Next Week's FX Forecast (July 29, 2024 to August 2, 2024)

★ Goto Day Tokyo Interbank Rate Blaster EA

“CyberGotobi” is here

Next Week Market Outlook

Rapid Yen Strength

The USD/JPY continued to fall this week, briefly pushing into the low 151 per dollar territory.The downturn was compounded by a weak stock market, increasing risk-off demand for yen.

It rebounded to the late 153s, but faced selling pressure around 154. The US 10-year yield fell from 4.243% at the end of last week to 4.197%, suggesting the dollar is a bit weaker for now.

Meanwhile, cross-yen pairs saw sizable selling and broad weakness.EUR/JPY in the 164s, GBP/JPY around 195, and AUD/JPY briefly breaking the 100 levelbefore buyers returned, but caution against yen strength remains, so a further decline may be parried with patience.

The Dow Jones fell sharply, with risk-off moves intensifying at timesalso observed.Nikkei Stock Average plunged to the mid-37,000s, marking a large drop. With the yen strengthening, a period of adjustment seems likely for a while.

Gold saw sizable selling, breaking below the 2400 level. It briefly slipped toward the 2350 area, then rebounded by weekend, but upside is expected to remain heavy.

Crude oil fell below the 80 level, signaling a sell signal. The market is in a corrective mood, with concerns about China’s economic slowdown weighing on demand.

US 10-Year Treasury Yield

Forecast by CyberSignal

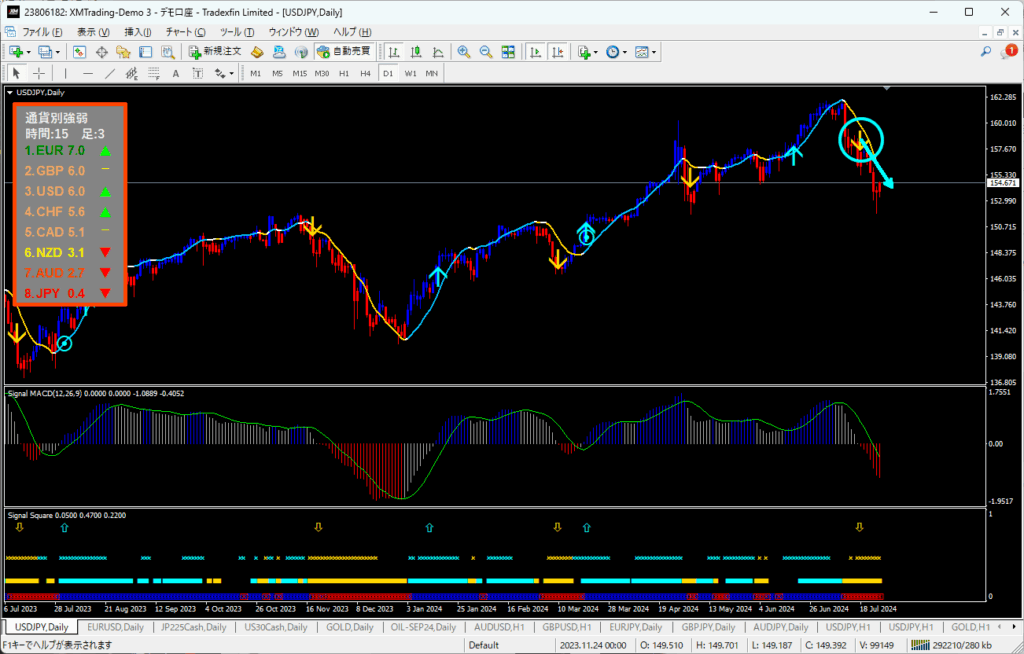

USD/JPY Outlook

USD/JPY Chart

It broke below the 160 level, generating a sell signal.

BOJ intervention remains a restraint, making aggressive buying unlikely.

The yen-strengthening environment is expected to persist.

