FX Exchange Rate Forecast for July 22, 2024

Tomorrow's FX Forecast

Market Outlook

| Yen | Dollar | Euro | Pound | Australian Dollar | Stocks | Gold | Crude Oil |

|---|---|---|---|---|---|---|---|

- USD/JPY to rise to mid-157s

- Cross currencies pressured by selling

- Global Windows issues weigh on markets

- US stocks continue to fall

- Commodity markets see broad selling

Analysis by Cyber Signal

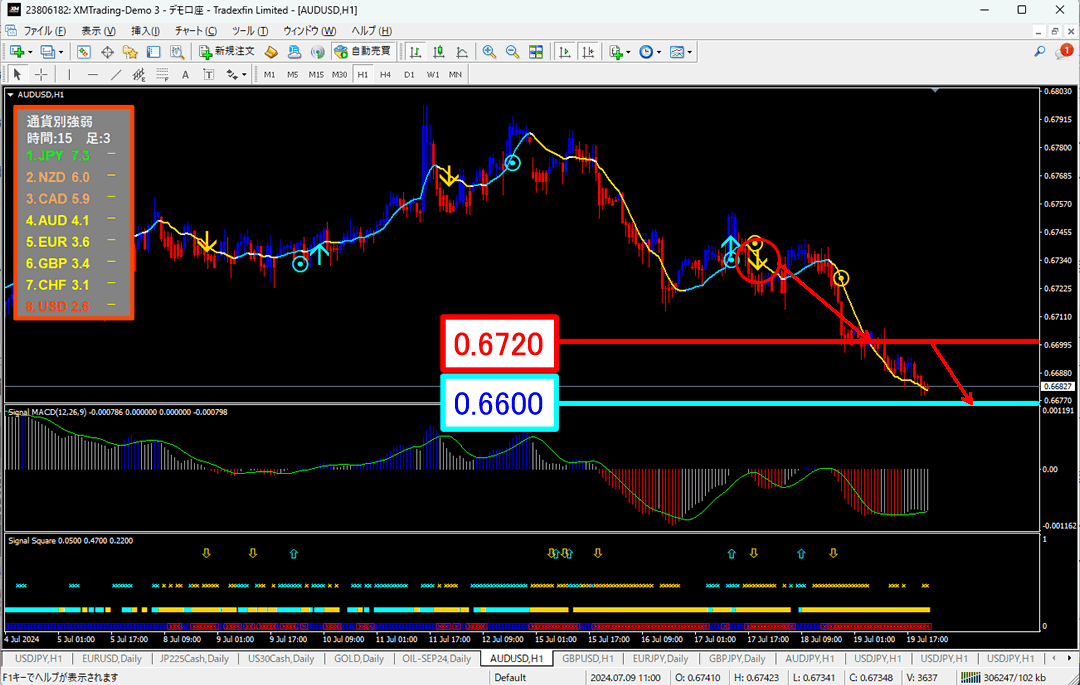

AUD/USD 0.6682 Falling (1-hour chart) ↓

Forecast range 0.6600–0.6720

Sell signal has appeared, indicating a downward trend.

We expect further declines.

Overview of the Previous Day

Dow Jones fell by 533 points, Nikkei dropped 62 points to 40,063overall.

USD/JPY rose to the mid-157s,Cross currencies pressured by selling.

Results of the Previous Day

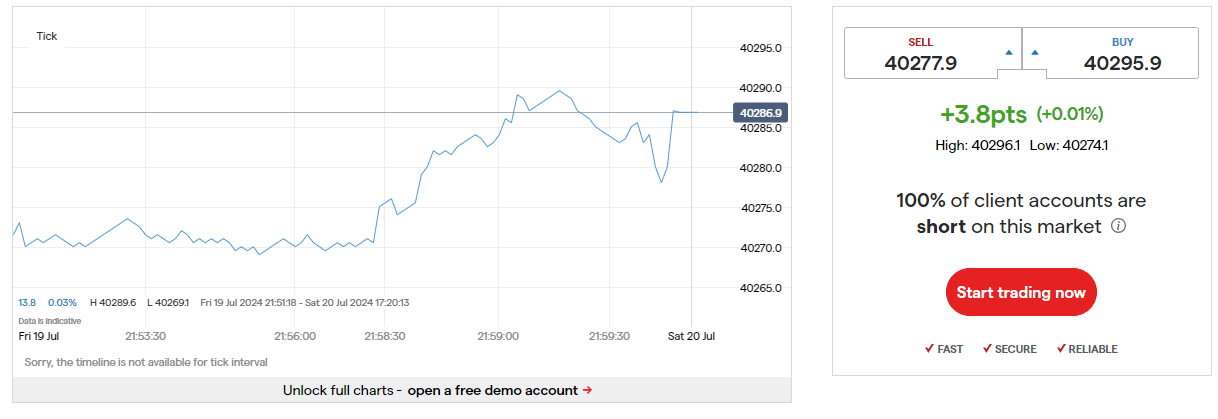

・Dow Jones40,287.53 (-377.49 -0.93%)

