Dangerous EA using averaging down

■ Initial

I used an EA that employs averaging down (grid) and suffered two major failures. I will describe the risks of using an EA that employs averaging down.

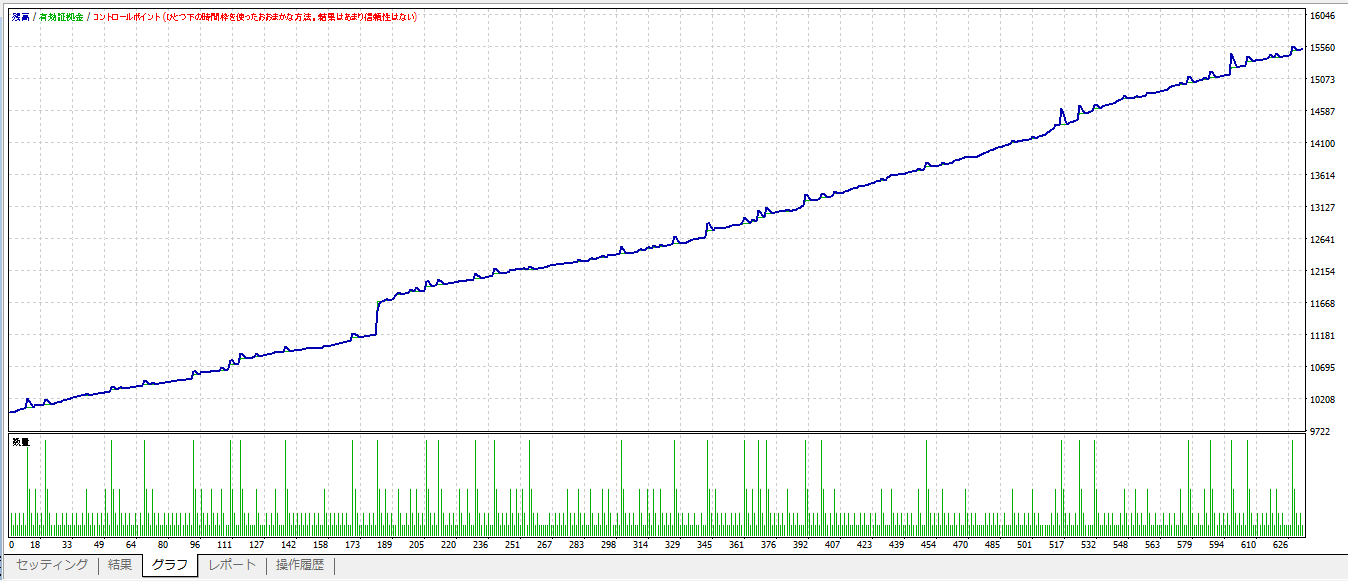

■ Initial Smooth Growth

An EA that uses averaging down works well at first, and the account balance keeps increasing.

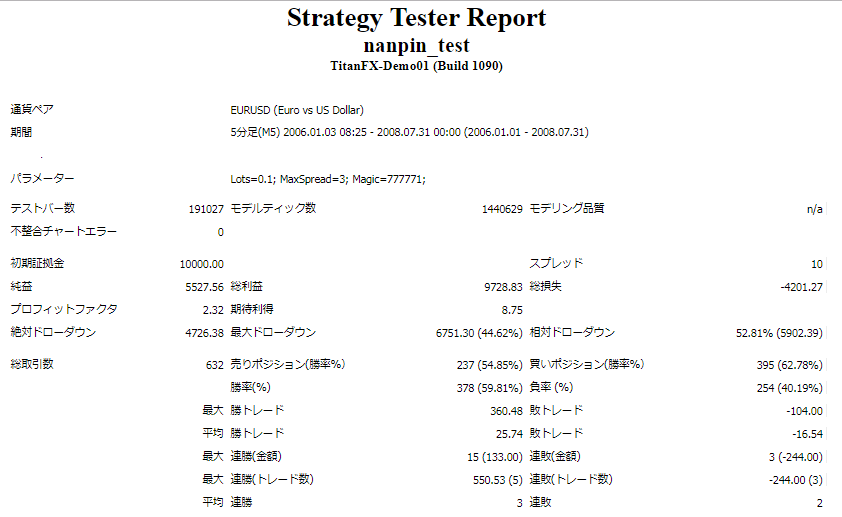

The figure below shows a one-and-a-half year backtest result of a certain averaging-down EA for EURUSD (M5).

It forms a very favorable rising trend line, doesn’t it!

As a human, when things go this well, one wants to make money quickly and increases the lot size, but a big pitfall lies ahead.

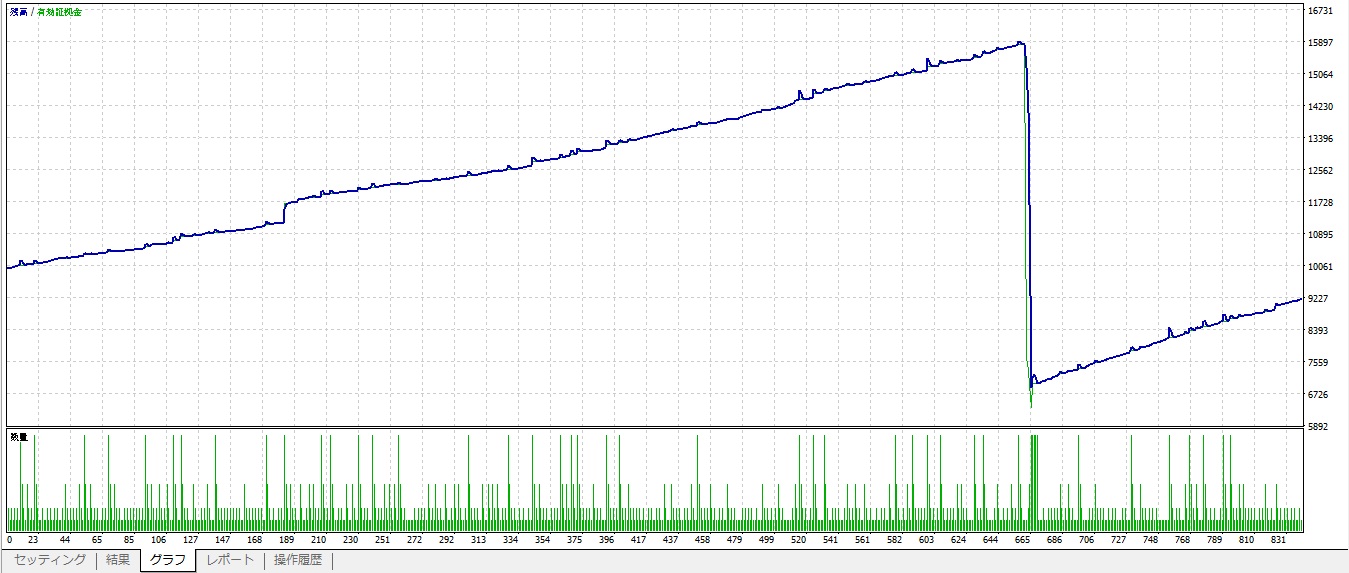

■ Large Drawdown

Subsequently, in about one month, it experiences a large drawdown as shown below, and the initial investment drops to nearly half.

■ EOs with Similar Risks

EAs with considerably smaller profit targets than stop losses show the same tendency.

■ Recommended EA

It is wiser to earn steadily with a single-lot EA without using averaging down or martingale strategies.