Pitfalls of compound interest investing

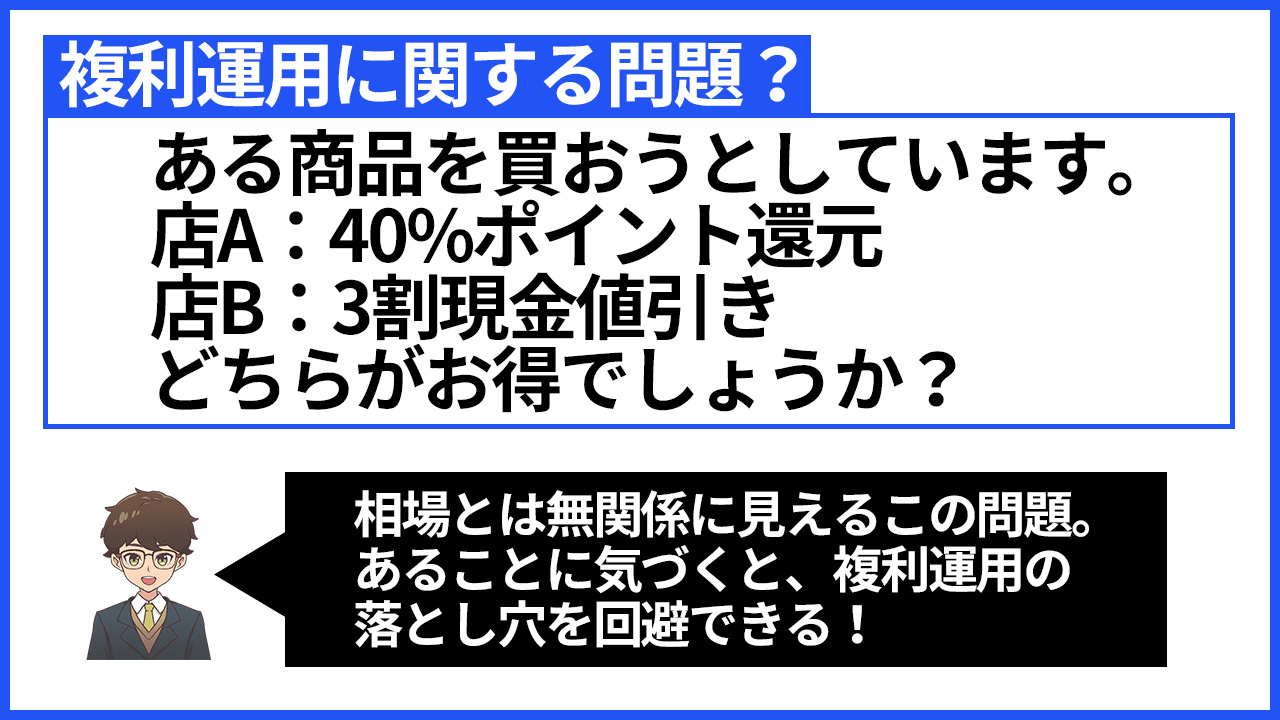

Question about compound interest operation?

We are looking to buy a certain product.

Store A: 40% point return

Store B: 30% cash discount

Which is more advantageous?

At first glance, it seems unrelated to market prices. This article explains the difference between compound operation and compounding-like operation.

Even Einstein called compound interest “humanity’s greatest invention.”

To unleash its power, you must pay attention to a certain point.

Answer

The 30% cash discount is more advantageous.

Explanation

First, we will explain the problem, then connect to the topic of compound interest.

At Store A, the points received have no restrictions and can be used as is.

The cash discount at Store B is as stated.

To make the explanation clear, call the product being purchased Product 1 and Product 2.

- Buy Product 1 for 10,000 yen at Store A, receive 4,000 yen worth of points, and buy Product 2 with those points for 4,000 yen.

- At Store B, buy Product 1 and Product 2 for 14,000 yen with a 30% discount, paying 9,800 yen.

To buy the two products totaling 14,000 yen,

- At Store A: 10,000 yen

- At Store B: 9,800 yen

was paid.

Therefore, Store B is more advantageous.

Now, another problem.

If you are investing,

- one year yields 40% profit

- next year yields 30% loss

Will the profits remain?

A 40% profit and a 30% loss might seem favorable, but if not simple interest and you apply compounding in a year whether profit or loss, then,

for example, starting with 1,000,000 yen,

Year 1: 40% profit = 1,000,000 × 1.4 = 1,400,000

Year 2: 30% loss = 1,400,000 × 0.7 = 980,000

it decreased.

The order does not matter.

Year 1: 30% loss = 1,000,000 × 0.7 = 700,000

Year 2: 40% profit = 700,000 × 1.4 = 980,000

A method with 40% profit and 30% loss yields profit if the principal is the same (simple interest), but changing the principal to win or lose causes the funds to decrease, giving the impression of a favorable deal.

In cases of winning and losing, this is called compounding operation.

The most important thing this problem aims to convey is,

If you want to increase assets with compound interest, winning is a prerequisite.

“One year, you happened to profit. Then you decide to use compound interest. The next year you lose.”

In this state, compound interest is actually counterproductive.

To perform compound interest, you must be in a state where you can profit during the period.

The shorter the period, the more advantageous to increase the number of compounding cycles, but it becomes more difficult.

Taxes on investment profits apply for a one-year period, so aim to create trading rules that can profit annually.

Only when you can win consistently can you perform compound interest.

【FX】 How to create winning trading rules, I’ll teach you

I will perform backtesting for you: “Backtesting of trading rules for the past 20 years”