Next Week's FX Forecast (July 22, 2024 – July 26, 2024)

Next Week's Market Outlook

Dow Jones and Gold Hit All-Time Highs

The dollar-yen, which fell sharply last week, rebounded to the mid-157 range by the latter part of the week. Caution remains over Bank of Japan currency intervention, so it is a cautious rebound as we watch the market.

If no speculative moves are seen, it seems unlikely that further intervention will occur.U.S. 10-year Treasury yields rose from 4.178% at the end of last week to 4.243%, suggesting continued demand for the dollarwill persist.

On the other hand, cross-yen pairs are slightly soft, selling persisted in the early to mid-week, but rebounded somewhat toward the latter part. The dollar strength was pressured by other dollar-Yen crosses. With yen strength fading, we hope for a renewed yen depreciation move.

The Dow Jones continued to rise, hitting all-time highsThis happened. The Nikkei Average plunged due to yen strength, and a period of adjustment is likely to continue.

Gold continued to rebound, hitting all-time highsThere has been some selling afterward, but with U.S. yields leveling off, a pullback should be contained after the selling pressure ends.

Crude oil has been in an upward trend since a buy signal appeared. During the driving season, gasoline demand rises, and crude tends to move higher with it.

U.S. 10-Year Treasury Yield

Forecast by CyberSignal

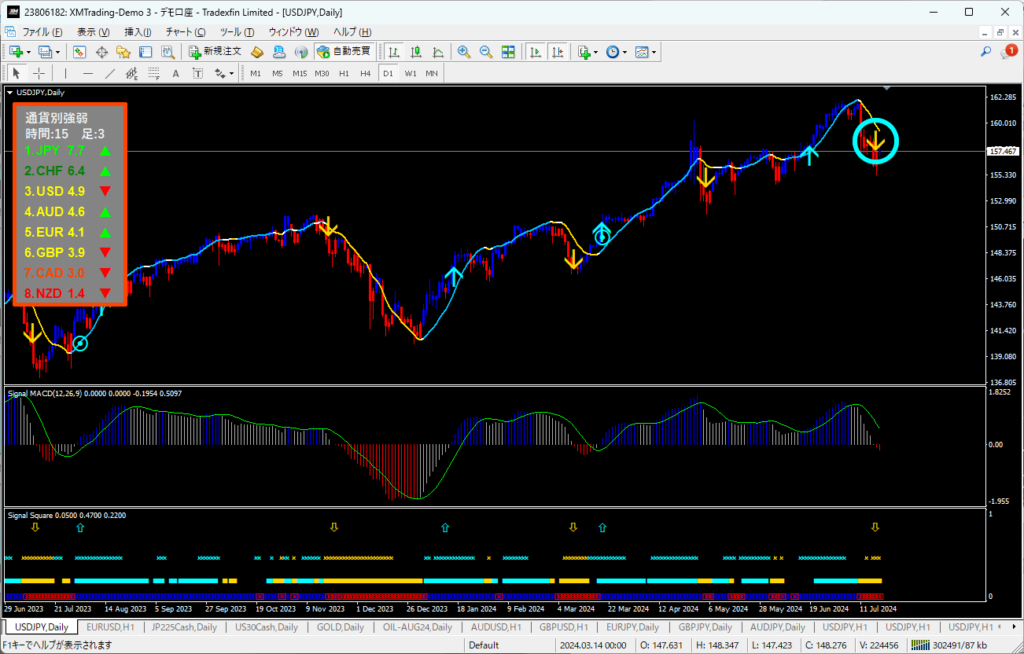

Dollar-Yen Forecast

Dollar-Yen Chart

The price fell below 160, and a selling signal appeared.

BOJ intervention remains a drag, making aggressive buying unlikely.

We expect the upward move to continue to be limited.

