【FX】Simple and incredibly powerful. The strongest contrarian entry method using pin bars

The pin bar has a long wick, which gives it strong visual impact and makes it stand out, and is therefore a price action that many traders pay attention to.

Here, I would like to introduce a simple entry method using pin bars.

What defines a “pin bar”

First, what qualifies as a pin bar? There is the question of where a pin bar starts and ends, but in general the criterion is

“when the ratio of wick to body is 3:1 or greater.”

There is a standard that it is considered a pin bar if this ratio holds.

Indeed, when you look at actual markets, pin bars with a 3:1 or greater ratio tend to function more reliably.

For example, in this chart,“a candle with a longer wick than the body”is not a reversal price action.

Wicks of this length tend to result in trend continuation movements that test the wick tip rather than reversing.

During economic announcements, many of these ratios between wick and body are delicate, and if you blindly adopt a counter-trend approach based on them, you may be taken by moves testing the wick tip, so beware.

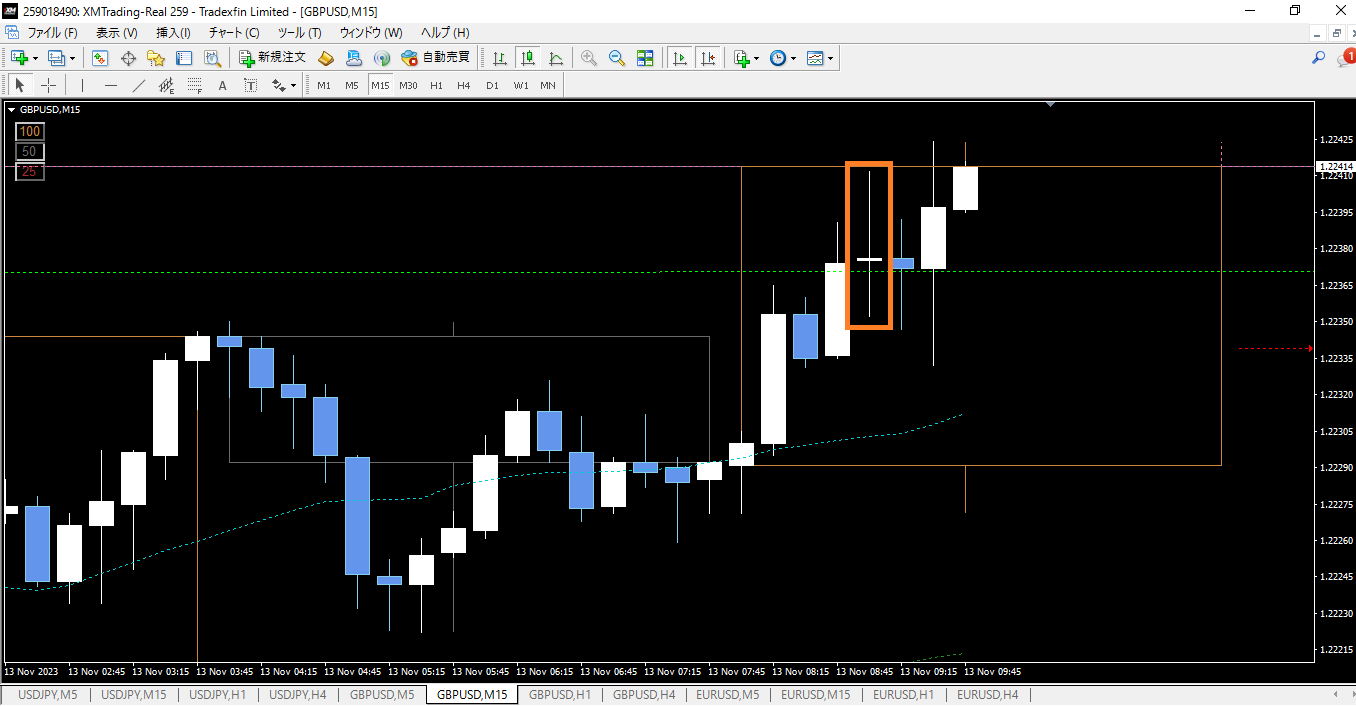

Alternatively, in cases like a “cross” that has both an upper wick and a lower wick, you should not rely on it too much either.

