Interview with an expert trader who turned 90,000 into 230,000 in just 10 days!

- Profile

- Performance is ...

- Not trading during certain indicators is safer

- Remarkably, a part-time job of 1 hour a day!

- Advice from a top trader

Table of Contents

Like a star appearing, now a standard tool for winning, that tool “Tenjo Meijin”

Does it actually make money?

To verify the truth, we organized a research team and conducted field interviews with actual users.Actual usersinterviewed.

Tenjo Meijin Interview Case:1

Profile, Method

Name: Shōtarō-sama

Age: 33

Gender: Male

Related tool usage: automated tool operation only

Style: Part-time trader

Daily trading time: about 1 hour

Other methods: none. Only Tenjo Meijin.

How much did you actually make?

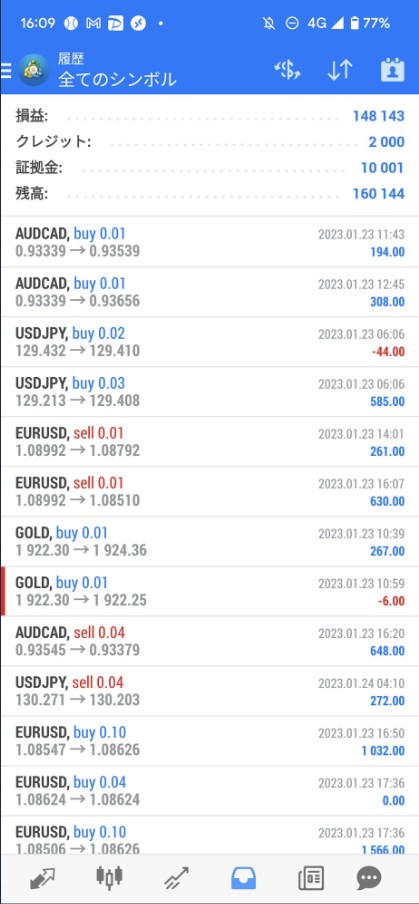

Investigator (hereafter C): May I ask about your operating results?

Shōtarō-sama (hereafter S): Started operating on January 23, andfrom 90,000 yen to 230,000 yen by February 2increased.

C: In about 10 business days, about 2.5x! Quite a good result. If you could share trading images, it would be参考 (useful) ...

S: I will send images.

↑ As the capital increases, the allowable lot size also increases, enabling compounding operation.

Also, discretionary trading on signals appears to be done (described below).

↑ In the immediate period after starting, they operated with the minimum lot to observe.

↑ Profit on interview day was +40,000 yen.

For the author, around here it would be tempting towithdraw the principal...

ーー although only 10 days of operation yielded a confirmed profit of +150,000 yen,if you look closely, the “effective margin” is300,000 yen. In other words, including unrealized gains, the profit is

つまり含み益を入れると210,000 yen profitということだ! The pace is astonishing!

What do you watch out for during operation?

C: I was impressed that the operating results are better than official figures.

Please tell us what you consciously monitor during operation!

S: I am mindful of whether indicators are present. If something with a rating of 4 stars or higher appears on Minkabu, I stop auto trading,

or depending on held positions, I consider manual stop-loss.

ーー- Because economic indicators bring high uncertainty, it is safer to stop properly to eliminate gambling elements.

We know this, but when you think it might win, it’s hard to stop EA...

C: Is it fully automated trading?

S: No, there is still some discretion. I look at charts for each interval with indicators, and decide whether to enter when a signal appears.

C: I see. For larger lots, you analyze across timeframes, right?

ーー- Timeframes, currency strength, fundamentals, and other factors—they allow a discretionary trader to enter with confidence, which makes sense.

When I can’t view charts, I let the automatic tool handle it, but if there is a chance to trade with a bit more size using discretion, I take a larger position.

That sense of balance is likely the source of the profits.

Diving into trading style

C: With this level of profit, I thought you were a full-time trader, but you’re actuallya part-time trader, right?

S: Yes. Part-time,daily trading time is about 1 hour, using semi-discretionary EA.

C: About 1 hour a day. Indeed, for part-time traders, an automatic tool that handles entry to exit with settings is a strong ally.

ーーー21万円 in 10 days means 10 hours of operation,giving an hourly rate of 20,000 yen—a high hourly wage!

