+【10/23~24 BTCUSD Bitcoin】(17)(BTC trading mindset)

About trading BTCUSD Bitcoin on 10/23-24, I will summarize from entry to settlement.

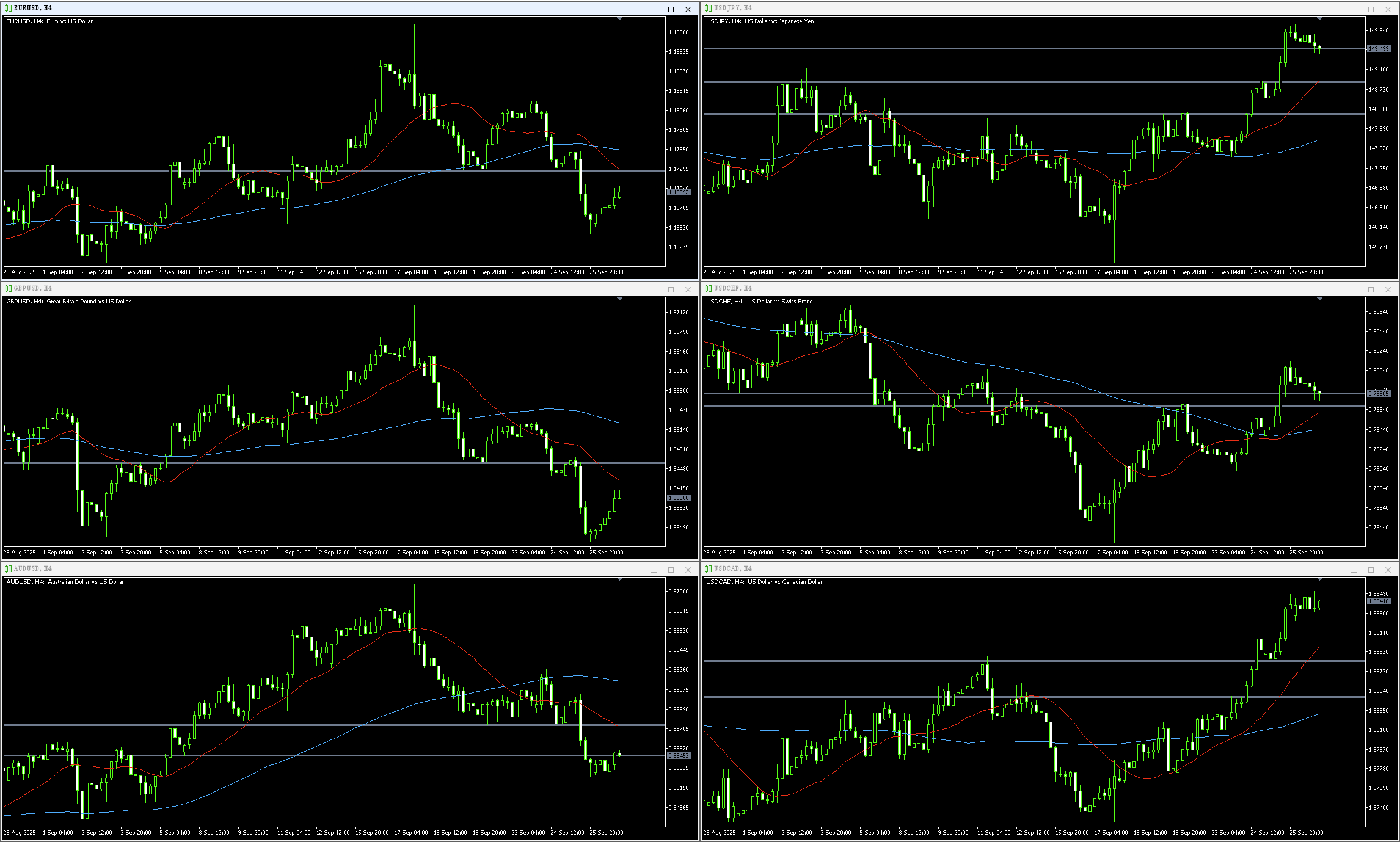

From this time, I started taking screenshots for BTC as well, so I will mix BTC occasionally with the forex focus.

—

First, as a premise, I hold BTC by accumulating long-term physical ownership and diversify it across three hard wallets without selling.

