Caution is needed with free emails from investment advisers

Be careful with emails or LINE messages that claim to recommend stocks for free from investment advisers.

I have a case where someone asked me for advice, so I’ll share it.

An investor’s acquaintance joined a LINE group where a certain investment adviser teaches stock picks for free.

Once you join that group, they say you can learn very legitimate content through live streams and the like.

They teach the basics of candlesticks and technical indicators, so it seemed reassuring.

And the very reason they joined the group was, unsurprisingly, that they were drawn by the offer of free stock recommendations.

In the investment advisory business, staff are not supposed to buy the recommended stocks themselves.

Therefore, the adviser in question did not buy those stocks.

There is a higher likelihood that the customers who were told first have already bought them.

Naturally, these are paying customers.

To digress a little, for example, major matchmaking or marriage services

have been reporting that they share customer information between connected companies.

From the perspective of everyone, can you say confidently that two different investment advisers that look like separate companies

have no connections?

If both sides have many customers,

sooner or later a group among the higher-ups will know exactly “which stock is planned to be bought at what price.”

Customers interact with a free consulting investment advisory firm individually, but

investment advisers deal with dozens of customers.

Such free emails may say, “If we make money, please pay us a reward,” or

“If you buy, please tell us,” in exchange for nothing in return.

If that includes an intention to manipulate the stock price of pre-embedded stocks, it may be delivered only as a whisper on timelines or emails.

Not everyone operates that way, but it’s common that you can’t get good results from a free tier.

Otherwise, there should be a different purpose such as books or schools for attracting customers.

I asked about that stock and analyzed it, and

it was this kind of stock.

Its performance isn’t bad and there are dividends, but

it’s already risen to some extent and seems to be hovering at a high price region.

By the way, in that group LINE they were calling it a recommended value stock.

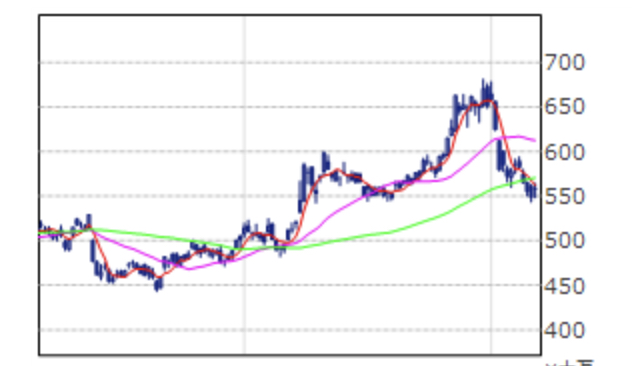

Here is the daily chart for that stock.

They were told to buy at 550 yen, sell at 680 yen,

and cut losses if it falls to 510 yen.

It’s clearly range-bound at a high price level.

Since it previously rebounded at 590 yen and then dropped, there is a possibility it could rise that far, but holding for the long term would require courage.

Until a little while ago, 490 yen was the support line, so there is a real possibility it could fall that far.

On the daily chart, if it rebounds and heads upward at 550 yen, theoretically it has touched the 550 yen support zone...

But that is a support line formed by a high-price consolidation.

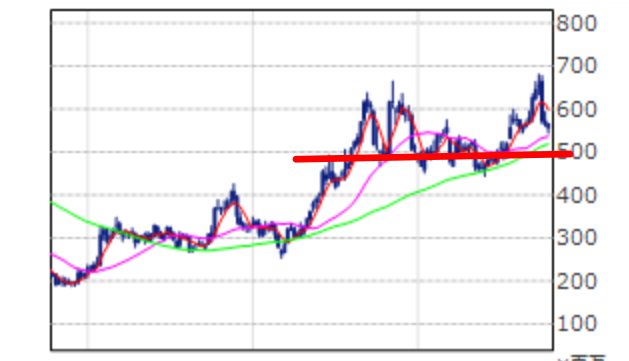

On the weekly chart, there is a support line around 490 yen.

If you buy around 550 yen, you may end up trapped in a high-price situation and become a victim of the loss.

Since the stock’s recent high was 680 yen, those who couldn’t cut losses and held through a sour market may panic-sell, potentially bringing it back to 490 yen.

Support and resistance lines

are one of the types of technical analysis used to identify entry points.

Of course, decisions on longer timeframes as described above tend to reflect stronger trends.

It’s hard to go against the long-term trend.

There is truth and falsehood mixed in free stock recommendations via email.

Develop your own judgment and defend against it.