"Peerless" Synchro System Practical Edition Part 10: Special Techniques Edition: Method to Change Perspective Using a 1-Minute Footnote

“天下無双” Synchronization System - Configuration

■ Indicator configuration and priorities

Indicators consist of the followingThree main indicators and two sub indicators2 totaling five indicators.

Main/Please display and understand these three first. They excel in combination.

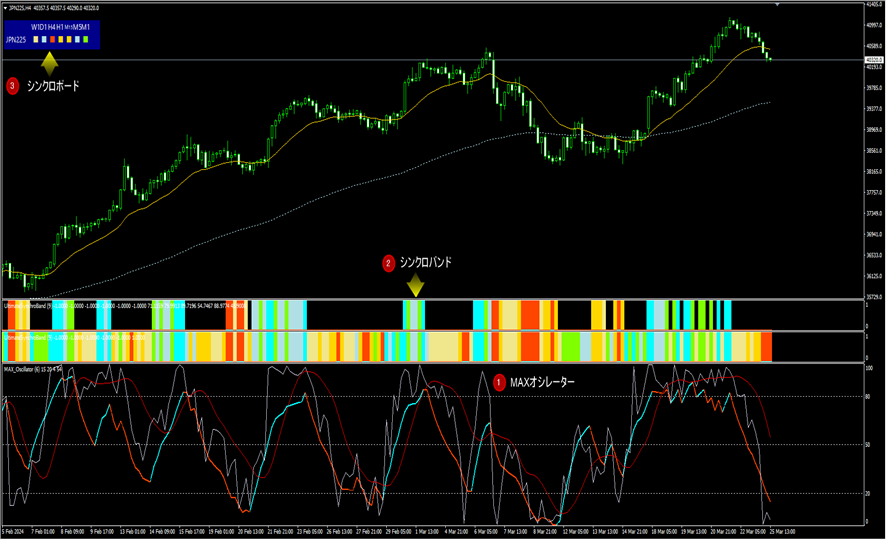

① MAX Oscillator:A newly developed oscillator.

② Ultimate Synchrono Band:Color band of the oscillator window

Visualizes price momentum direction, strength, and a watchful/neutral stateMTF alignment.

③ Ultimate Synchrono Board:Color board.

Displays the state of sync bands across multiple currencies and timeframes at once.

Sub:①②③ become familiar, confirm that you can win with only ①②③, and use as a supplement

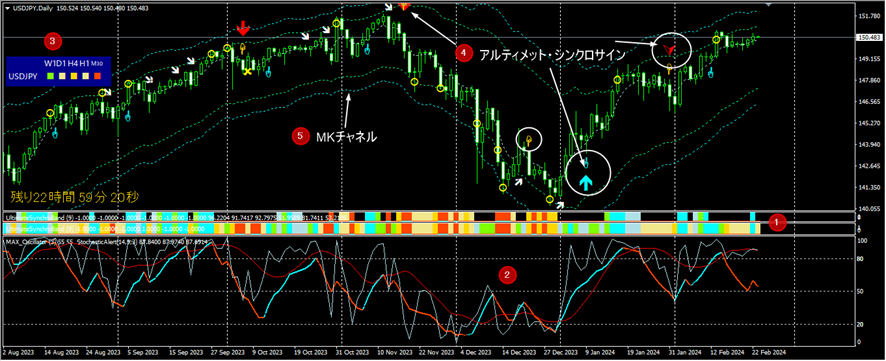

④ Ultimate Synchrono Signal:Arrow signals.

Shows up/down momentum signals, temporary disabling of signals, and divergences.Useful for reinforcing rationale and issuing caution。(Originally this was the main.

⑤ MK Channel:A river-like belt on the main chart.

Essentially a width-measure tool, used for measuring value ranges, deviations from MA, avoidance of late entries, early take-profit targets, etc.

The order of reading the manual is alsoto proceed with ①②③,,andthen proceed to testing and practice,then adopt ④ and ⑤ as needed, and decide what is necessary or unnecessary.

※The following are recommended usage examples for day trading, scalping, and swing trading.

