"Peerless" Synchronization System Practical Edition 17: Checking the Do-Not-Do List (3)

Introduction • Special Interview Video

We introduced it in video interview form from Gogojan.

Content with viewing benefitsis included. If you have not watched yet, please take a look at least once.

Episode 1

https://www.gogojungle.co.jp/info/22070

Episode 2

https://www.gogojungle.co.jp/info/22078

Episode 3

https://www.gogojungle.co.jp/info/22089

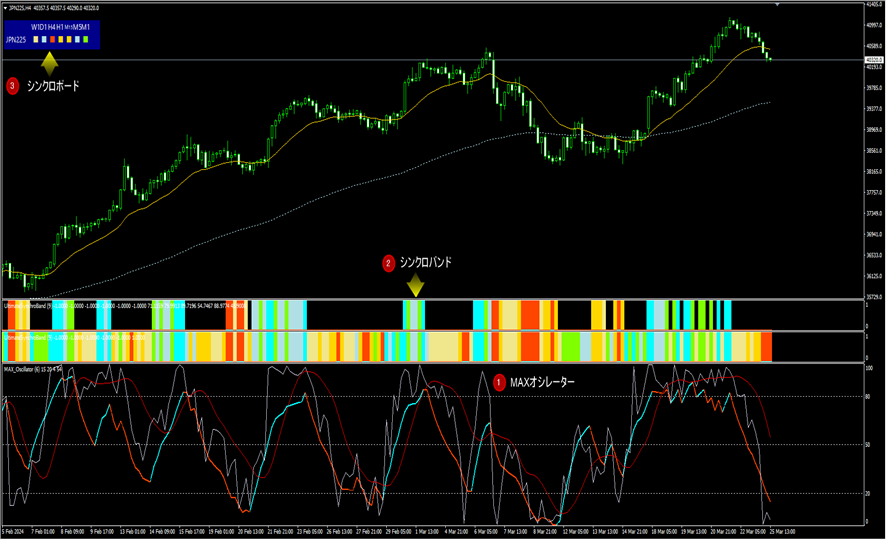

“Tenka Musou” Synchronization System · Configuration

■ Indictor configuration and priorities

Indicators consist of the followingMain three, sub2in total five indicators.

Main/Display and understand these three first. They perform best in combination.

① MAX Oscillator:A newly developed oscillator.

② Ultimate Synchrono Band:Color band for the oscillator window

Direction of price movement, strength, watchful recommended state・MTFConformityvisualizes them.

③ Ultimate Synchrono Board:Color board.

Shows the state of synchronization bands across multiple currencies and timeframes at once.

Sub:①②③ become familiar with them, confirm that you can win with only ①②③, and use as support

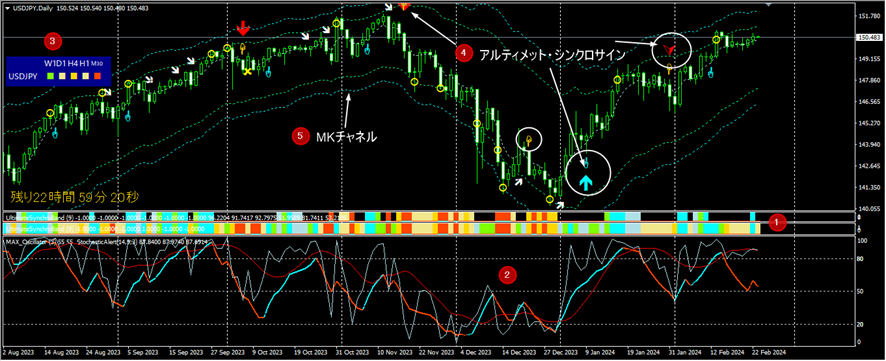

④ Ultimate Synchrono Sign:Arrow sign.

Shows upward and downward signs of price movement, a sign temporarily disabled, and a divergence.Useful for reinforcing bases and warnings。(Originally this was the mainpart)

⑤ MK Channel:A belt-like main chart channel.

Its essence is a price range meter, measuring range,MAdeviations, catching highs, suppressing rapid climbs, and securing take-profit targets.

