What is the latest tax-saving method using cryptocurrency mining?

Instead of buying cryptocurrency with your own money

a mechanism where you automatically receive cryptocurrency

official endorsement from the Ministry of Economy, Trade and Industry

a new investment method recognized by the government: "Mining Investment"

Surprisingly "quiet" mining machines (Note: the sound you hear is from another noise in the room.)

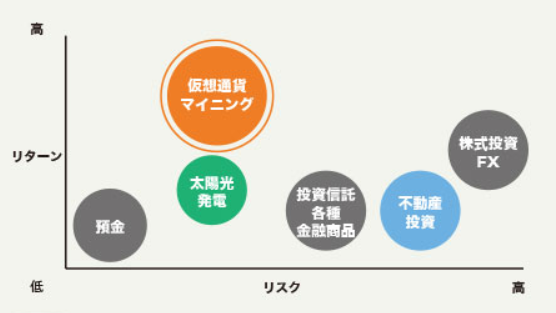

When you hear about virtual currencies, many people may feel uneasy.Even though many are aware of Bitcoin price drops and exchange hacks

However, "

cryptocurrency trading" and"cryptocurrency mining"are completely different investment methods.

ExampleIf you start with trading cryptocurrencies, you face the risk of a crypto price crash.

However, if you start with cryptocurrency mining, you can reliably obtain cryptocurrency every day, every hour.

You can hold mined cryptocurrency as is or cash it out immediately, either way is possible.

In short, a hybrid investment including cryptocurrency trading becomes possible, so

mining investmentis actually a very solid and reliable investment method.

Unlike physical cryptocurrency investments, you can treat the mining machines themselves as capital expenditure,mining machines

and deduct them as expenses since they are capital investments.

Furthermore, by outsourcing the operating costs of mining machines, outsourcing expenses can also be deductible,

making tax deductions effective,tax savingsas well.

Therefore, whether individuals or corporations, more and more people are applying to reduce profits in the current term for this reason.

One of the reasons why cryptocurrency mining is an excellent investment method is

the "Special Taxation for Strengthening Management of Small and Medium Enterprises" allowing100% immediate depreciationto be used.

The Ministry of Economy, Trade and Industry has prepared the special tax system as part of tax incentives to improve profits for small and medium enterprises.

The Small and Medium Enterprise Management Strengthening Tax Incentive is a system that allows special depreciation (immediate depreciation) up to the acquisition amount for small and medium enterprises that have obtained certification for their management improvement plan.

Annual 100% immediate depreciation or tax credit can be chosen (until March 31, 2019), and individuals can also use it.

- ※ Corporate capital or contributed capital of 1 hundred million yen or less

- ※ Individuals with 1,000 or fewer regularly employed employees

- ※ There are limits on the period during which depreciation is allowed

- ※ Individual customers can also use it

For example, a corporation with a profit of 50 million yen that makes a 51.8 million yen equipment investment can

depreciate 100% immediately, reducing the corporate tax payable from 17.5 million yen to

0 yen in the first year through depreciation!If depreciation exceeds the limit, it can be carried forward to the next business year.

Will you quietly pay taxes?

Or will you invest in equipment?

You cannot purchase cryptocurrency with expenses to obtain cryptocurrency, but

you can purchase mining machines with expenses to obtain cryptocurrency.

In other words, this is a magical product that allows you to invest in cryptocurrency through expenses.

That is the same meaning as above.

Compared to directly purchasing cryptocurrency, it may take some time to acquire cryptocurrency.

However, considering investment risk, it is more certain to purchase mining machines.

This benefit is very large, and everyone who fits the criteria is purchasing mining machines.

Even if you mine cryptocurrency, there is a possibility that profits may not meet expectations due to market conditions,

but there is a good chance of doubling or tripling your returns.

Given the growth of the cryptocurrency market, there is no reason not to invest.

Currently, mining machine parts are in short supply worldwide.

It is likely that supply will become even more constrained in the future.

If you wait until the market starts rising to buy mining machines, it may already be too late.

|How to choose mining machines suitable for cryptocurrency mining

Since last year, the cryptocurrency market has overheated and major companies (SBI, DMM, GMO, etc.) have entered the mining business one after another,

but aside from the big players, what kind of machines should individuals or small companies buy for mining?

Currently, mining machines can be broadly divided into three types.

First, ASIC and graphics cards (GPU). GPU-based mining is primarily divided into two manufacturers: AMD RX series and NVIDIA GTX series, each with its own characteristics.

There are distinct features for each.

1. ASIC

ASIC refers to an integrated circuit custom-made for mining.

The leading mining company Bitmain developed equipment specialized for mining Bitcoin for its own large-scale mining farms, and models such as Antminer L3+ and S9 have circulated on the market. In response, GMO released the new mining products Miner B2, B3, which are also of this type.

The advantage of ASIC is that it can mine very effectively, but there are many drawbacks.

• The initial profitability is so high that it becomes highly sought after domestically, but

ASICs are generally developed by Bitmain, used in-house, and only released to the market when no longer needed,

so although initial profitability is high, once many people obtain and operate them, profitability drops rapidly.

• They can only mine Bitcoin (BTC), so if that currency falls, mining becomes unprofitable.

(At the current BTC price of 900,000 yen or less for break-even, most cases are unprofitable due to electricity costs.)

※GMO Miner B3 profitability simulation →goo.gl/wfDQjo

• High power consumption.

• Large exhaust heat (hot air).

• Loud operating noise (roaring).

• When Bitcoin can no longer be mined, you cannot switch to other currencies, so resale value is virtually nonexistent.

Therefore, you should avoid using anything other than your own development for external use.

GPU

GPU stands for a processor that handles calculations necessary to render 3D graphics in place of the CPU,

commonly called graphic boards (graphics cards).

Mostly used for PC gaming, but versatile and applicable to mining as well.

2. AMD RX series GPUs

RX470, RX570, RX Vega, etc. from AMD.

Not ideal for gaming, but good for video playback, with low power consumption and heat, making mining efficient, which has attracted attention from miners.

A drawback is that while they can mine Ethereum, their mining performance for other algorithms/cryptocurrencies is low, so if Ethereum ASICs are developed, they could be severely affected.

3. NVIDIA GTX series GPUs

GeForce GTX 1060, 1070, 1080, etc., popular in 3D PC gaming.

They have mining performance for various currencies with different algorithms, high versatility, and high resale value.

They mine many different currencies, but the mined coins can be consolidated into Bitcoin (BTC) when acquired.

Even at current Bitcoin (BTC) price declines, they generate stable profits.

※Our machine profitability simulation →goo.gl/qTLkA7

In short, mining investment may not have explosive short-term gains, but it is the lowest-risk option.

Since it is a long-term investment, prioritizing stability over explosive short-term gains is natural.

If a non-major company actually mines at home or in their own facility, considering the number of cryptocurrencies they can support, mining efficiency, power efficiency, price, resale value, and other factors,

currently the most suitable for mining is mining machines that use GTX-series graphics boards.

The machines in the video above are of this third GTX-series GPU type.

When considering mining machines, please pay close attention to this aspect.

Cryptocurrency mining machines