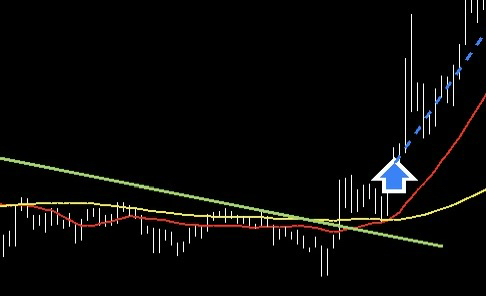

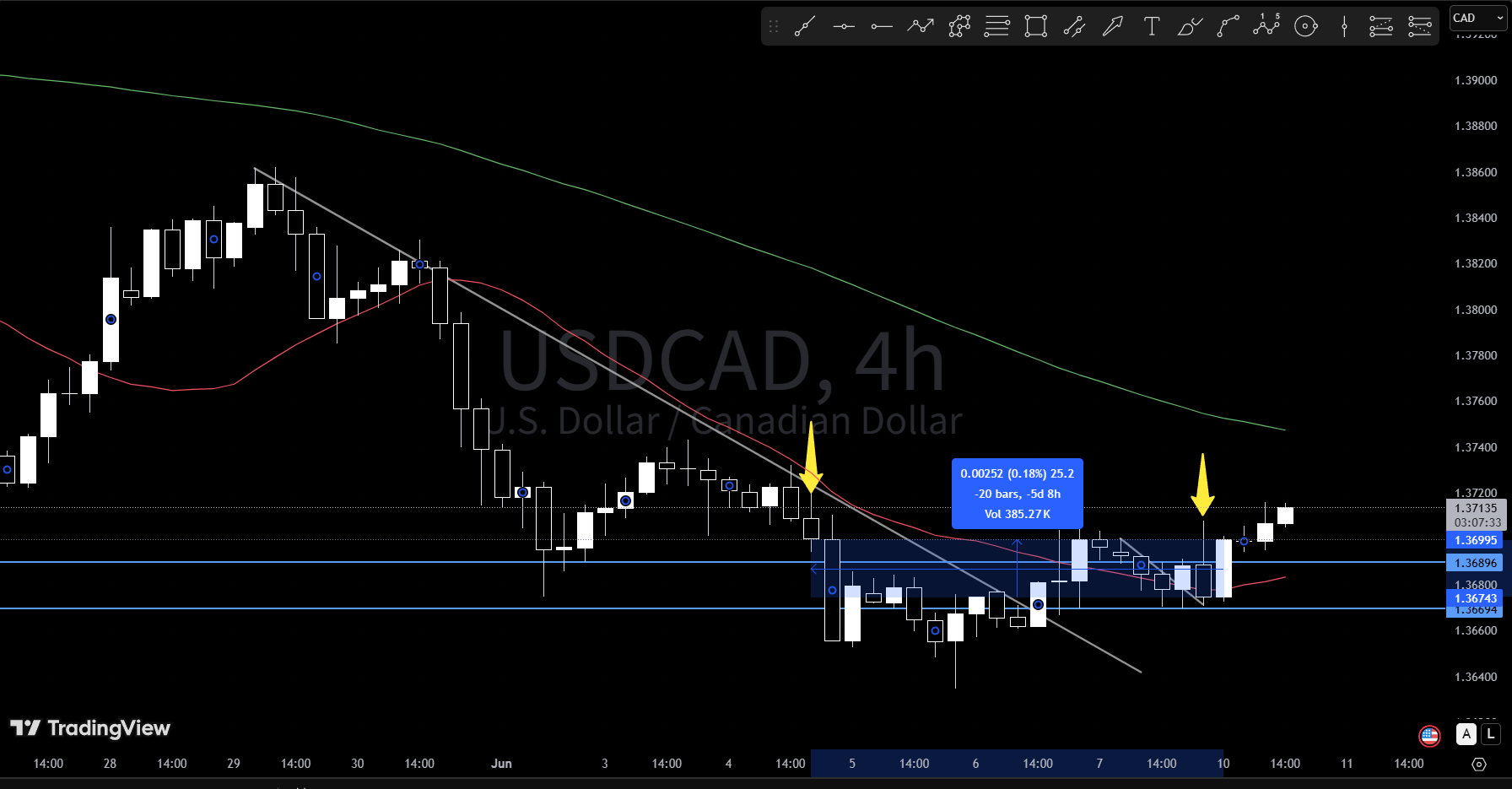

Among those, the area of concentrated orders can be treated with the same idea as forex, so if there is a chance, I will trade with a stance of holding for a few days when it grows from day trading like forex.

Since charts exist and people all over the world trade, there are concentrated areas where prices move significantly: where many people cut losses, settle positions, or buy new positions. If the condition is highly advantageous, I will enter.

