TNA_EA Lab Mastering the Use of Hedge Positions

What is Hedging (both sides)

Holding both a long and a short position

simultaneously position is called hedging.

“What does this even mean?”

you might think.

In FX, hedging is sometimes said to be meaningless.

There are even books that claim so.

However, depending on how you use it,

I believe it can be a very effective method.

If used correctly,it can be very effective.

I have said that it can be used in certain ways,

and first, selecting the trading instrument is important.

What I recommend is

for currency pairs,AUD/NZD

For CFDs, then“Gold”「XAUUSD」

The reason is that in both cases, the price is unlikely to move overwhelmingly in one direction,

and the price range is narrow, so you can trade within that range for a long time.

AUD/NZD because Australia and New Zealand

are both resource-rich countries geopolitically close,and are located nearly in the same place.

Also, with “Gold,” unlike currencies,

it has a finite resource andan absolutely universal value,so

it is unlikely to fall indefinitely.

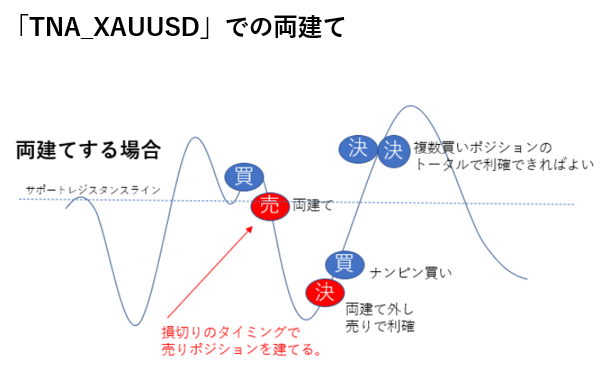

So, concretely,

consider the case where you hold a long position

and the price starts to fall.

What would happen?

A very common approach is

to take aloss cut(loss cut)loss cut

they tell you to do so.

If it continues to drop,

you wouldand lock in the loss,

and you would not be holding the position any longer,

in order to trade again,

you would need to find a new entry point to buy or sell.

Continuity of trades would be interrupted,

and unless you place the next entry, you wouldn’t make a profit.

If trading is a rhythm,

you can’t ride the rhythm.

On the other hand, instead of a loss cut,you do not cut the loss,

and keep the long position as is,and

while keeping the long position.

What difference would this make?

If you hold a short position without a loss cut,

the long position will incur further unrealized losses,

but the newly opened short position will gain unrealized profits equal to that amount.

The net of unrealized losses and gains

will keep the unrealized loss from the opposite side as it was at the moment you hedged.

This is used in hedging.

From this hedged state, after a while, when one side starts to show unrealized profit,

Then, only the position on the non-profitable side remains,

and you would again be carrying unrealized losses,

but that is acceptable.

Againlose-cutentry point comes,

open a new opposite trade and

bring it back to hedging.

Alternatively, from a state where only the non-profitable side remains,

you could reverse

and enter positions in the direction of the trend to profit,

by opening positions in the same direction as the profitable one when the trend appears.

This means you would hold a longer entry when you buy,

and a higher entry when you sell.

So-called averaging down (Nampin) positions.

The timing for closing a Nampin positiondepends on whether the trend when you opened the Nampin

If you determine that the Nampin position alone should take profit

or if you believe the trend will continue,

continue with the other positions,

then calculate the combined unrealized profits and losses to decide if total is positive.

If total is positive, you take profit.

Carrying out hedging means repeatedly applying the above logic

and continuing, so that at some point you become profitable without noticing.

In other words, instead of stopping out, by holding opposite positions you keep sowing seeds for future profit.

Thus, hedging is a method used withNampintogether.

The good thing about this method is that when using an EA that stops at a loss cut,

you may end up trapped in a range andlose money due to losseswhereas with hedging you can

continue to accumulate unrealized gains while holding losses.

If you must cut losses,cutting losses locks in the loss,

and would not further increase losses,

but that's all there is to it.

However,instead of cutting losses,

if you hedge, you can continue the trade,

potentially yielding large profits.

The discretion when hedging is difficult to decide, but

if you systematize it with an EA,you can rely on the EA to handle it,

making it a very compatible method for turning into an EA-based logic.

Turning this method into a logic and wrapping it into an EA is

the original in-house developed

OriginalXAUUSD”EA named“TNA_.