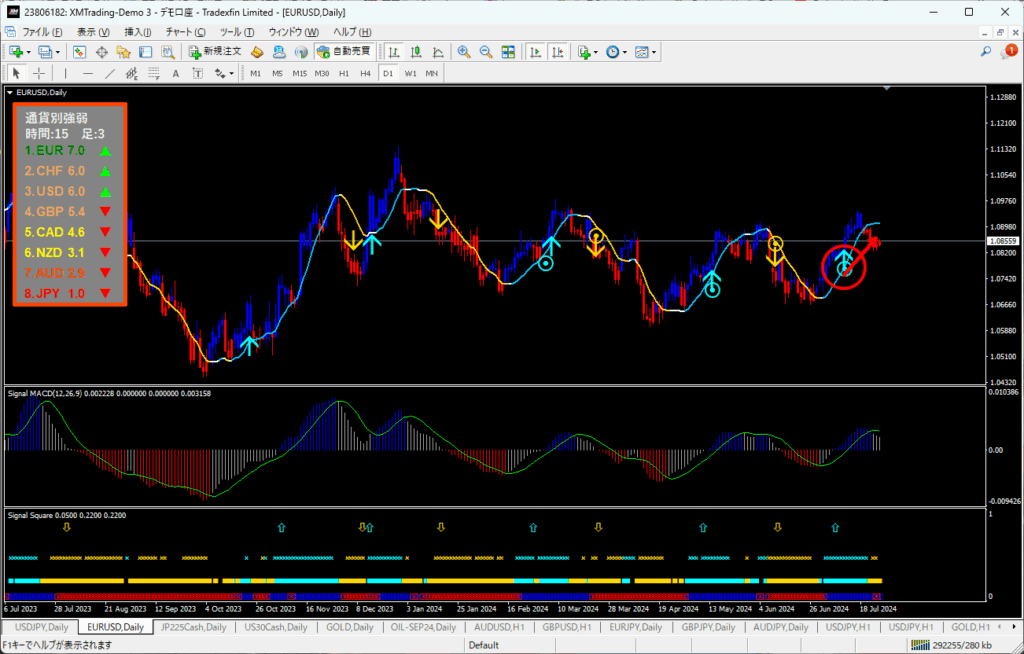

EUR/USD Outlook

EUR/USD Chart

Rebounded to around 1.08, generating a buy signal.

Lower US yields support a weaker dollar.

Buying pressure is expected to continue.

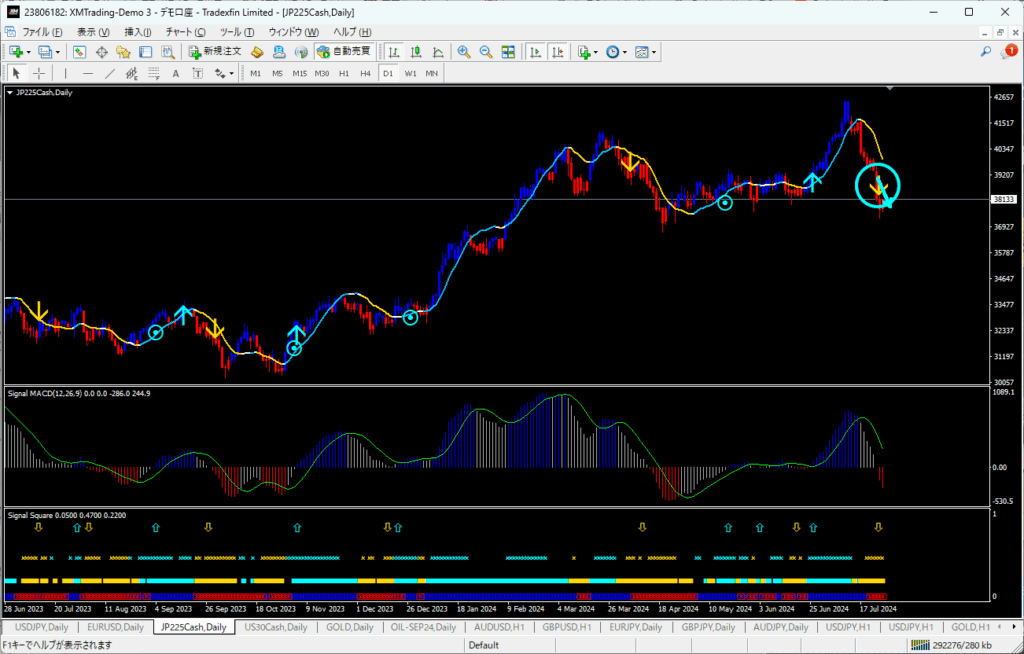

Nikkei 225 Outlook

Nikkei Chart

Fell to the 38,000 level, generating a sell signal.