The order to read the manual can beprogressed from ①②③,displaying only ①②③,and proceed to testing and practice

Thereafter, incorporate ④ and ⑤ and decide what is necessary or unnecessary.

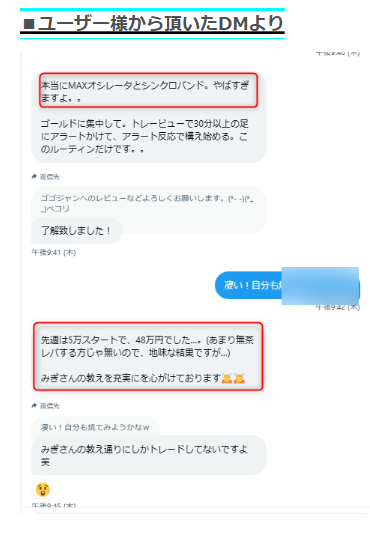

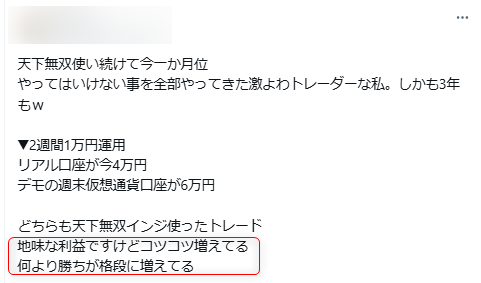

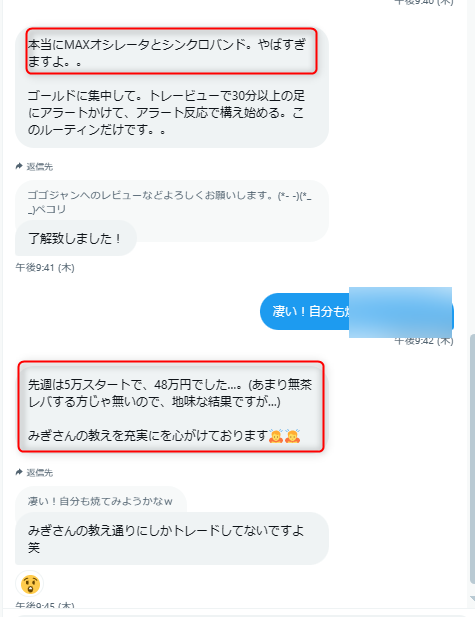

Feedback from existing users is mostly like the following.

From the DMs received

Users’ posts at OO0

■ Please check the list of articles so far at the link below.

https://www.gogojungle.co.jp/finance/navi/series/1745

※The following are recommended usage examples in day trading, scalping, and swing trading.

■ Article content this time: Verifying the three things you must not do

In interacting with users, some people start doing well in the short term, others not so much, and some take time but eventually do well, but

since each person's trading experience and learning history differ, there is a limit to what can be done.

However, those who succeed seem to always be able to take gains anywhere, butin reality, they clearly understand what not to do and do not do it. That thoroughness is common.

Therefore, from the previous issue onward, when using the system,list what not to do and inspect each itemto understand the system.

■ List of things not to do

■ Not to do ④

Entering near the moment and not waiting for the big move when a one-minute chart rule opposite signal occurs

