4 years of forward track record! Capable of handling from low-risk investments to high-return investments, "Black Panther USDJPY"

Among the EAs sold on GogoJungle, there is an outstanding EA with a four-year forward-running track record and a continued upward trajectory.

That is'Black Panther USDJPY'is.

【Black Panther USDJPY Overview】

Currency Pair: [USD/JPY]

Trading Style: [Scalping]

Maximum Number of Positions: 15 (Other: freely adjustable.)

Operation Type: Compound (compound and simple interest available)

Maximum Lot Size: 0.3 (maximum per single position)

Time Frame Used: M5

Maximum Stop Loss: 50

Take Profit: Executed by the logic.

“Black Panther” entries on one side only from 3:00 AM to 9:00 AM Japan time, up to 15 positions (modifiable),

and closes the positions by 16:00 on the same day, a type of EA called “Morning Scalp.”

【What kind of trades does it make?】

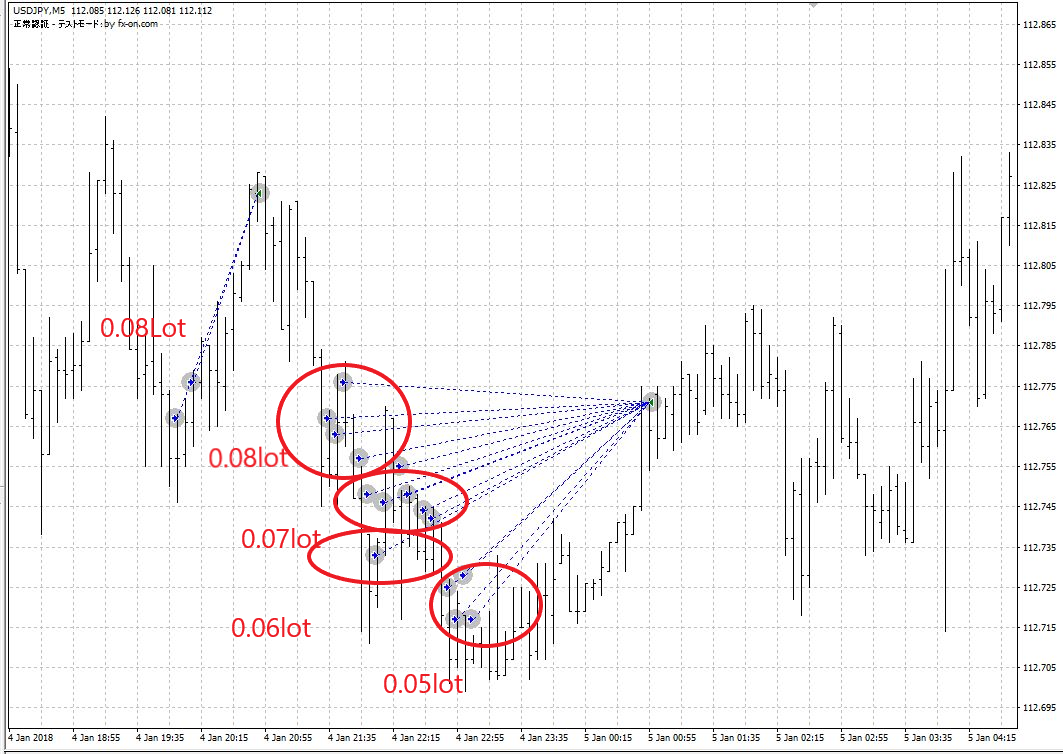

Let’s look at the trades in Visual Backtester mode.

From late night to early morning Japan time, it places multiple buy orders on dips and sell orders on rallies.

You might be surprised by the large number of positions, but what matters is the total lot size.

If using compounding, with the default Risk 4% it adjusts the lot size so that the maximum drawdown stays around 10–15%, so you don’t need to worry.

This Risk% is the percentage of excess equity (or the portion of the account balance you choose) that will be used to hold positions; by default it uses 4% of excess equity (for 1,000,000 yen, that’s 40,000 yen) to hold positions.

Red: SELL

Blue: BUY

Case where it places sells on retracements.

It enters with multiple positions, and closes them all at once when they are in profit.

In compounding operation, the lot sizes are variable, starting large (0.08 > 0.07 > 0.06 > 0.05, etc.), and adding with smaller lots on counter-trend averaging.

Trading frequency is also high,about 1,900 trades per year. It trades almost every day, so you won’t find the operation boring.

Also, with a maximum SL of 50 pips, you can foresee the maximum loss in advance, which is a reassuring point.

【Forward Performance】

The forward operation started with an initial margin of 1,000,000 yen and with the welfare feature ON (Risk value 4%), and after 4 years of operation,Net profit +1,200,000 yen (return 100.9%), maximum drawdown 10%, and PF (Profit Factor) 1.37is what it has been.

