Over 40% annual return with 1,000 trades per year! 'Ozashiki Diamond'

Over 1000 trades per year!

Up to 3 positions open, roughly 1000 pips per year

'Ozashiki Diamond'

(

【Ozashiki Diamond Overview】

Currency pair: [USD/JPY]

Trading style: [Scalping]

Maximum number of positions: 3

Timeframe used: M5

Maximum stop loss: 0; Others: auto-settlement. Adjustable

Take profit: 0; Others: auto-settlement

Forward testing is still short, so it is slightly negative, but

what is its potential?

Let’s explore it through backtests

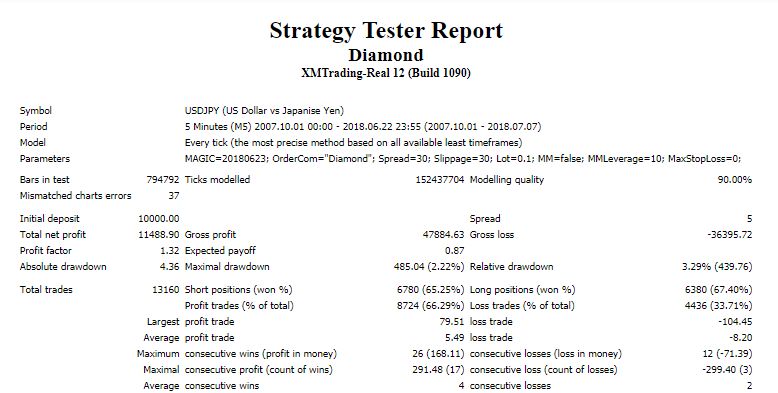

■ Backtest Analysis

Over about 12 years of backtesting

Fixed 0.1 lot

Spread 0.5

Total trades: 13,160 (over 1,000 per year)

Maximum drawdown: $485

Net profit: +$11,488

Average gain per trade: 5.4 pips

Average loss per trade: -8.2 pips

Win rate: 66%

This is the result.

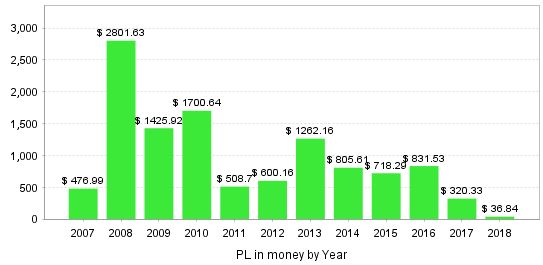

【Monthly Profit and Loss】

August seems a little weak, but there are no years with a negative annual performance.

【Annual Profit and Loss】

For 2007, data runs from October onward; in 2018, data goes up to July.

The most profitable year overall was 2008.

It seems that more volatile markets tend to yield higher profits.

There are over 1,000 trades per year, and the average annual gain per 0.1 lot over the past 10 years is $1,097,

and the average annual gain in the most recent 5 years is $787.

Since you can hold up to 3 positions,

the recommended margin per 0.1 lot is

(4.5*3) + (4.5*2) = 22.5

0.1 lot can be operated with roughly ¥225,000.

In that case, the average annual return in backtests over the past 5 years is 35%

Over the past 10 years, 48%.

◆ Advantages of Stop Loss at 0 (logic-based exit)

Some may worry that stop loss is set to 0.

If the stop loss is tight, spreads widen during rollover or Monday opening gaps, often hitting the stop loss.

It's commonly called stop hunting.

Therefore, to avoid stop hunting, some EAs deliberately set the stop loss to be a logic-based exit.

If you're worried about not having a stop loss...

you can set it via parameters, so based on past backtests, setting it between 100 pips and 150 pips should be

be fine in case something happens.

In practice,the maximum stop loss for a logic-based exit is about 100 pips.

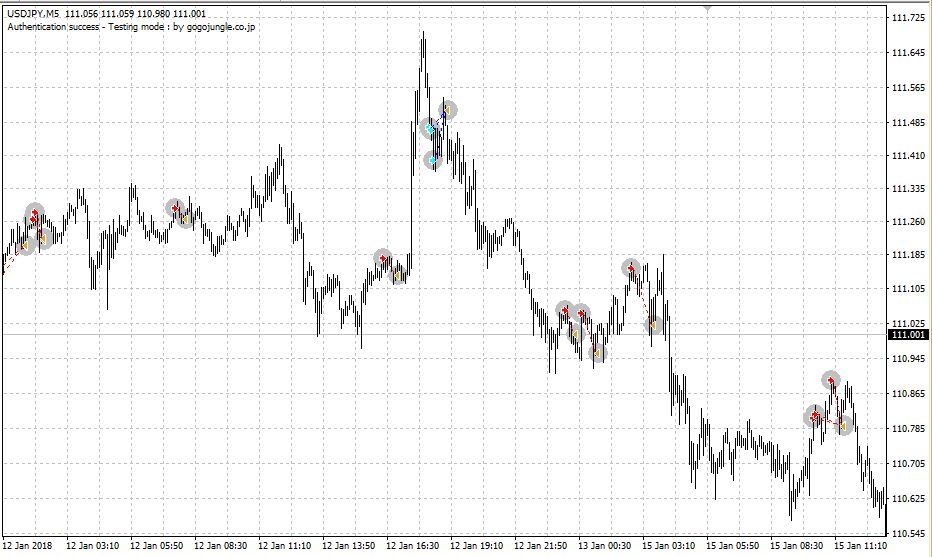

■ Trading Example

Red: SELL

Light blue: BUY

Basically, it is trend-following,

short on rising prices and long on falling prices, holding up to 3 positions simultaneously

Selling on new lows and buying on new highs makes it close to discretionary trading, a trade you can watch with confidence.

With an average gain of about 5 pips, accounts with tighter spreads have an advantage.

Recommended for those who prefer an EA with a high trading frequency!