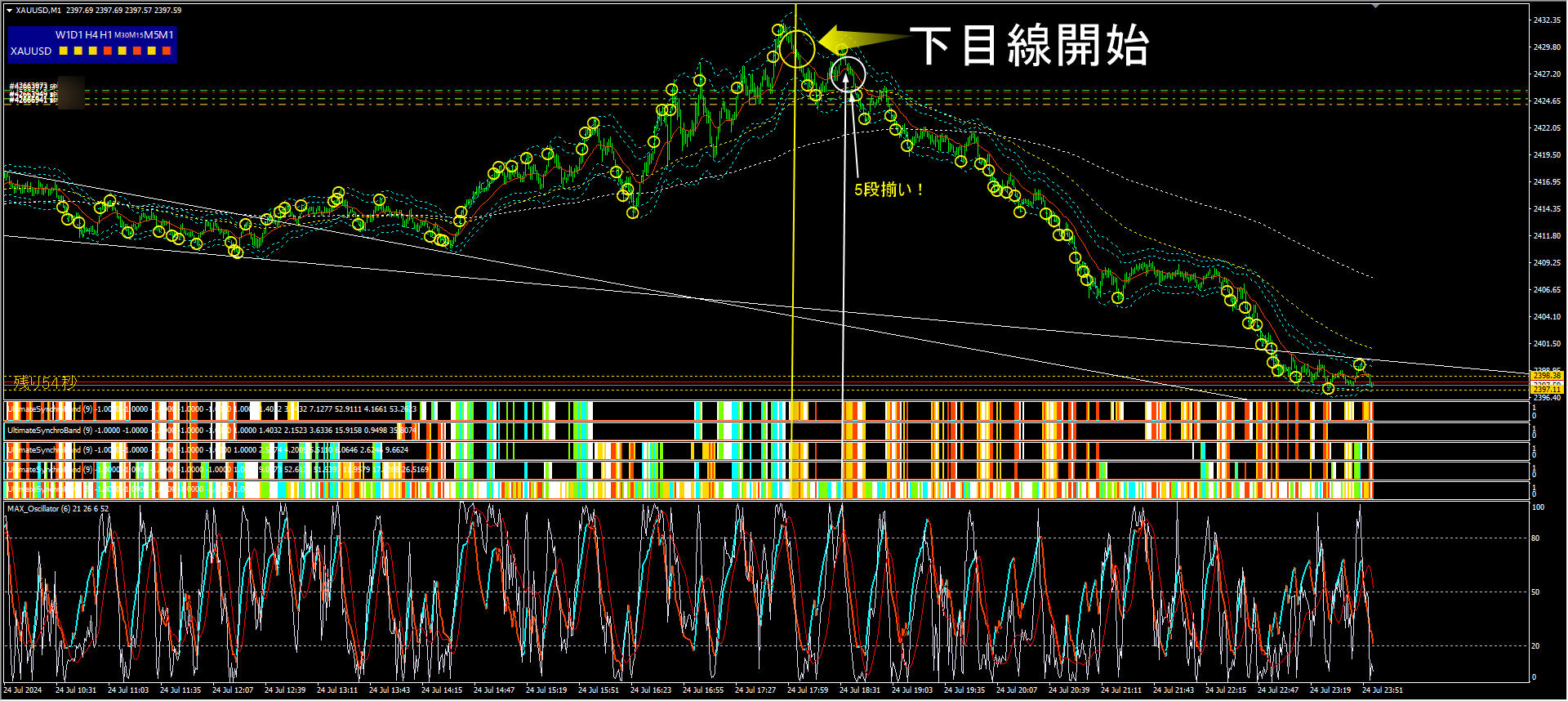

First, what is the one-minute timeframe viewpoint switch rule described earlier? Please refer to the screenshots.

■ One-minute Ultimate Synchrono Band

(The 5-layer colored band) Please look at it.

Upward strong · light blue Upward weak · green /Downward strong · red Downward weak · yellow

White · watching Neutral

※You can additionally specify higher timeframes to reference.

From bottom: 1 minute · 5 minutes · 15 minutes · 30 minutes · 1 hour settings. When price movements align across timeframes, colors appear.

■ When 3 or more of the 5 bands align, shift your focus to the consecutive direction.

※ Caution ①: If the 1-minute and 5-minute bands are not aligned, it may be better to stay on the sidelines

※ Caution ②: The most favorable entry is at the start of a sequence or the next one

※ Caution ③: Even if aligned upward, do not rush in; wait for the moment when the MAX oscillator switches from bottom to top.