Dollar weakness pushed the yen higher, weighing on the index.

Until FX moves stabilize, upside may remain capped.

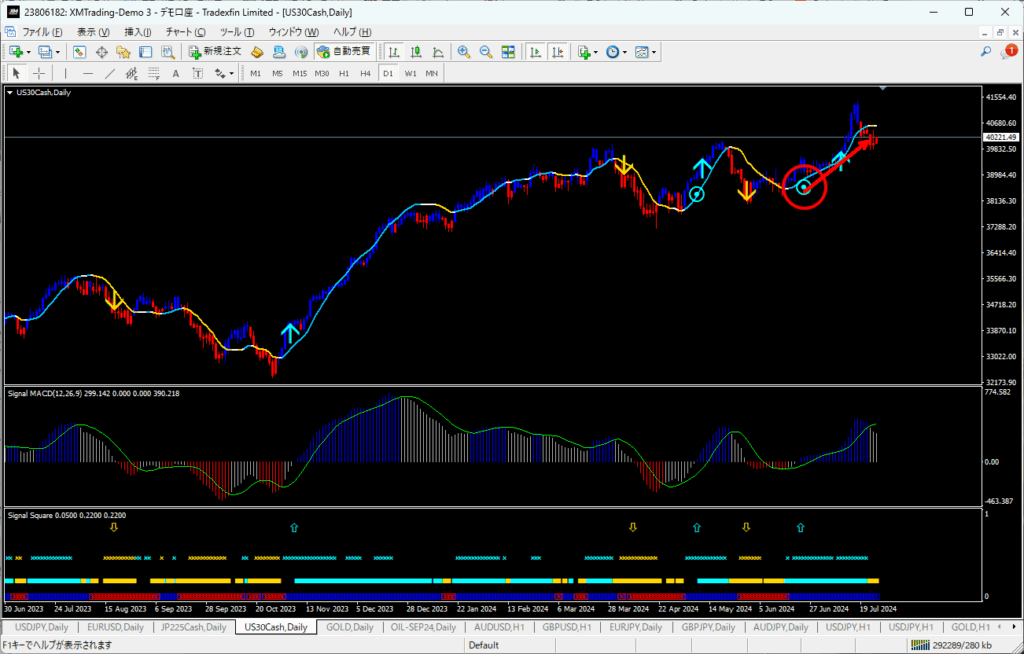

Dow Jones Outlook

Dow Chart

Recovered to around 39,000, generating a buy signal.

Movement will depend on yields and corporate earnings, with buying edging ahead.

Recent record highs suggest continued strength at higher levels.

