Reviewing MultiLogicShot_EA

In our house as well, since its introduction, MultiLogicShot_EA has achieved excellent results; what is the secret behind its strength!?

I would like to try to reveal it.

MultiLogicShot_EA

First, from the official “About the EA,”

** ≫ Feature 1: High-win-rate, stable trading

MultiLogicShot_EA trades only during times when the win rate is high in the morning.

Also, it supports three currencies: USDJPY, EURUSD, GBPUSD.

Therefore, by diversifying across multiple currencies, earnings tend to be more stable, and

risk reduction is also achieved.

Note that the logic and parameters are not applied with the same settings to all currencies; they are

adjusted according to each currency’s price movement characteristics.

(The basic logic is common to all currencies, but parameters are altered considering each currency’s features.)

** ≫ Feature 2: Multiple settlement processes with different take-profit widths

For each single entry, three different settlement logic patterns are implemented.

By implementing multiple settlement logics,

● early settlement logic → aiming to secure minimum profit based on market conditions

while...

● late settlement logic → aiming for larger profits

We perform such trades.

--- Here ends the quote

I see—there’s a lot to cover just with this.

Now, let’s look at the backtest results.

In the official backtest, details are published only for USDJPY, so

I ran it here. The results may differ from the official ones,

I would appreciate your understanding.

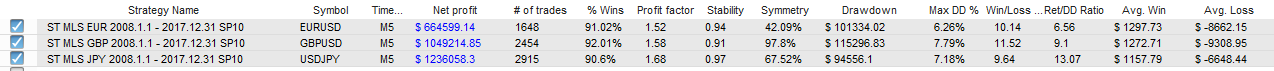

First is the backtest for three currency pairs.

All 0.1 Lot, spread 10, for 2008/01/01–2017/12/31, 10 years

GBP might be better with a slightly wider spread… but oh well

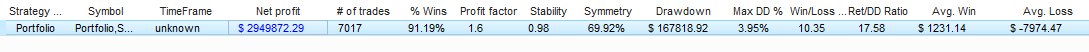

Summary for the three currency pairs comes out like this ↓↓↓

Across all currency pairs, the PF is above 1.5, and the DD is roughly around 100,000 yen;

Profit and number of trades, in order from largest to smallest, USDJPY > GBPUSD > EURUSD.

When combining the three, the total profit over 10 years is just under 3,000,000 yen, but

the maximum DD is contained at 167,818 yen, so a single EA provides a portfolio effect.