This one technically satisfies the pin bar body-to-wick ratio, but it has a lower wick almost as long as the upper wick, indicating market indecision.

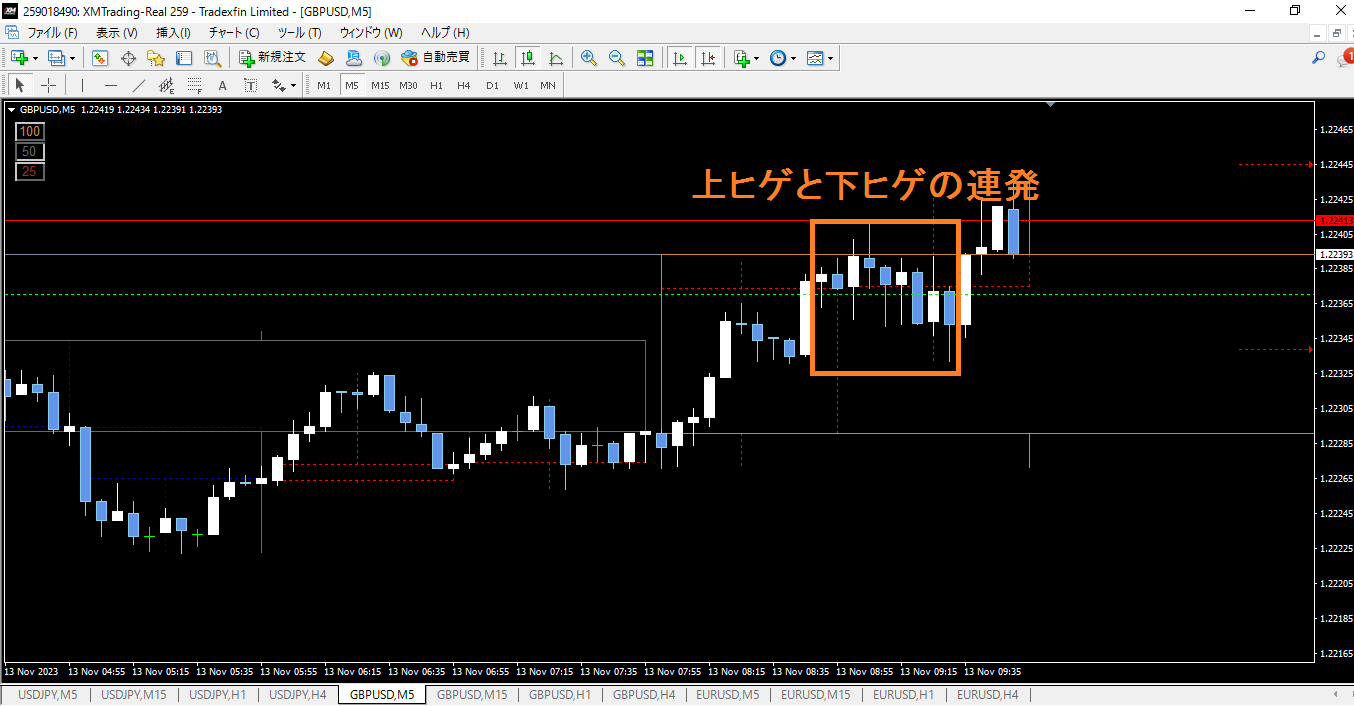

The image above is a 15-minute chart, but if you zoom into a 5-minute chart, you can see the upper and lower wicks firing off repeatedly, indicating just a range-bound market.

Seeing a pin bar does not mean an immediate reversal entry

This applies not only to pin bars but to all price actions and chart patterns: just because a pin bar appears does not mean it is an immediate reversal signal.

