GBPJPY Swing Big Strategy ~ To Avoid Missing Opportunities ~

The article is about GBPJPY swing trading, providing information and strategic commentary limited to GBPJPY swing, developed and listed by us.

※ Advertisements are included.

From the initial swing EA development, it has been a little under a year as of the writing date (2024/3/25).

As more users use our EA and we gain experience, we have noticed various sources scattered around, so this article will first整理 those information and share it.

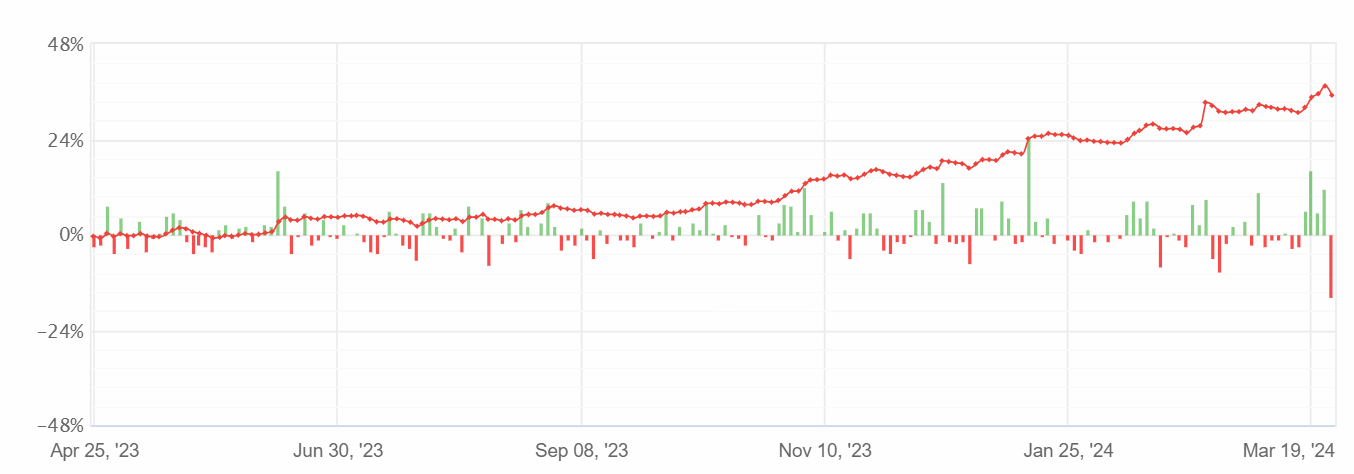

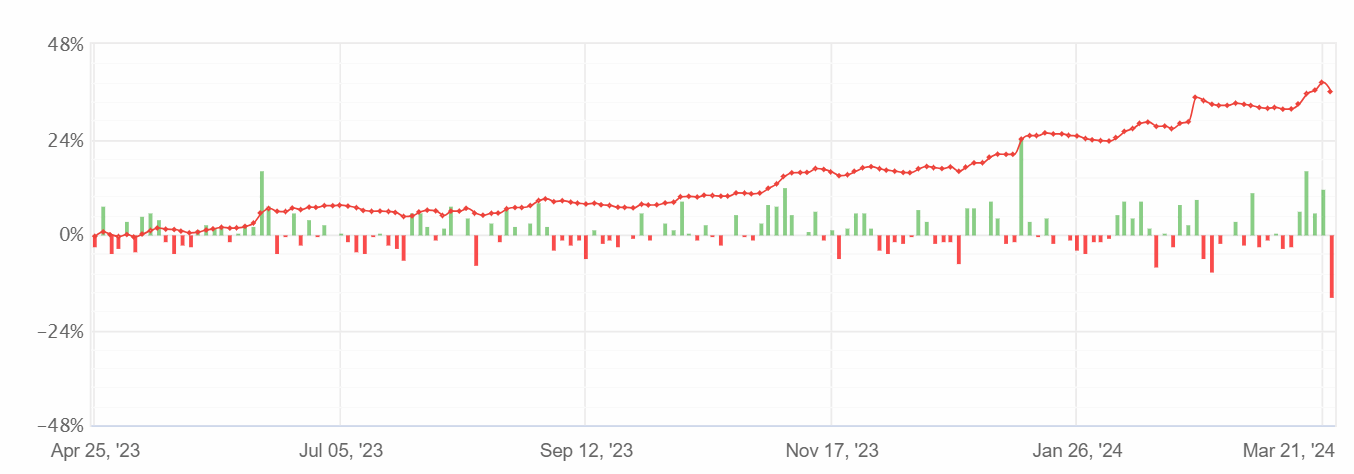

Below is a real forward for nine kinds in aggregate (FXTF).

