【December 29, 2023】Past validation using the Heaven and Earth Indicators (New Zealand Yen)

This will be our final article of the year. Since I started writing articles for Investment Navigation Plus this year, I have felt a strong sense of responsibility and have spent days filled with tension. I hope to continue writing articles next year while enjoying this sense of tension. Thank you for your continued support next year as well.

Now, for the final verification article of the year, this time I will introduce the entry point for the latest USD/JPY.

・This article mainly focuses on historical verification using the “Heaven and Earth Indicator.”

・The content is based on the use of the most accurate tool in this kit,“15-minute chart + 4-hour chart simultaneous monitoring method”.

・This tool is a groundbreaking trading tool that can be used even if you do not understand classic FX theories (Elliott Wave, Dow Theory, Grail of Granville’s Law, cycle theory, price action, Fibonacci, support/resistance, channels, etc.).

Heaven and Earth Indicator is a trading method that uses my original indicator developed by Abusan, released in February 2022.

Thanks to everyone's support, we were honored to receive「GogoJungle Award 2022, 2023」 for two consecutive years.

■ Heaven and Earth Indicator

https://www.gogojungle.co.jp/tools/indicators/35780

■ Heaven and Earth Indicator [MT5 version]

https://www.gogojungle.co.jp/tools/indicators/47523

■ Heaven and Earth Mountain

https://www.gogojungle.co.jp/tools/indicators/37744

■ Heaven and Earth EA ~ Semi-discretionary Auto Trading System ~

https://www.gogojungle.co.jp/tools/indicators/43213

■ Heaven and Earth Dashboard

https://www.gogojungle.co.jp/tools/indicators/46257

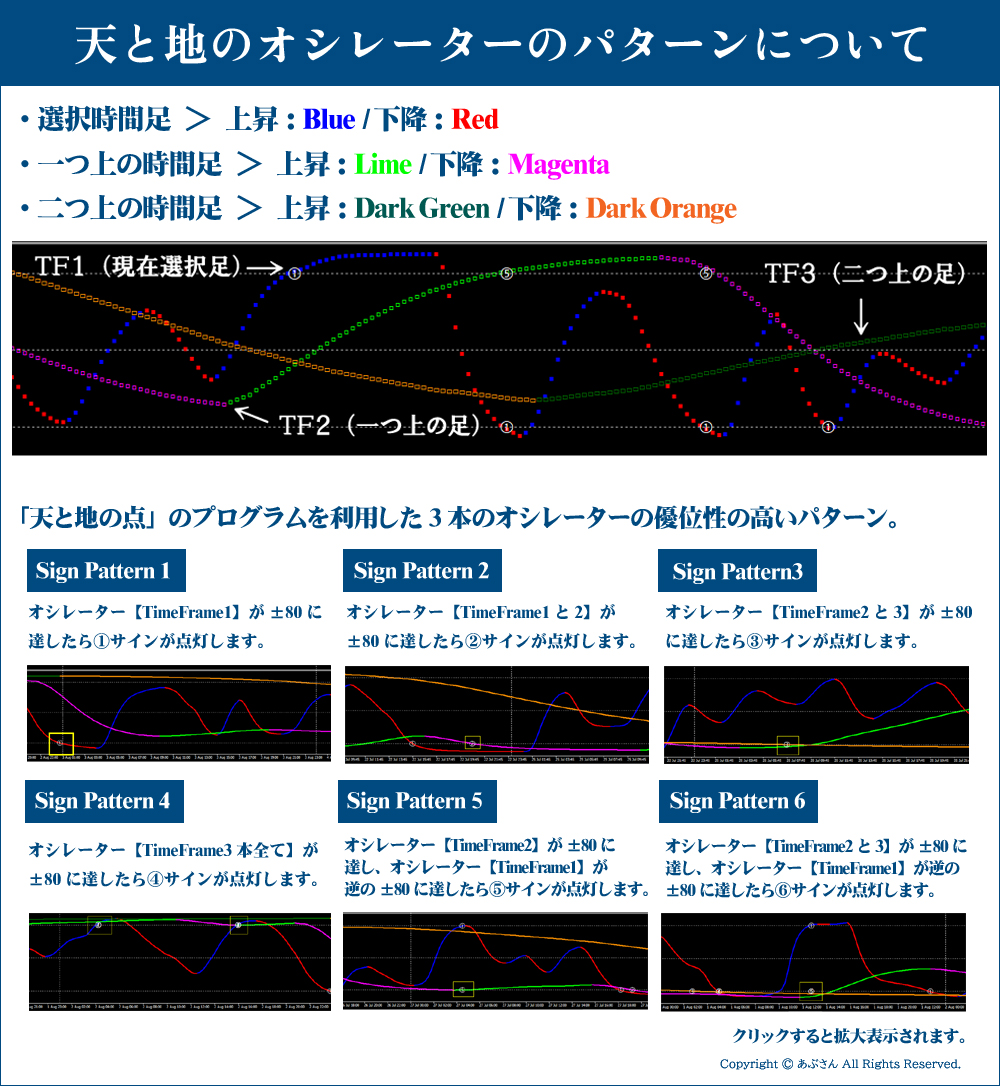

※ For the specialized terms used in this blog, please refer to the following “Names of the parts of Heaven and Earth Indicator” and “Oscillator patterns of Heaven and Earth Indicator.” If you have any other questions, you can usually understand by referring to the Heaven and Earth Indicator sales page. If you are already a user, reading the manual should be enough, right?