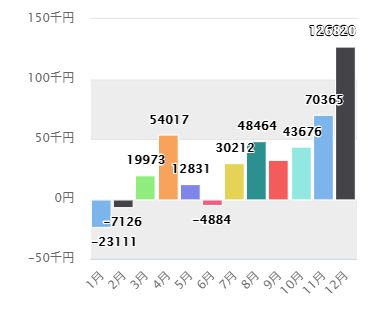

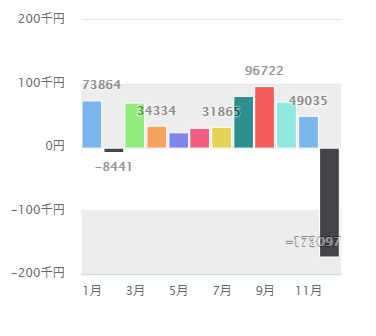

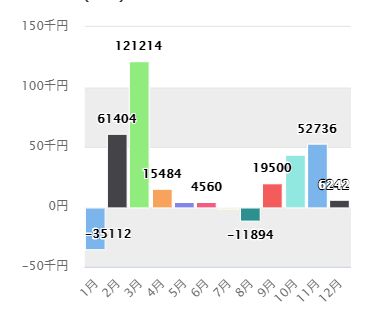

【Forward Yearly Performance】

In compound operation, we look at profit and loss, not pips. (Because the lot size varies with the account balance.)

▲2016年+403,000円の収益! 初期口座資金に対して+40%増!

▲2017年は2回ほど大きなドローダウンがあり、+148,000円ほどの収益となりました。

年初口座資金1,400,000円に対し、+10%増!

▲2018年は、12月に大きくマイナスになりましたが、トータル+432,000円の収益です

年初口座資金1,580,000円に対して、+27%の増加!

▲2019年は+250,000円の利益、年初口座資金2,010,000円に対して+12%増!

年間+10-20%の利益を少ないと感じるかもしれませんが、この利益に対するリスク(最大ドローダウン)が10%ほどであることにぜひ注目していただきたいです。

口座破綻するリスクがほぼなく、100万円の資金があったとして年間あたり10万円程度のリスクで、リスクを超えるリターンを出しているという点、そしてそれを4年間も継続している点が素晴らしいといえませんか。

As mentioned below, the forward results are under default settings with ultra-low risk, and by changing the MM Risk% parameter, you can operate in a more balanced, aggressive mode in terms of risk and return.