Swing nine types

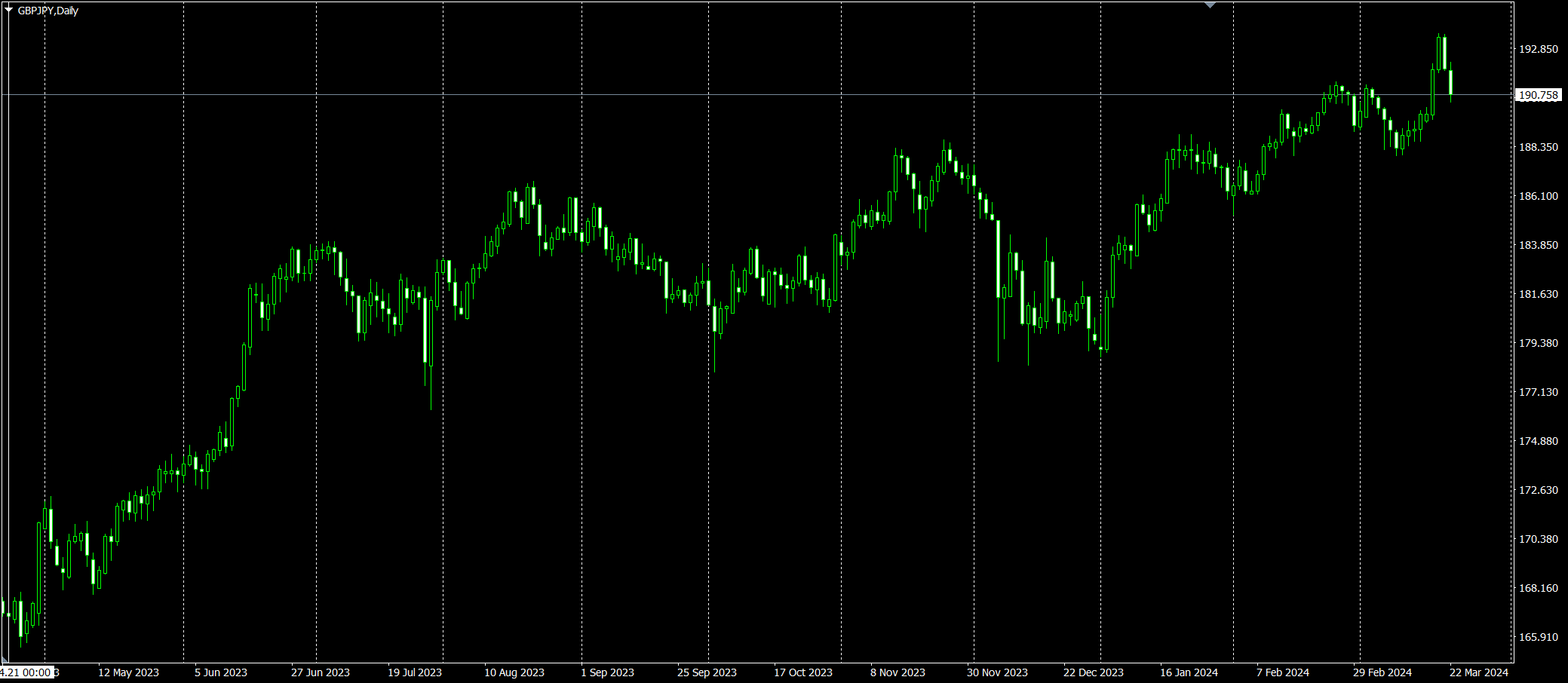

The daily chart aligned to the period is shown below。

Swing types tend to sync with daily movement and performance.

Range-bound markets are sluggish; when upward momentum is strong, longs perform well, and during declines shorts occasionally extend profits.

Total: 337.1 pips

PF: 0.95

To increase synchronization with the market, we have formed a portfolio within GBPJPY swing by combining several logics.

■ Logics Explained

There are five EA varieties when divided by main logic (trigger).

The more similar the logic, the higher the correlation, so please be careful when pairing sets.

1. RGM-79D / MSM-10 / MSM-07E:

Logics aiming to catch trend reversals.

