Let's manage risk with ATR!

Issues Related to ATR

"What is TR (True Range)? It is the day's maximum price movement, but merely looking at the difference between the day's high and low is not enough. Please explain why."

Even when trading, unless you understand how much a given instrument moves in a day (volatility), you cannot manage risk.

Take this opportunity to learn ATR and be able to manage risk.

Answer

"Because you need to consider days when gaps occur"

Explanation

We use ATR as part of risk management to know how much you could potentially lose in a day.

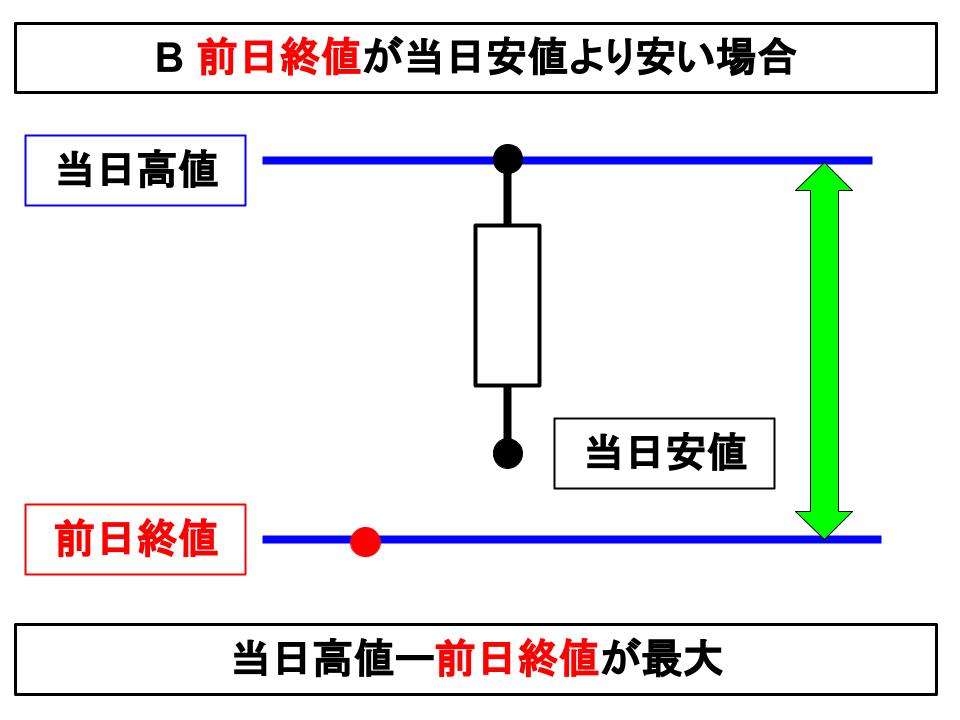

For example, if you buy at yesterday's close and a gap down occurs, your loss can exceed the difference between the day's high and low.

