The use of "Visualization Indicators" (Part 105)

“Visualization Indicator” usage (part105)

1. Advance and develop the “28 Currency Pair List Indicator” into an indicator

“8CPVisualization Indicator”to drawAUDJPY.

There are versions of the “8CPVisualization Indicator”: Oceania version, version, version, version. This time, I used the Oceania version.

The top half is the AUDJPY 15-minute chart. The bottom half is from the “8CPVisualization Indicator.” The green thick line graph corresponds toAUDJPY.

On Thursday, AUDJPY fell sharply, so I entered a sell. When the chart bottomed and reversed, I closed the position.About250 pips of profitwas obtained.

2. Best SelectTry the indicator

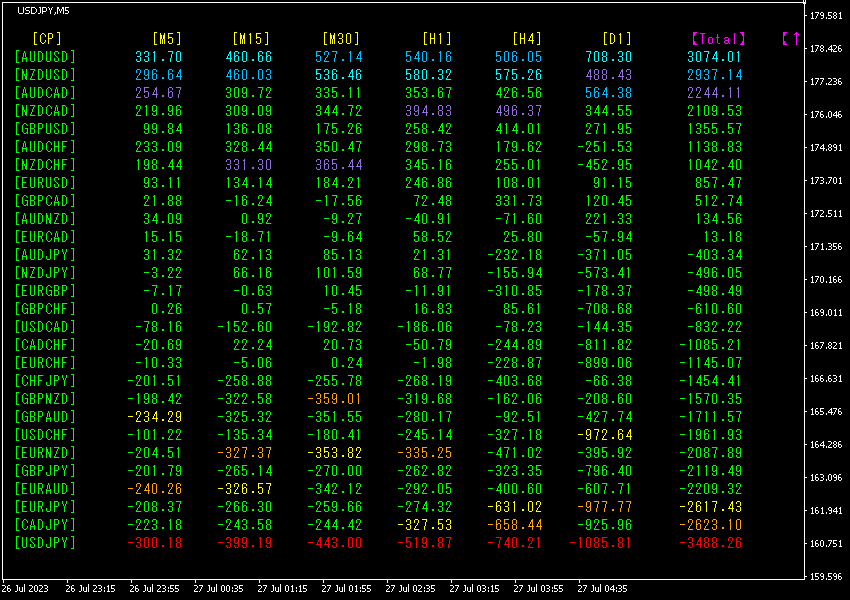

The figure below shows a screenshot taken onJuly27,2023 at 11:09()

is red for all timeframes, and the total value is-3488.26, a large negative number. This indicates a strong downtrend in USDJPY.

The red arrows mark the point where the screenshot was taken. It is in the middle of a downtrend with a descending right shoulder. The rate then retraced upward, but the next day it fell further.

“28 Currency Pairs Best Select Indicator” can easily identify which currency among 28 pairs is showing the strongest trend. It also tells you whether to trade now with numbers and colors. It’s a superior indicator for judging all currency pairs at a glance.

“28 Currency Pairs Best Select Indicator”

https://www.gogojungle.co.jp/tools/indicators/35128

3. Since May of the year before last, how has EURJPY moved?

SinceMay has been tracked.

To view the overall trend, I’ve drawn roughly the past 3 weeks on a 30-minute chart.

Last time I wrote the following:

EUR is above, moving upward, is downward, so EURJPY is expected to rise, but it has reached near the recent high, so it may stall.

Then the head was pressed down, and a sharp drop followed.

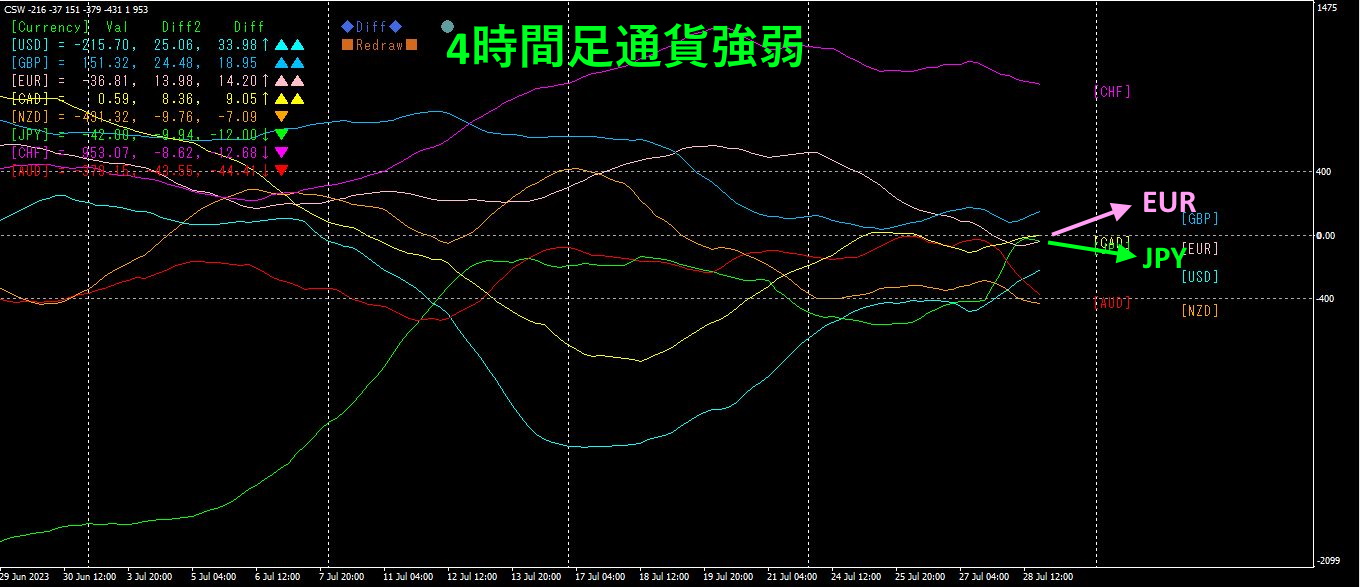

4Timeframe currency strength chart.

Pink isEUR, green isJPY. is above, so EURJPY is expected to rise.

4. Seek a bottom across all currency pairs and devise a trend strategy (target:USDCHF).

2505“Market Bottom SearchIndicator” is used to identify the next target currency pair,USDCHF

chart—let’s take a look.

is in the “bottom reversal” phase, so, as in steps ①–③, draw a descending line and enter a buy when it breaks above. The trading becomes very simple. Right now, I am long after breaking above the ③ descending line and waiting for a break below the ④ rising line. There is a profit of on the position.

“Trend Line EX” is finally ready to play a key role. By drawing a diagonal down-sloping line with “Trend Line EX,” it automatically buys when broken and automatically closes when the rising line is broken—an automatic, hands-off trading method. If you don’t yet own “Trend Line EX,” please consider purchasing.”

※“Trend Line EX

https://www.gogojungle.co.jp/tools/indicators/42257

For those interested in the “8C Currency Strength Visualization Indicator,” please refer to the page below.

version https://www.gogojungle.co.jp/tools/indicators/39150

version https://www.gogojungle.co.jp/tools/indicators/39159

【My products on sale】