6/15 Range Hunter Results

Good morning.

This is Cylist Trader.

Last week, FOMC and ECB were in the spotlight.

The postponement of ECB rate hikes was somewhat surprising.

Currently, a trade war with the United States is underway.

China is also imposing retaliatory tariffs.

The euro is taking a similar stance.

As a result, I do not think it will hurt the U.S. economy,

stock prices remain solid.

However, attracted by this, commodity prices are also declining.

Emerging market currencies and commodity currencies continue to fall.

Australia, Brazil, Turkey, etc..

Turkey implemented an emergency rate hike at the end of May to stop the lira from falling.

Furthermore, at this month's policy rate decision meeting, another 1.25% hike was announced.

In one month, about 10% in rate hikes were implemented.

Nevertheless, Turkey continues to be sold off.

The central bank's policy may be difficult.

Profits-taking and stop-loss for Turkish lira crosses are being squared off..

Emerging market currencies can drop at any time.

Japanese swap traders have held TRY/JPY for a long period,

but I consider this to be dangerous.

Recently, in Turkey's depreciation, about 20% of Japanese traders faced forced liquidations, I have heard.

Originally a risk-off mood, but since U.S. stocks did not collapse, people are holding.

If U.S. stock prices crumble, a risk-off trend may emerge.

This week's focus isECB Forum.

Last year, due to President Draghi's remarks,

the market shifted to tapering and euro-buying.

Additionally, Bank of England Governor Carney mentioned rate hikes at that session, pushing the pound higher.

Here is this year's ECB Forum schedule.

6/19

02:

17:30 Draghi, Executive Director de Ploury,

20:00, Lane, President of the Central Bank of Ireland (ECB president candidate)

6/20

22:30 Panel Discussion

Draghi (ECB) speaks,

These are the notable lecture schedules.

From these, there is a good chance of forming the next trend in the content of the lectures.

If a trend begins to form, it might be good to ride it.

15th Range Hunter results

+¥3,373

+$17.8

Cumulative results since June 2017

+\2,914,523

(3 accounts, total per position 0.07 Lot)

Cumulative results since April 2018

+$3205.17

(3 accounts, total per position 0.07 Lot)

Well then, please continue to take care of me today as well.

Well then, please continue to take care of me today as well.

Details are publicly posted daily with a history on the blog.

↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓

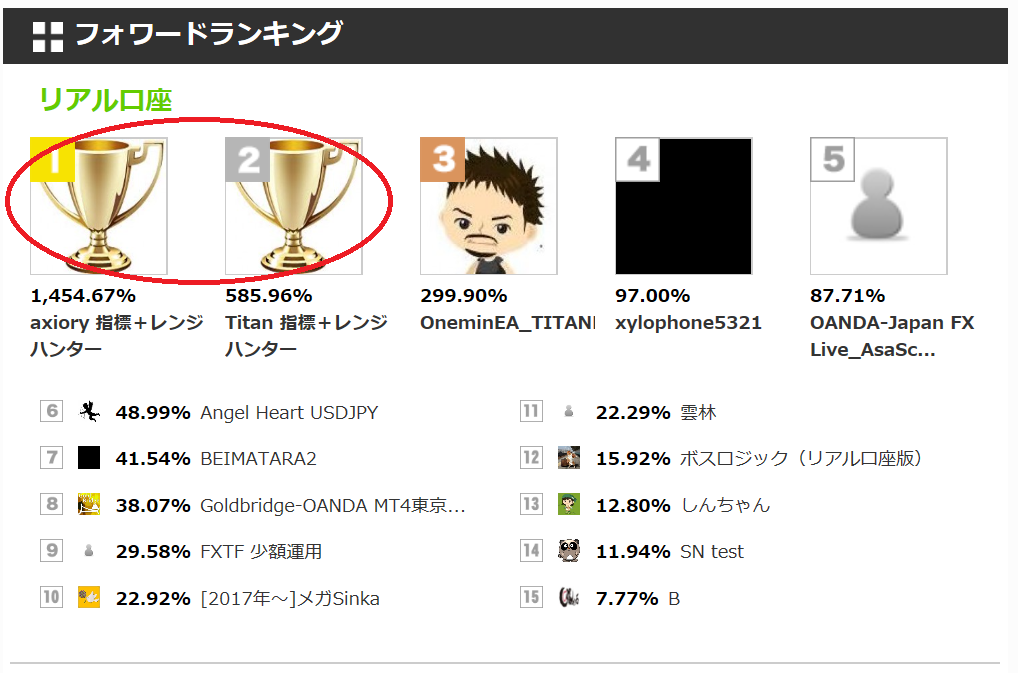

Everyone on GogoJyan's MT4

Indicators + Range Hunter

are published with history!!

↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