Incorporate Brave Point Getter into katamike’s EURUSD version EA portfolio

Recently, Mr. katamike released an EURUSD version of the Brave Point Getter.

With the EURUSD version performing exceptionally well amid the abundance of EURUSD options, and the increasing number of USDJPY EAs, I became very interested in the EURUSD version.

Actually, the other day I deliberated whether to use Brave’s EURUSD version or to choose katamike’s four-EA bundle in the GoGoJungle Line@ campaign, and in the end

I purchased the four-piece set from the campaign, and since two out of the four are EURUSD pairs, I am currently running three katamike EURUSD EAs in total.

At present I am running Hyakukaryoran (Many Flowers), Takemaru, and Stable Point Getter, and for this investigation, I want to see what happens if Brave Point Getter is added to the portfolio,

how it performs with the three EAs I am currently using, whether to consolidate everything into one account or split into two, and which combination would be best,

I would like to explore which combinations match best.

Note: As mentioned repeatedly, this analysis will be conducted entirely on the EURUSD version.

First, I will download the four EAs’ backtests from the GoGoJungle official site and assemble them into one portfolio using QuantAnalyzer.

Regarding the backtests, two were run at 1.0 Lot and two at 0.1 Lot, so they use different lot sizes, which is a bit of extra work, but with QuantAnalyzer’s

“What if analysis,” I will convert the 1.0 Lot backtests to 0.1 Lot and unify the four EAs into one portfolio!

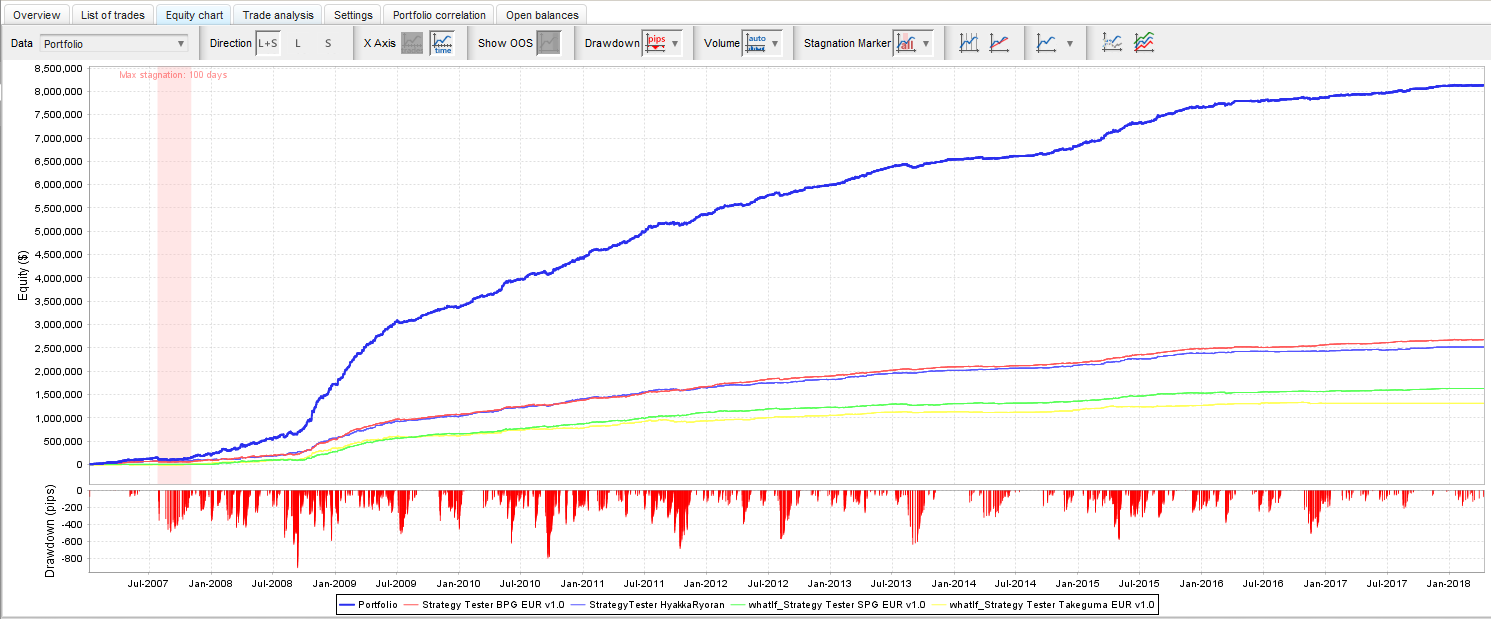

↓↓↓ This is the synthesized chart.

Pink represents Brave、blue represents Hyakukaryoran、green represents Stable、黄色がたけぐま、そして、the blue solid line is the totalです。

Brave and Hyakukaryoran show nearly the same profit and loss, and Stable and Takemaru also seem to get along quite well, with some time gaps.

According to the EA introductions, these four EAs are based on Takemaru with new logic added and profit-taking conditions changed, so

they share the same lineage. Therefore, it’s natural that the profit/loss curves look similar.