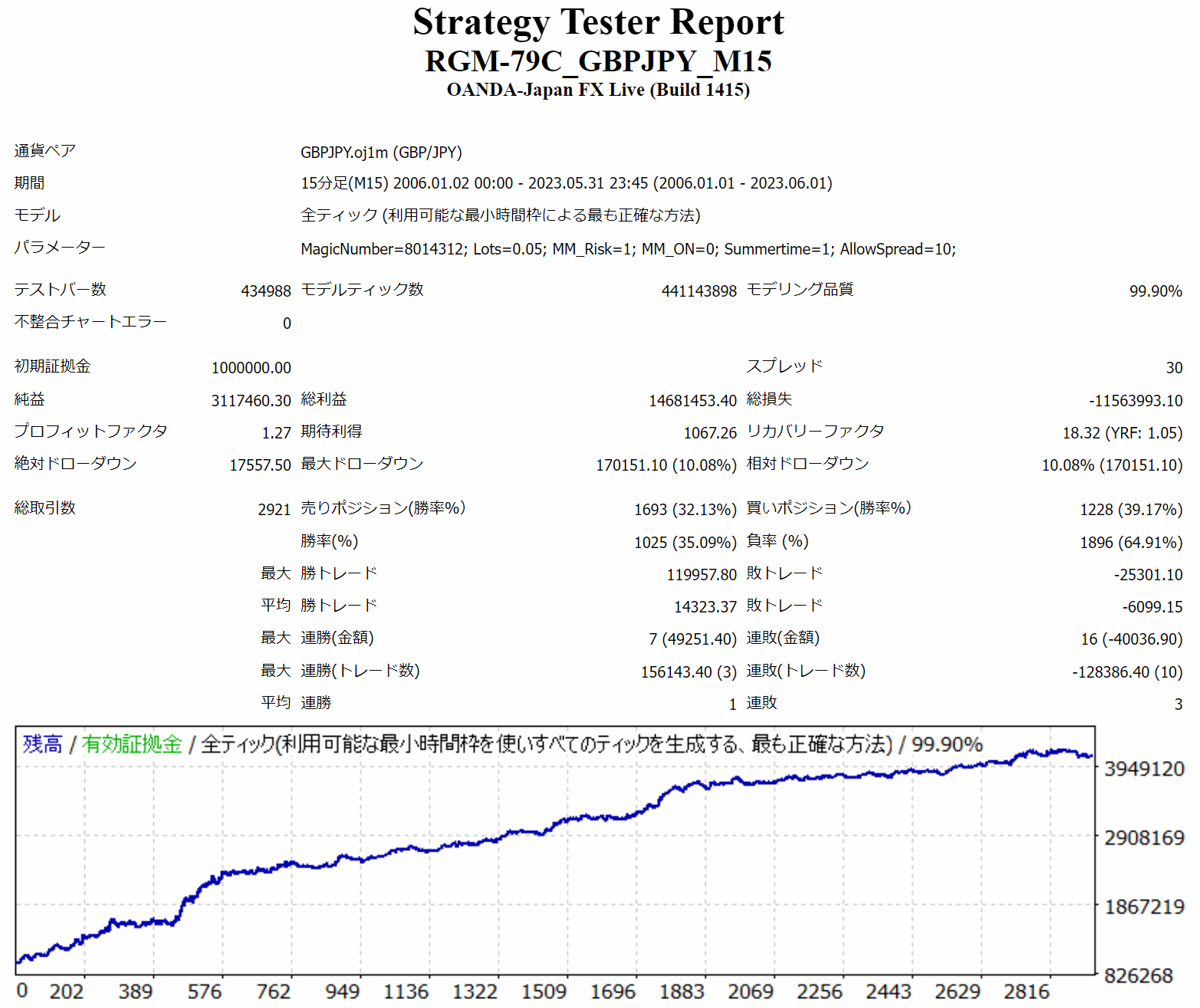

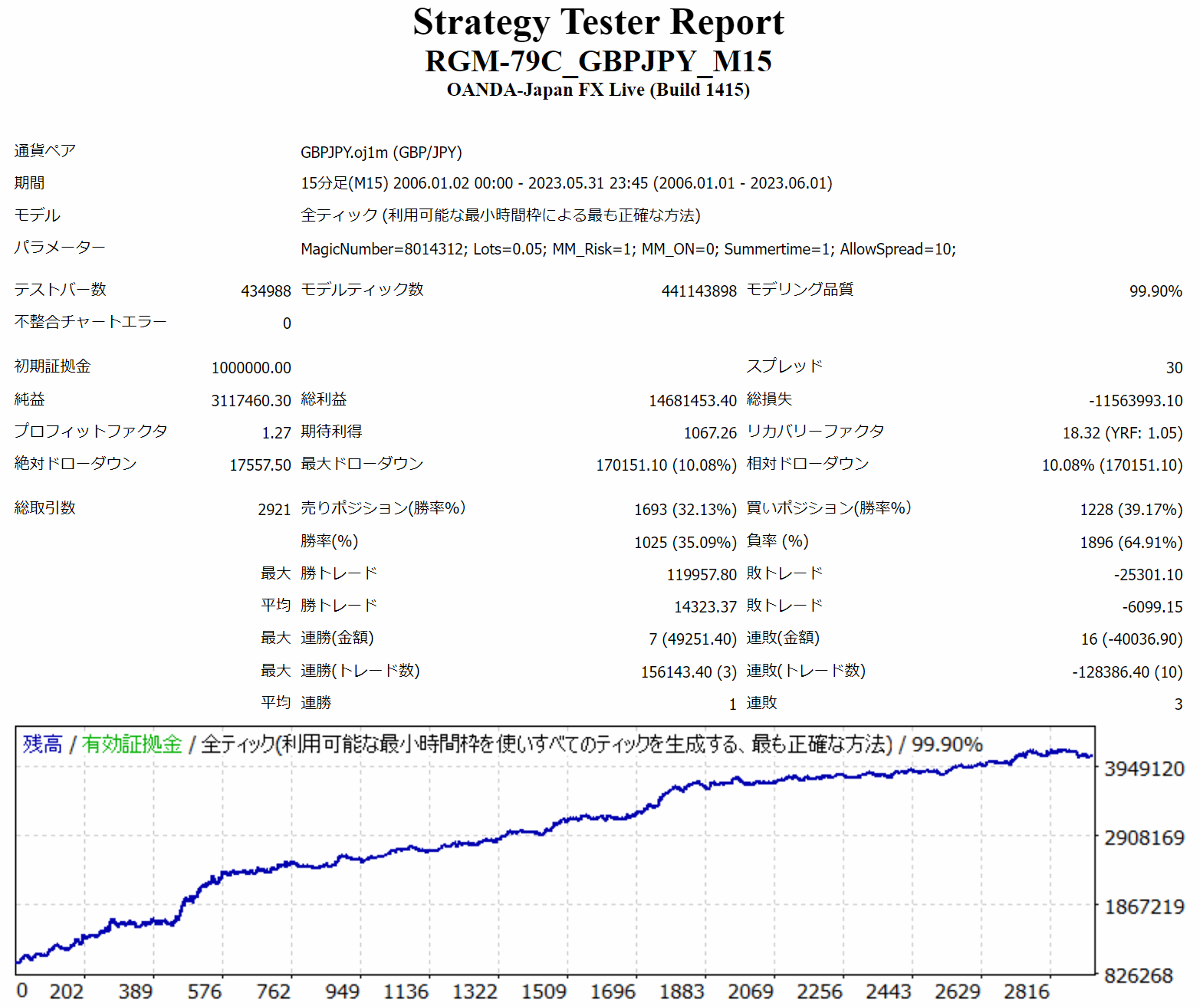

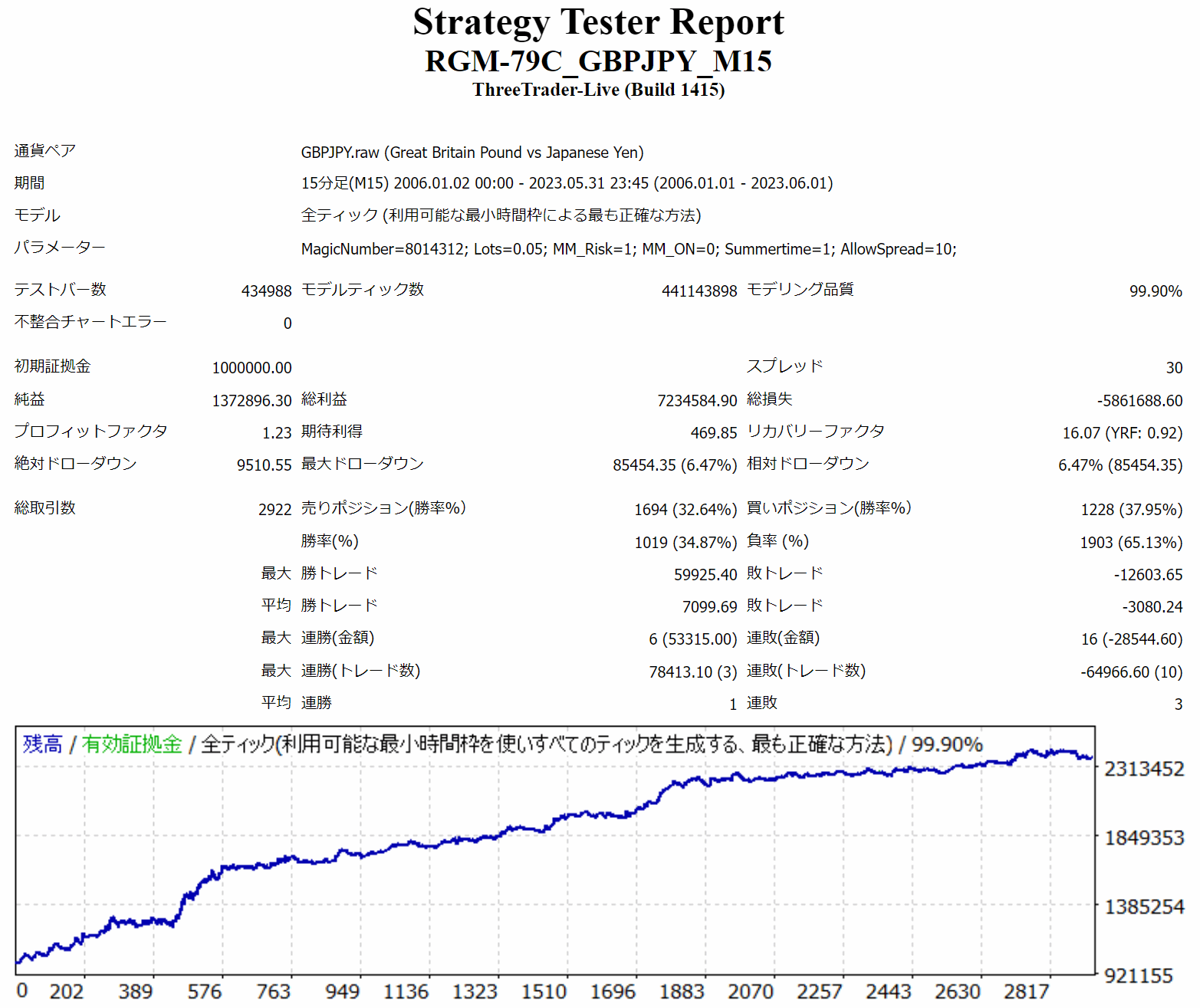

2. RGM-79C / EMS-04 / EMS-10F-GMO:

Aiming to buy on dips and sell on pullbacks.

3. MSM-08:

Follows if a trend continuation is confirmed.

4. MSM-04F:

Signal is expansion of volatility.

5. MSM-03C:

Requires volatility expansion and一定 price movement.

