The 'Last 3 Furlongs' offers a minimum annual return of +50% with compound interest, increasing by +540% in two and a half years!

Although the number of trades is small, the maximum drawdown is in the 20,000-yen range per 0.1 lot.

A “Three Furlongs Up” suited for high-leverage trading

With the Premium version's compounding feature, what difference does it make to the return rate?

We compared the expected annual return with compounding!

Details of the ‘Three Furlongs Up’ without the compounding feature are here

High win rate, low drawdown, and suited for high-leverage trading: ‘Three Furlongs Up’

◆ Basic specs of “Three Furlongs Up” ◆

Approximately 100 trades per year,

Maximum drawdown of 26,000 yen per 0.1 lot

Expected annual profit is around 300,000 yen.

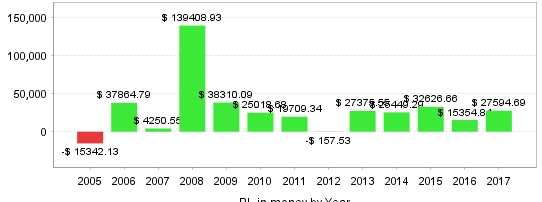

Backtest annual profit for 0.1 lot is shown below ↓

By the way, the recommended margin per 0.1 lot is,

(4.5) + (Maximum DD 2.6 × 2) = 97,000 yen

Thus, the forward-looking recommended margin is in the 500,000-yen range, but when considering the risks in past backtests,

Considering this,0.1 lot per 100,000 yenseems appropriate.

Additionally, the backtest predictsan average annual return of about 30%or so,

What kind of profit rate can be expected using the compounding feature?

We compared mid-term, long-term, and yearly operation with 1 million yen in margin.

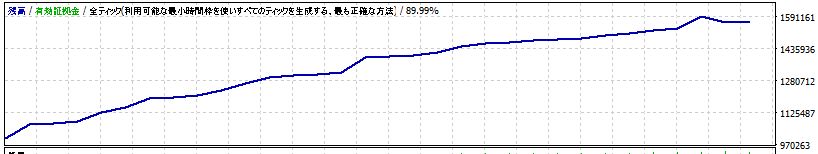

2.5 years of compounding (2016–2018.6)

Net profit+5.4 million yen!

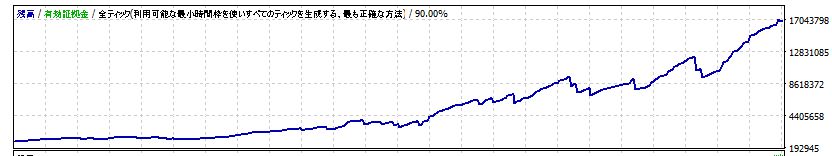

4.5 years of compounding (2014–2018.6)

Account balance of 17,000,000 yen,+1600%!

and it turned out to be an excellent result.

However, in reality it’s rare to keep funds invested for years without withdrawals, so let’s backtest year by year.

◆ If you reset every year and operate with 1,000,000 yen

2015

2015: +750,000 yen (relative DD 24%)

2016

2016: +1,700,000 yen! (relative DD 27%)

The latter-half drawdown was unfortunate, though…

2017

2017: +510,000 yen (relative DD 24%)

The latter-half drawdown is again a concern…

First half of 2018

+500,000 yen in 6 months (relative DD 8%)

Drawdowns appeared in the second half every year, so

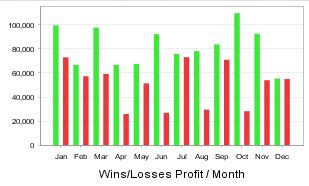

let’s look at monthly backtest profits/losses (0.1 lot fixed)

December losses stand out.

Looking at profit vs loss by amount, September and December are almost break-even, so

you might pause operations or reduce the lot size.

But since total isn’t negative, those who don’t mind can continue as is.

With fixed lots, about 30% annual return per 1,000,000 yen, but

with compounding, you can expect more than +50% per yearas a result!

Because of compounding, the longer the investment period, the higher the profit rate.

Note that with the default compounding settings,

it is designed to use 90% of funds for lot holdings in a 25x leverage account.

In 25x leverage accounts, the maximum drawdown is kept within 30%, but

if you operate with default settings on high-leverage accounts such as 100x, the number of lots held may be too large, causing drawdown to exceed usable margin and trigger forced liquidation.

To avoid this, you need to set a parameter for what percentage of the account is used for holding lots.

By leveraging the low maximum drawdown and high win rate, you can achieve surprisingly high profits with compounding

A typical EA!

Please also consider compounding ♪

Premium version of the Three Furlongs Up (with compounding feature)