Things to be mindful of to use effectively - recap

①Be mindful of staying out of trades

② From the highs/lows of the MAX Oscillator, or from divergence,

initiation of reversal & synchronization when shifting from a convergence

③ Strong synchronization - especially higher-timeframe alignment synchronization - in “unrivaled” mode

※ Do not fight the five-minute timeframe and higher-timeframe strong synchronization.

One-hour timeframe, higher-timeframe strong synchronization is the strongest mode for day trading, etc.

④ Be mindful of 4-hour, daily, and weekly states.

※ Choose pairs in as good a state as possible, and only trade when in a good state.

※ Even with the same technique, performance varies greatly with different environments.

⑤ Be mindful of MK Channel (especially 15-minute timeframe with a 3x deviation)

First, internalize these five as the basic framework.

※For the article up to this point, please refer to the link below.

https://www.gogojungle.co.jp/finance/navi/series/1745

Special Techniques Part 1: How to change your perspective using a 1-minute chart

In long-term interaction with users, a common issue is people who

spend too much time staring at the 1-minute or 5-minute charts and fail to consider higher timeframes.

So this time,using the Up-Level alignment function of the Synchrono Band,

we will introduce a method for changing perspective while watching the 1-minute chart..Introduction continues.

■What is higher-timeframe alignment?

Ultimate Synchrono Band (color band of the oscillator) on the upper layer

Overlay bands specify the timeframes to reference. When the state of price action and the specified timeframe align, color appears on the upper band as well.

※Only when the specified timeframe and price movement states are in alignment will the color appear on the upper band..

※ In this higher-timeframe strong Synchrono, it is advantageous to enter at the “start” timing.

