"Peerless" Synchronization System Practical Edition Part 14: A Case of a Major Shift in Trend ②: Points to Note in Swing Transition

In the beginning - Special interview video

We introduced it from Gogojan as a video interview.

Contents with viewing privilegesare as follows. If you have not watched yet, please take a look at least once.

Episode 1

https://www.gogojungle.co.jp/info/22070

Episode 2

https://www.gogojungle.co.jp/info/22078

Episode 3

https://www.gogojungle.co.jp/info/22089

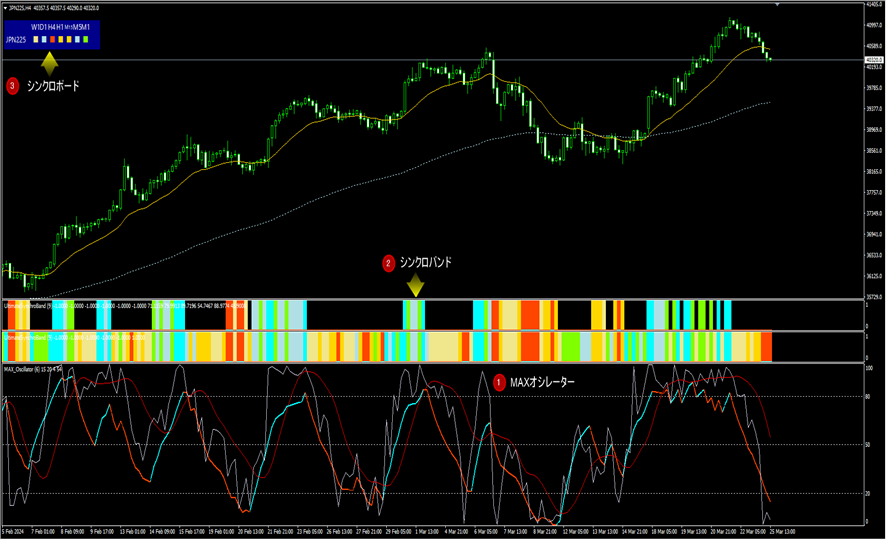

“Tenka Musou” Synchronization System - Configuration

■ Indicator composition and priorities

Indicators are composed of the followingThree main indicators and two sub indicators5 in total.

Main/Display these three first and understand them. They work powerfully in combination.

① MAX Oscillator:A newly developed oscillator.

② Ultimate Synchrono Band:Color band of the oscillator window

Direction, strength, watching state, and MTf alignmentMTF alignmentvisualize them.

③ Ultimate Synchrono Board:Color board.

Shows the state of synchronization bands across multiple currencies and timeframes at once.

Sub:①②③ become familiar, confirm that you can win with only ①②③, and use as a supplementary tool

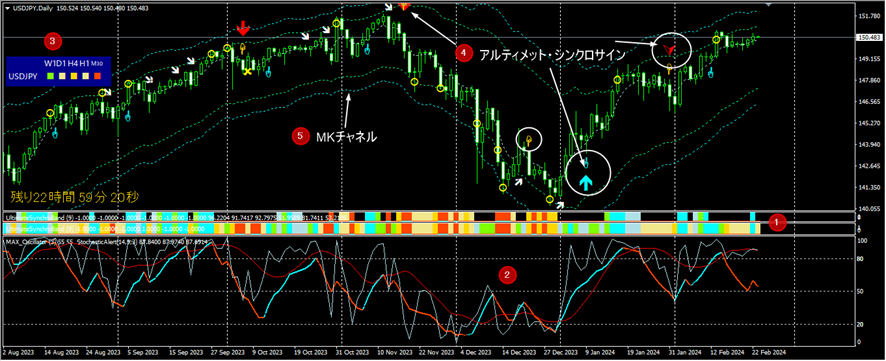

④ Ultimate Synchrono Sign:Arrow sign.

Shows up/down signs of price movement, a temporary invalidation of signs, and divergence.Useful to reinforce evidence and issue caution。(Originally this was the main).

⑤ MK Channel:A ribbon-like main chart band.

Essentially a price range measuring device, measuring price range,MA deviations, catching highs, suppressing pullbacks, and setting profit targets.

