Smart EA Selection (Goal Setting, Key Points)

1. Confirming available funds and setting target amount

Everyone has dreams and goals in life. However, in everyday life, many people face financial anxiety, and the dreams they once envisioned may get buried day by day. Dreams give passion and hope to one's life.

Investing in FX is a means to resolve financial anxiety and to re-challenge toward those dreams, so you must succeed.

However, if you don’t plan or set goals and just buy seemingly promising EAs, use them a little, and if you don’t earn profits,

you may immediately keep buying other EAs, or when things look promising, reckless increases in lot sizes occur,

and I feel many people exit within a year or two.

First, determine how much disposable capital you have to invest, how much you can invest monthly, and after how many years

you want to have what amount of money as a goal.

2. Compounding calculations of profitability and asset balance

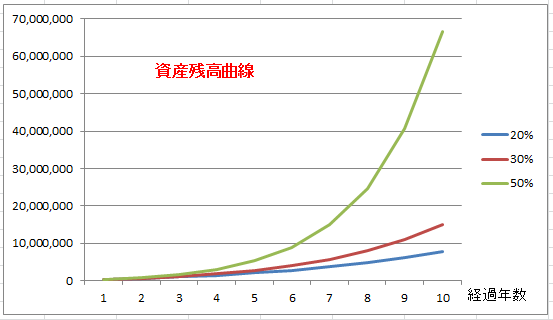

If you perform compound calculations based on the initial investment, monthly investment, and the EA’s annual return, the amount after 10 years will be as follows.

■ No initial investment

Monthly investment: 20,000 yen

Annual return 20%: 7,500,000 yen

Annual return 30%: 15,000,000 yen

Annual return 50%: 66,000,000 yen

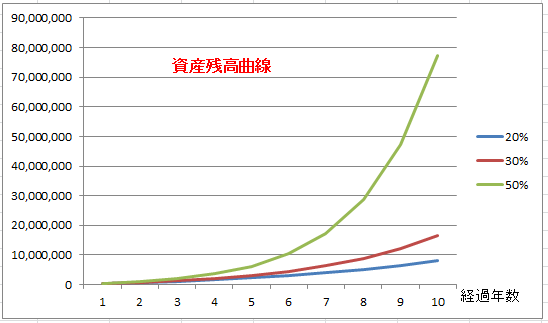

■ Initial investment 100,000 yen

Monthly investment: 20,000 yen

Annual return 20%: 8,200,000 yen

Annual return 30%: 16,000,000 yen

Annual return 50%: 77,000,000 yen

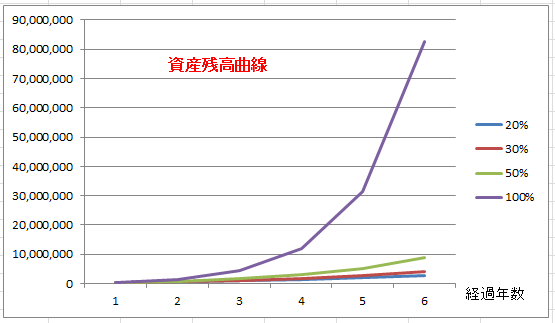

If an EA with 100% annual return is available, after 6 years

■ No initial investment

Monthly investment: 20,000 yen

Annual return 20%: 2,790,000 yen

Annual return 30%: 4,030,000 yen

Annual return 50%: 8,950,000 yen

Annual return 100%: 82,000,000 yen

3. Important points for EA selection

① High profitability

As mentioned above, differences in profitability can lead to big future differences.

② Small maximum drawdown

A smaller maximum drawdown allows you to increase lot sizes.

The key points in EA selection are high profitability and small maximum drawdown.

③ High risk-reward ratio.

The risk-reward ratio can be calculated as profit amount ÷ maximum drawdown amount, so an EA with a high risk-reward ratio can yield more profit.

④ High number of trades.

If the number of trades is small, you can significantly improve the above ①–③ through strategy tester optimization, but most often it results in curve-fitting and dismal forward results.

A yearly average of more than 200 trades provides a sense of security.

4. Building a portfolio

To diversify risk, it is good to build a portfolio with multiple EAs. Choose 3–5, and, depending on the situation, replace part of the EAs about every six months.

Next time, I will write about confirming the reliability of backtests. (Please replace this part when publishing to the public.)