【Video】I learned from Tomoaki Hirano a method that sensitively reacts to RSI to detect clear entry opportunities

Mr. Tomonori Hirano, who is proficient in technical analysis and continues to thrive in the world of FX by employing numerous trading methods, shares a method for catching trading opportunities with an RSI tuned to react sharply to price movements. (Interview: Editorial Department Kakuchi)

What you can learn from this video

In this video, you will learn the following:

- General uses of RSI, differences from this method's unique usage, and advantages

- The meaning of using two time frames

- Unique rules for taking profits and cutting losses

- Examples of trade points using actual charts

● Video length: 7 minutes 13 seconds

Profile of Tomonori Hirano

After graduating from a university in the United States, he worked in overseas exchange-related roles before joining Himawari Securities. He has handled FX operations in general, served as a dealer in the self-trading division, and provided FX and Nikkei 225 information from the Information Desk, while also teaching seminars. Currently, he is independent and has established Trade Time Co., Ltd. He conducts self-trading, investment education, and support for individual investors, while actively disseminating information to FX companies and holding seminars.

Official site:Trade Press Winning FX Blog

A word from the editor in charge, Kakuchi

Most general oscillator indicators, including RSI, tell you when prices are overbought or oversold over relatively long trends.

However, with this method, by deliberately using RSI in a brisk manner, it becomes a method that clearly indicates trading opportunities.

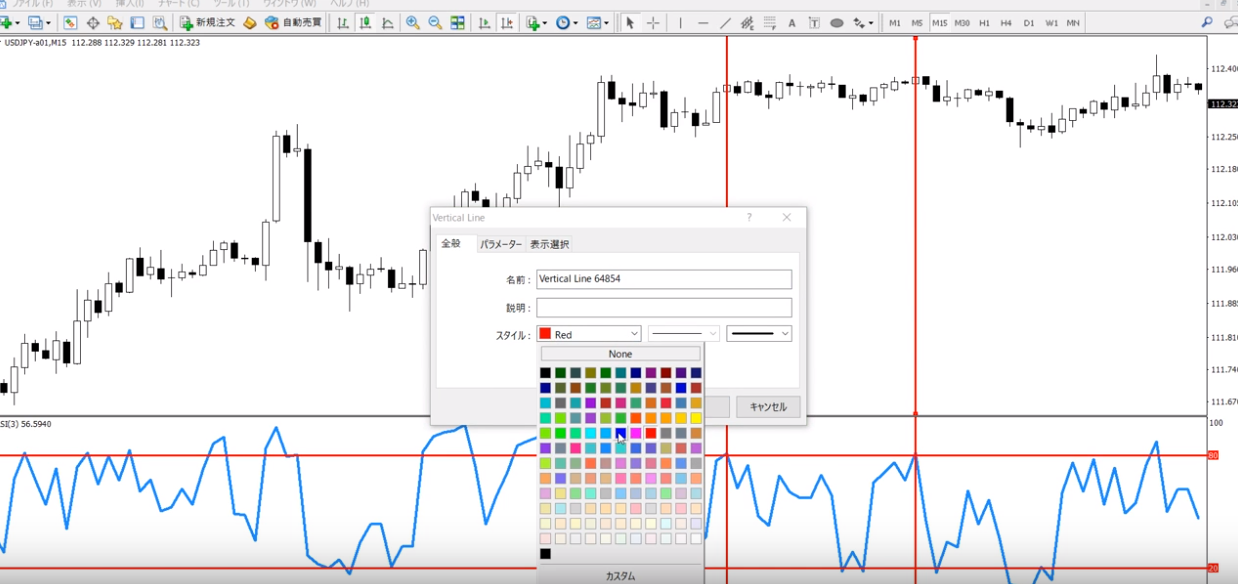

This is a sample from the video.

How to view FX method videos

The portion that can be viewed by those who purchase the article (at the bottom of this article) embeds the FX method video. Click the play button to start the video.

⇒From 250 yen to learn! Other [Famous Trader FX Method Videos] are here