Dragonflies, crosses, and Toba candlesticks explained【Japanese stock trading essence】

How to Find Free Public Entry Points

The basics of stock trading are here

Paid-grade trading techniques are here

How to aiming for sharp rises with an obscure stock that performs like a penny stock

Delivering techniques, market conditions, and fundamentals

A newsletter that will surely be useful.

Japanese Stock Trading Essentials

Title: Explaining Doji, Cross, and Tombstone Candlestick Patterns【Japanese Stock Trading Essentials】

Source: Amigo Investment School

This article's content is copyrighted by the author and protected under copyright law.

This page discusses the candlestick patterns

Doji, Cross, and Tombstone patterns

To access more information and subscribe affordably, regular subscriptions are recommended.

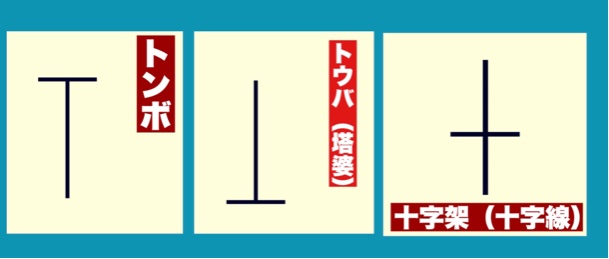

Below are images of candlestick patterns.

Here, three candlestick patterns are explained.

We will look at the three types: Tombstone, Tombstone-like, and Cross shapes.

The tombstone candlestick is one of the candlestick patterns that shows a specific shape on price charts.

The Tombstone shape is characterized as follows:

- There is a long upper shadow (bearish) or a long lower shadow (bullish), with the body (the solid part) being very small.

- The tombstone shape suggests a potential market reversal point.

- For example, a tombstone with a long bullish candle at the top can indicate a shift from selling to buying.

The tombstone pattern should be considered not in isolation but in relation to neighboring candles and preceding/following market conditions.

There are cases where a high likelihood of a trend reversal exists, but also temporary fluctuations, so it is important to make trading decisions by combining with other technical analyses.

The detailed assessment method is described below.