"Unparalleled in the World" Syncro System Practical Edition 16: Inspecting the Do-Not-Do List 2

Introduction - Special Interview Video

We introduced it in the form of a video interview from Gogojan.

Content with viewing privilegesis included. If you haven’t viewed it yet, please take a look at least once.

Episode 1

https://www.gogojungle.co.jp/info/22070

Episode 2

https://www.gogojungle.co.jp/info/22078

Episode 3

https://www.gogojungle.co.jp/info/22089

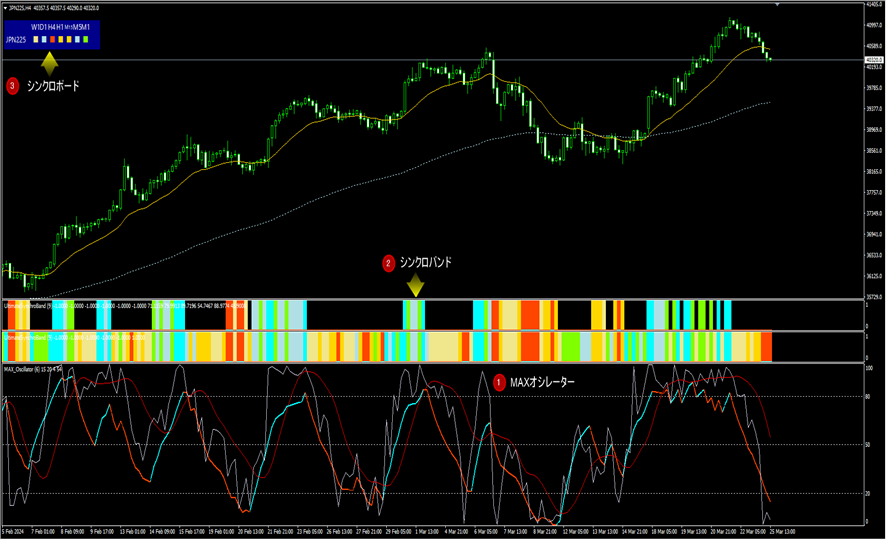

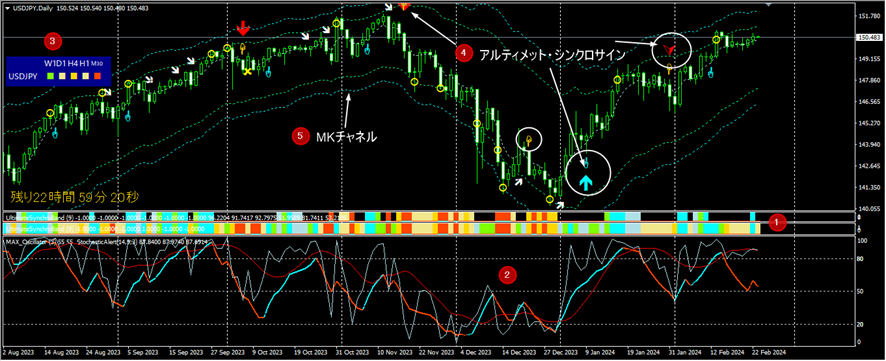

"World-Beat" Synchronization System - Structure

■ Indicators’ composition and priority

Indicators consist of the followingMain three, Sub2in total five indicators

Main/Please first display and understand these three. They exert power in combination.

① MAX Oscillator:A newly developed oscillator.

② Ultimate Synchrono Band:Color band in the oscillator window

Direction, strength, observation-friendly state—MTFConformity visualizes it.

③ Ultimate Synchrono Board:Color board.

Shows the state of sync bands across multiple currencies and timeframes at a glance.

Sub:①②③ become familiarized, confirm you can win with only ①②③, and use as support

④ Ultimate Synchrono Sign:Arrow sign.

Shows upward/downward signals, a momentary invalidation of signals, and divergences.Useful for reinforcing rationale and cautionary notes。(Originally this was the mainitem)

⑤ MK Channel:A riverside-like band on the main chart.