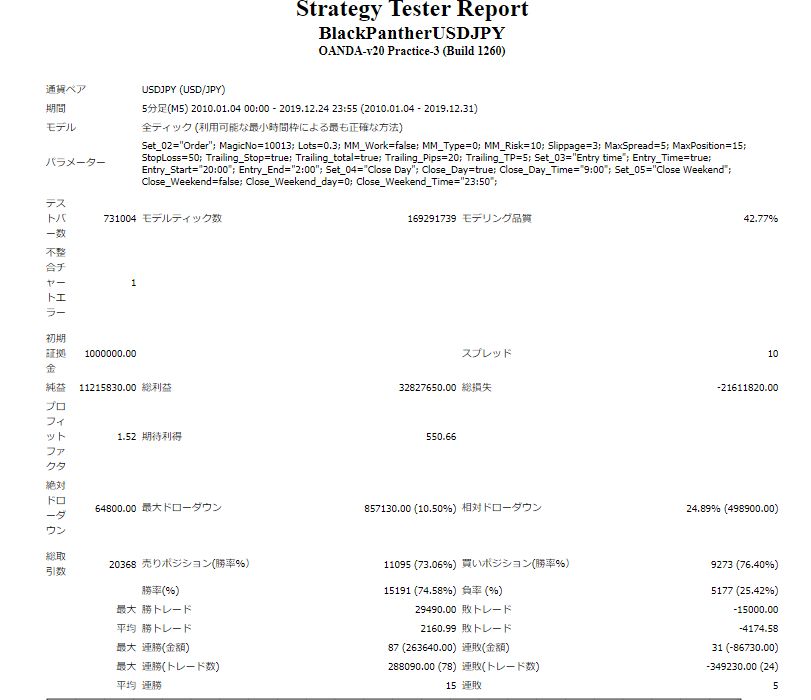

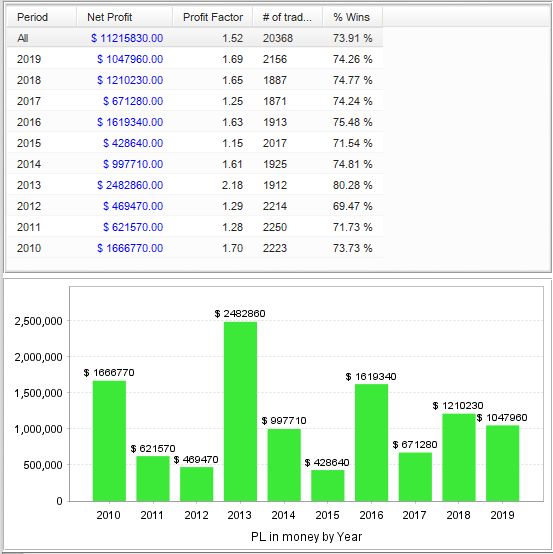

Backtest Analysis

Even though there are four years of forward performance, backtests may not be very necessary; as a reference, let’s verify simple and compound cases.

【Simple-Interest Operation: What is needed to operate at the maximum 0.3 lot?】

Backtest period: 2010.01.04-2019.12.31 (10 years)

Spread 1.0

Fixed 0.3 lots

Annual average profit: 1,120,000 yen

Annual average number of trades: 2,037

Maximum drawdown: 857,000 yen

Recommended margin:

{(4.5×3)×15}+(85.7×2)=3,739,000円

This is what it turned into.

In this case, the expected annual return isabout 30%..

年間毎の利益でいうと40万円~200万円と差がありますが、マイナスになった年がなく、フォワード4年間においてもマイナスになっていないため

バックテストのデータには信頼性があるといえます。

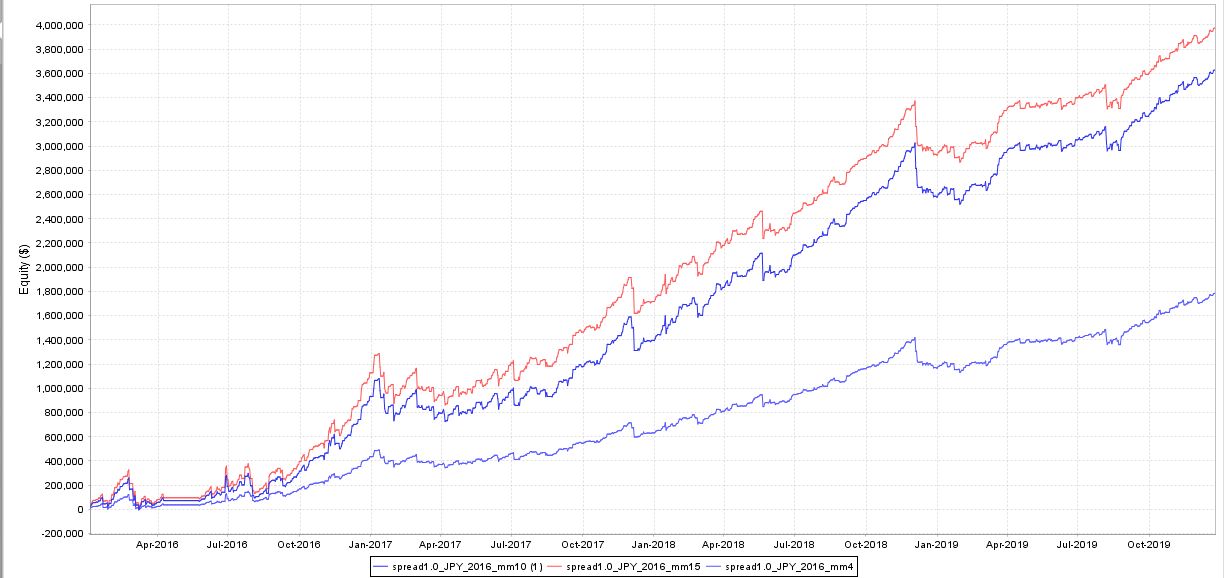

【Compound Operation: Can the funds start from any amount?】

In compound operation, changing the Risk% setting will automatically adjust the lot size.

Defaults to Risk 4%, and for a 1,000,000 yen account, the minimum size of one position is about 0.05 lots.

However, in this case the maximum DD is around 10% (low-risk), so it might feel a bit wasteful.

We compared the past four-year performance in backtests for the default Risk4%, and the aggressive modes Risk10% and Risk15%.

◆Comparison of Risk4%, 10%, 15% with 1,000,000 yen initial margin over 4 years

▲MM Risk4, 10, 15 from bottom

There is no difference in maximum drawdown between Risk10% and Risk15% because it quickly reaches the max lot of 0.3.

In the Risk10% case, starting from 1,000,000 yen, it reached 0.3 after 9 months, and

In the Risk15% case, starting from 1,000,000 yen, it reached 0.3 after 1 month..

Once 0.3 lots are reached, the profit and loss are the same for both.

Each profit amount was: 4% +1,780,000; Risk10% +3,620,000; Risk15% +3,970,000.