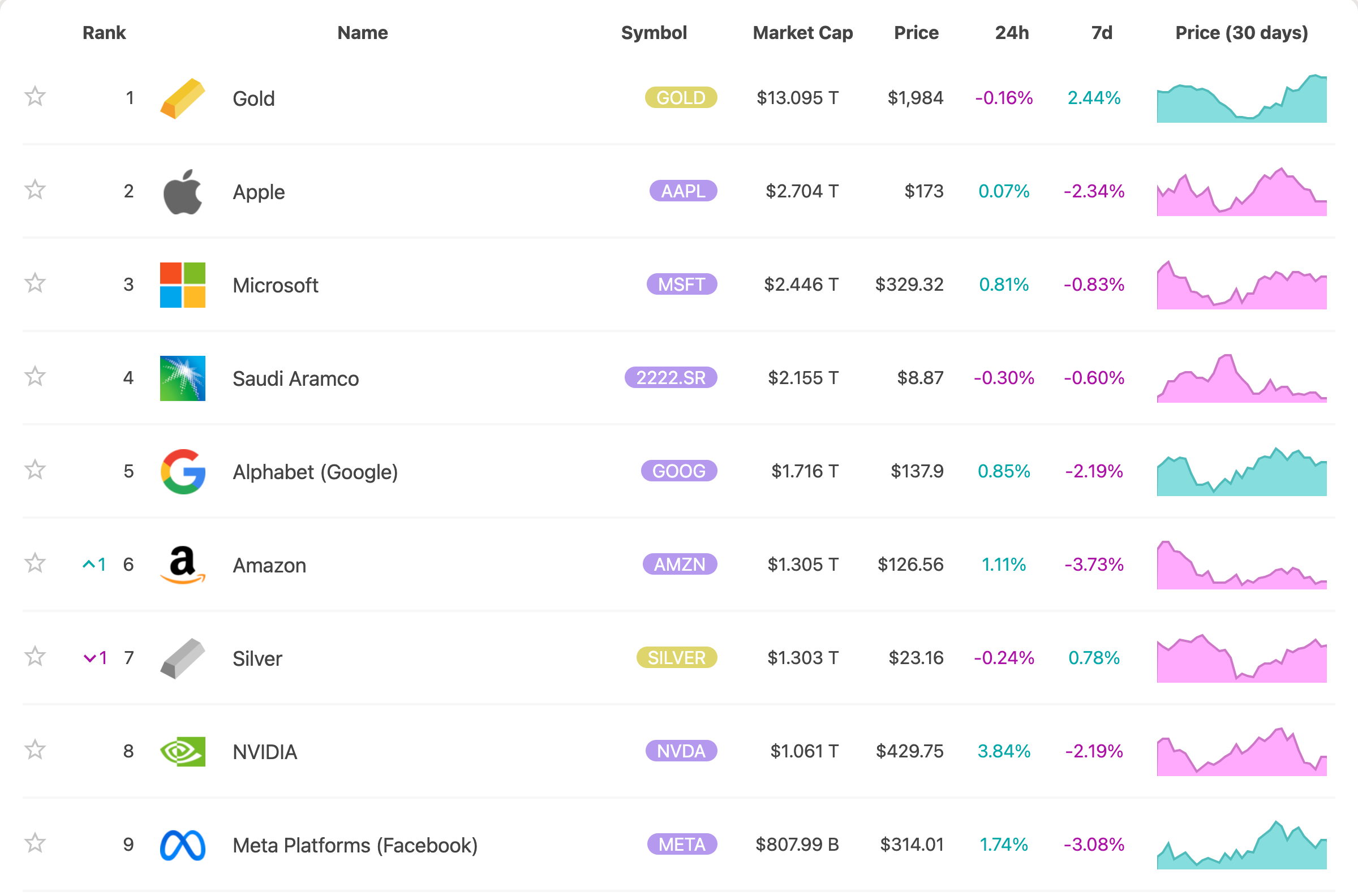

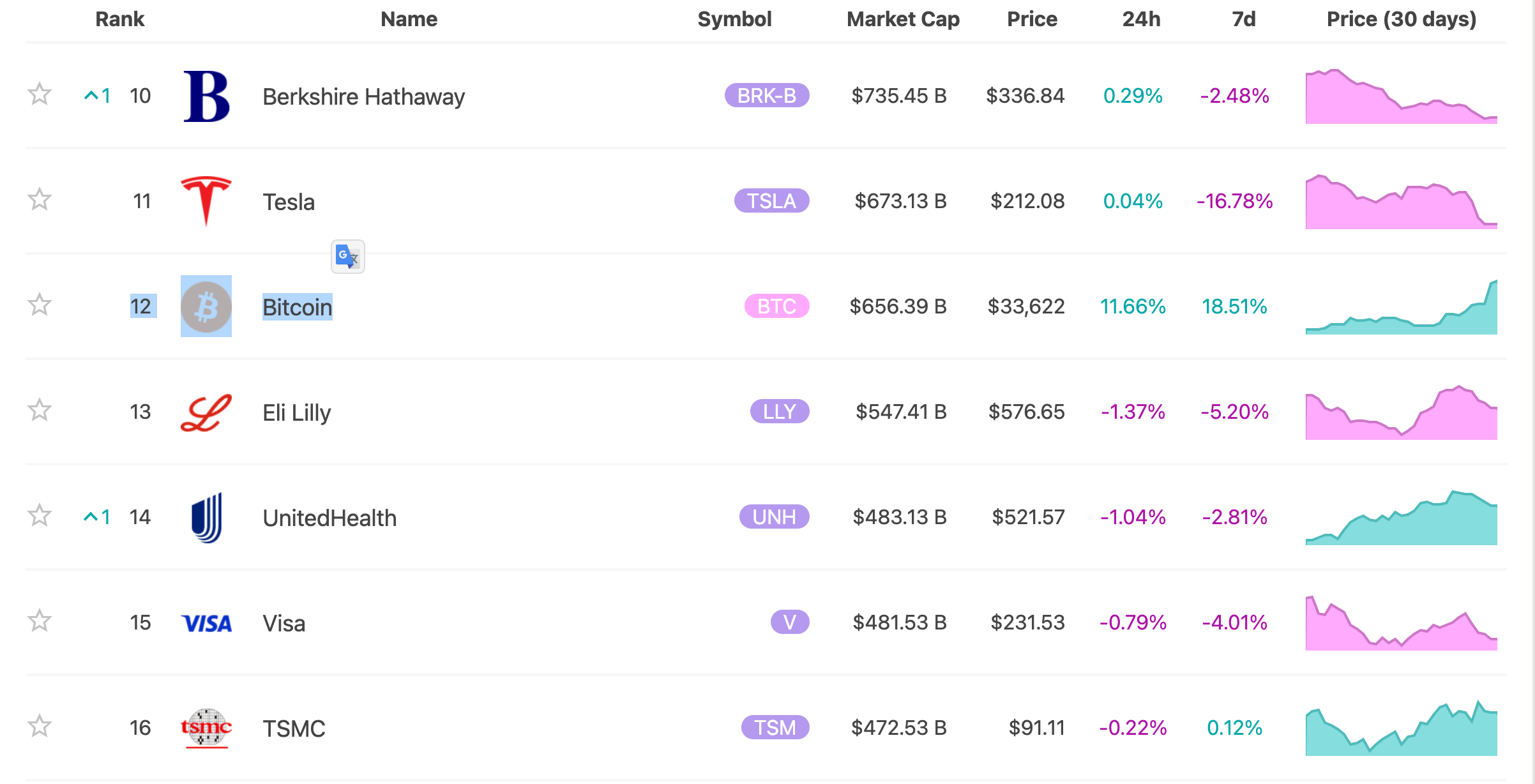

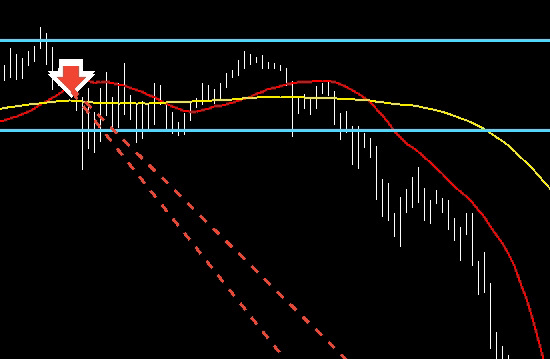

The trading target is mainly BTCUSD, the dollar-denominated Bitcoin, and not altcoins. As of 2023/10/24, BTC’s market capitalization is large enough to be comparable to US stocks like $TSLA (Tesla), so the technicals on the chart and the concentration of orders are somewhat trustworthy. (See image 2, 12th position below)

With a small market capitalization and low volume, obviously few people watch, so chart-based technicals are less effective and order concentration is also low, so I rarely trade altcoins. When I hold, it is in physical form.

—

Now, let's review from the entry point.

October 23 (Mon): Long entry on BTC.

The stop-loss line is,