Essentially a price range measuring tool, measuring range,MAdeviation, catching tops, suppressing pullbacks, and securing take-profit targets.

The reading order is also described asprogressing through ①②③,showing only ①②③,proceeding to validation and practice

Thereafter, incorporate ④ and ⑤ and decide what is necessary or unnecessary.

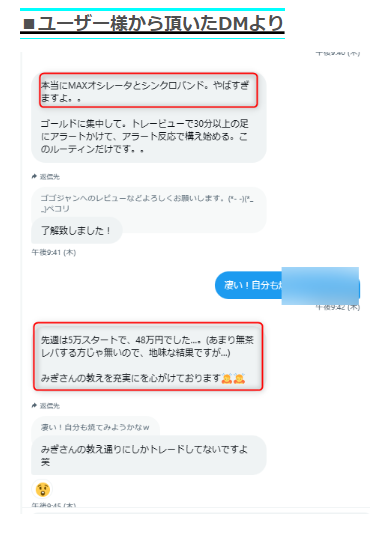

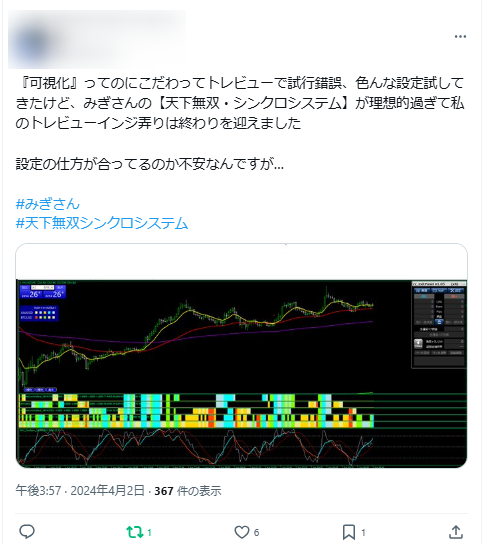

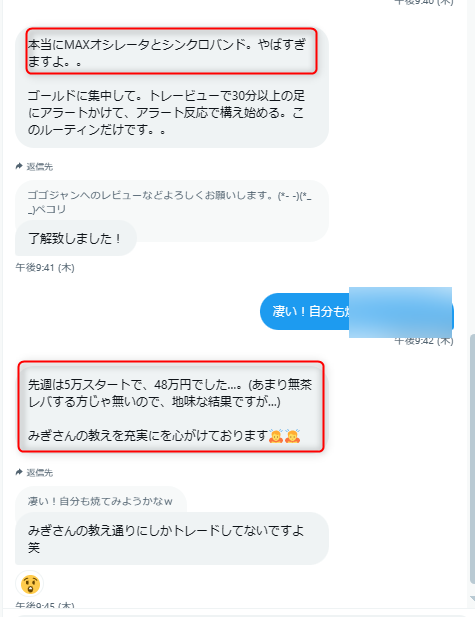

Existing users’ evaluations are typically as follows.

From user DMs

Users’ posts on SNS

■ Please refer to the list of previous articles at the link below.

https://www.gogojungle.co.jp/finance/navi/series/1745

※Below are recommended usage examples in day trading, scalping, and swing trading.

■ Article contents this time: Verifying the “Do Not Do List” 2

In interactions with users, some start succeeding in the short term, others not, and some take time but eventually succeed; each person’s trading experience and learning history differ, so some degree of variance is inevitable.

However, those who succeed seem to be able to take positions anytime, anywhere, but in reality they thoroughly understand what not to do and refrain from doing it. This is common.

From now on, the article will develop in the direction of understanding the system by listing what not to do and inspecting each item.

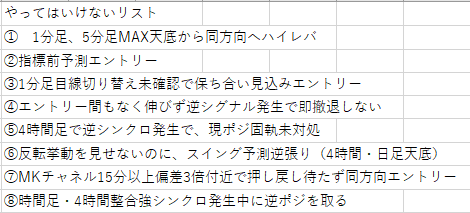

■ Do Not Do List

■ Do Not Do③

1-minute chart perspective switch rule not confirmed, entering while in consolidation

First, what is the 1-minute chart perspective switch rule? See the screenshot.

