10/12 Nikkei 225 daily chart 5-minute interval reflection【Japan Stock Trading Essentials】

How to Find Free Public Entry Points

Here are the basic methods for stock trading

Here are paid-grade trading techniques

How to aim for rapid gains with maniac stocks that move as a manipulated stock group

We deliver techniques, market conditions, and fundamentals

This is a newsletter that will surely be useful.

Japanese Stock Trading Essentials

Title: 10/12 Recalling the Nikkei 225 Daily Chart 5-Minute Chart [Japanese Stock Trading Essentials]

Source: Amigo Investment School

This article is protected by copyright; the content copyright belongs to the author.

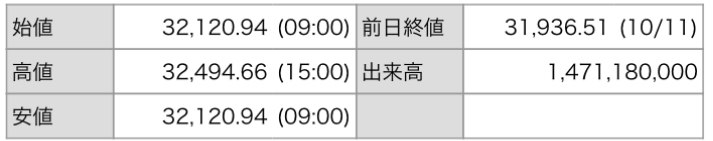

On this page we will discuss the theme of recalling the Nikkei 225 daily chart on 10/12 using a 5-minute chart.

To access more information and subscribe at a discount, regular subscriptions are recommended.

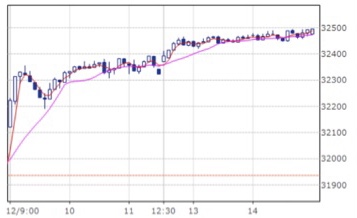

We will review the day's movement of the Nikkei 225 using a 5-minute chart.

In the morning session, two large bullish candles started with strong bodies.

About 15 minutes into the morning session, a candle with a long lower shadow and a small body, called a 'colorful' (catered) candle, appeared.

When two large bullish candles (bullish candles with long bodies) appear, followed by a bullish candle with a small body and a long lower shadow, this can be interpreted as a signal for a counter-trend.

In other words, if the price is in an uptrend, this pattern suggests that the price may reverse and fall.

Subsequently, a bearish candle appeared as suggested by that long-lower-shadow bullish candle, and the price declined.