The recommended reading order is also to proceed through ①②③, display only ①②③, and then proceed to verification and practice

After that, incorporating ④ and ⑤, please decide what is necessary or unnecessary.

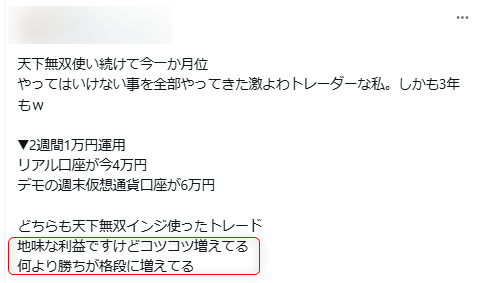

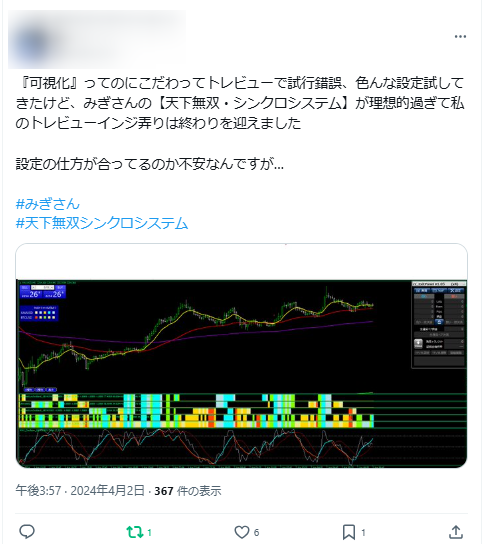

Existing users' feedback has been mostly like the following.

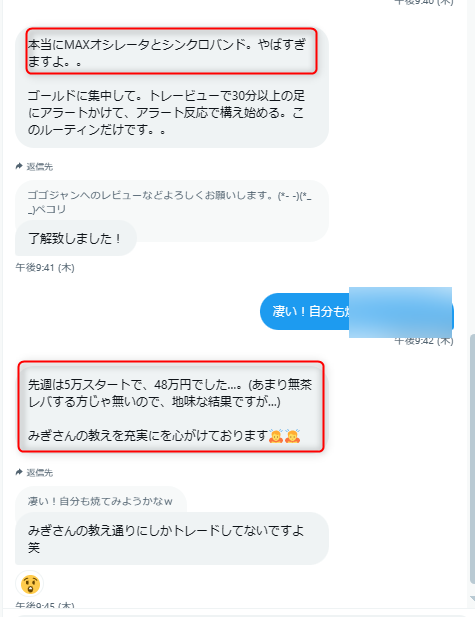

From DMs received

This is someone who has been using it for only about a month

Users, posts on SNS

■ For a list of previous articles, please check the link below.

https://www.gogojungle.co.jp/finance/navi/series/1745

※Below are recommended usages in day trading, scalping, and swing trading.

■ Article contents this time: Case② during a major trend reversal: points to note