■ 1-minute Ultimate Synchrono Band

(the five-tier color band) please refer to it.

Upward strong - light blue; upward weak - green / downward strong - red; downward weak - yellow

White - observe; neutral

※Additionally, you can specify the higher timeframe you want to reference.

From bottom, set 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour. When the price movements across timeframes align, colors appear.

■ When three or more of the five tiers align, shift your perspective toward the consecutive one.

※ Note ①: If 1-minute and 5-minute are not aligned, it’s better to wait and observe

※ Note ②: The most favorable entry is at the start of a sequence or the next one

※ Note ③: Even if aligned upward, do not rush in; time the moment when the MAX Oscillator changes from bottom to top.

(the reverse for downward)

〇 See more details in the article below.

https://www.gogojungle.co.jp/finance/navi/articles/71850?via=authors_detail

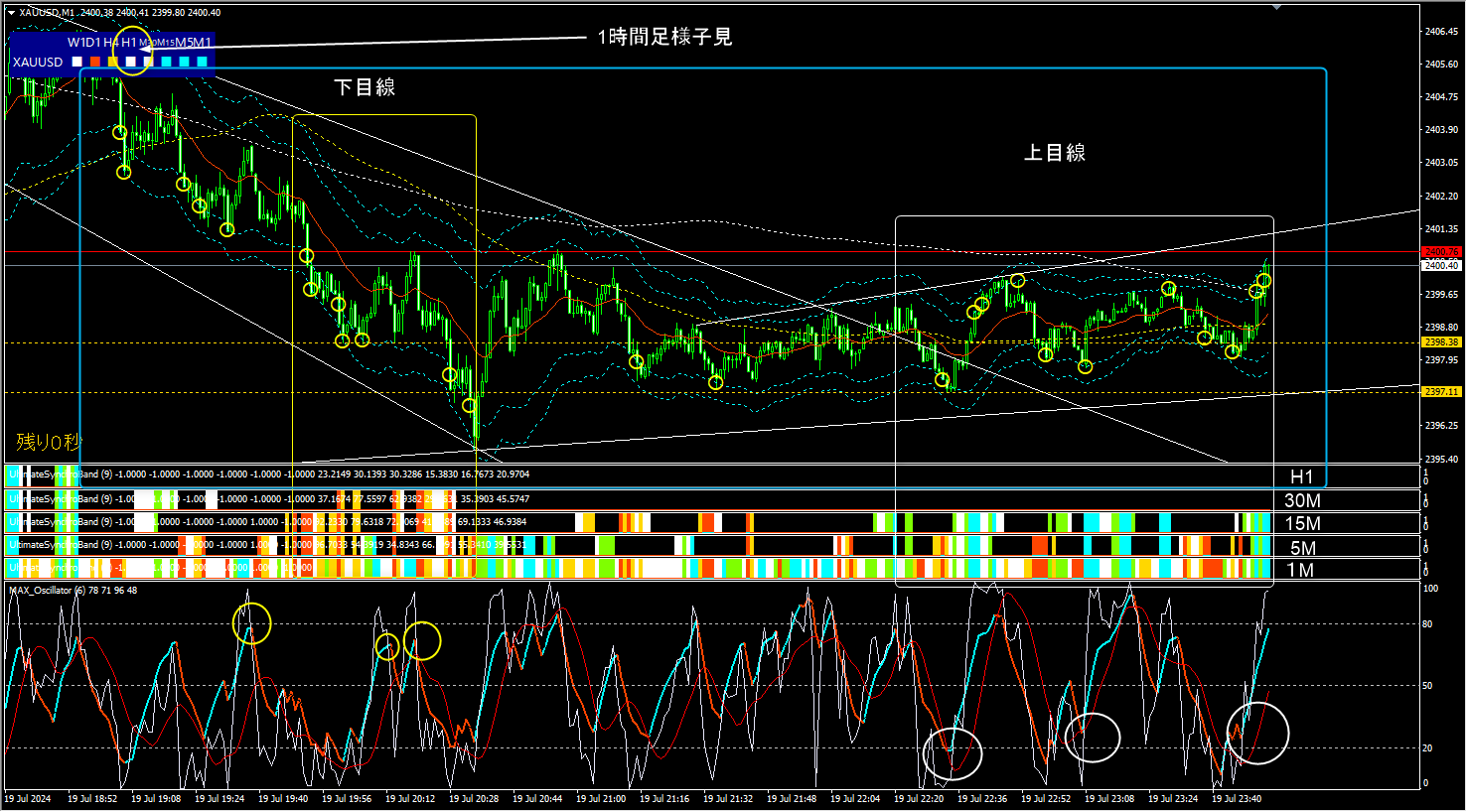

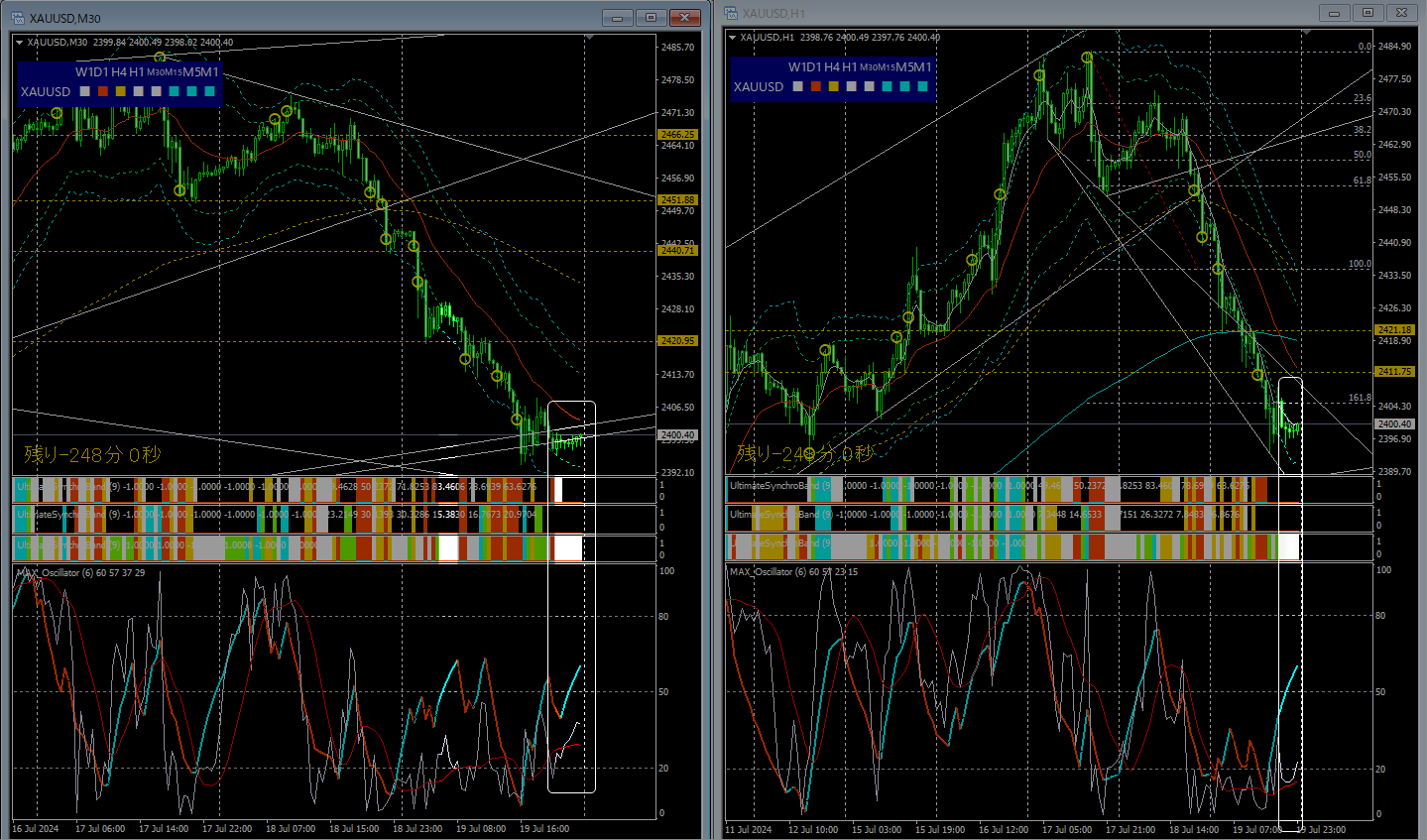

■ Case ① A large decline pauses for a moment, then gold

Important Point ①First, understand the state of the higher timeframe

■ Tip for effective use ①

Be mindful of waiting – congested and irregular price action tends to occur.That's right.

At this time, the 1-hour and 30-minute charts indicate wait/neutral signals.

From the 1-minute chart, you can see irregular, choppy price movements.

If you were to enter at this time,

you should faithfully follow the perspective switch rules described above.