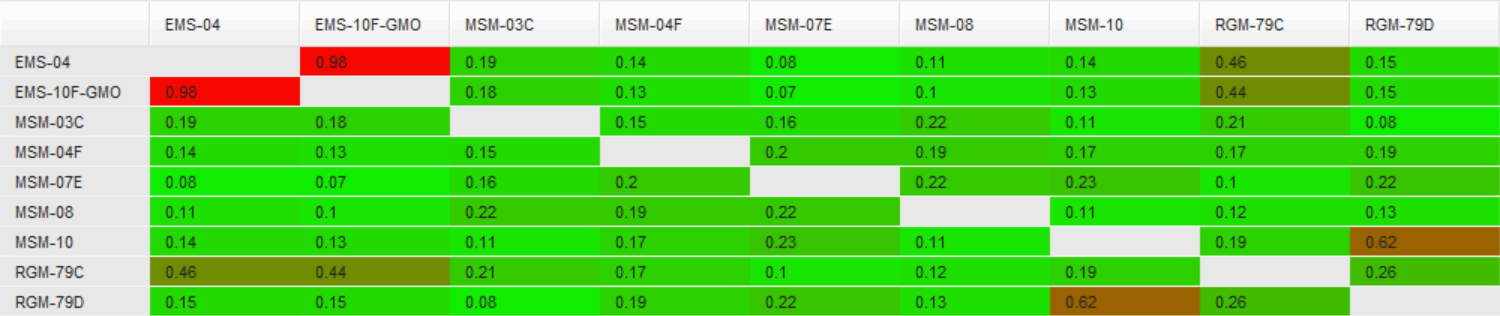

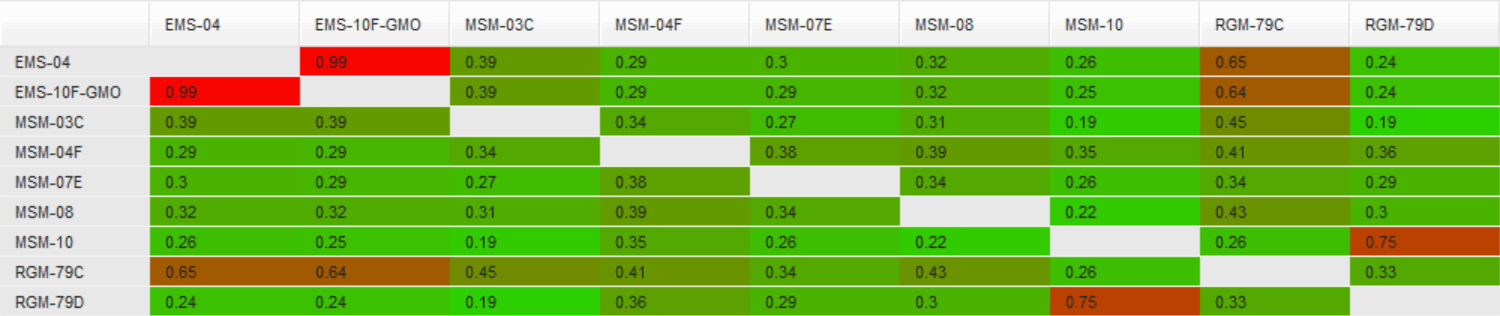

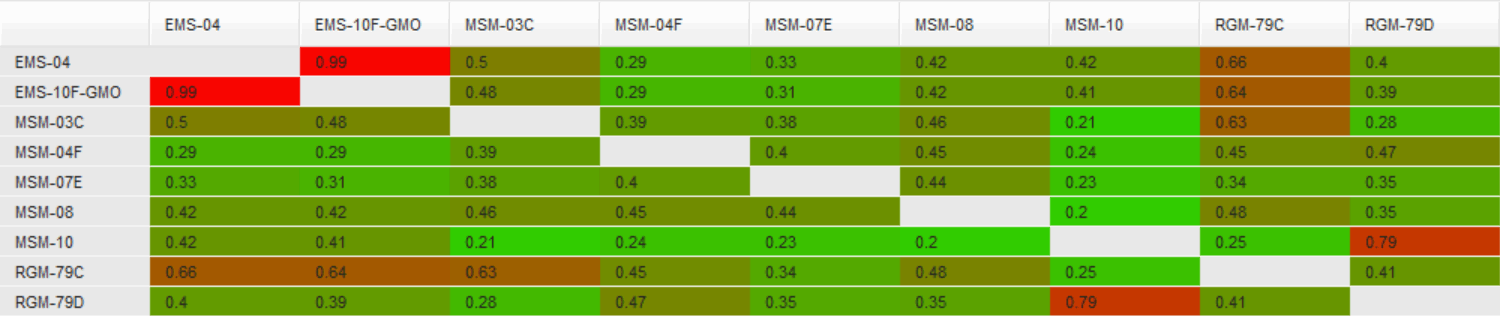

■ Correlation

Correlations for each are shown in the table below. (Compared 2013/1/1–2023/1/1)

Because entry timings differ, there are differences in daily correlations.

Looking at monthly correlations shows more that yield similar results in profit/loss.

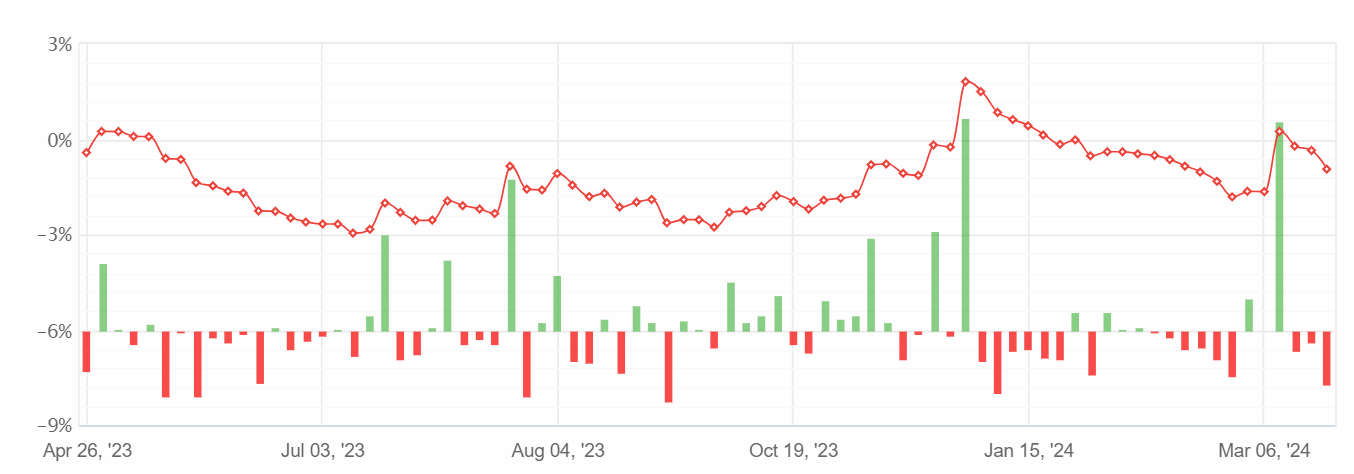

■ Impact of Swaps

GBPJPY swing is greatly affected by swaps.