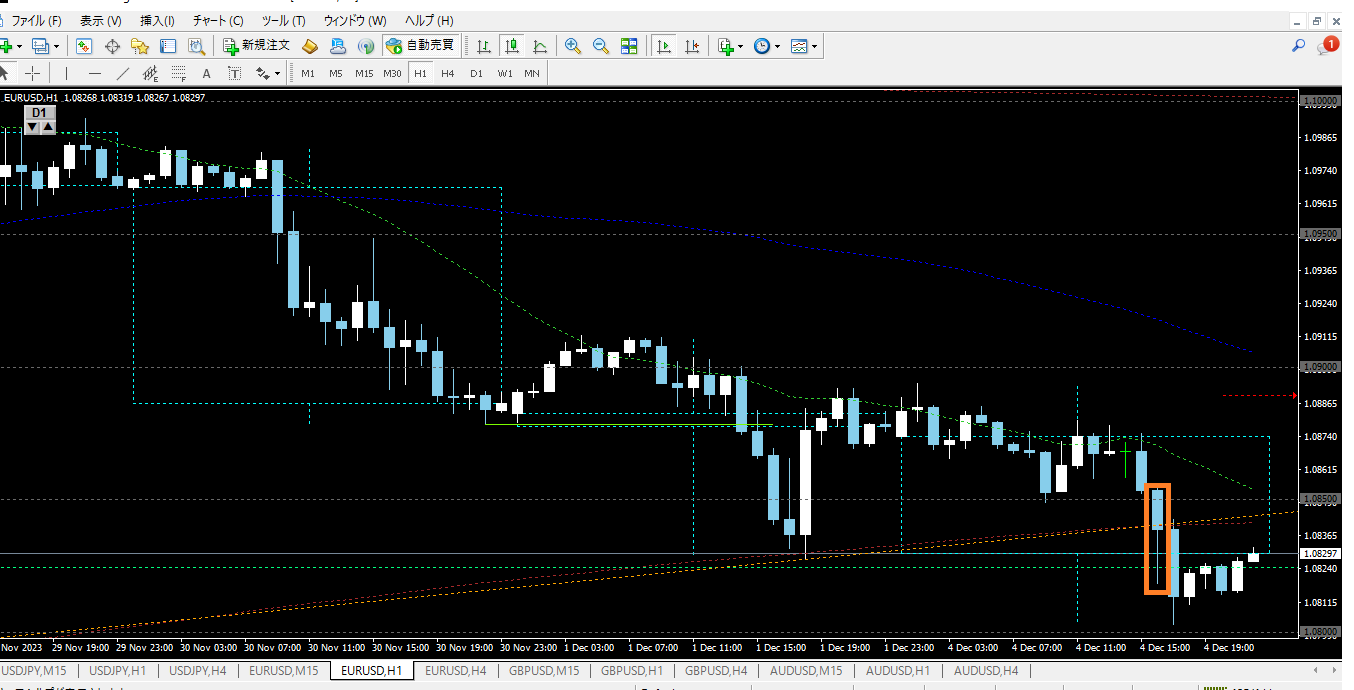

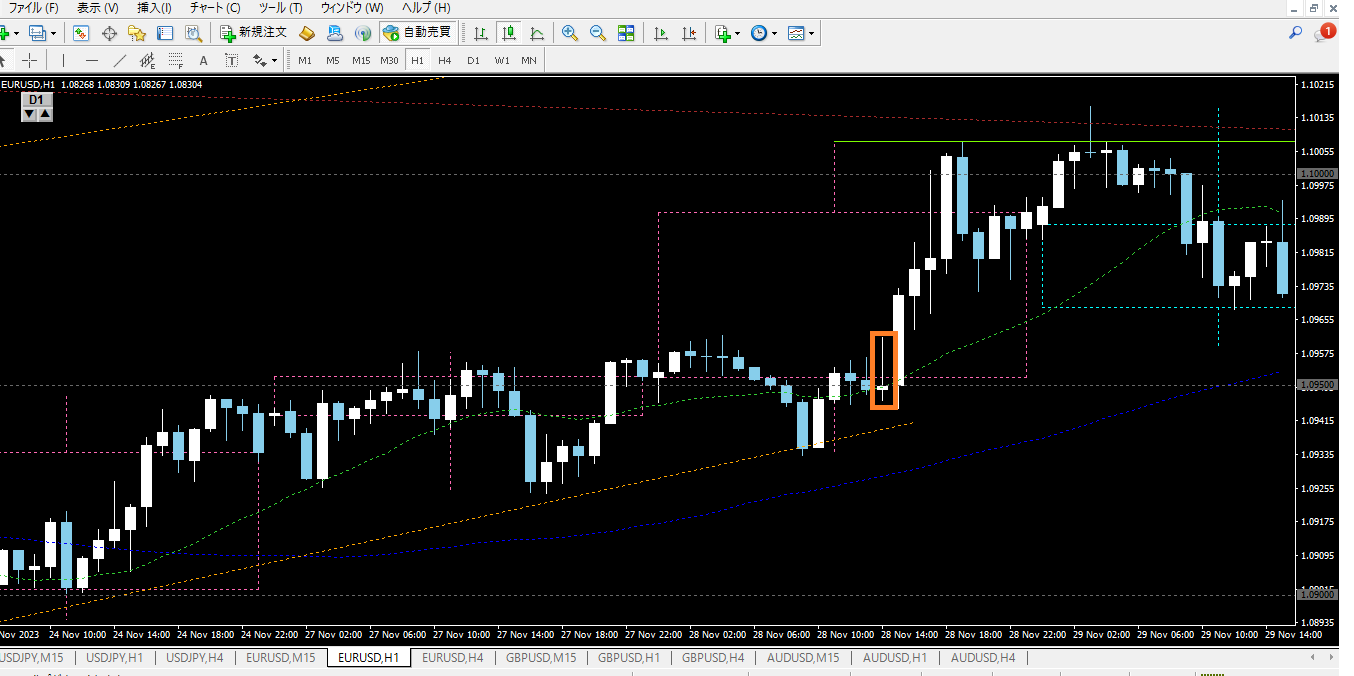

For example, here is a pin bar with an upper wick on the EUR/USD 1-hour chart. If you had entered a sell position based on this alone, you would have faced the opposite outcome and been caught in an uptrend with a stop-out.

On longer timeframes, like the 1-hour chart rather than 5-minute or 1-minute, pin bars feel more compelling as entry reasons, but false signals happen too, so

“Pin bar = immediate contrarian entry”

is dangerous.

So, specifically, when is a pin bar effective? It turns into a very solid entry method when it appears at a turning point, as a straightforward and intuitive principle.At a pivotal point, it becomes a highly effective entry method.

The most straightforward example within a “pivot point” is

“the previous day’s high/low.”

This is the most intuitive way to use pin bars effectively.

Day traders are obvious, but even scalpers pay attention to the previous day’s high and low.

When pin bars appear in these places, their credibility tends to rise.