(the reverse applies downward)

〇 See more in the article below.

https://www.gogojungle.co.jp/finance/navi/articles/71850?via=authors_detail

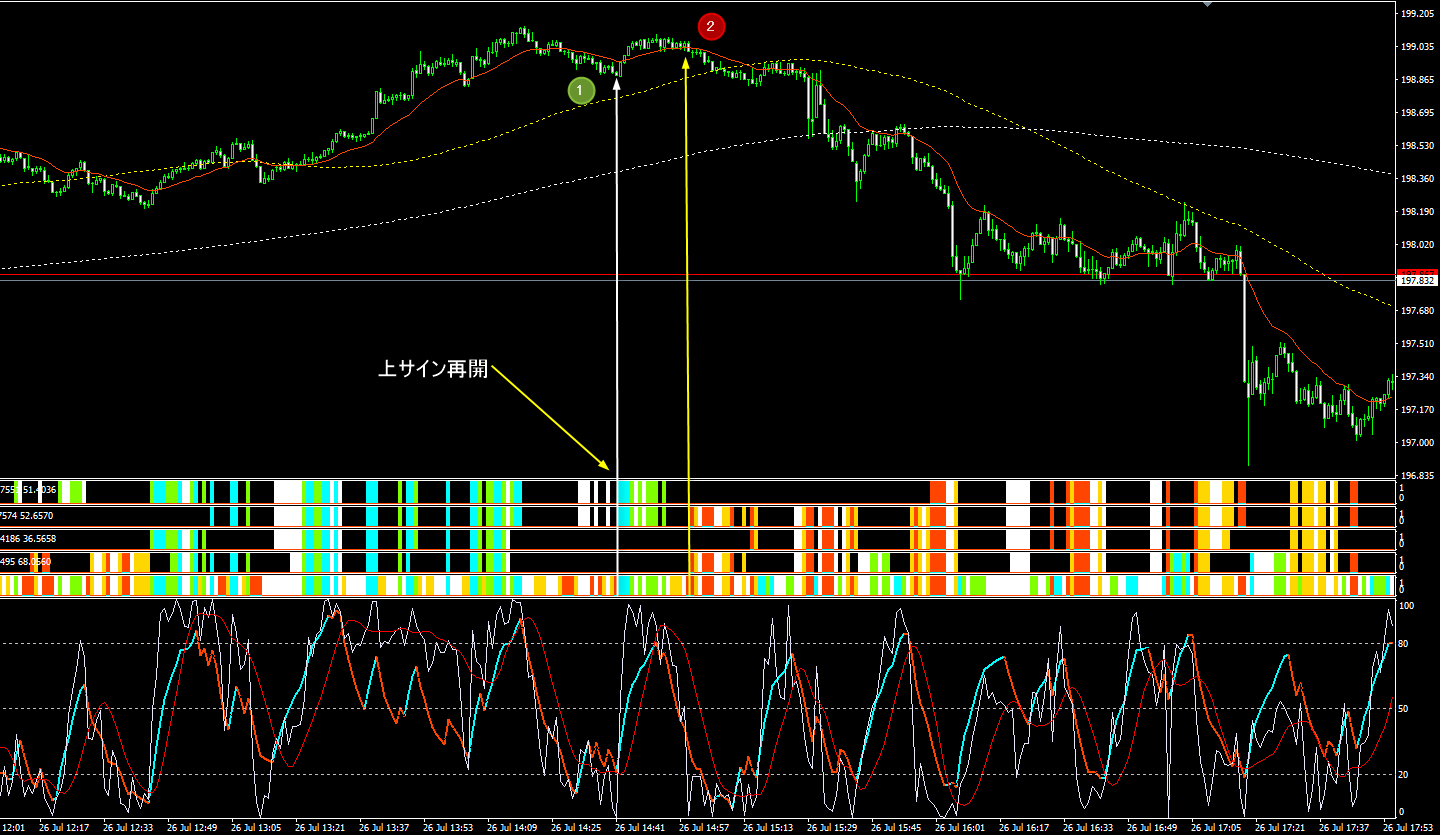

■ Case ① 7/26 – a case in GBP/JPY

Important Point ①Regardless of what happened before,do not go against the signal

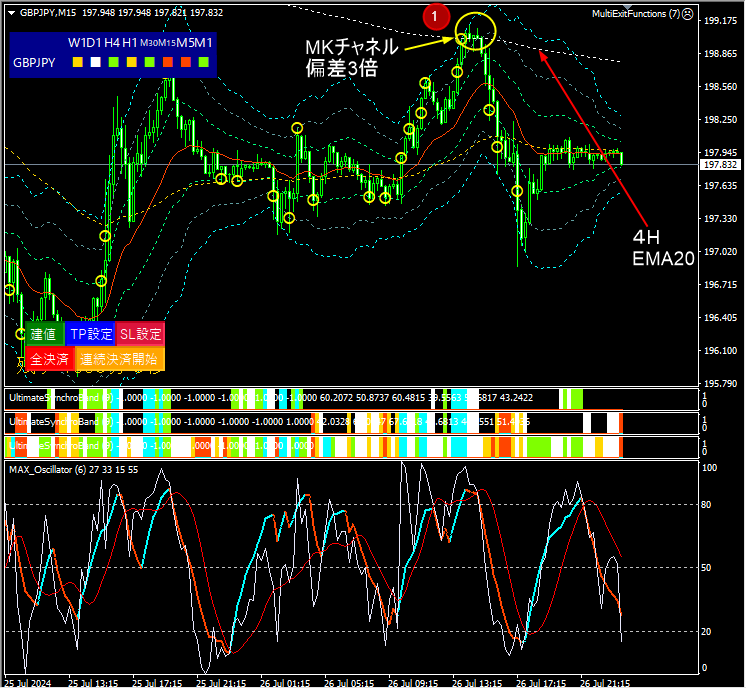

■ 2 days in GBP/JPY on 15-minute chart

Across the board for yen pairs, recently fell sharply, with a rise that suggested a reversal after the 25-day moving average

That day also rose by about 2 yen during European time.However, for example, if you had bought at timing ① because price had risen smoothly up to now, and

immediately after, even if a down signal appeared at ② on the 1-minute chart, would you ignore it and exit…?

Subsequently, it collapsed by nearly 2 yen (200 pips).If you hadn’t exited immediately, you would have taken a big loss.

Moreover, stubborn averaging down or placing buy positions without confirming signals is strictly prohibited!

Important Point ② Conduct thorough environment recognition on higher timeframes

On the 15-minute chart, point ① coincides with the 15-minute MK channel deviation triple and the 4-hour EMA20 overlap.

Both tend to act as strong resistance, where a pullback is likely to occur.

⇒ Firmly recognize the environment on higher timeframes

★Pursuit of highs and whether it becomes a rush to sell; recognizing the environment on higher timeframes in advance is very important.