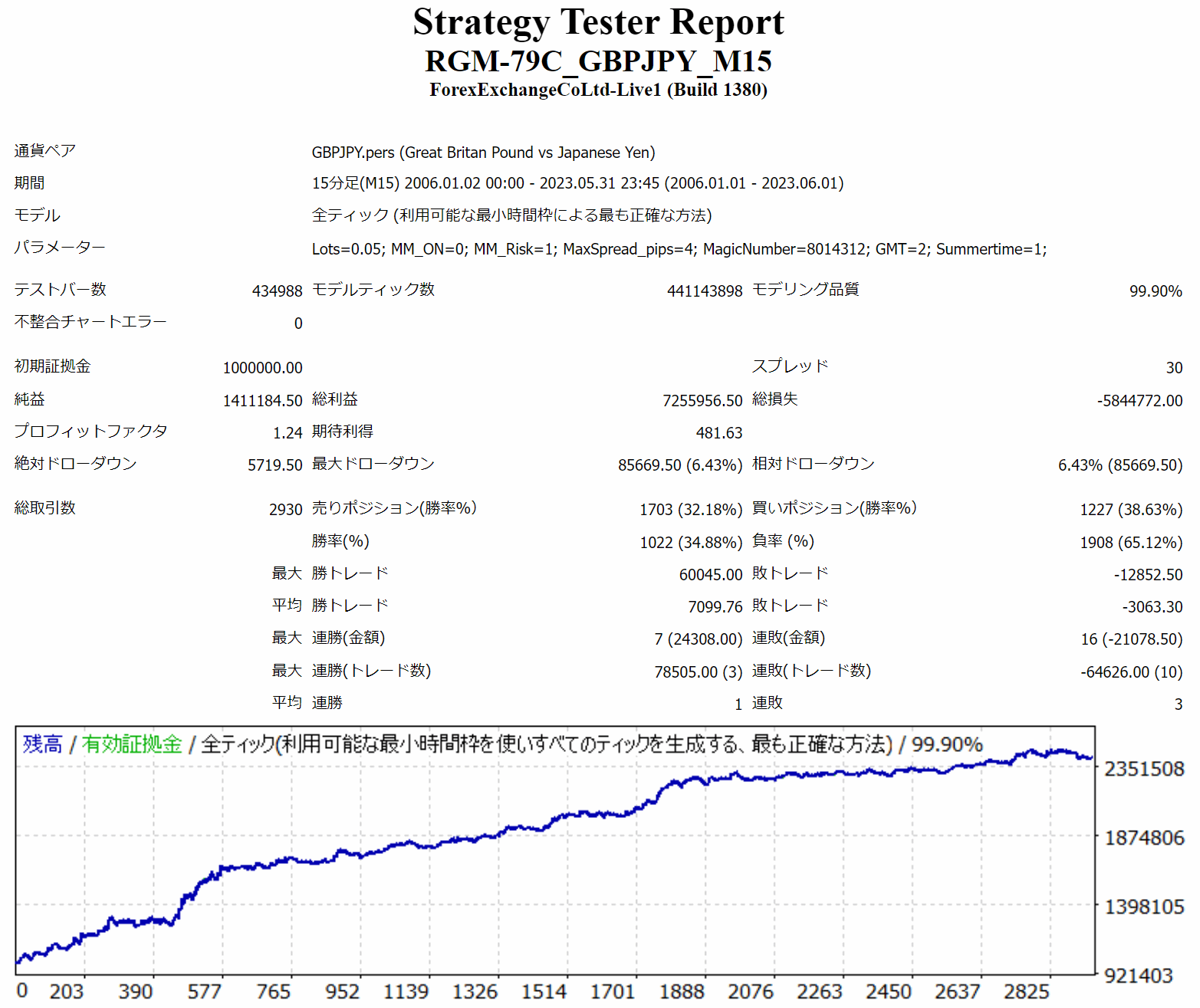

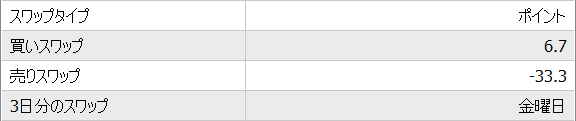

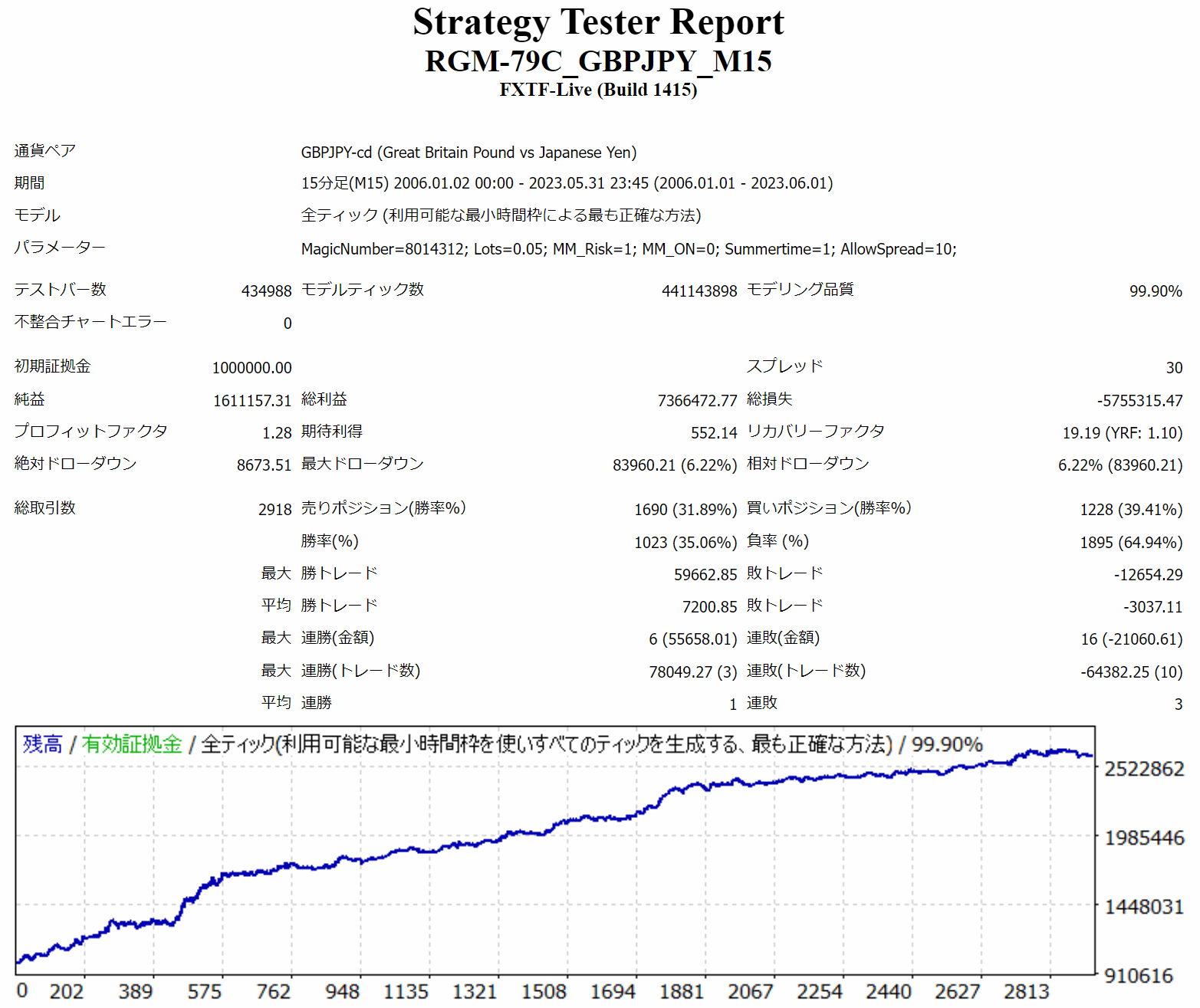

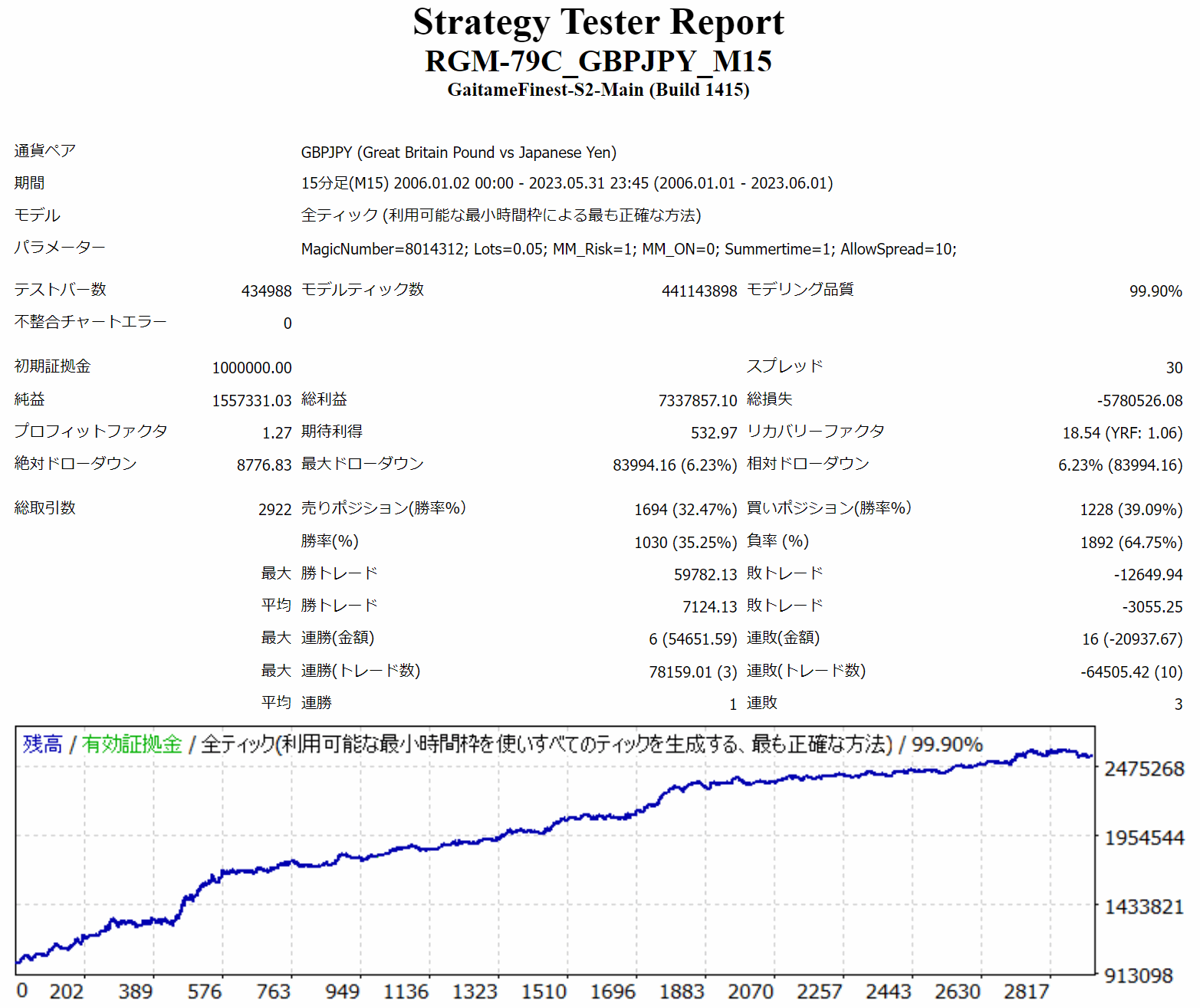

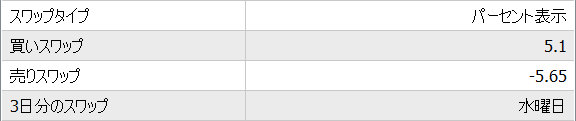

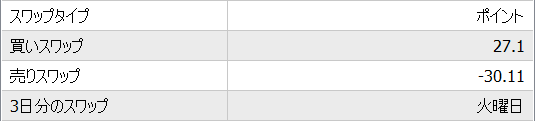

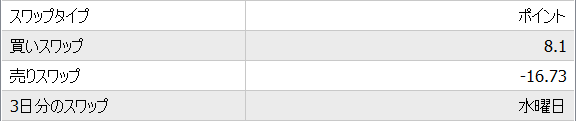

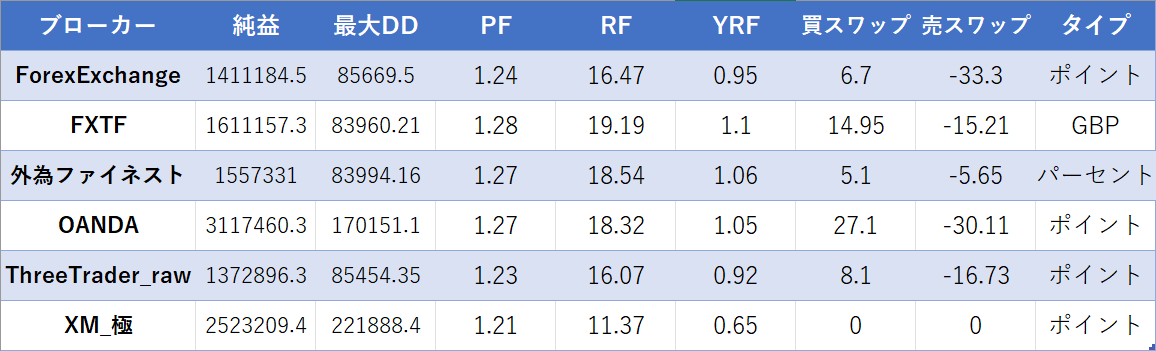

We compared swaps across brokers for RGM-79C.

1. ForexExchange

2. FXTF

3. Yoshinari Forex Finest

4. OANDA (Tokyo server)

5. ThreeTrader_raw

6. XM_Goku

7. Overall assessment

Even swapping differences can cause the net profit and maximum drawdown to differ greatly.

Swaps with zero on extreme accounts had the lowest recovery factor.

For brokers like OANDA, where both positive and negative swaps are similar and high, performance tended to be better.

In swing strategies, leveraging swaps can be advantageous.

