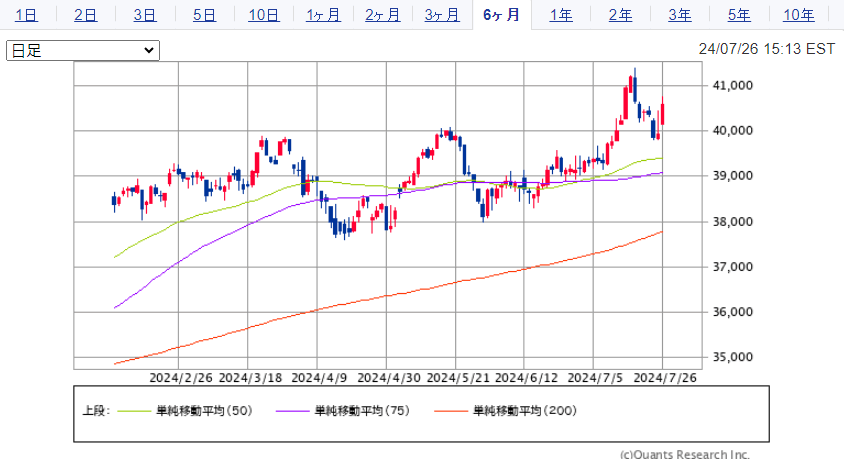

Dow Jones Chart (Daily)

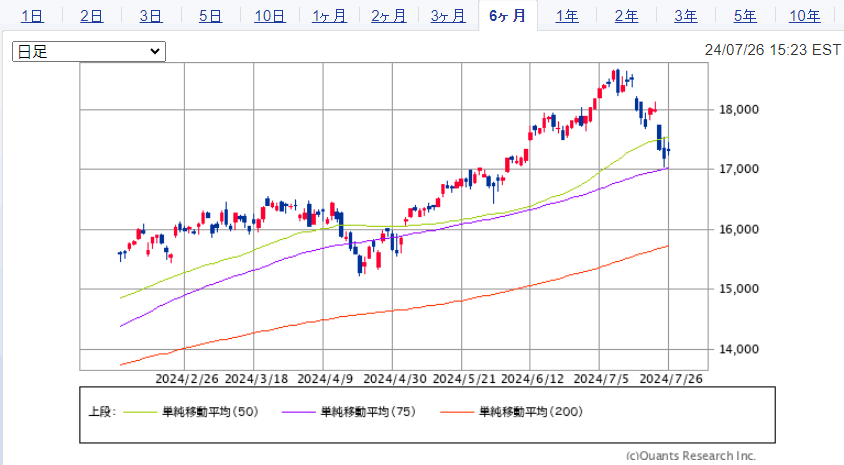

Nasdaq Chart (Daily)

Overall, buyback momentum remains superior

Last week's Dow surged on buybacks, up by +654 points, a strong rise。

Nasdaq also rebounded with a +1.03% gain。

With June U.S. PCE Deflator in line with expectations, inflation appears to be cooling, supporting stock buying.

Meta +2.71%, Microsoft +1.64%, Amazon +1.47% led a rebound in IT/Tech stocks. Qualcomm +2.66%, Micron +1.82%, AMD +1.21%, Intel +0.80%, Nvidia +0.69% also saw bargain buying in semiconductors.

In contrast,Uber -2.04%, Eli Lilly -2.02%, Alphabet -0.28% faced selling in individual stocks.

Overall, advancers totaled 3330 issues, decliners 1170, with 71.8% of all issues rising.

Stock price movement by theme

Semiconductors+1.35%

Generative AI+1.11%

Oil & Energy+0.80%

Grains+0.86%

Europe-related+0.93%

Cryptocurrencies+2.23%

Increases were followed by selling pressure at the top

U.S. 10-year yield

USD/JPY saw a rebound, rising briefly to 154.74. However, selling pressure returned,and it declined toward the upper 153sas we head into the weekend.

The U.S. 10-year yield has fallen to 4.1697%, so the dollar is expected to stay mildly firm or restrained.

Meanwhile,Cross-yen pairs moved mixedly, overall up slightly. After the initial rebound, they are pushed back by selling pressure similar to USD/JPY.

Per currency, commodity-linked currencies such as Australian dollar and Canadian dollar may weaken due to crude oil declines.

