TNA_EA Lab: The idea of making spreadsheets your ally

Table of Contents

① What is a Spread

② Characteristics of the Spread

③ The idea of making the spread your ally

④ Original Indicator “Spread Visibility-Kun”

What is the Spread

It is the difference between the buy rate and the sell rate

that exists at all times.

In other words,

the buy rate is greater than the sell rate

in magnitude.

Therefore, at the moment you buy,

and at the moment you sell, anyone would

inevitably incur a spread-related unrealized loss.

This cannot be avoided,

and it may be considered as a fee.

Moreover, in highly volatile markets,

the width of the spread widens.

About this spread,

how do you view it?

① Troublesome

② Annoying

③ If only the spread were fixed at a constant

then that would be nice

and so on

Spread Characteristics

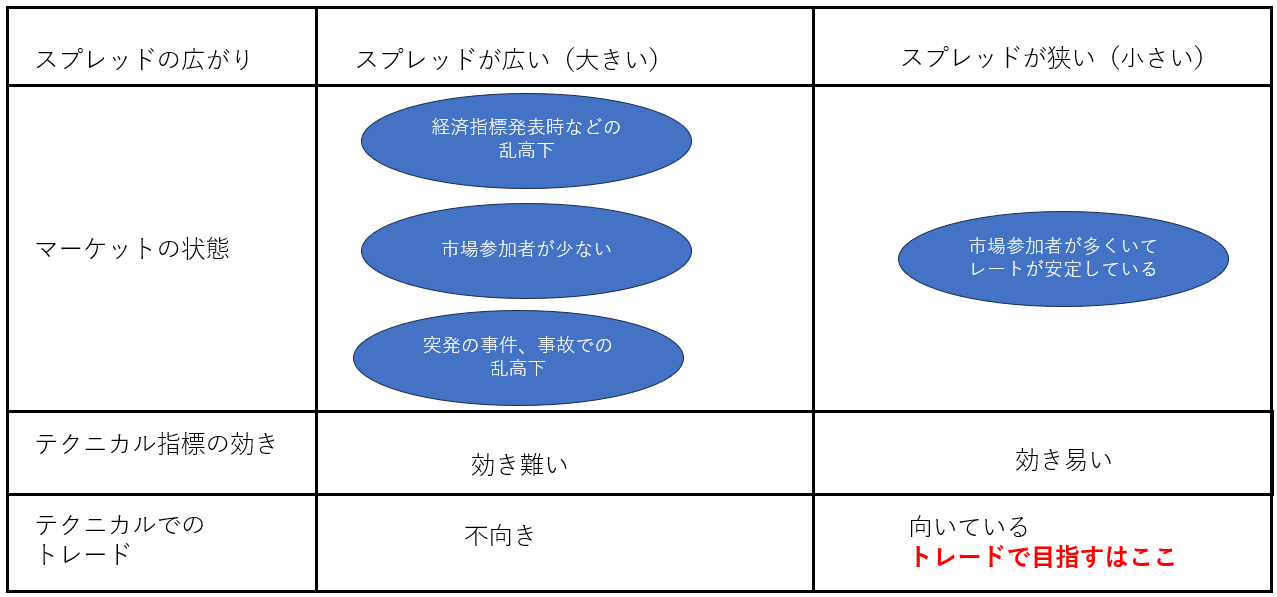

A table summarizing the spread movements is as follows.

As shown below, during the release of employment data, when it swings wildly,

the spread widens tremendously.

Additionally, before 9:00 Japan time,

there are fewer market participants

and the spread tends to be wide.

Trades based on technical indicators

are fundamentally based on probability, so

they do not respond well to sudden irregularities

or markets with small populations.

Therefore,

on the contrary, consider using the spread as an indicator

to guide your decisions.

The spread itself serves as an indicator of whether the market

is stable and whether technical indicators work

or not.

If you seek trading efficiency,you should incorporate the spread as an indicator

into your strategy.

The Idea of Making the Spread Your Ally

was shaped into an EA

Original Self-Made EA「TNA_XAUUSD」.

Also, as a standalone indicator,

Original Indicator “Spread Visibility-Kun”is provided.

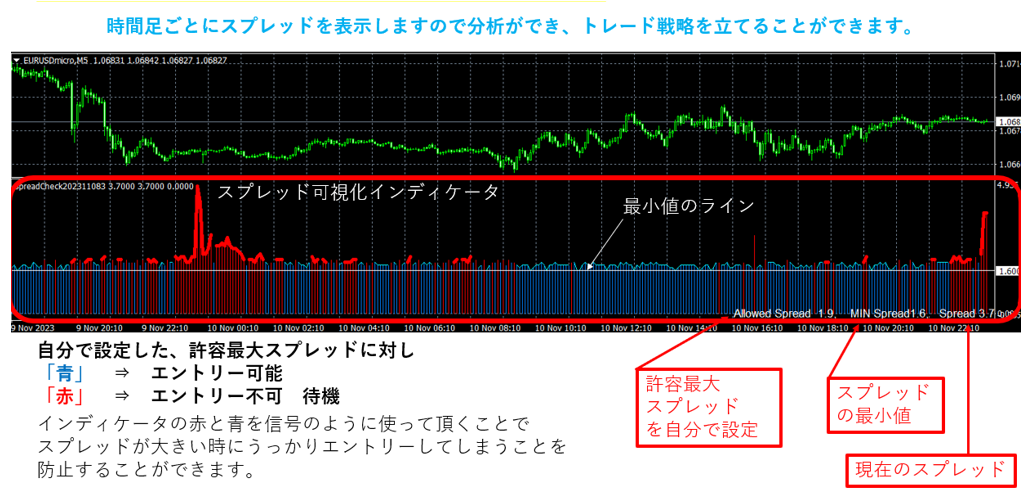

Original Indicator “Spread Visibility-Kun”

For the trading target, displays the size of the spread over time on a histogram in a sub-chart.

It also records the minimum spread.

With this indicator,

you can visualize the spread trend,

and by selecting trading times with stable, small spreads,

you can trade in a time frame that naturally has a higher likelihood of effective technical indicators.

The original indicator “Spread Visibility-Kun” can be introduced here.