■ Notes

This is how it turned out for RGM-79C. Other EAs may yield different results.

The swaps in the table are those on the testing date. In real trading, swaps are not fixed and continuously vary.

If you log in on a day with 3x swaps and backtest, that triple value will be reflected across all past results. Report outcomes can change significantly.

Some brokers do not reflect swaps in backtests.

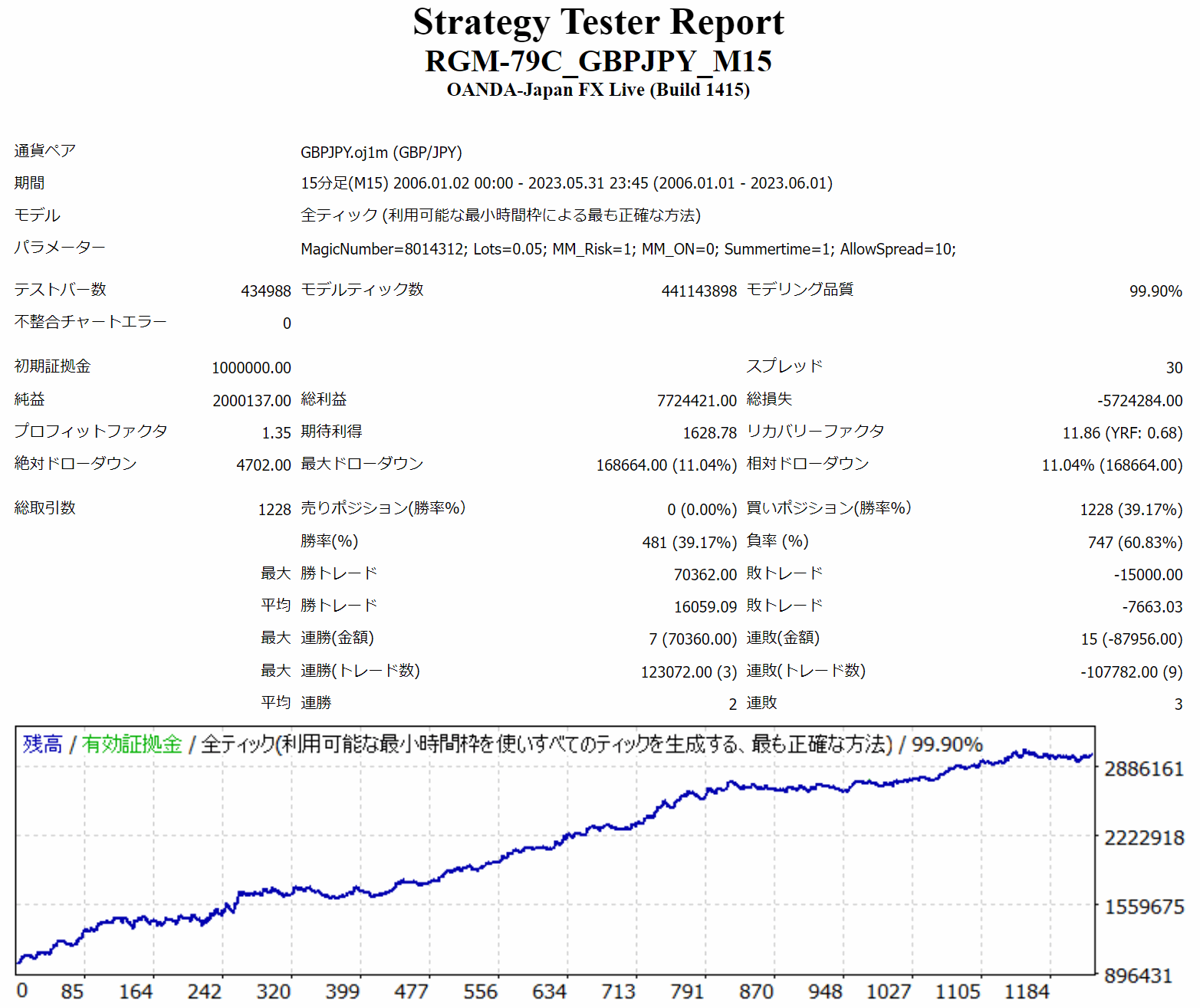

■ Long-only Strategy

Because swaps favor long positions, there is an idea to operate only longs.

In conclusion, it seemed marginally favorable in the long run.

1. Comparison with Oanda

PF increases, but RF decreases.

Volatility tends to be rougher and drawdown deeper.

The current forward is favorable because it fits an upward-trending market.

If there is a pullback or trend reversal that is not responded to by shorts, losses may become deeper and longer.

2. Sign Tool

This has also been tried.

Similar to the sign tool, the idea was to use a long-term (daily) logic to illuminate signals when an upward trend occurs.

However, merging that logic inside the EA reduces performance.

Long-term logic that could improve performance was considered, but the marginal gains were small and effectiveness was unstable across EAs, so manual control via sign tools was abandoned.