Gold is bought; Crude remains under pressure

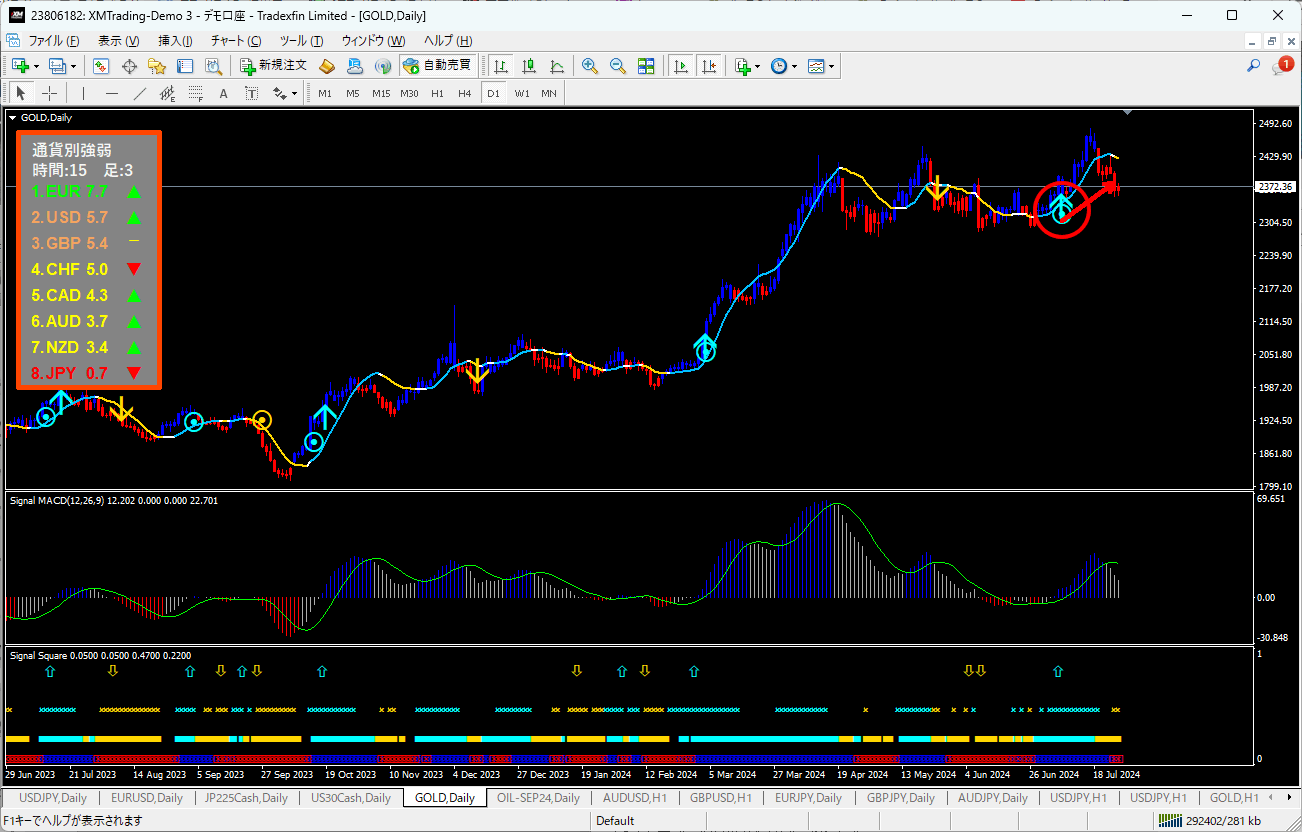

Gold Chart (Daily)

