To check the momentum of continuing upward moves. Kōya Hiro’s "From the Technical Room"

November 27, 2016, 10:03

Sustainability of the bull market by the number of new highs

This year's market was driven down sharply by shocks originating overseas,

and as selling pressure abated, it repeatedly tried to rebound, and

a rebound attempt continued through September,when

short selling ratio served as a valid indicator to gauge the market direction.

There was no clear sign of a move that would push prices higher,

despite the attempt to chase the highs and push gains upward, with the high price rising

continuing as the market did not show such momentum.

As evidence of this situation, the number of new highs exceeded 100.

From the beginning of the year through September, there were only two days when new highs surpassed

100,

which is clearly evident.However, before the Trump effect, in October, the Japanese stock market

began to display strength to push prices higher, and in November, the yen depreciation accelerated due to the Trump phenomenon, bolstering the rise,

and the momentum of the increase was reinforced

as evidenced by the rapid rise in the number of new highs.

As long as the number of new highs remains high, maintaining this elevated level is crucial.

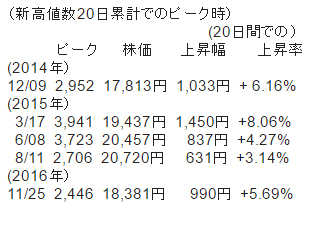

Below, we checked, for the past two years, the peak of the market by the monthly cumulative number of new highs. The 2014 example

shows after the Bank of Japan's additional easing, the bull market had an average of

147 new highs per day, indicating strong market momentum.

What exceeded that was the rally from last year (February–March), with

daily new highs approaching 197 and 200,

showing strong momentum.

What to note here is that around the time the 20-day cumulative new highs

peaked, stock prices also hit a high and fell back.

Furthermore, to push higher, the number of new highs needs to exceed 200

At present, both the dollar-yen rate and stock prices show technical signs of being overheated, and concerns about a quick correction rise

.>There is a concern that when stock prices rise beyond overheated conditions,

individual stock picking willingness must not diminish

.

Maintaining three-digit numbers of new highs is the minimum condition,

and from here, pushing higher may require surpassing 200.

New highs numbers are checked daily in real time.

At present, it remains crucial to determine whether the market trend will persist.

This will be the most important indicator.