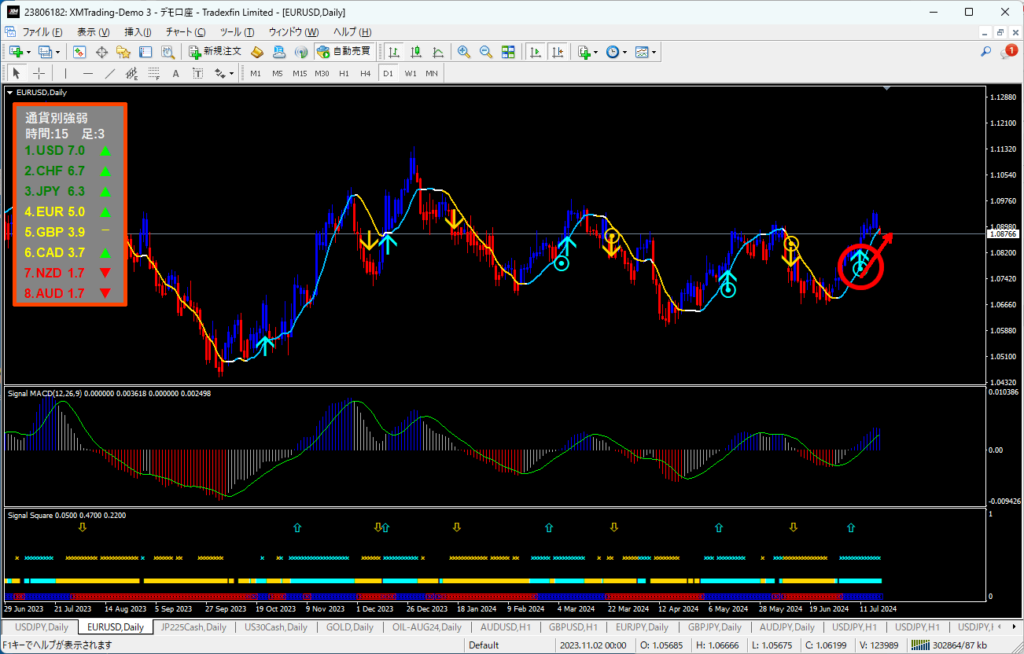

Euro-Dollar Forecast

Euro-Dollar Chart

Rebounded to the 1.08 area, with a buying signal emitted.

Lower U.S. yields support a weaker dollar.

We expect the buy-side to remain dominant.

Nikkei 225 Forecast

Nikkei 225 Chart

Hoped to return to the 38,000 level, with a buy signal issued.

With the Dow Jones and Nasdaq hitting all-time highs, Japanese equities are also rallying.

However, they have recently been eroded by sharp yen strength, so remaining cautious is prudent until things settle.

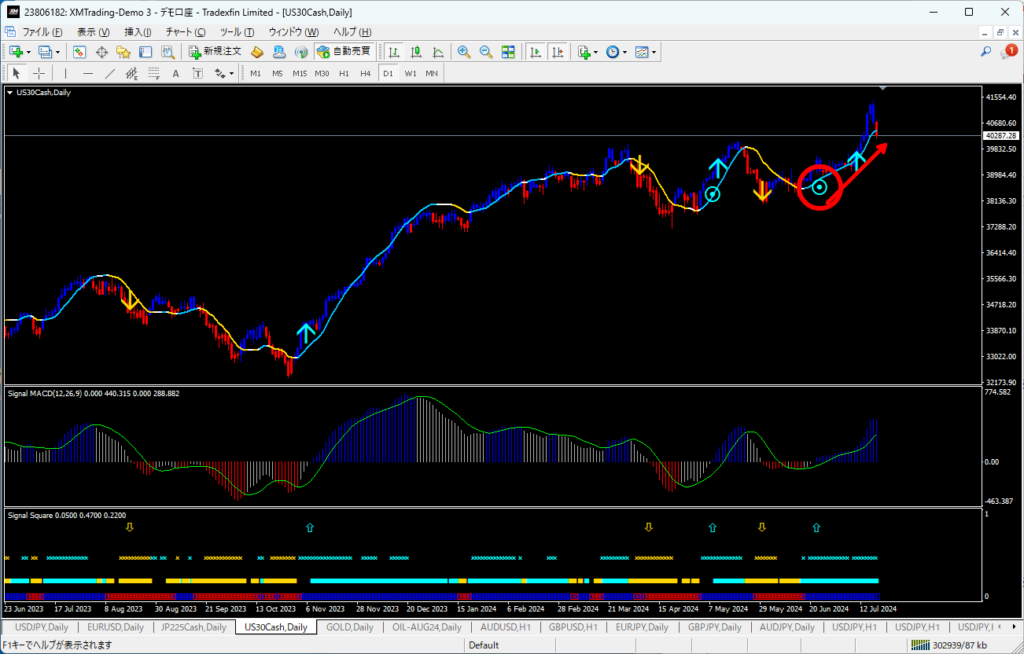

Dow Jones Forecast

Dow Jones Chart

Recovered to the 39,000 level, with a buy signal.