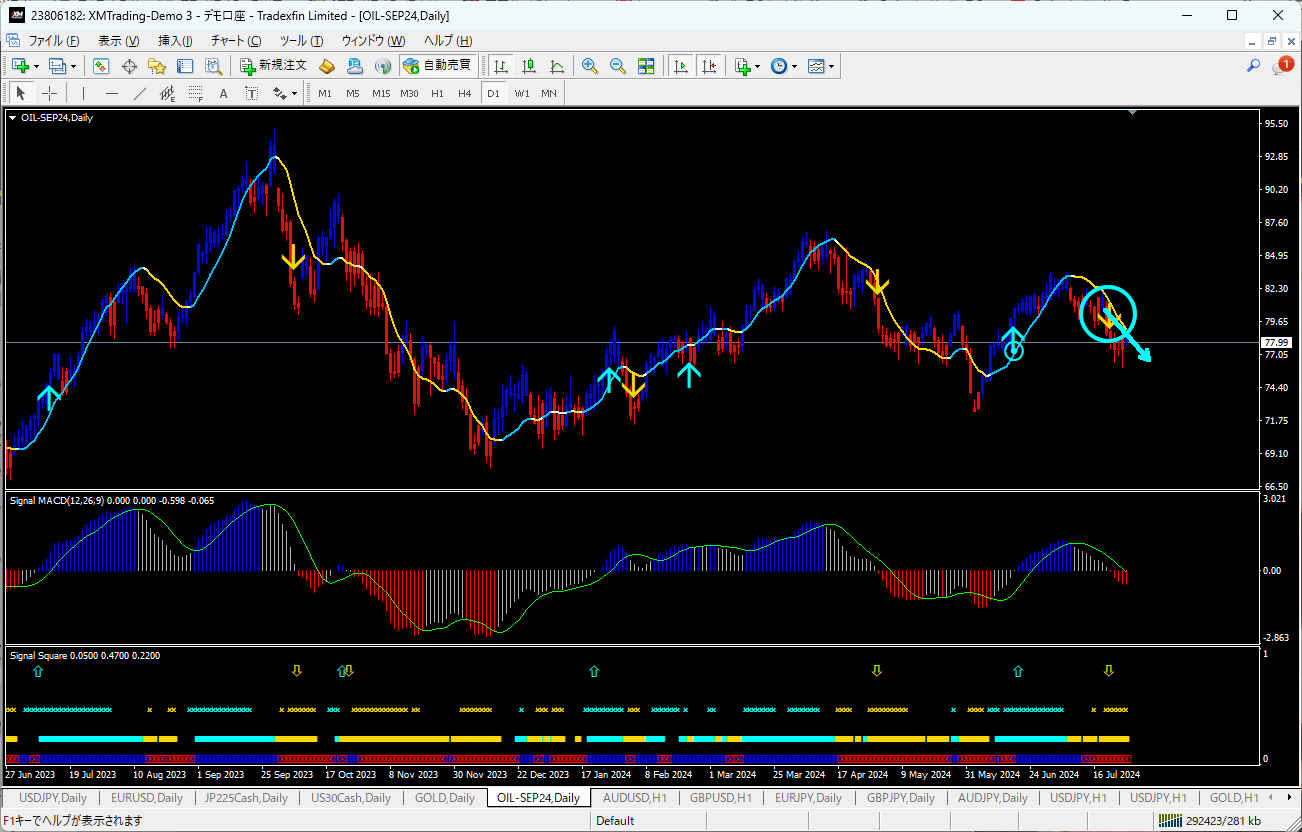

Crude Oil WTI Chart (Daily)

Gold rose by +$21 to around $2385As U.S. June PCE Deflator was in line with expectations and yields fell, a rebound occurred.

However, recovering to the $2400 level will require further catalysts.

Crude fell by -2.35%, dropping to the $76 rangeChina demand concerns and Gaza ceasefire hopes weighed on prices.

If a ceasefire is realized, Middle East tensions would ease and oil supply concerns would recede.

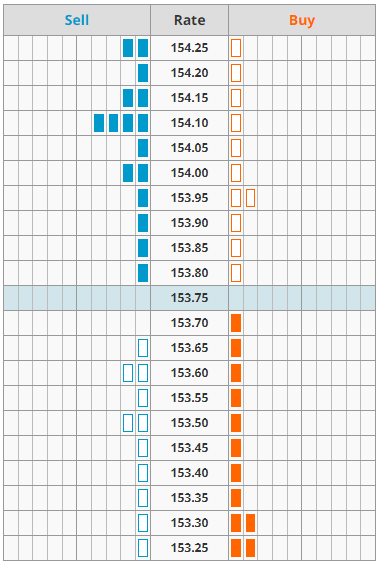

USD/JPY order flow and Sunday Dow

Sunday Dow (5-minute chart)

Nikkei futures rose by +537 points to 38,205 in after-hours tradingSunday Dow gained slightly by +3 points.

Tokyo stock market is set to open higher on Monday, but upside may be limited as the yen remains relatively strong.

Support for USD/JPY is around 153.25–153.30, with resistance at 1154.10. Liquidity is thin, suggesting higher volatility.

Until the results of the Bank of Japan meeting are announced, a corrective phase is expected to continue.

Dollar-Yen order book information

Economic indicators

★★★

23:00 (U.S.) July Consumer Confidence (Conference Board)

Previous: 100.4 Forecast: 99.8