Method Explanation

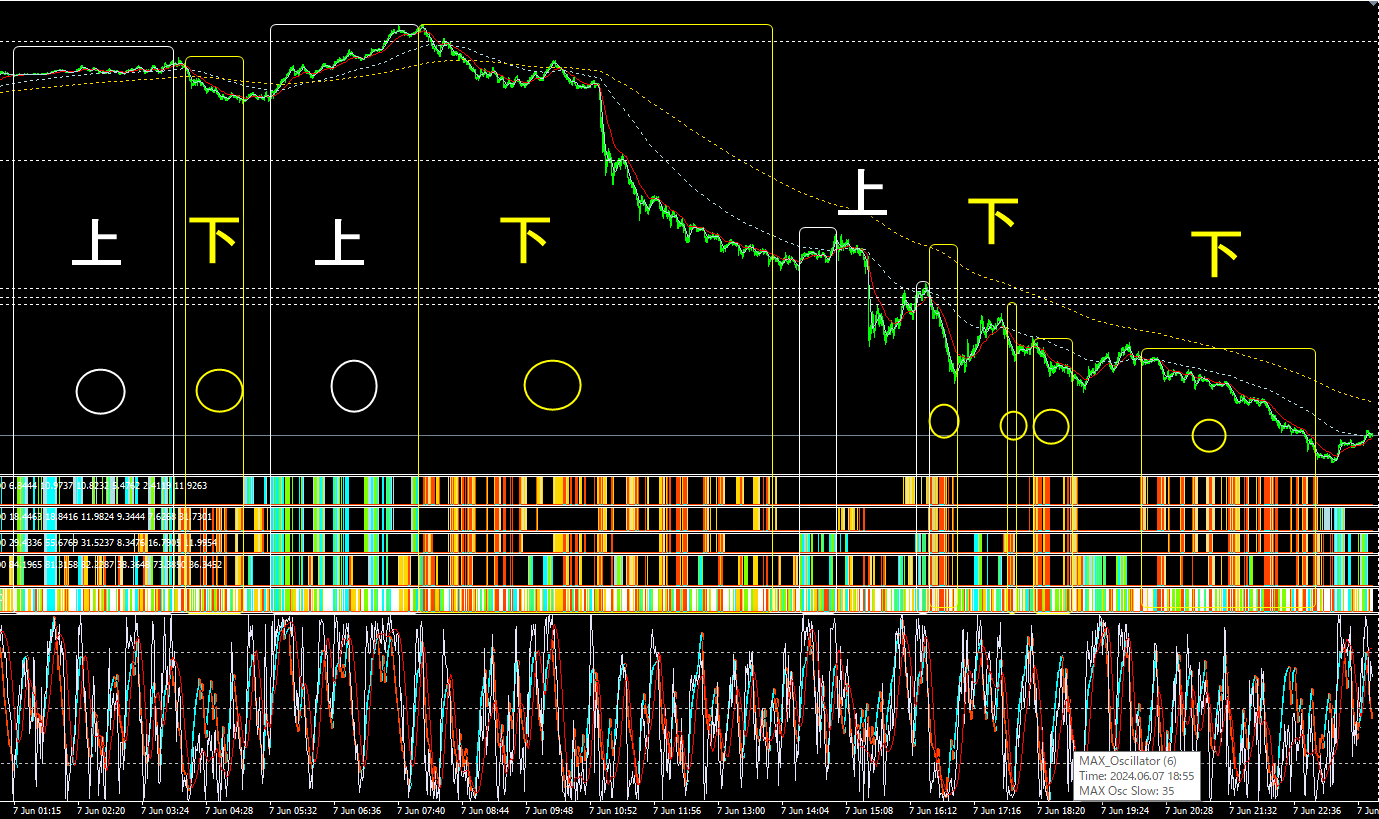

① Set the 1-minute Synchrono Band to five levels

② Among the five levels,if three or more signs in a row point in the same direction, decide your direction there

③ For day trading, if using the 30-minute timeframe, when the 4th level or higher does not light up, or for the 1-hour timeframe when the 5th level does not light up, observe.

Caution

① Do not chase deeply when the5-minute, 15-minute, etc., higher-timeframe MAX Oscillator is near its peaks/troughs

② During indicator times, prioritize 1-minute and 5-minute alignment. However, changing perspective itself is safer following the above rules

※ On 6/7 Friday at the 1-minute chart, apply the above rules

※ Yellow frame is lower perspective, white frame is higher perspective

※ If you base on the 30-minute or 1-hour chart, except for the circled areas, stay watchful.

※ For a lower perspective entry, it is even better to enter on a reversal from the 1-minute or 5-minute MAX Oscillator

※ If you entered on an upswing from the 30-minute chart and left it running, it could have yielded massive profits.

The only one in Japan,as a subscription for external indicators,has persisted for over two years, a testament to its effectiveness

isnot

just lip service.

① Not only up/down but also② Watchfulness indicação, ③ Watch out for tops and bottoms, ④ Reversals, ⑤ Strength of price movement,

⑥ MTF (multi-timeframe) alignment consistency, ⑦

All can be depicted accurately and without delay.

※ This is my personal opinion, and admittedly biased, butGoGoJungle's discretionary auxiliary indicators are No.1 in capabilityin my view,

and probably not wrong.

Sales are not anywhere close to top-ranked products...

Please deepen your understanding and apply it in practice.

天下無双 Series: Detailed analysis tool links

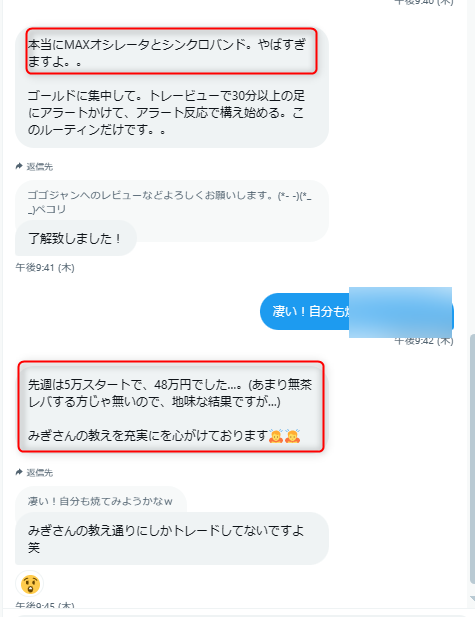

■ Messages from users

■ MAX Oscillator - MT4/5 version

https://www.gogojungle.co.jp/tools/indicators/50340

■ Also the Two Review version

https://www.gogojungle.co.jp/tools/ebooks/50353

https://www.gogojungle.co.jp/tools/indicators/42606

■ A set of five indicators packs including the above indicators, monthly subscription

“天下無双” Synchronization System

https://www.gogojungle.co.jp/tools/indicators/50319

Two reviews version - Ultimate Synchrono System

https://www.gogojungle.co.jp/tools/ebooks/50353