With an initial 1,000,000 yen, raising the Risk% quickly reaches 0.3 lots, so the compounding leverage effect isn’t very noticeable.

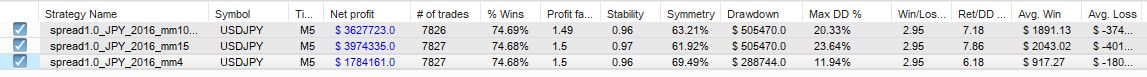

【An Effective Approach: Start with a Small Amount and Increase Risk to Reach 0.3 Lots】

Considering the maximum lot is 0.3, Black Panther is most capital-efficient when you start small and increase the Risk% to grow to 0.3. Since it automatically calculates the lot size with compounding, you can operate with as little as 100,000 yen or 300,000 yen.

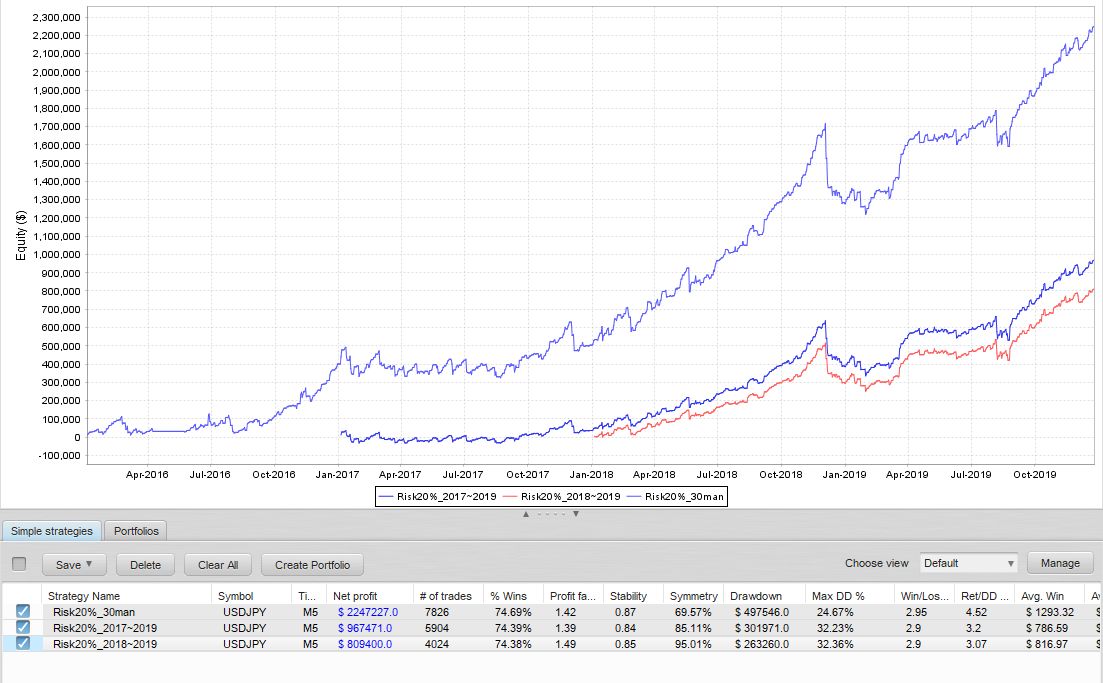

Of course it depends on the year you start, but let’s try starting with 300,000 yen at Risk 20.

Starting with 300,000 yen in 2016 and operating for 4 years, you gain +2,240,000 yen! (+746% increase) Maximum DD 24%

Starting with 300,000 yen in 2017 and operating for 3 years, you gain +970,000 yen! (+300% increase) Maximum DD 32%

Starting with 300,000 yen in 2018 and operating for 2 years, you gain +800,000 yen! (+260% increase) Maximum DD 32%

Risk around 20% tends to keep maximum drawdowns in the 30% range even in years with poorer performance. Moreover, starting with a small amount, the rate of profit growth could easily exceed 100% per year.

▲ Forward results for the last 4 years, 3 years, and 2 years at Risk 20%

There are good and not-so-good years, so we recommend running for more than 2 years.

【Summary】

Black Panther is…

★ In compound operation, the initial capital doesn’t matter; with the default Risk4%, you can achieve 10-40% annual return through compounding

★ An EA that’s ideal for those who don’t see their funds grow with fixed lot sizing

★ You can maximize the compounding effect by increasing the Risk% with small funds

★ There are no annual losses, so even if you experience a large drawdown, stay patient with the operation

★ When using compounding, the rule is one EA per account (portfolios are not suitable)

We’ve once again presented the charm of Black Panther that forward performance alone can’t reveal!

Updated 2020/2/14. Written By Tera GogoJungle Marketing.