Therefore,

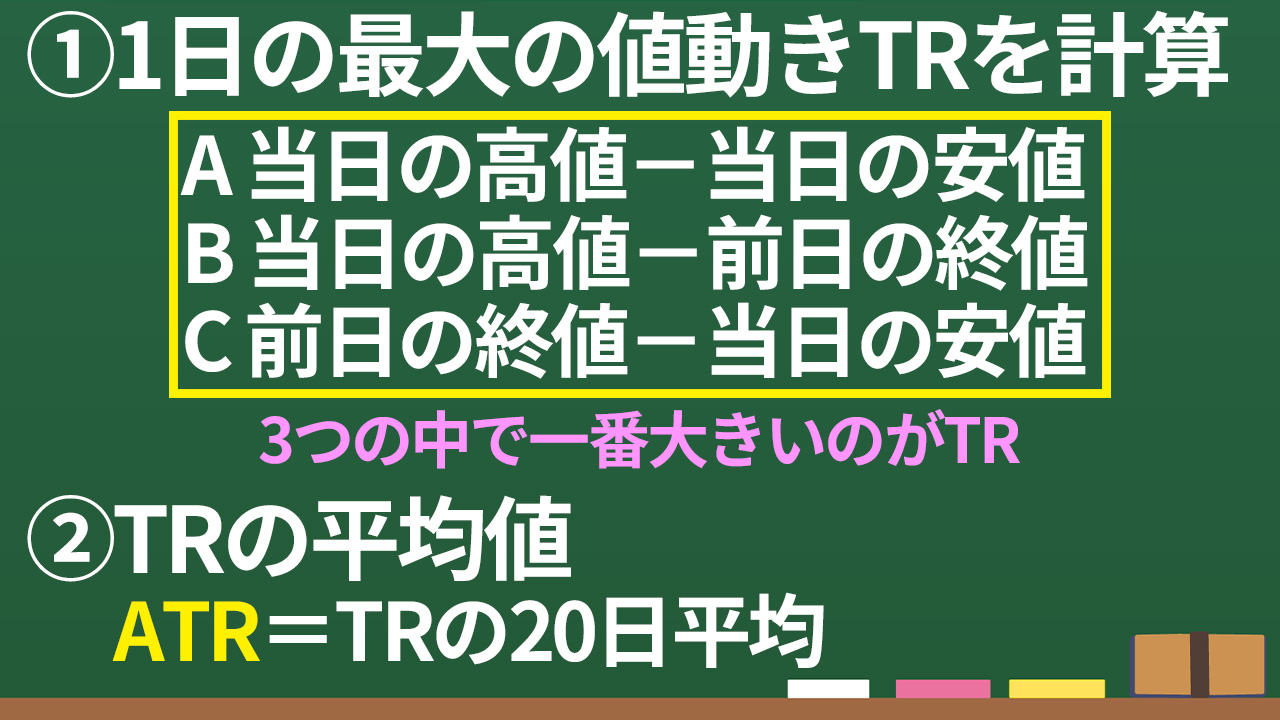

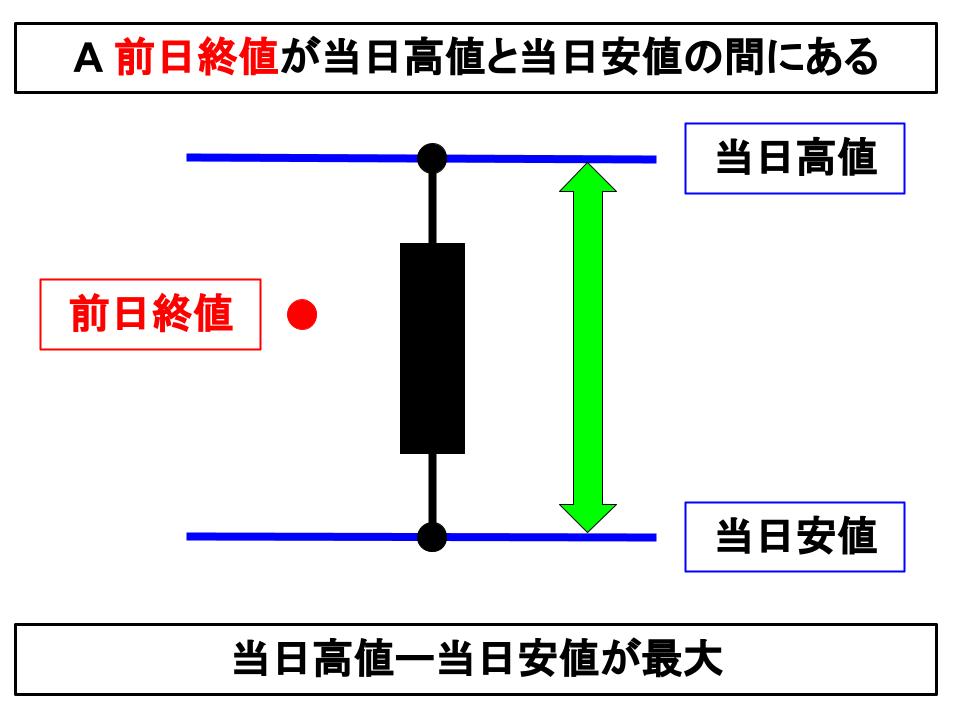

A Previous day's close is between today's high and today's low

B Previous day's close is lower than today's low

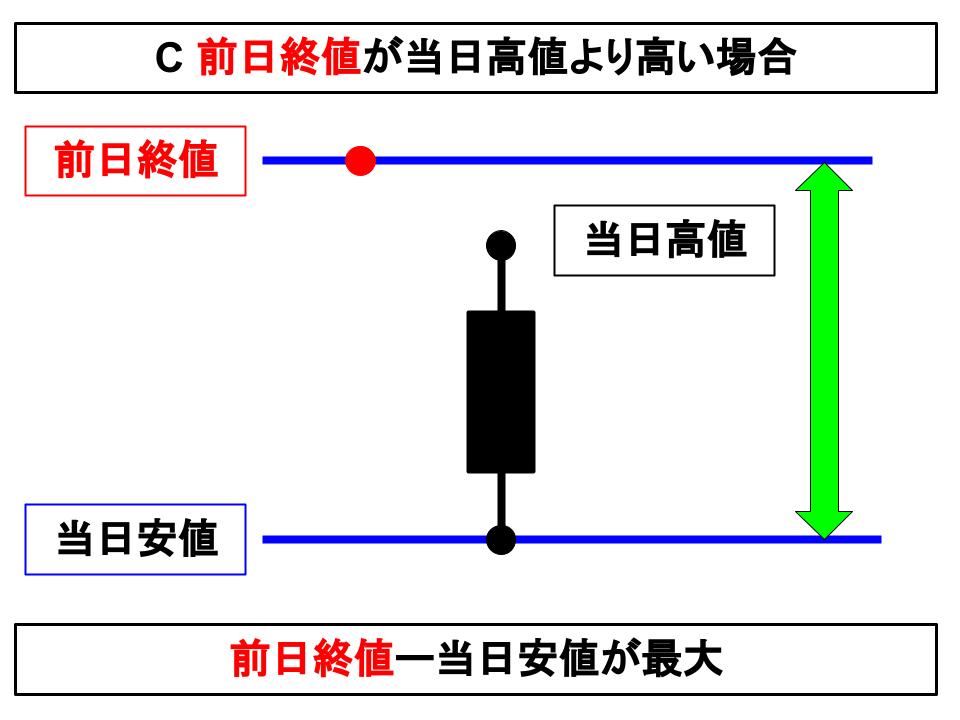

C Previous day's close is higher than today's high

We need to consider these three patterns.

By doing so, you can understand the day's maximum price movement.

If checking whether a gap exists is cumbersome,

・Today’s high − today’s low

・Today’s high − yesterday’s close

・Yesterday’s close − today’s low

calculate them and the largest of the three is the TR.

Then, simply average over 20 days to obtain ATR (Average True Range).

ATR is mainly used for funds management and risk control.