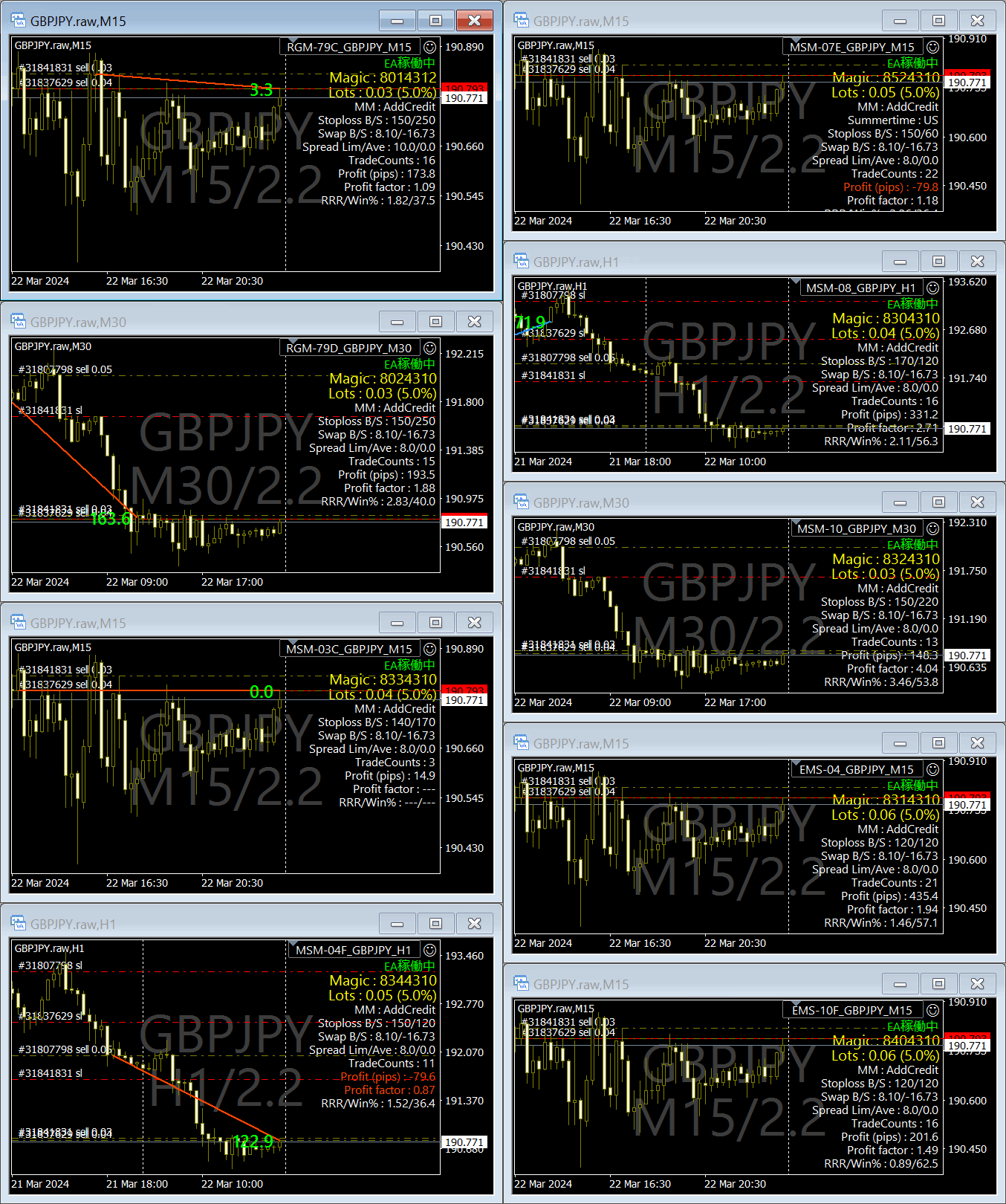

■ Portfolio Strategy

GBPJPY Swing targets occasional large moves.

One EA with one logic may miss good opportunities.

Therefore, portfolioing with multiple EAs is considered effective.

The image shows a GBPJPY swing-only portfolio.

Some portfolios may show overall negative results. When multiple EAs with different logics run, stronger performers from other EAs can compensate.

Even correlated assets set in multiple ways can lead to cases where one misses a chance while another is entering or has different profit targets.

■ Concerns for the Future

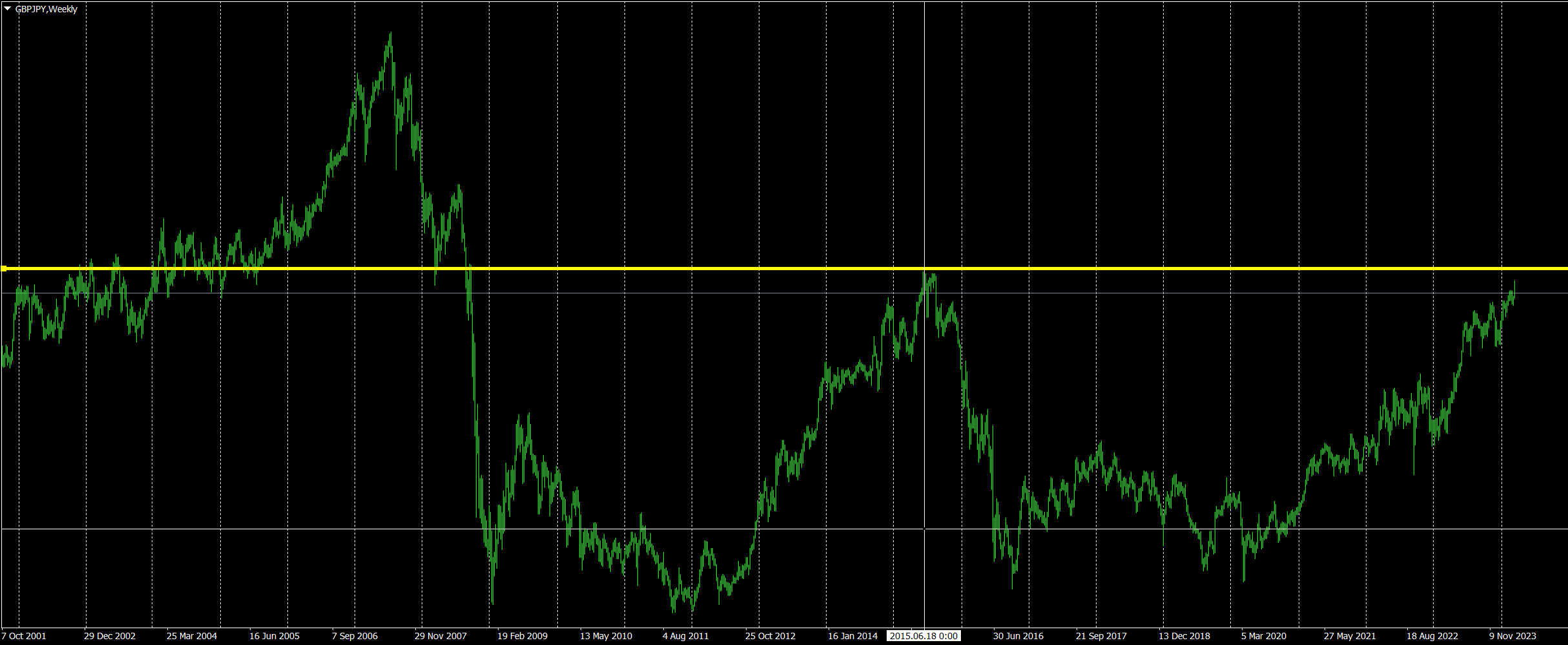

1. Near-term milestone

As of writing this article (2024/3/25), we are within about 500 pips of the high reached in 2015.

First, expect consolidation and potential stagnation there.

2. Long-term downtrend

3. Range

If direction is unclear, it becomes unfavorable.

Until the trend direction and angle align, it will be tough.

4. Swaps

■ GBPJPY Swing Benefits

One of the highest volatility among FX pairs, making it easier to target pips.

Potential to capture profit margins comparable to gold.

Technicals work well.

With major currency pairs, fundamentals also tend to work well.

Cross-yen pairs have excellent swaps.

Swing types benefit more as volatility increases.

Strong against spikes caused by indicators or fundamentals.

Stable when aligned with long-term trends; especially favorable in uptrends.

Spread resilience.

■ 攻略まとめ

■ EA Acquisition Methods Summary

Acquisition methods were scattered, so here整理 them.

Beyond our EAs, there are many excellent EAs for GBPJPY in the world.

EA Acquisition Methods

1. RGM-79C / RGM-79D

2. MSM-07E

3. MSM-10 / EMS-04

Available under certain conditions with MOSA Market discount codes.

4. EMS-10F-GMO

A name-tie-up EA.

Only available through methods in the campaign.

5. MSM-08

Distributed to those who previously filled out a survey.

Future availability is undecided.

6. MSM-04F / MSM-03C

REALTRADE

■ ThreeTrader_raw

■ Cautions and Disclaimers

▶ This article does not recommend overseas FX brokers or provide advice on EA operation.

▶ All broker selection and operation are 100% the reader’s own responsibility.