Now, we will move on to the verification.

Thank you in advance!

※ All images can be enlarged by clicking.

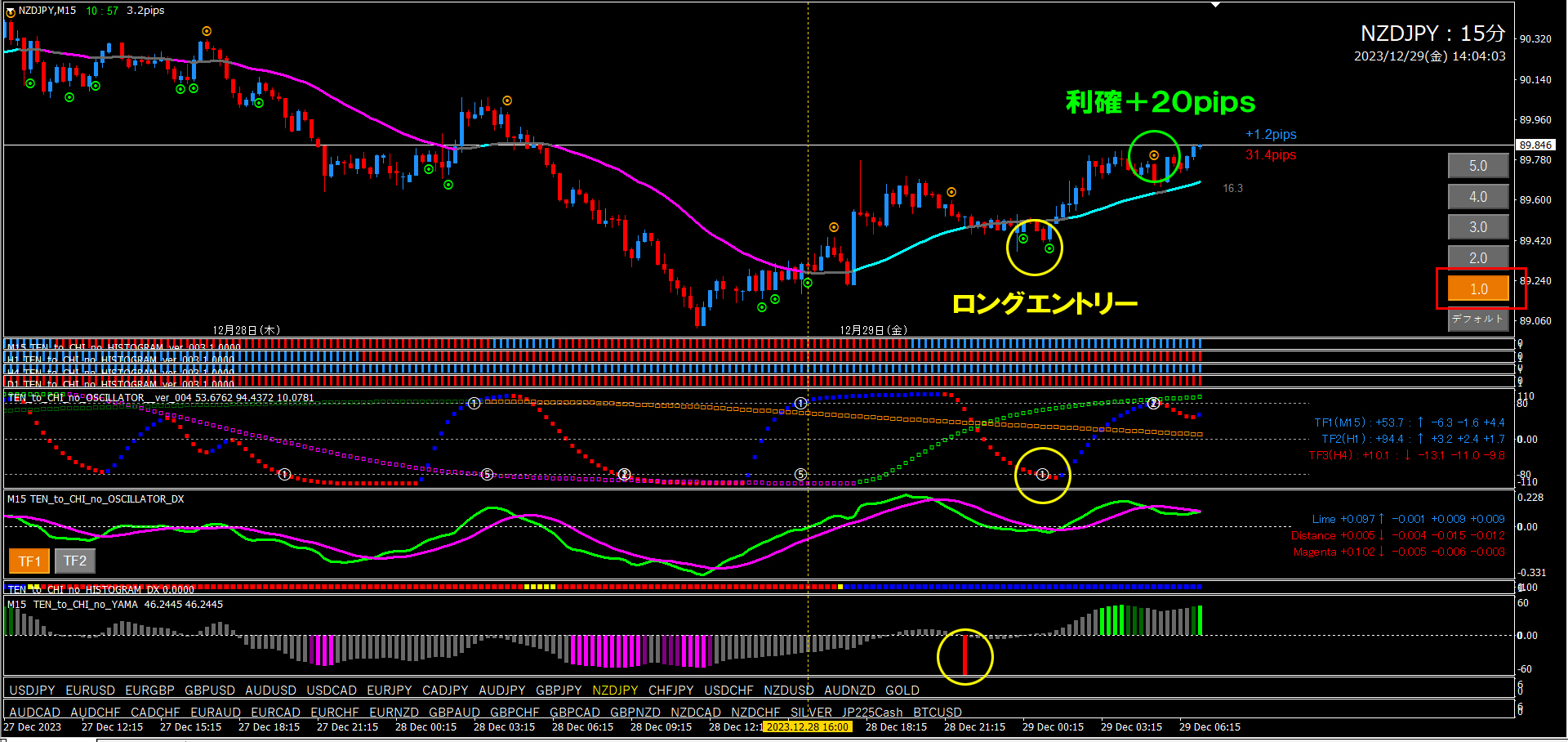

USD/JPY 15-minute + 4-hour past verification (from December 28, 2023 to present)

※ Please note the yellow vertical line. The 15-minute chart also has a yellow vertical line at the same location. (Using LINK LINE)