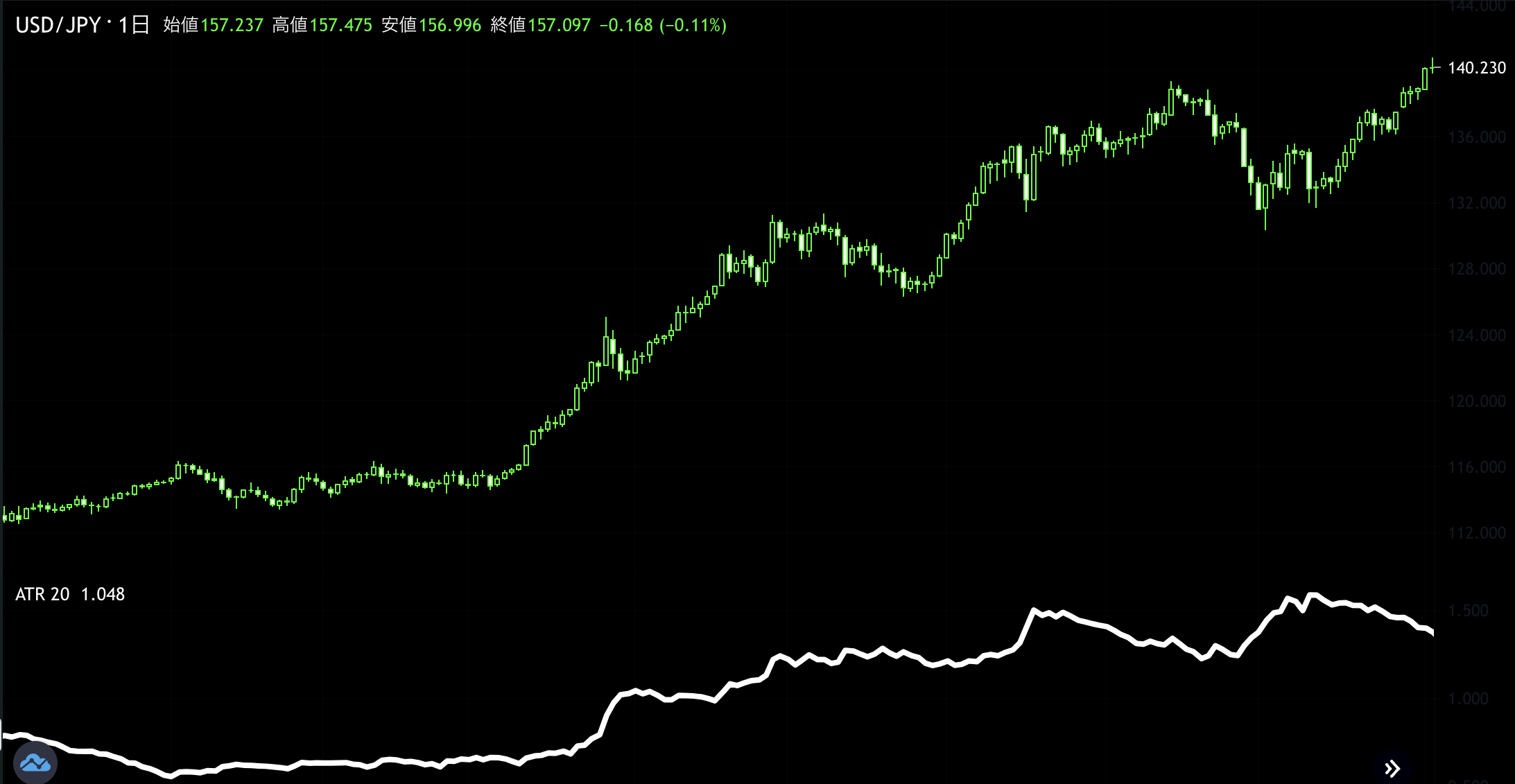

For example, even when trading USD/JPY, some days move only about 0.5 yen, while other days move more than 2 yen.

When the range varies that much, you cannot trade with the same position size or the same stop loss width.

You need to take measures to control risk on days with larger moves, such as reducing position size.

Also, setting a stop loss too narrowly can cause you to exit during small moves when you are in a real trend.

If you know the average daily movement, you can adjust position size and stop loss width accordingly.

That is the purpose of ATR.

An increasing ATR indicates that the trend is heating up.

Conversely, a low and stable ATR indicates a ranging market.

Online chart systems automatically adjust price ranges, making volatility hard to gauge.

By checking ATR, you can grasp how much price movement to expect.

When you trade regularly, consciously monitor ATR!

Past verification data of ATR-based trading rules is now公開中!

Have past verifications done for you: "Verification of trading rules for the last 20 years"