※ Pound and dollar reversal from late June to early JulyMy entry: screenshot as of 7/4It may look successful at first glance, but this is actually the fourth Tri-Entry.Actually, before this entry,I had taken three long positions, repeatedly taking partial profits and exiting at breakeven.Screenshot on 6/24Screenshot on 6/27Entry screenshot on 6/28Key point: reversals often take timeAAs mentioned in the previous article, larger timeframe trend reversals tend to take time.Especially when changing from down to up, it usually takes longer.B For now, if the 1-hour and 4-hour align and a reverse synchronization appears,① try hedging with equal positions② partially take profits and aim for the next riseand so on, avoid fixed bets, observe and gradually enter, keeping safety in mind.By the time of the last entry, three times partial profits, and breakeven exits have been repeated, but it could have been more efficient to close both in day trading.Point: When can you decide to hold for swing trading?① As a minimum condition, alignment of daily and 4-hour price movements (it would be better if weekly also aligned).② Still not absolute.⇒ If a reverse synchronization appears on 1-hour and 4-hour while the price is still range-bound, take safety actions! First, look at the 4-hour state.Synchronization bands with higher timeframes align from bottom: none (4h) / daily / weekly.Even at point ①, the synchronization band aligned on 4-hour and weekly,but the daily did not align yet.In fact, even if the daily alignment would have been achieved, the wicks appeared andthe timeframe moved strongly against us on the 4-hour, so I exited with profits.Then, at point ②, finally weekly, daily, and 4-hour all aligned, and I decided to hold. As of now (July 7, 2024) over 170P, but this position can be closed at breakeven, so I plan to hold strongly.※ Important!A strong 1-hour/4-hour synchronization is day-trading invincible mode⇒ Going against it leads to loss!※ Important!When weekly and daily align to synchronize, attempt long-term holding.⇒ If possible in day trading, aim in the same directionSummary① Reversal (especially from down to up) takes time※ CountermeasuresIf it doesn't extend much, and a reverse synchronization appears on 1-hour and 4-hour alignments,① Try hedging with equal positions② Partial profits and aim for the next riseand so on, avoid fixed bets, observe and gradually enter to secure safety② Conditions under which holding for swing trading is possible!As a minimum condition, alignment of daily and 4-hour price movements(ideally weekly alignment as well)Still not absolute.⇒ If a reverse synchronization appears on 1-hour and 4-hour while still in a range, take safety actions!※ Important!Strong synchronization on 1-hour and 4-hour means day-trade invincible mode⇒ Going against it leads to loss!※ Important!When weekly and daily align to synchronize, attempt long-term holding.⇒ If possible in day trading, aim in the same directionIf you confirm well and can respond carefully to reversals,you can start trades with very high expected value.Practice diligently, verify, and implement!※ Nowadays, the market is operated by advanced AI developed with vast funds and genius engineers.Do not think lightly; learn humbly, repeat many times, and grow!Tenka Musou Series: About analysis tools■ Messages from users※ For details on the Tenka Musou Synchronization System, see below“Tenka Musou” Synchronization Systemhttps://www.gogojungle.co.jp/tools/indicators/50319Review Version - Ultimate Synchronization Systemhttps://www.gogojungle.co.jp/tools/ebooks/50353※ Each indicator of the system is also available as a one-time purchase.■ MAX Oscillator - MT4/5 versionhttps://www.gogojungle.co.jp/tools/indicators/50340■ Similarly, the Review versionhttps://www.gogojungle.co.jp/tools/ebooks/50353■ Ultimate Synchrono Bandhttps://www.gogojungle.co.jp/tools/indicators/42606

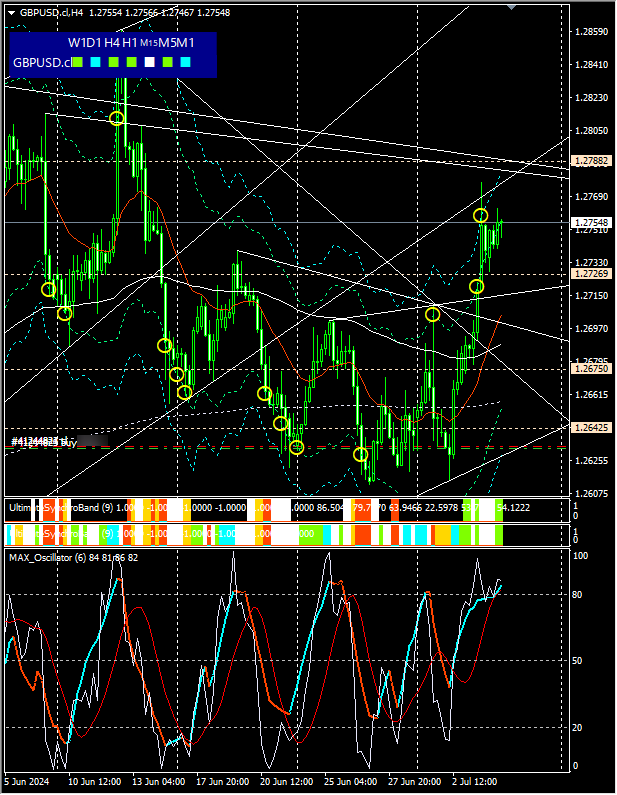

My entry: screenshot as of 7/4

It may look successful at first glance, but this is actually the fourth Tri-Entry.

Actually, before this entry,I had taken three long positions, repeatedly taking partial profits and exiting at breakeven.

