TNA_EA Lab Do not make predictions!!

Do Not Make Predictions

Whether in stocks or FX or other investment trading,

keep in mind not to make predictions.

Among them, in FX, when tied to probability,

even beginners

can trade without predicting

in a practical and easy-to-follow framework,

making it suitable for those

who are trading for the first time.

What happens if you do predict?

Let's think about it.

① For the asset you invest in,

you predict whether the price will rise or fall.

② If you predict the direction and it rises, you buy; if it falls, you sell.

③ Since you made a prediction,

it is natural to seek the result.

If it goes as predicted,

you cry out, "Hooray!!"

If it doesn't,

you think, "Oh well, that's disappointing!!

I'll just try again."

This is what tends to happen.

What do you think about the steps ①②③?

"It's not normal! What's wrong?"

you may wonder.

Actually, when I first started trading,

I was like that. At the beginning,

this seemed normal, and this looked likegambling to me

without realizing it.

In Japan, there is little investment education,

so when people hear that you are trading stocks or FX,

they may think you are not seriously working,

or you are addicted to gambling.

This happens because both traders and non-traders

tend to think that trading in investments is about

the above ①②③,

and thus it has become a widely held belief.

From now on, we aim to reverse this

Do not predict = Do not gamble.

Do Not Gamble

So how can you avoid gambling?

The answer is: simply do not make predictions.

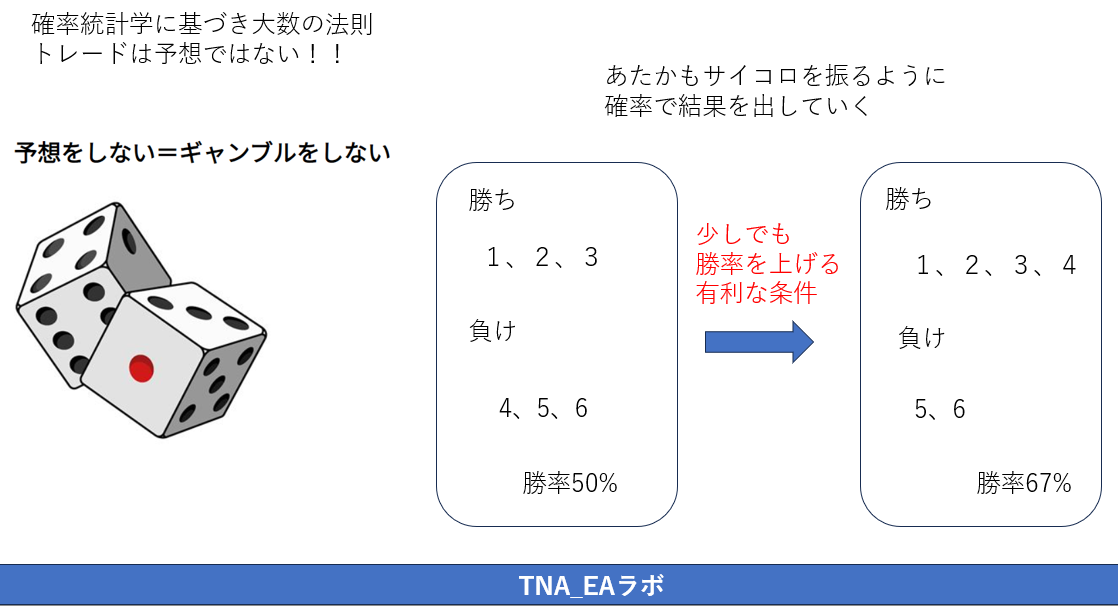

For example, imagine a dice.

Roll the dice;

if 1, 2, or 3 comes up, you win; if 4, 5, or 6 comes up, you lose.

Who predicts in advance what the next roll will be?

I think no one.

Because most people know that with a die,

each number has a fair chance of coming up,

and eventually any number will appear.

In other words, even without knowing the probability theory

statistics, a child can understand that concept.

With a dice, since 1, 2, 3 give a win and 4, 5, 6 give a loss, the probability is 50%.

After repeating several times, you might see 1,2,3 appear more often,

or 4,5,6 appear more often.

But do not stop there; continue calmly for hundreds of trials.

Then, ultimately, wins and losses will tend toward 50%.

This is called the law of large numbers.

If you repeat calmly and consistently, you will get results consistent with probability.

In short,

this is what it means to not make predictions.

This does not lead to gambling, does it?

In actual investing,

to win, you may need rules such that 1,2,3,4 win and 5,6 lose,

and to have even a slightly higher probability of winning,

you would adopt trading methods with higher win probability,

but in investment trading,

what we should aim for is this approach.

Win by Probability

Probability Statistics

To not predict, what should one do?

As answered in the previous section,

instead of predictions,probability statistics should be linked to the study.

The method is simple.

1) Decide trading rules. (entry rules and exit rules)

2) Trade according to those rules and test how many wins and losses you would have.

3) Apply the law of large numbers and trade calmly according to the rules, as if rolling a dice.

2) shows that the win rate tested then becomes the probability, and you achieve results corresponding to that probability.

However, a bit tricky is that

1) How should you decide the trading rules?

2) Has the testing period been sufficiently validated?

Even with a good win rate,

if the risk-reward is poor,

you won't get results, so

what is the risk-reward of that rule?

Once both ① and ② are cleared, you worry whether you can

continue trading exactly according to the rules in ③.

But don't worry.

There is a strong ally by your side.

That is automated trading using an EA.

An EA is a programmed automated software,

so the logic it is programmed with is the rule itself.

And,

it excels at trading calmly, strictly according to the rules.

Also,

during the development process, backtesting is performed using past data,

so you can roughly know the win rate.

At TNA_EA Lab, we recommend an original EA built on probability statistics concepts

Thank you for your attention.