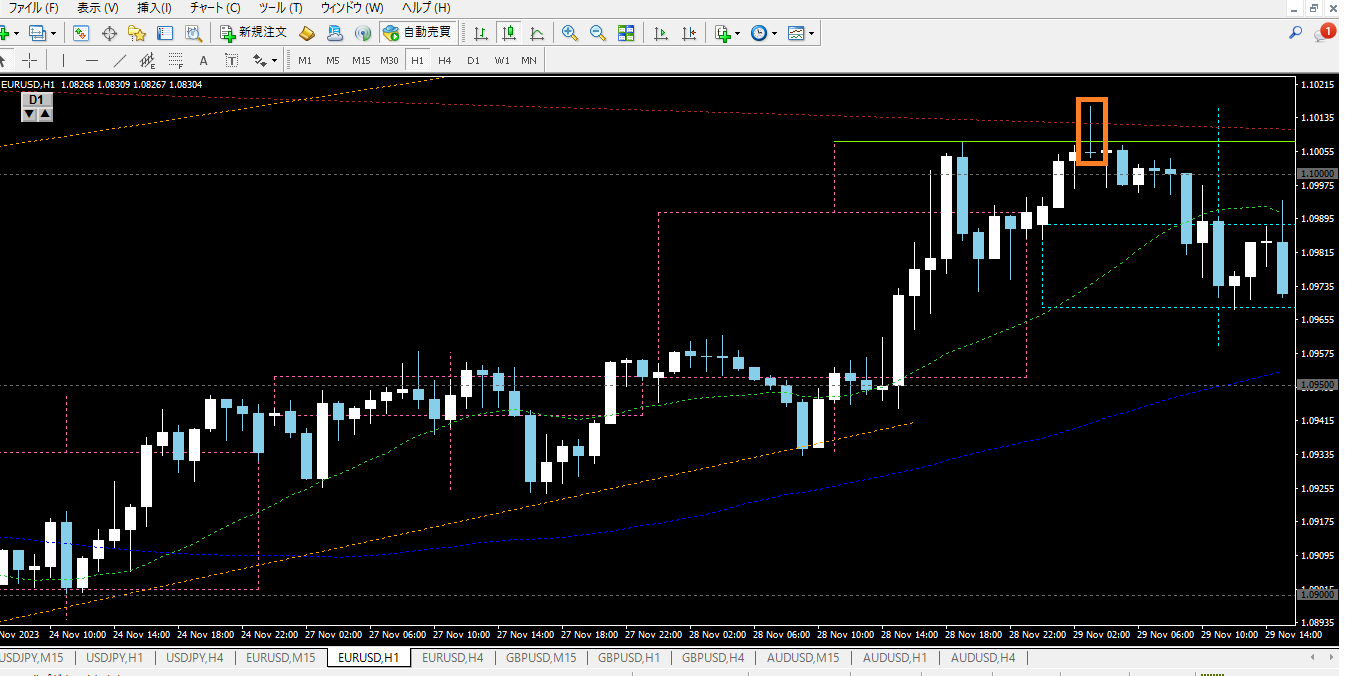

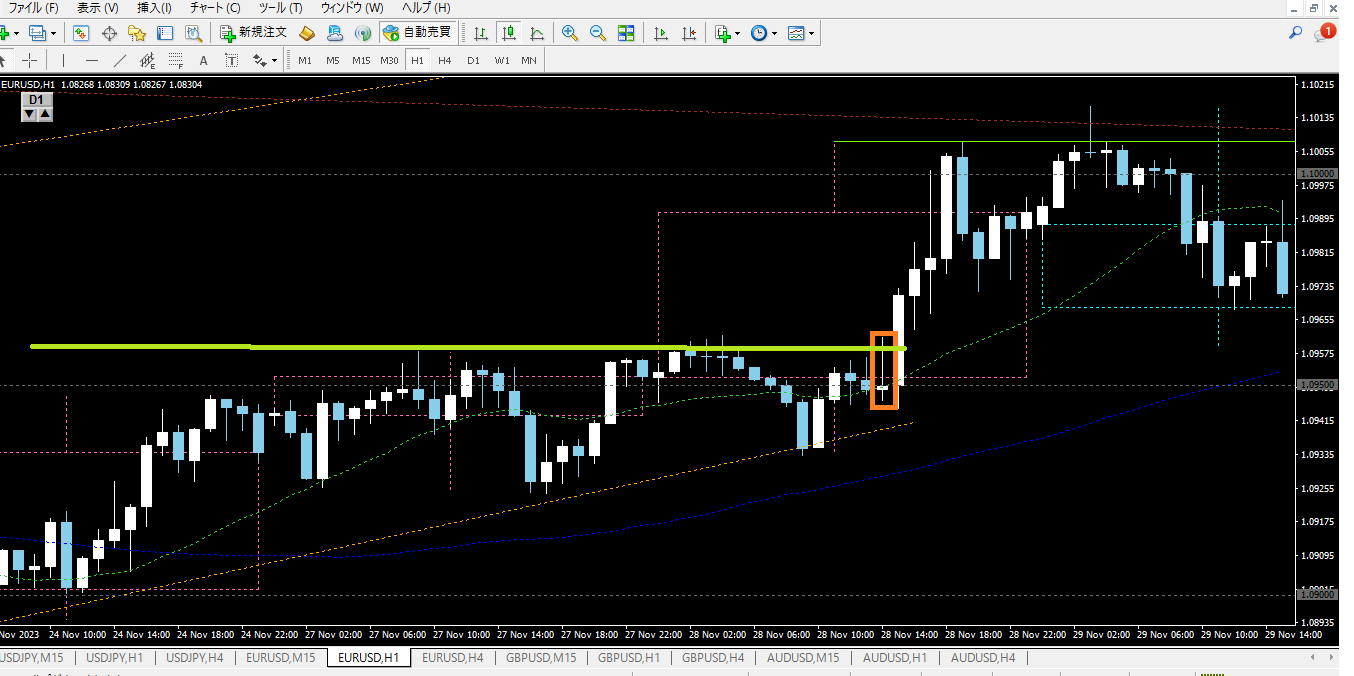

If you look again at the previous image, there is also another upper-wick pin bar that appeared and correctly captured the initial move of a reversal.