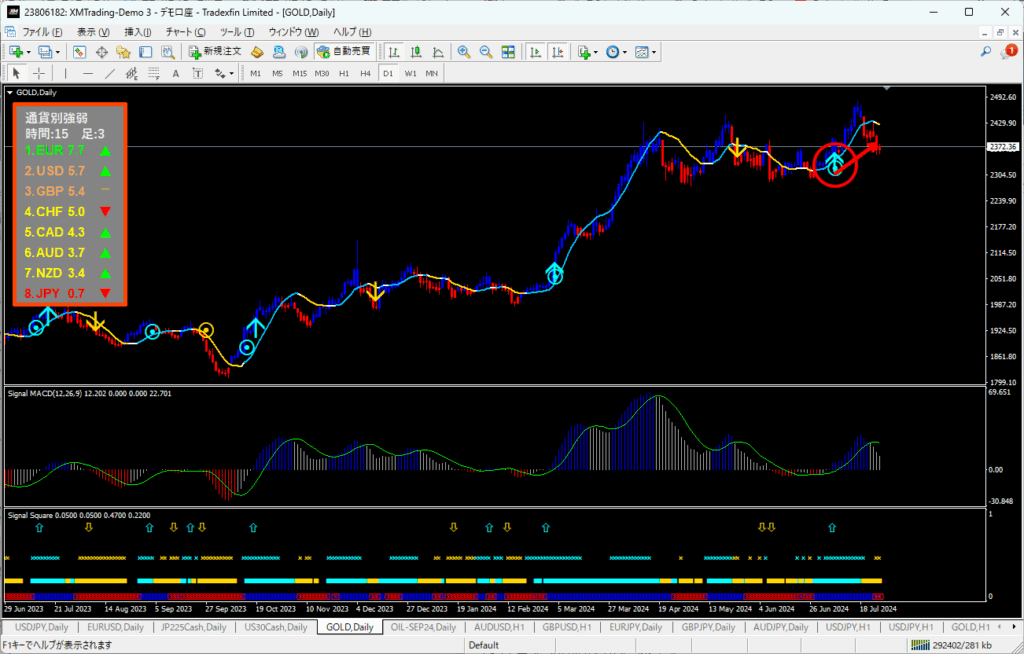

Gold Outlook

Gold Chart

Reclaimed the 2400 level, generating a buy signal.

Falling yields support dollar weakness and solid buying interest.

New record highs may resume, indicating strong demand.

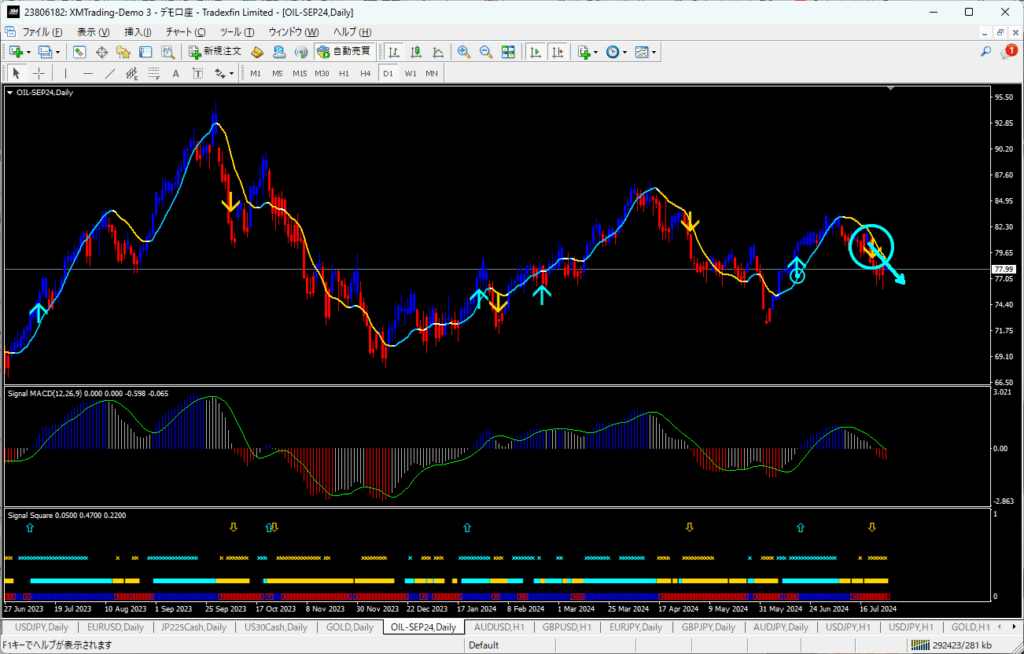

Crude Oil (WTI) Outlook

WTI Chart

Broke below 80, signaling a sell.

The 80 level acts as resistance, suggesting a return-sell bias.

China economic slowdown concerns weigh on demand expectations, fueling worries.

Economic Indicators

Next week, focus on the BOJ meeting on Wednesday and the US employment report on Friday.

In the previous BOJ meeting, talk emerged of tapering government bond purchases. Until results are known, yen weakness is unlikely. The July US payrolls are expected at 188k, down from 206k; if under 200k, dollar selling may respond.

7/29 (Mon)

No notable releases

7/30 (Tue)

(US) July Consumer Confidence Index

7/31 (Wed)

(Japan) BOJ Monetary Policy Meeting

(US) July ADP Employment, FOMC Policy Rate Announcement

8/1 (Thu)

(UK) Policy Rate Announcement

(US) Initial Jobless Claims, July ISM Manufacturing Index

8/2 (Fri)

(US) July Employment Report