・Nikkei Average39,605.00 (-458 -1.15%)

・Gold2,398.79 (-46.17 -1.88%)

・WTI Crude78.76 (-2.54 -3.12%)

Economic Indicators

None of significance

Strategies for Tomorrow

Market Points

△ Bullish drivers: U.S. yields rising

▽ Bearish factors: Dow Jones and oil declines

◆ USD/JPY rising to the mid-157s

◆ Cross currencies pressured by selling

◆ U.S. 10-year yield rises to 4.243%

◆ Major dollar crosses fall slightly

◆ U.S. stocks remain biased to selling

◆ Gold down by $46

◆ Crude oil down 3.12%

◆ No major economic indicators due

◆ Sunday Dow +3 points

◆ Nikkei futures down 458 yen to 39,605

☆ Expecting a dollar-strength, stock-soft environment

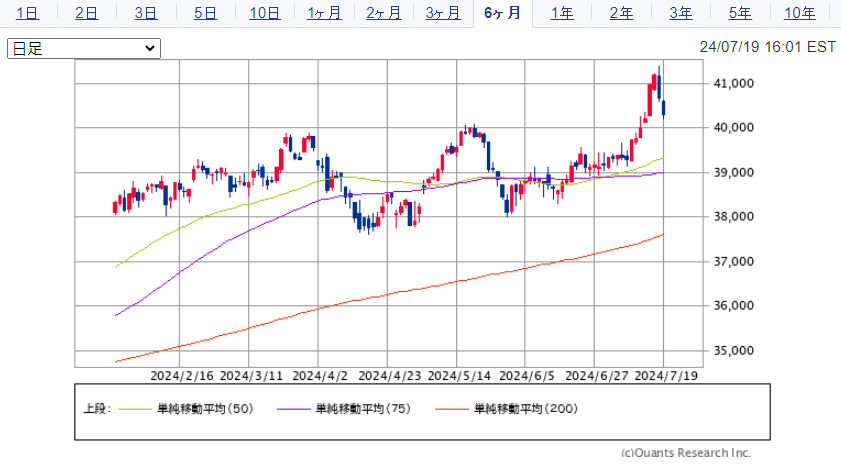

Dow Jones Chart (Daily)

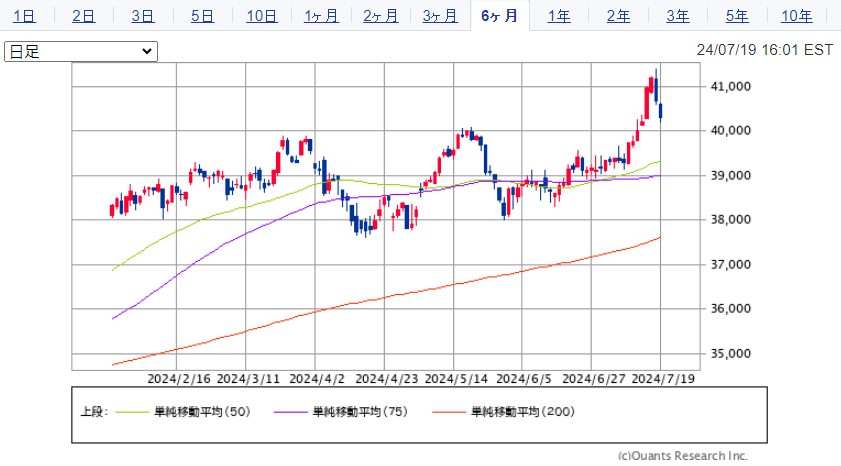

Nasdaq Chart (Daily)

Global Windows Trouble Weighs on Sentiment

Last Friday, the Dow continued to fall, down by 377 points.

Nasdaq also struggled, down about 0.81%.

As the weekend approaches, global Windows system issues have heightened risk aversion.

Intel -5.42%, Qualcomm -2.74%, AMD -2.69%, Micron -2.72%, Nvidia -2.61% led semiconductor weakness. Tesla -4.02%, Ford -3.92%, GM -2.72% fell in autos.

Conversely,Merck +1.22%, Eli Lilly +1.01%, Pfizer +0.88%, AbbVie +0.69% gained in healthcare.

Overall, 1,488 gainers vs 2,995 decliners across all stocks, with 64.6% down.