In this case,entering up or down without any justification leads to confusion and frequent losses.This tends to result in a rapid loss of capital.

Moreover, high-leverage entries are strictly prohibited!

Important Point ② If the higher timeframe is in wait, exit early.

Longer holds are possible when the higher timeframe clearly shows the trend.

However, on 15-minute, 30-minute, 1-hour, or even 4-hour charts for currencies,

when in wait-signal, price movement is unstable and the trend is unclear.

⇒ When the higher timeframe is in wait, exit early.

★Even if your judgment is correct, exit early until it becomes clear!

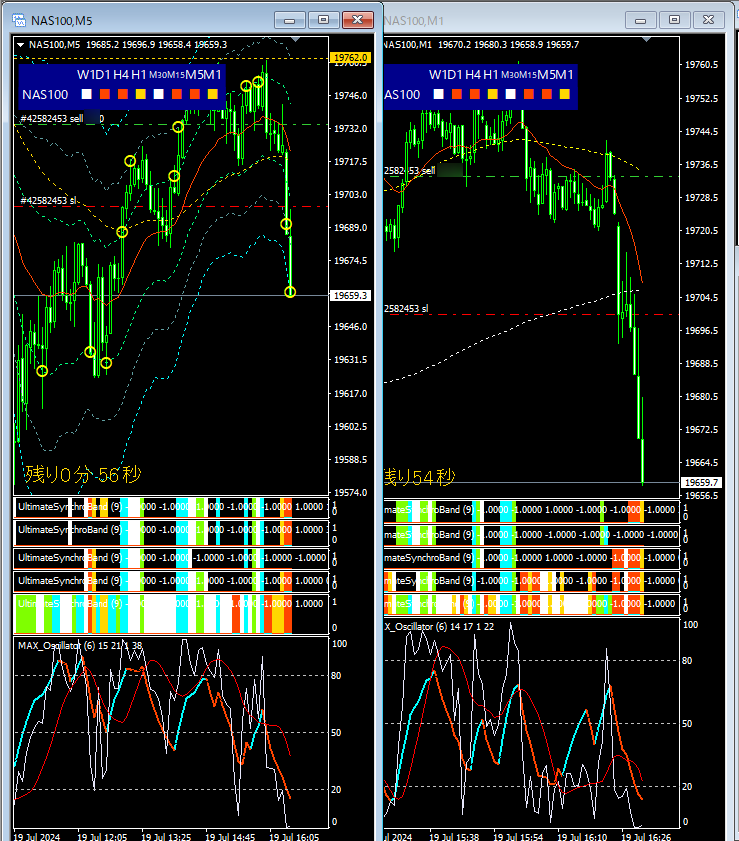

■ Case ② Nasdaq opening (NAS100) at market open

At market open, do not enter US stock indices with erratic behavior.