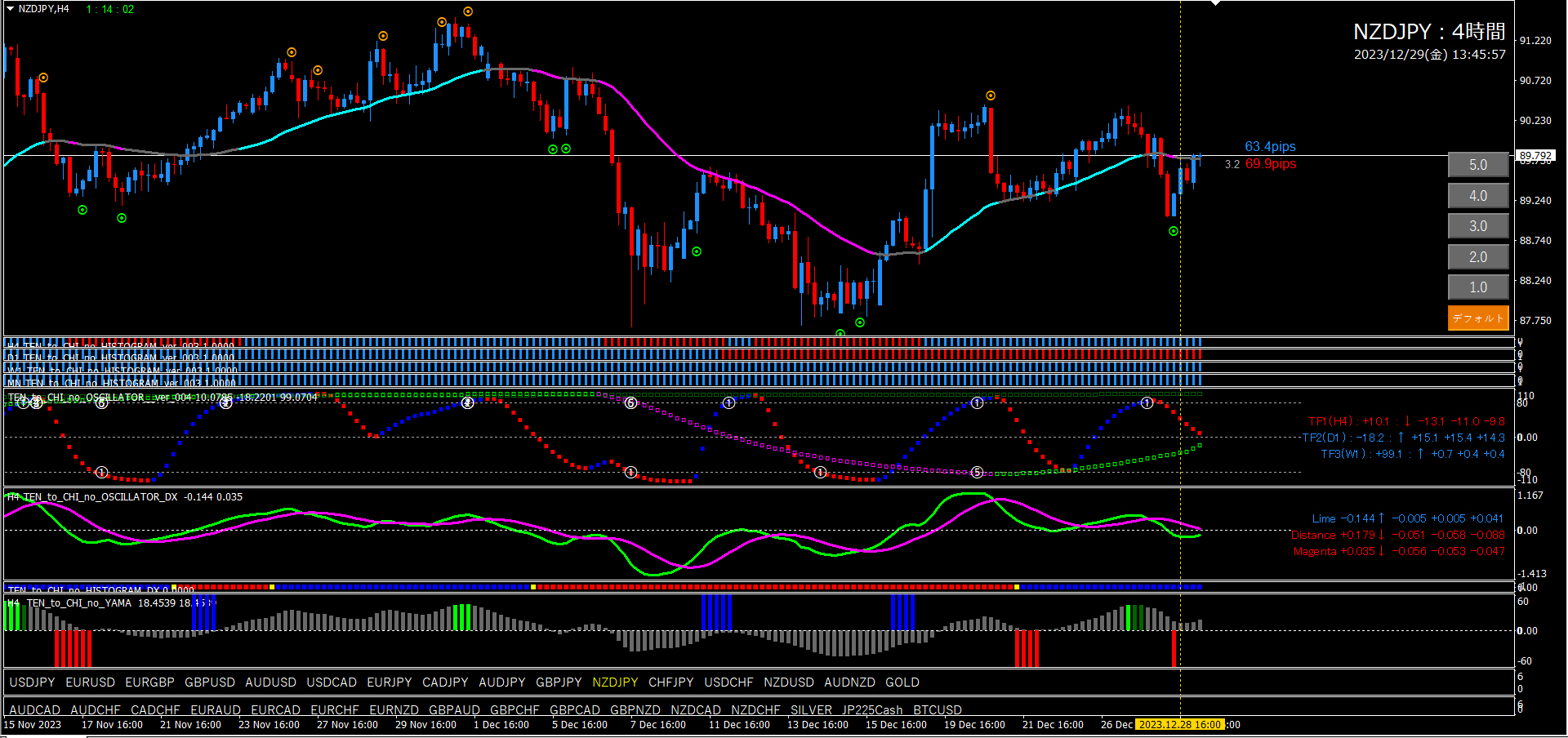

■ 4-hour chart (environmental recognition)

The yellow vertical line indicates an uptrend.

First, look at Oscillator TF2. While TF2 is rising, there are long entry signs and a dip as well. Oscillator DX is beginning to contract. The histogram and Histogram DX look good. At this point, I determine an uptrend.

The yellow vertical line indicates an uptrend as judged on the 4-hour chart.

Yellow circle is the long entry point. Green circle is the take-profit point signaled by a short entry signal.

When confirming the upward movement of Oscillator TF2, if the candle falls below the line and Oscillator Signal ① appears, but the long-entry signal does not appear for some time, the conventional approach is to lower the dot level to 1.0. Some users may not understand the purpose of the dot level, but this kind of exploration helps switch the entry trigger. The reason there is a dot-level switching button is to allow easy switching and confirmation. Get into the habit of pressing the button repeatedly to check.

If the 4-hour chart (environment recognition) shows an uptrend, confirm the rise on TF2. Once confirmed, set the EA pattern that best fits the current situation.

・If the current candlestick is below the line, there is a high possibility that a long-entry signal will appear, so set EA Pattern ①. If the upward momentum is clear, setting the dot level to 1.0 increases the likelihood of meeting the condition and triggering.

・If TF1 is around -80, or Oscillator Signal ① appears, set EA Pattern ②.

・If TF1 and TF2 reach -80 and Oscillator Signal ② appears, aim for EA Pattern ③.

・If the dip lights up (dips), set EA Pattern ④ at that moment.

・If the candlestick is near the line, use EA Pattern ⑥. However, EA Pattern ⑥ requires other corroborating factors such as TF1 position.

That is all.

We hope this is helpful for everyone.