"Peerless" Syncro System Practical Edition Part 8: Environment Perception Edition - Also Be Mindful of MK Channel 5/30

"Matchless Under Heaven" Synchronization System - Structure

■ Indicator Configuration and Priorities

Indicators consist of the followingThree Main + Sub2 indicators, for a total of five indicators.

Main/Display these three first and understand. They work powerfully in combination.

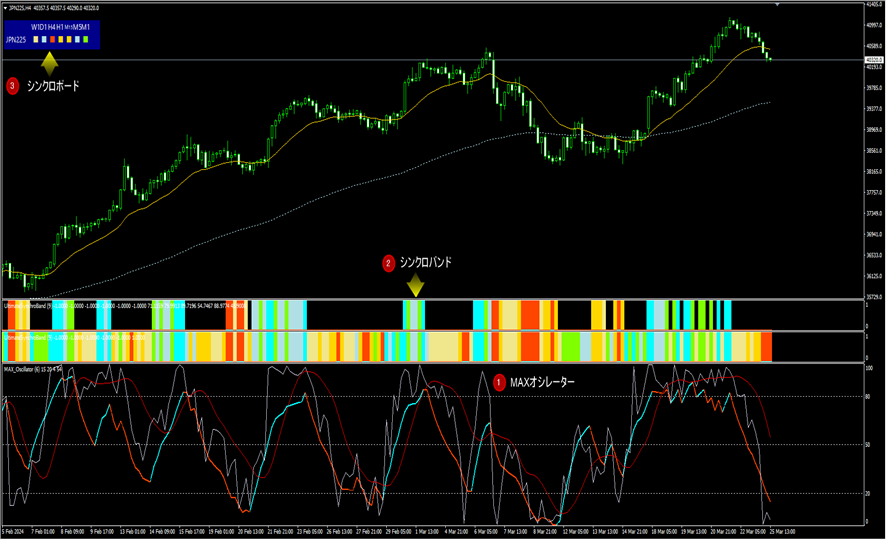

① MAX Oscillator:A newly developed oscillator.

② :Color band of the oscillator window

Direction and strength of price movement, recommended watch state •MTF alignment visualized.

③ :Color board.

Sub:①②③ become familiar, confirm that you can win with ①②③ alone, and use as a supplement

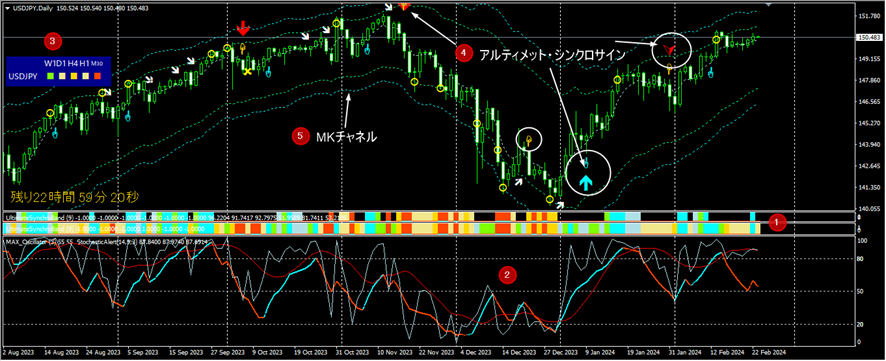

④ :Arrow indicators.

Indicate up/down price signs, temporarily disable signals, and depict divergences.Useful for reinforcing rationale and raising awareness.(Originally this was the mainindicator)

⑤ MK Channel:A river-like belt in the main chart.

Essentially a price range measuring tool, used for measuring value range, deviation from MA, catching tops, preventing rapid declines, and setting profit targets.

The recommended reading order isto proceed with ①②③,, Display only ①②③, then proceed to testing and practice, and after that incorporate ④ and ⑤,and decide what is necessary or unnecessary.

※The following are recommended usage examples for day trading, scalping, and swing trading.

Principle of Use ④:

Be mindful of the 4-hour, daily, and weekly charts as well.

A feature of this system is thatwith the MAX Oscillator, near-wave bottoms and tops reversals or reversals after divergences become visible showing how waves reverse.

The main indicator MAX Oscillator suggests wave reversals. Together with Ultimate Synchrono Band, the continuation or strength of waves is visualized.

