U.S. 2-year bonds surge, yen strengthens again?

Hello, this is the administrator Nikkei OP Sales Boy.

Thank you very much for visiting this blog.

I would like to provide information that can be of help to everyone, so I appreciate your support.

Now, the theme this time isThe U.S. yield curve.

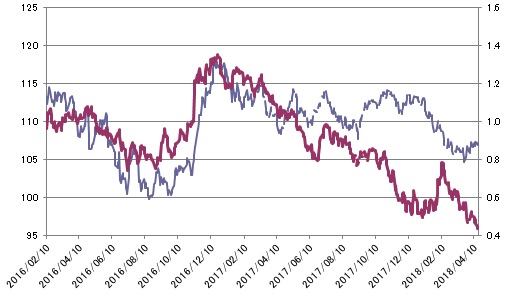

Recently, rising yields on the U.S. 2-year Treasury have become noticeable. On April 18th, it finally surpassed 2.4%.

The 10-year yield has also risen, but not as much as the 2-year.

As a result, the spread between the 2-year and 10-year bonds has narrowed to 0.444%.

Below is the 2-year vs 10-year yield gap (red, right axis, %) and the USD/JPY rate (blue, left axis, in yen), which I have introduced several times.

Recently, the divergence has widened again. If this linkage strengthens again, it would imply a yen appreciation.

Source) From Bloomberg, prepared by the administrator

Note) The above expresses my personal views and is intended solely to improve financial literacy. Therefore, it is not created for investment solicitation. Also, while the blog content is based on data from reliable sources, the administrator does not guarantee its accuracy. Actual investment decisions should be made at your own risk.

<Please click to support us, thank you very much. m(_ _)m>