▶ What is the secret to increasing assets while saving taxes through cryptocurrency mining?

Rather than buying cryptocurrency with your own money

an “automatic cryptocurrency giveaway system”

Ministry of Economy, Trade and Industry endorsement

A new investment method approved by the government“Mining investment”

When you hear about cryptoyou might feel uneasy. In reality, however, many people feel the same way.

You may know that the drop in Bitcoin and unauthorized withdrawals from exchanges caused widespread headlines.

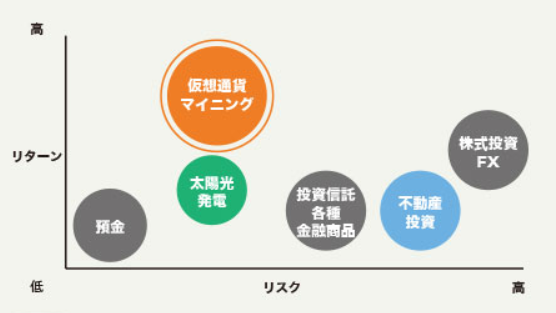

However, “crypto trading” and“cryptocurrency mining”are completely different investment methods.

ExampleIf you start with crypto trading, there is a risk of crypto price crashes.

However, if you start with cryptocurrency mining, you can reliably obtain cryptocurrencies daily and hourly.

You can hold the mined crypto as is, or cash out immediately—either is possible.

In other words, a hybrid investment that includes crypto trading becomes possible, so

mining investmentis actually a very solid and prudent investment method.

Unlike direct physical crypto investments, acquiring mining machines is a capital investment, allowing you to treat it as an expense for tax purposes.Mining machines

can be expensed under depreciation as operating costs by outsourcing the maintenance and operation costs.

Moreover, by outsourcing the operating costs of mining machines, outsourcing expenses can also be expensed,

making tax deductions very effective.

Therefore, whether an individual or a corporate entity, more people are applying because they want to reduce the current period’s profit to lower taxes.

One of the reasons mining cryptocurrency is an excellent investment method is that

the “Small and Medium Enterprise Management Tax System”allows100% immediate depreciationto be used.

The Ministry of Economy, Trade and Industry has prepared the Small and Medium Enterprise Management Tax System as part of tax incentives to improve profits for small businesses.

The Small and Medium Enterprise Management Tax System is a program that allows small and medium enterprises certified for business capability improvement plans to fully depreciate (immediate depreciation) up to the amount of the asset.

Either 100% immediate depreciation for the year or a tax credit can be selected (until March 31, 2019), and individuals can also use it.

- ※ Corporate capital or contributed capital of 1 billion yen or less

- ※ Individuals with 1,000 or fewer regular employees

- ※ There are limits on the period that depreciation can be recognized

- ※ Individual customers can also use it

For example, if a company with a profit of 50 million yen makes a 51.8 million yen equipment investment,

100% immediate depreciation is possible, meaning the corporate tax payable of 17.5 million yen would be

zero in the first year through depreciation!!.

If depreciation exceeds the limit, the excess can be carried forward to the next fiscal year.

Will you quietly pay taxes?

Or will you invest in equipment?

You cannot purchase cryptocurrencies with expenses to obtain cryptocurrency, but

you can purchase mining machines as expenses to acquire cryptocurrency.

In other words, you can invest in cryptocurrency through expenses—it's like magic.

That is the same meaning.

Compared with directly purchasing cryptocurrency, it may take a little longer to obtain crypto.

However, considering investment risk, buying mining machines is more reliable.

This benefit is huge, and those who apply are purchasing mining machines.

Even if you mine cryptocurrency, there is a possibility that market conditions prevent expected profits,

but there is plenty of potential for twofold or threefold gains.

Considering the growth of the cryptocurrency market, there is no reason not to invest.

Currently, mining machine parts are becoming difficult to obtain worldwide.

In the future, it is expected that parts will become even harder to obtain.

When the market starts to rise, it is already too late to buy mining machines.

Cryptocurrency mining machines

Mining investment that can start immediately

Next-generation investment with annual returns over 50%!