U.S. stock indices, especially Dow Jones Industrial Average and Nasdaq or related product CFDs, you may know, at open sometimes move drastically in one direction, butthey whip you around mercilessly!

※ If you enter without any basis, simply watching price movement will burn you

Example: NAS100 1-minute chart right after U.S. market open on July 19

Move rapidly with a 5-minute pace. The price range is about 70 pips.

If you dive in and enter, you’ll be carried along and crushed, and your margin will rapidly decrease.This is something only experienced traders know.

However, with the 1-minute chart perspective switch rule above, even if you momentarily bounce upward,the Synchrono Band continues to indicate the perspective downward.In that case, as shown, the result moved strongly downward.ImportantDo not dive-in when going down too;Wait for the MAX Oscillator to rise and time the moment it switches from bottom to top.※ My entryIn this way, I repeatedly enter downward.Summary■ Do Not Do③1-minute chart perspective switch rule not confirmed, entering while in consolidation■ When three or more of the five tiers align, shift perspective toward the consecutive one.※ Note ①: If 1-minute and 5-minute are not aligned, better to wait and observe※ Note ②: The most favorable entry is at the start of the sequence or the next one※ Note ③: Even when aligned upward, do not rush; time the moment when the MAX Oscillator switches from bottom to top. (the reverse for downward)Important When the higher timeframe is waiting, exit early.※ Please also make sure to reinforce this!One by one, properly “wear them in,” and be able to handle them in real trading.※ Now the market is moved by the latest AI developed with huge funds and genius engineers.Let’s learn humbly and repeatedly, and grow!天下無双 Series: About the Analysis Tools■ From user DMs※ For details on the天下無双 Synchrono System, please refer to below“天下無双” Synchrono Systemhttps://www.gogojungle.co.jp/tools/indicators/50319Trial version – Ultimate Synchrono Systemhttps://www.gogojungle.co.jp/tools/ebooks/50353※ Each system indicator is also available in a perpetual version.■ MAX Oscillator – MT4/5 versionhttps://www.gogojungle.co.jp/tools/indicators/50340■ Similarly, Trial versionhttps://www.gogojungle.co.jp/tools/ebooks/50353■ Ultimate Synchrono Bandhttps://www.gogojungle.co.jp/tools/indicators/42606

the Synchrono Band continues to indicate the perspective downward.

In that case, as shown, the result moved strongly downward.

ImportantDo not dive-in when going down too;

Wait for the MAX Oscillator to rise and time the moment it switches from bottom to top.

※ My entry

In this way, I repeatedly enter downward.

■ Do Not Do③

1-minute chart perspective switch rule not confirmed, entering while in consolidation

■ When three or more of the five tiers align, shift perspective toward the consecutive one.

※ Note ①: If 1-minute and 5-minute are not aligned, better to wait and observe

※ Note ②: The most favorable entry is at the start of the sequence or the next one

※ Note ③: Even when aligned upward, do not rush; time the moment when the MAX Oscillator switches from bottom to top.

(the reverse for downward)

Important

※ Please also make sure to reinforce this!

One by one, properly “wear them in,” and be able to handle them in real trading.

※ Now the market is moved by the latest AI developed with huge funds and genius engineers.

Let’s learn humbly and repeatedly, and grow!

天下無双 Series: About the Analysis Tools

■ From user DMs

※ For details on the天下無双 Synchrono System, please refer to below

“天下無双” Synchrono System

https://www.gogojungle.co.jp/tools/indicators/50319

Trial version – Ultimate Synchrono System

https://www.gogojungle.co.jp/tools/ebooks/50353

※ Each system indicator is also available in a perpetual version.

■ MAX Oscillator – MT4/5 version

https://www.gogojungle.co.jp/tools/indicators/50340

■ Similarly, Trial version

https://www.gogojungle.co.jp/tools/ebooks/50353

■ Ultimate Synchrono Band

https://www.gogojungle.co.jp/tools/indicators/42606