However, the maximum drawdown remains around 900 pips, which is relatively low, and aside from a 100-day stagnation period in 2007, it has steadily grown profits in other periods.

(Note: The Stable version’s backtest starts in 2008, so during that period it includes only the three EAs.)

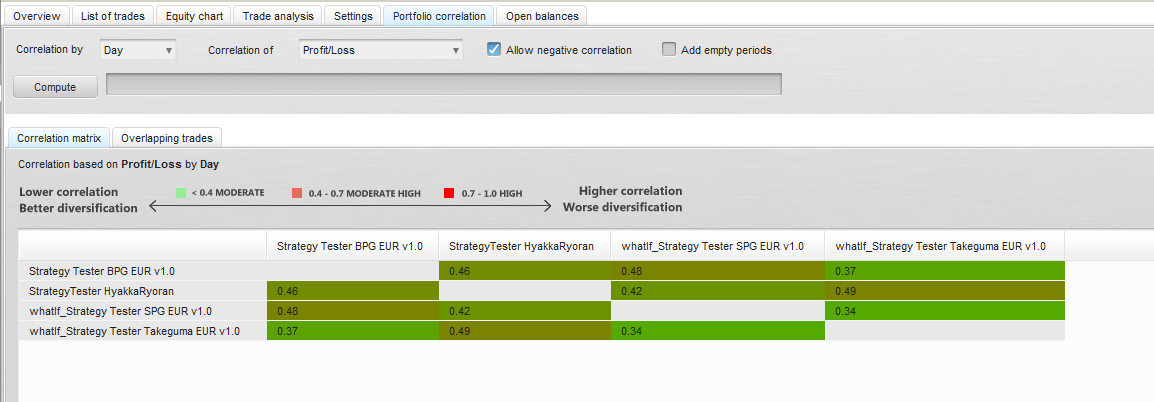

Now, let’s look at the correlations among the four EAs ↓↓↓

If we sort by lowest correlation,

Stable + Takemaru = 0.34

Brave + Takemaru = 0.37

Stable + Hyakukaryoran = 0.42

Brave + Hyakukaryoran = 0.46

Brave + Stable = 0.48

Takemaru + Hyakukaryoran = 0.49

Looking at QuantAnalyzer’s display, correlations below 0.4 are considered Moderate, which seems not bad, but since all combinations are below 0.5,

you could mix and match according to preference as well...

This is a tough decision, huh ????

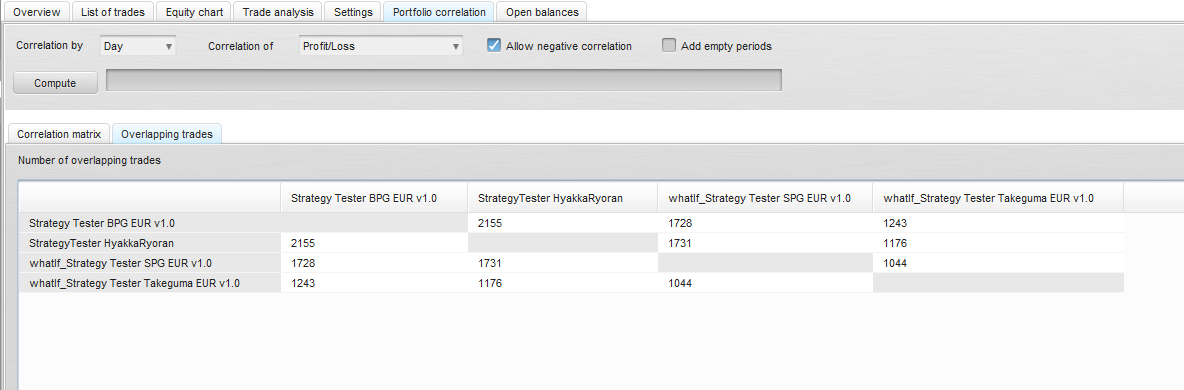

Lastly, here is a table showing how much the positions of each EA overlap.

As expected, since they share the same entry logic, there is a lot of overlap.

Total trades: Takemaru (1211) < Stable (2123) < Hyakukaryoran (2315) < Brave (2439),

so by comparing these numbers you can see how much overlap there is. It’s amazing that you can still develop a high-performing EA just by changing profit-taking conditions even with this much overlap.

Even if you run all four on the same account, there doesn’t seem to be a big danger of large drawdowns, and

running on a single account to improve capital efficiency could yield very impressive results.

This time, I am considering distributing them across two brokers to diversify, and I’d like to balance across accounts as well,

and I plan to run with these two combinations.

- Brave + Takemaru = correlation 0.37, profits ranked 1 and 4, overlapping trades 1243

- Stable + Hyakukaryoran = correlation 0.42, profits ranked 2 and 3, overlapping trades 1731

Now, I’m curious to see how it will turn out, I’m looking forward to it.

The EAs that participated in this investigation are ↓↓↓