Sector Performance

Semiconductors-1.74%

Generative AI-1.19%

Oil & Energy-1.02%

Grains-0.46%

Europe-Linked-0.23%

Cryptocurrencies+2.50%

Other Currencies Weakened Against the Dollar

U.S. 10-Year Treasury Yield

USD/JPY remains firm, rising to the mid-157s. It briefly reached 157.88 but faces topside caution and selling near highs.

U.S. 10-year yield rose to 4.243%; with other currencies under pressure, a mildly stronger dollar environment is expected.

Meanwhile,Cross currencies under selling pressure and overall declines.

With European equities roughly down ~1%, euro and pound are soft. With crude back under $80, commodity currencies like the AUD are also pressured.

Windows system outage has been resolved and overall sentiment is mildly bullish for the dollar.

Commodity Markets See Broad Selling

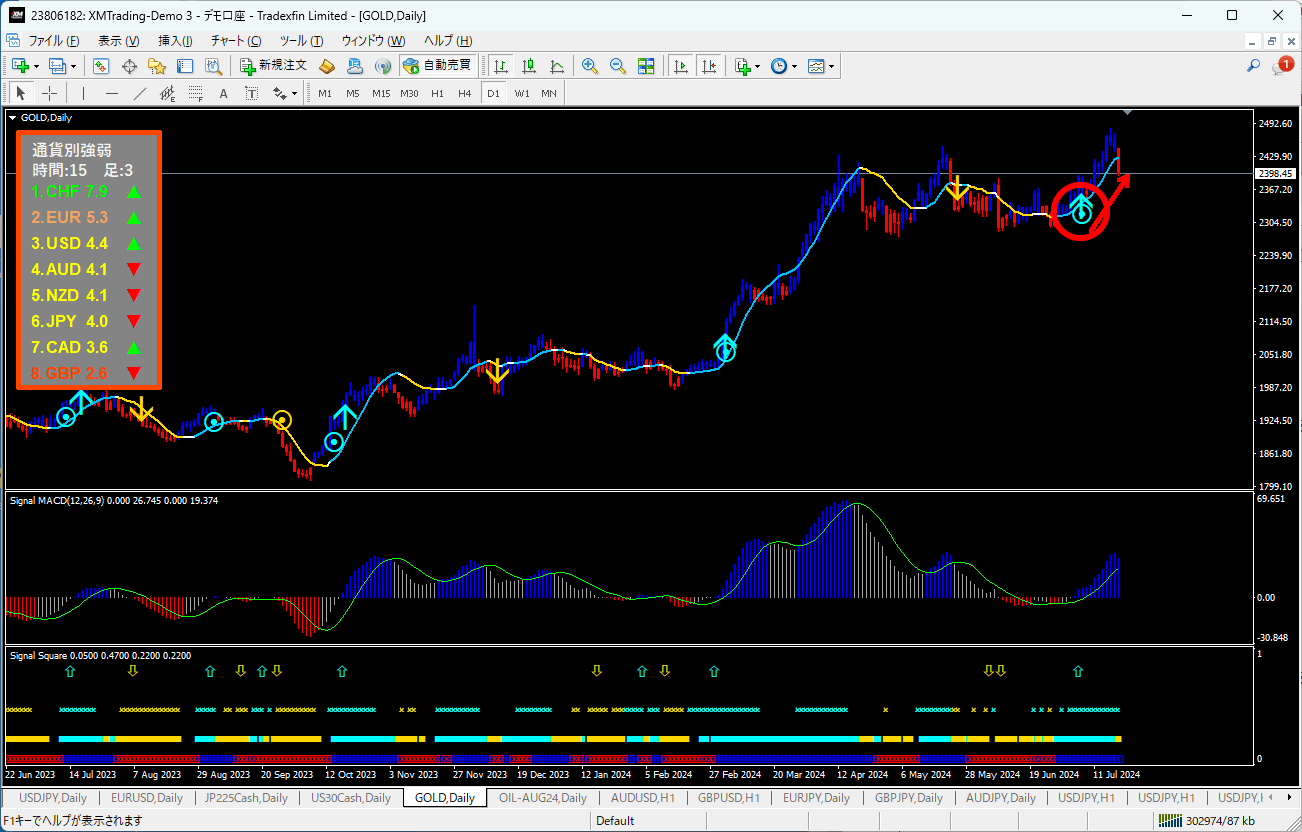

Gold Chart (Daily)