Compared to the earlier failure-to-reverse pin bar, the form of the pin bar itself isn’t drastically different, but the big difference here is

“it appears after briefly breaking above the previous day’s high.”

This is where the pin bar appears with an upper wick that fails to break above the prior high.

I display both the hourly chart and the daily candles simultaneously on the left; in this image, the pink dotted and the light blue dotted candles are the daily candles.

The horizontal line drawn from the high of the pink-dotted candle on the left is exactly the previous day’s high.

In other words, this pin bar is

“an upper-wick pin bar that attempted to break the previous day’s high but failed.”

Pin bars like this, which fail to break the pivot high, lose follow-through from buyers and trend downward, turning into a downtrend.

If you consider a concrete entry method,

1. Pin bar confirmed

2. Break the high/low of the pin bar in the following candle

Even this simple method can yield a reasonable win rate.

Conversely, the first pin bar introduced above is near the previous day’s low, but the breakout is weak and there are signs of attempted breakouts already, so the credibility of the level as a horizontal line is reduced. That is why the price action credibility is also lower.

Additionally, if multiple pivots coincide at a level, you can use pin bars to target precise entries.

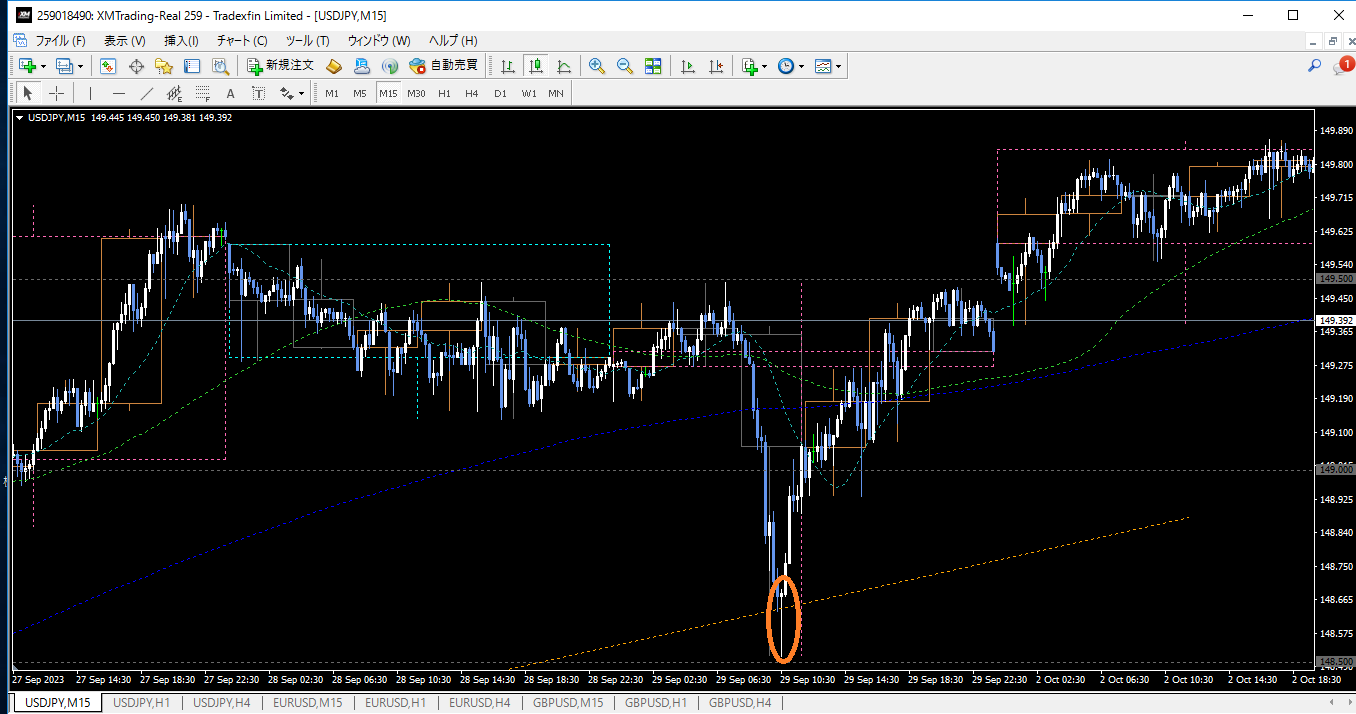

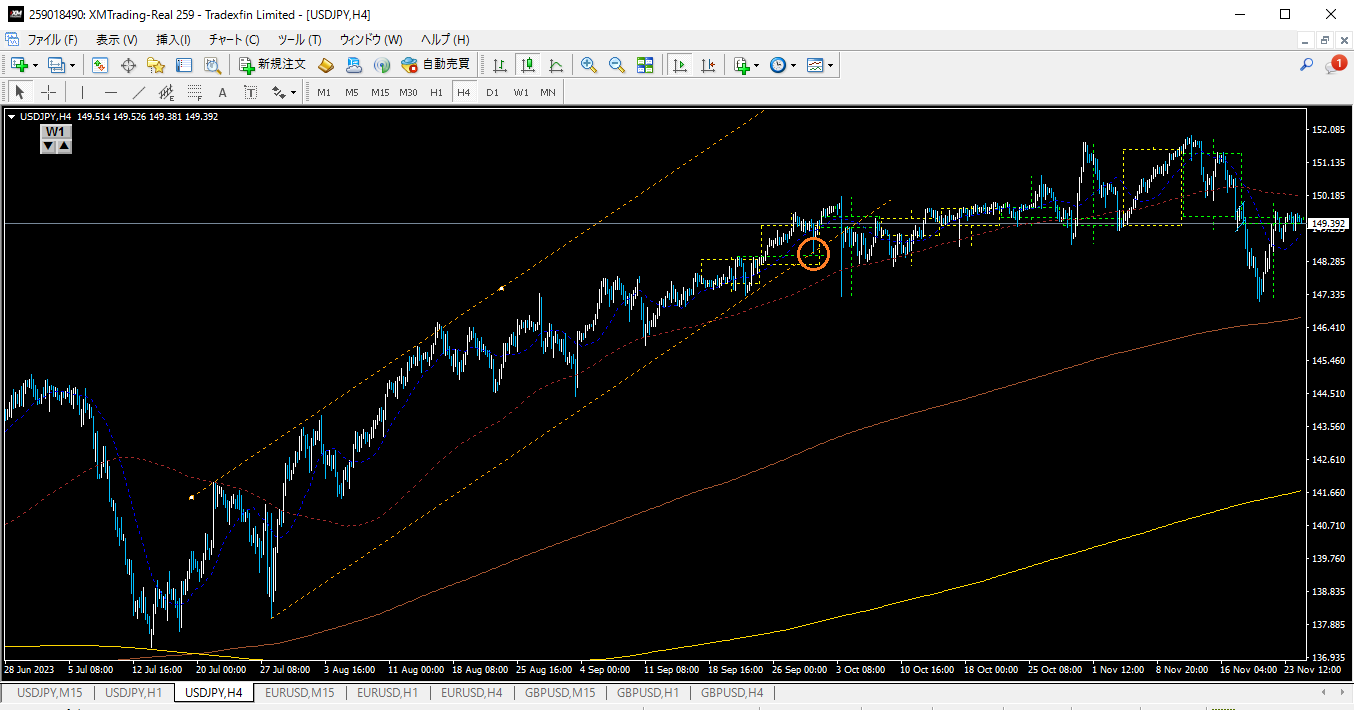

For example, in this 15-minute chart where a lower-wick pin bar appeared,

・Round-number at 148.50

・(as of this chart) previous week’s high

・lower boundary of the 4-hour channel

these several support candidates converge in one area.

At first glance, entering solely on a pin bar amid a sharp descent seems extremely risky, but by confirming the longer-term trend, you can execute targeted buy entries at these points.

This pin bar-basedcontrarian entry method is described in detail in a paid book.

https://www.gogojungle.co.jp/tools/ebooks/47500

This method targets rejection after a breakout false alarm by focusing on the gradient of the lines discussed above, aiming to profit from a rebound fueled by the stop losses of breakout-traders.

This is a simple method, but the win rate can be quite high.

Part of a paid book is published for free in an article, so please refer to it.