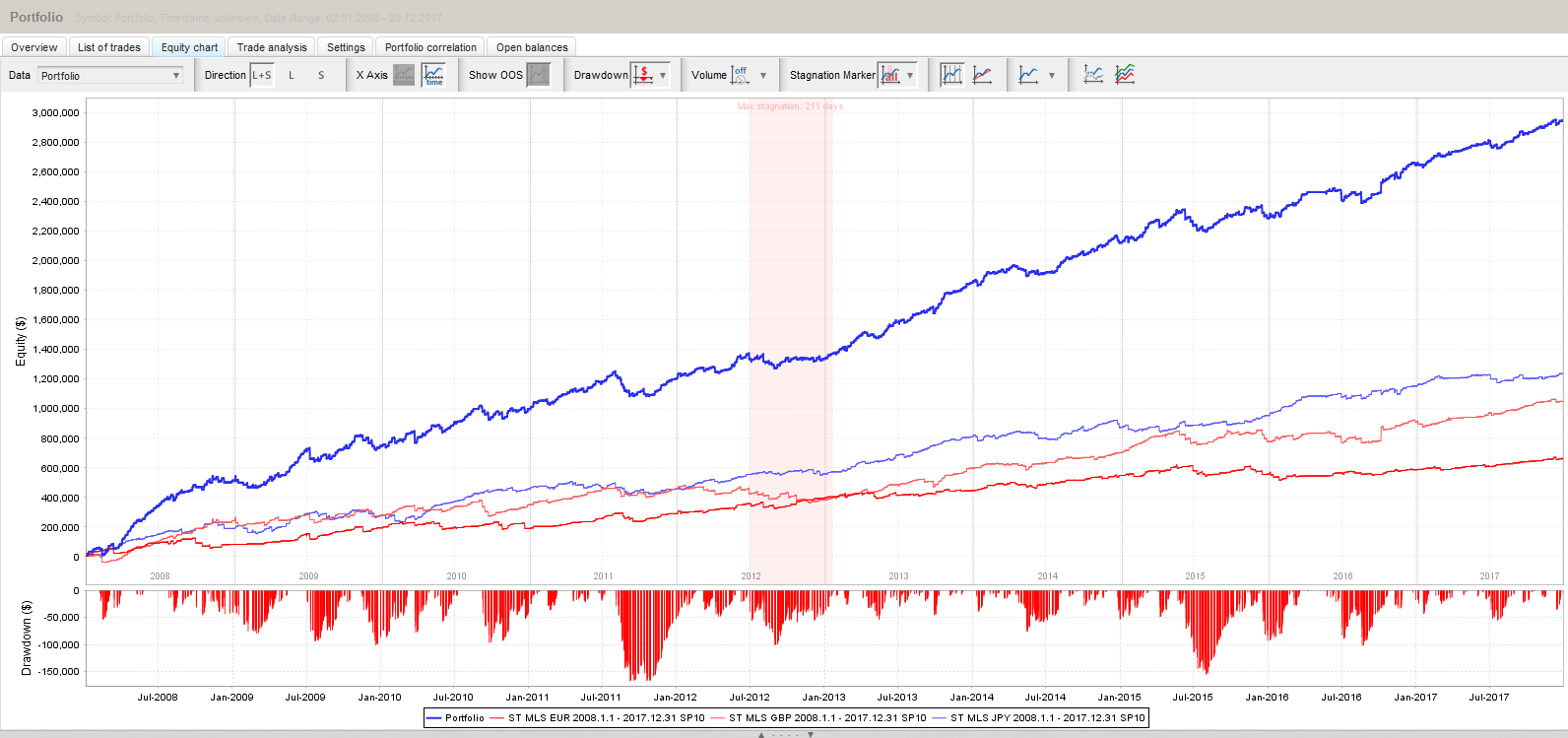

Next, let’s check the profit chart.

There were large drawdowns around autumn 2011 and summer 2015,

but it appears to have recovered within the same year.

Also, there’s a stagnation period from the second half of 2012 to early 2013 for about half a year, but

other than that, profits have consistently grown.

Monthly performance shows that across the year, profits rise every year.

From April to June 2014, there were three consecutive months of losses, but the losses aren’t very large, right?

Rather, the years with the largest DD were 2011 and 2015, in terms of amount,

and visually, the maximum DD chart is easier to understand.

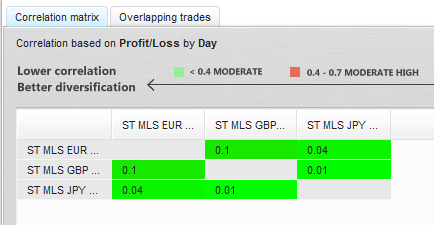

As a bonus, regarding correlations, since currency pairs differ,

the correlations are essentially zero. It is perfectly fine to run the three together.

In summary, from this investigation, the secret behind MultiLogicShot’s strength is!

*** A portfolio effect can be obtained with a single EA

*** The portfolio effect helps suppress the DD

*** The recovery after DD is typically around three months

I think that’s about right.

Now,On the other hand, is there any blind spot in MultiLogicShot?

From experiences so far,

*** It requires a large margin

As stated in the official features, since multiple settlement logics are implemented,

the initial entry is made with a lot size three times the set Lot.

Moreover, since it holds up to two positions, there are cases where a single currency pair is entered with six times the set Lot.

And since that would apply to three currency pairs, that’s eighteen times in total.

Specifically, if you set 0.1 Lot, it amounts to 1.8 Lots.

With domestic brokers, 0.1 Lot is about the limit.

*** After entry, it often hits stop-loss right away

This is not rare; it happens quite a bit.

And there are times when there are two positions, for example with 0.1 Lot settings,

0.3 Lot x 2 positions can SL-sell smoothly. Something like that.

However, the system is well designed, and most cases see losses cut off around 30 pips before SL hit.

Backtest results suggest consecutive losses of two occur in such cases.

*** The forward lots in the official forward test change

Well, this isn’t the EA’s fault, but Gogojan’s forward measurement seems unable to support partial closures, so the Lot at initial entry is shown as 0.3,

but in reality, only about 0.1 Lot is being settled in many cases.

So it’s a bit hard to calculate. If you use Myfxbook, this area is accurate, so

feel free to reference it on our account as well.

** Also various other points

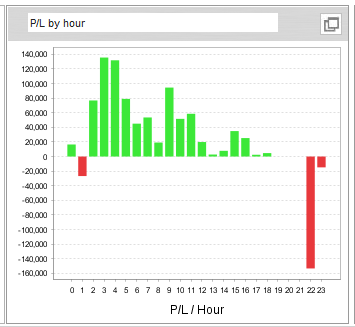

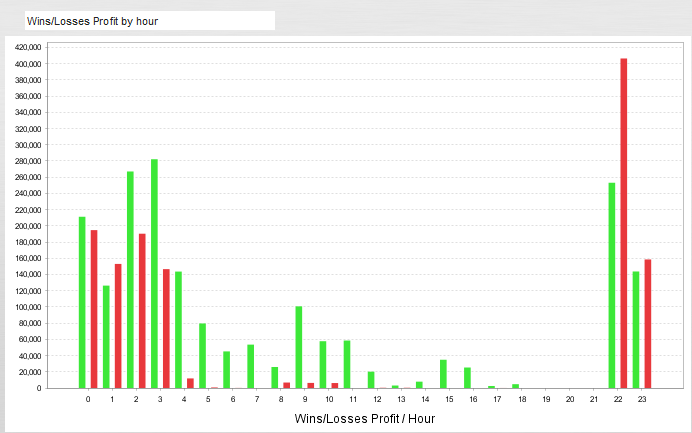

Looking at Quant Analyzer’s Trade analysis, and thinking, “Huh?” here ↓↓↓

In the EURUSD analysis, around 22:00 there seems to be unusually high losses.

This is a time-based profitability analysis, and losses appear here as well.

In such cases, one idea is to pause the EA only during this time window.

Currently, you cannot pause the EA for a specific time via its settings, but

it could be worth proposing to the developer.

On 2018/06/09 in the community, the developer announced the following upgrade.

Wonderful!

【Change log】

■ Support for changing entry time

Added a parameter to enable changing the entry time.

MultiLogicShot with excellent operational performance

We believe it will continue to perform well!