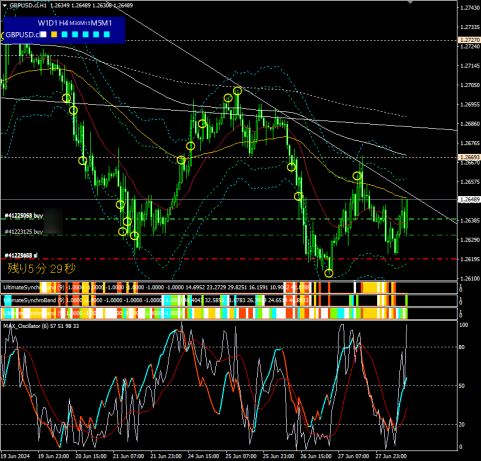

Screenshot on 6/24

Screenshot on 6/27

Entry screenshot on 6/28

Key point: reversals often take time

AAs mentioned in the previous article, larger timeframe trend reversals tend to take time.

Especially when changing from down to up, it usually takes longer.

B For now, if the 1-hour and 4-hour align and a reverse synchronization appears,

① try hedging with equal positions

② partially take profits and aim for the next rise

and so on, avoid fixed bets, observe and gradually enter, keeping safety in mind.

By the time of the last entry, three times partial profits, and breakeven exits have been repeated, but it could have been more efficient to close both in day trading.

Point: When can you decide to hold for swing trading?

① As a minimum condition, alignment of daily and 4-hour price movements (it would be better if weekly also aligned).② Still not absolute.

⇒ If a reverse synchronization appears on 1-hour and 4-hour while the price is still range-bound, take safety actions!

First, look at the 4-hour state.Synchronization bands with higher timeframes align from bottom: none (4h) / daily / weekly.

Even at point ①, the synchronization band aligned on 4-hour and weekly,but the daily did not align yet.

In fact, even if the daily alignment would have been achieved, the wicks appeared andthe timeframe moved strongly against us on the 4-hour, so I exited with profits.

Then, at point ②, finally weekly, daily, and 4-hour all aligned, and I decided to hold.

As of now (July 7, 2024) over 170P, but this position can be closed at breakeven, so I plan to hold strongly.

※ Important!A strong 1-hour/4-hour synchronization is day-trading invincible mode

⇒ Going against it leads to loss!

※ Important!When weekly and daily align to synchronize, attempt long-term holding.

⇒ If possible in day trading, aim in the same direction

① Reversal (especially from down to up) takes time

※ Countermeasures

If it doesn't extend much, and a reverse synchronization appears on 1-hour and 4-hour alignments,

① Try hedging with equal positions

② Partial profits and aim for the next rise

and so on, avoid fixed bets, observe and gradually enter to secure safety

② Conditions under which holding for swing trading is possible!

As a minimum condition, alignment of daily and 4-hour price movements(ideally weekly alignment as well)

Still not absolute.

⇒ If a reverse synchronization appears on 1-hour and 4-hour while still in a range, take safety actions!

※ Important!Strong synchronization on 1-hour and 4-hour means day-trade invincible mode

⇒ Going against it leads to loss!

※ Important!When weekly and daily align to synchronize, attempt long-term holding.

⇒ If possible in day trading, aim in the same direction

If you confirm well and can respond carefully to reversals,

you can start trades with very high expected value.

※ Nowadays, the market is operated by advanced AI developed with vast funds and genius engineers.

Do not think lightly; learn humbly, repeat many times, and grow!

Tenka Musou Series: About analysis tools

■ Messages from users

※ For details on the Tenka Musou Synchronization System, see below

“Tenka Musou” Synchronization System

https://www.gogojungle.co.jp/tools/indicators/50319

Review Version - Ultimate Synchronization System

https://www.gogojungle.co.jp/tools/ebooks/50353

※ Each indicator of the system is also available as a one-time purchase.

■ MAX Oscillator - MT4/5 version

https://www.gogojungle.co.jp/tools/indicators/50340

■ Similarly, the Review version

https://www.gogojungle.co.jp/tools/ebooks/50353

■ Ultimate Synchrono Band

https://www.gogojungle.co.jp/tools/indicators/42606