■Wave reversal example (e.g., from decline to rise)

① MAX Oscillator (three lines in the sub-window)

A From decline to rise ⇒ the main body near the bottom of the window changesred to blue.

B The white linesurpasses the other two lines

②Ultimate Synchrono Band(Oscillator color band)

B Higher timeframe reference bands also align and light up green or light blue

⇒ Indicates the transitioning wave is continuing.

■1-hour or higher timeframe alignments are often thought irrelevant except for semi-swing and swing trades, but

they are deeply connected to day-trading as well.

■ The state of price movement on timeframes 4 hours and above is

① Can be grasped through the MAX Oscillator and higher-timeframe alignment of the Synchrono Band for each timeframe

② The Synchrono Board visualizes the price-movement state of each timeframe.

■What is higher-timeframe alignment?

Ultimate Synchrono Band (Oscillator color band) has an upper band where

you specify the timeframe to reference, and overlay the band with that timeframe.

※Only when the specified timeframe and price-movement state are aligned, will color appear on the upper band as well.

Note: the colors shown reflect the color state of the displayed chart.

※This higher-timeframe strong Synchrono“start” timing entries are advantageous.

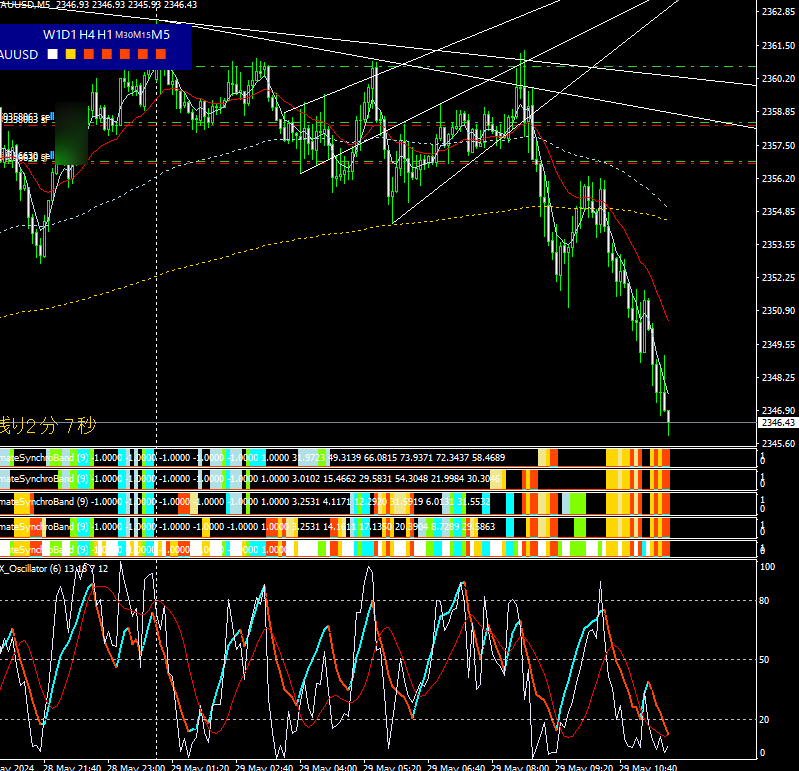

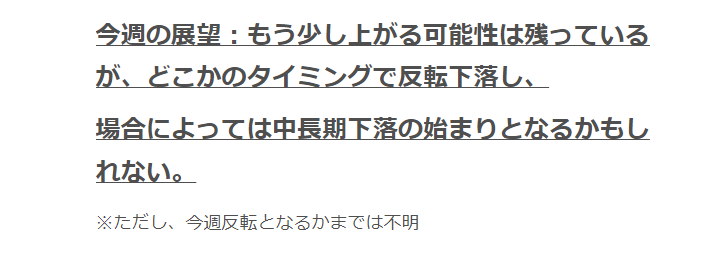

■ This week (Fourth week of May 2024) mid-week example in GOLD ①

As of the morning of May 29, the 4-hour MAX Oscillator isnearly at its peak.

However, the daily chart suggestsa stronger decline!

※Rather than rising, the probability of falling was higher.

■ That night, the state ⇒ large drop occurred.

※ At that time, the Synchrono Board (top-left signal board) shows a downtrend signal on daily or lower

①Yellow: Mild decline

② Red: Strong decline

The alignment strength on the 1-hour higher timeframe indicates day trading "Unrivaled Mode" → remember this as well!