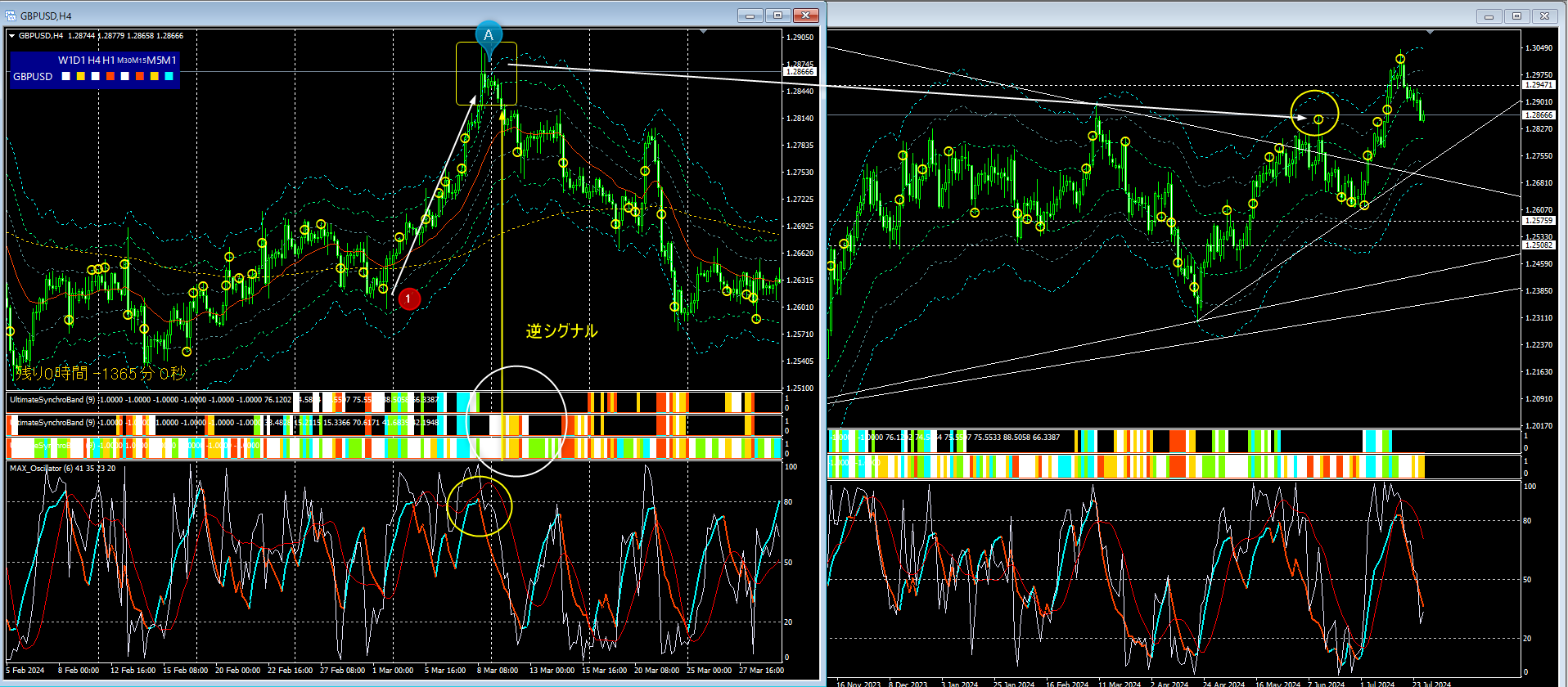

■ Not to do ⑤

On the 4-hour chart, even if a reverse signal occurs, hold current positions unresolved

My failure exampleFrom GBP, ignoring the 4-hour chart reversal signal and delaying take-profit

Bought intermittently from around GBP to around A, held up to around that level. It had extended quite a lot.

At that time, both the daily and 4-hour charts showed MAX Oscillator at the peak and a reversal warning signal lit up. Subsequently, the Synchrono Band also flashed a downward signal!

(However, because I believed it might rise further, I delayed taking profits until the next day, significantly reducing unrealized gains.)

This system is, in a sense, surprisingly accurate.

the signals shown by this system are more accurate! Do not go against them.

Important

Regardless of what happened before,

If a reverse signal occurs on the timeframe you are trading, take partial profits, or hedge at parity,

take profits or take some action in some way. Do not cling to existing positions or situations!

Summary

■ Not to do ④

Enter near the moment and do not exit immediately when a one-minute rule opposite signal occurs

■ Important!

※①: Regardless of what happened before, do not go against the signal

※②: Conduct thorough environment recognition on higher timeframes

Important

Be wary of pullbacks near the MK channel deviation triple, especially on 15-minute charts and higher!

※Make sure to keep this in mind!

■ Not to do ⑤

On the 4-hour chart, even if a reverse signal occurs, hold current positions unresolved

Important

Regardless of what happened before, no matter what popular analysts or influencers say,

the signals shown by this system are more accurate! Do not go against them.

Learn and apply each step thoroughly in real trading.

※ Nowadays, the market is driven by cutting-edge AI developed with huge funds or by genius engineers’ algorithms.

Do not think lightly; humbly learn repeatedly and grow!

Tenka Musou Series: About Analysis Tools

■ From user DMs

※ For details on the Tenka Musou Synchrono System, please see below

https://www.gogojungle.co.jp/tools/indicators/50319

Test version · Ultimate Synchrono System

https://www.gogojungle.co.jp/tools/ebooks/50353

※ Some of the system indicators are available as a one-time purchase.

■ MAX Oscillator · MT4/5 version

https://www.gogojungle.co.jp/tools/indicators/50340

■ Also the Test version

https://www.gogojungle.co.jp/tools/ebooks/50353

■ Ultimate Synchrono Band

https://www.gogojungle.co.jp/tools/indicators/42606