Moves will depend on U.S. yields and corporate earnings, gradually favoring buys.

Having briefly reached record highs, we expect the price to stay in a high range.

Gold Forecast

Gold Chart

Recovered into the 2,400 area, with a buy signal.

As U.S. yields decline, dollar selling accelerates, drawing substantial buying interest.

Headline highs could be breached again, indicating strong buying appetite.

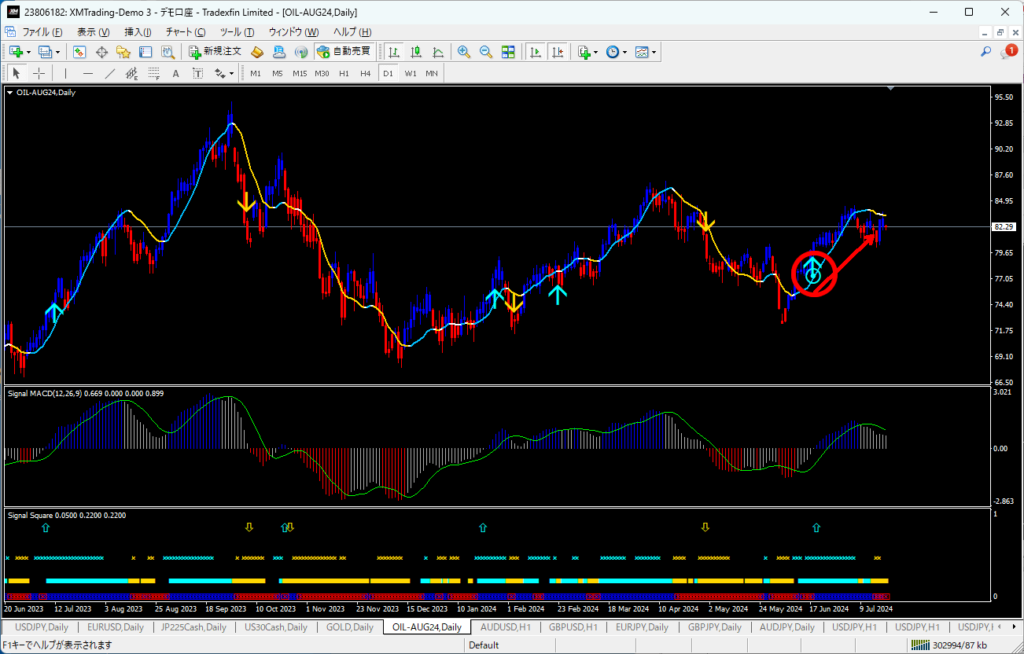

Crude Oil (WTI) Forecast

Crude Oil (WTI) Chart

Broke above the 75 handle, generating a buy signal.

Recovered the 80 level and extended toward the mid-80s.

During driving season, gasoline usage rises, and crude tends to rise as well.

Economic Indicators

Next week, focus on the U.S. Q2 2024 GDP flash estimate due Thursday. Expectations are for 1.9% growth, up from previous 1.4%, raising expectations for dollar buying after the release.

However, Friday’s U.S. June PCE deflator is expected to ease slightly to 2.5% from 2.6% previously.

Mon 7/22

Nothing notable

Tue 7/23

(U.S.) July Richmond Fed manufacturing index, June existing home sales

Wed 7/24

(U.S.) July Manufacturing PMI

Thu 7/25

(U.S.) Initial jobless claims, Q2 GDP flash estimate

Fri 7/26

(U.S.) June PCE deflator, University of Michigan July consumer sentiment index