■ This week (Fourth week of May 2024) mid-week example ② in USD/JPY

USD/JPY had risen greatly by the previous day, but looking at the daily MAX Oscillator shows

peak

And from the morning of the 30th, a larger decline begins.

Principle of Use ⑤:

Be mindful of MK Channel deviations of 2x and 3x (especially 15-minute or higher)

■ The outermost blue-dotted band in the screenshot corresponds to MK Channel period 20, deviation 3x.

It has turned at the bottom in a tight weave!

※ Celtic Channel is minor in Japan,

but among American professional futures traders, it is a very major indicator.

※

Price-range observation, overbuying, warning of rapid declines, profit-taking, and stop-point awareness

■ Summary

Principle of Use ④:

Be mindful of 4-hour, daily and weekly charts.

■

they are deeply connected to day trading as well.

Principle of Use ⑤:

Be mindful of MK Channel deviations of 2x and 3x (especially 15-minute or higher; deviation 3x)

■ Overshoot is possible, but

deviation 3x tends to act as resistance, helping to avoid chasing and providing profit targets!

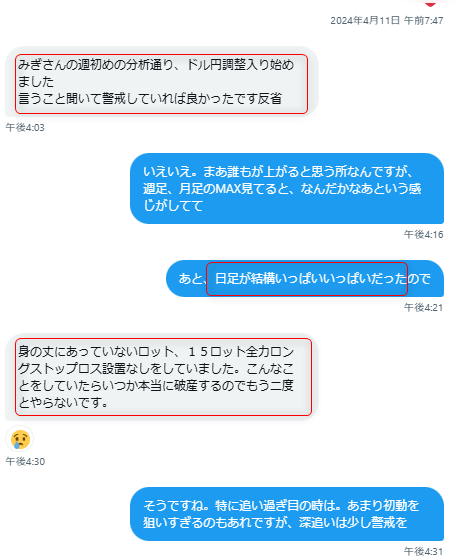

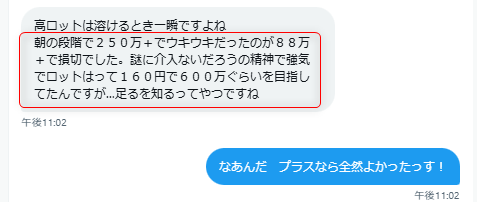

From a private DM

In a weekly USD/JPY analysis on Sunday, I made remarks as follows,and such reports are painful to hear!

Having failed many times before, it hurts.

■ Afterward, more DMs

Sorry for the worry ('◇')ゞ

■ Now the market is driven by cutting-edge AI developed with large funds and genius engineers

and sophisticated algorithms.

Do not be simplistic,and humbly learn and grow through repetition!

天下無双 Series: About the Analysis Tools

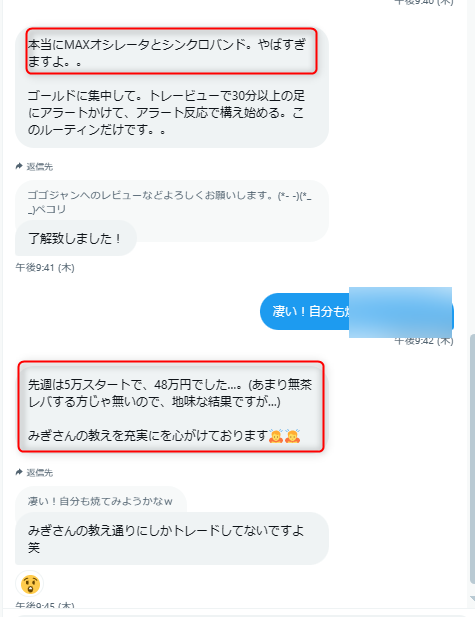

■ DM from users

※ For details on the天下無双 Synchronization System, see below

“天下無双” Synchronization System

https://www.gogojungle.co.jp/tools/indicators/50319

Toreview edition: Ultimate Synchrono System

https://www.gogojungle.co.jp/tools/ebooks/50353

※ Each indicator in the system is also available as a one-time purchase version.

■ MAX Oscillator - MT4/5 version

https://www.gogojungle.co.jp/tools/indicators/50340

■ Same - Toreview Edition

https://www.gogojungle.co.jp/tools/ebooks/50353

■ Ultimate Synchrono Band

https://www.gogojungle.co.jp/tools/indicators/42606