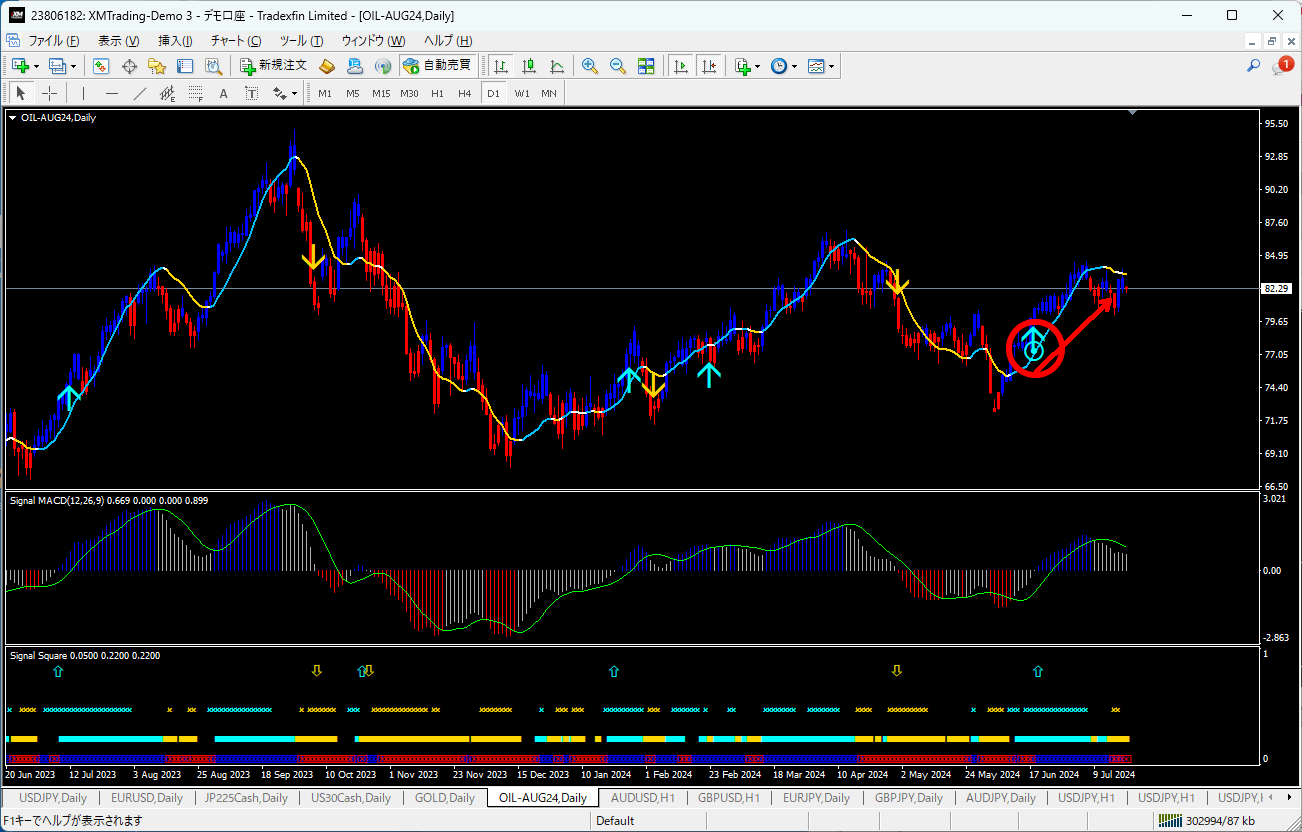

Crude Oil – WTI Chart (Daily)

Gold down by $46, driven by broad selling and a break below the $2400 level. No major new catalysts; after a recent all-time high, profit-taking pressured prices.

After the selling eases, prices may stabilize and rebound.

Crude down 3.12%, slipping to the $78s. Worsening U.S. stock declines contributed to selling in gasoline and heating oil.

Support appears near, with eyes on whether prices can re-enter the $80s.

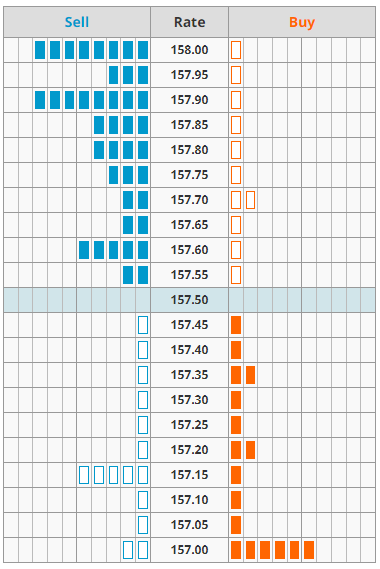

USD/JPY Order Flow and Sunday Dow

Sunday Dow (5-minute chart)

Nikkei futures fell 458 yen to 39,605 in after-hours trading. Sunday Dow rose by +3 points.

With the Dow continuing to fall, Japanese equities are expected to remain in a corrective mood.

Support for USD/JPY is at 157.15 and 157.00, while resistance is around 157.90 and 158.00. Caution for intervention keeps upside limited, but a holding at the 157 level suggests a gradual rise may continue.

USD/JPY Market Data

Economic Indicators

None of significance