The official operation also ran for about 15 days starting from 80,000 yen and yielded 50,000 yen profit. Not bad, but still falls short of 20,000 yen per hour.

Official operation uses only automated tools, but incorporating discretion might have yielded even more ... (tears)

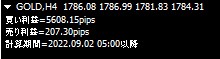

Tenjo Meijin Official Operation Results (Jan 10 – early Feb)

“Entering with discretion is a kind of gamble”

C: Many would like to achieve the same profit as Shōtarō-sama. Do you have recommended currency pairs?

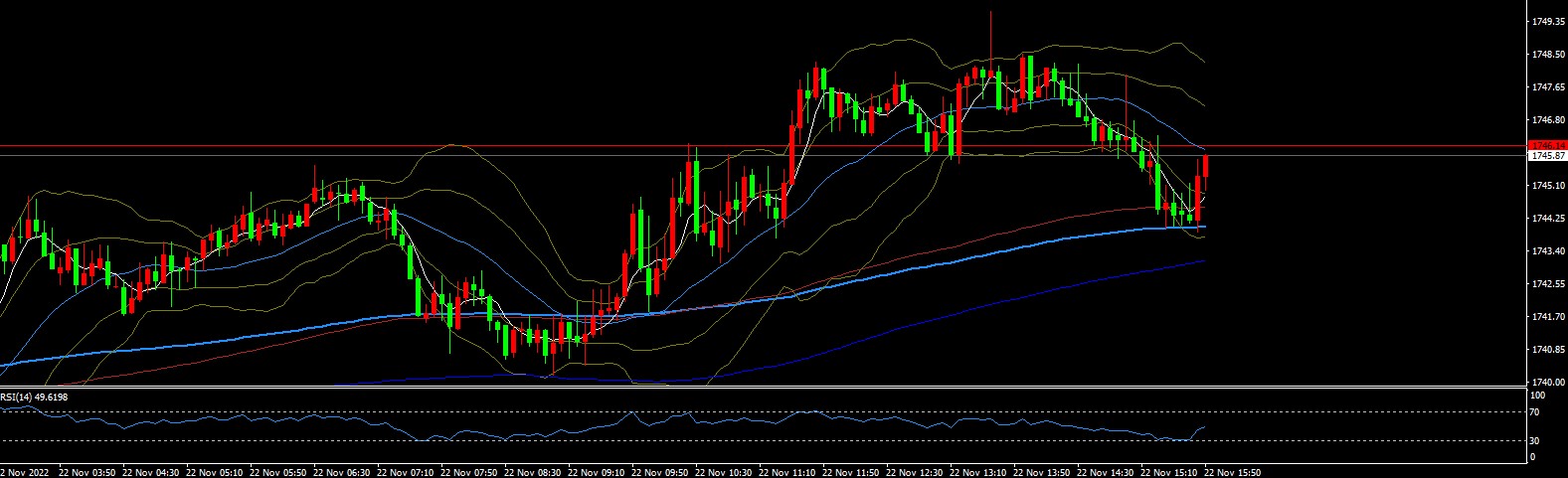

S: The EA pairs are USD/JPY, EUR/USD, USD/CAD, and GOLD. Initial lot is 0.05, then add 0.03 to run the EA (15-minute chart).

C: USD/JPY and EUR/USD are popular currencies. There’s plenty of information and it’s easy to read the big picture, making it accessible for beginners to advanced traders.

The other two pairs tend to range, so they may be operable without deep thought, but gold lately has been moving a bit fearfully.

S: Until now I have used separate gold and EUR/USD automated trading. Since I haven’t properly studied, I can’t do technical analysis myself, so I’ve only considered indicator-driven effects,Always entering with discretion is a kind of gambling

Tenjo Meijin makes suchentry points easy to understand even for beginners, which is helpful. The price is about 100,000 yen for the EA and indicators, butthe profit could cover the cost in two weeks, so buying was not a loss.

ーーー “Discretionary entries were gambling” ... even the author feels a sting in these words.

Without solid evidence, one tends to hold positions haphazardly and complex entry conditions can be twisted by the trader’s subjectivity.

For the author, greed was the biggest enemy, and one often twisted entry reasons to justify positions.

Clear signals can sever ties with unnecessary positions.

ーー- Indeed, what surprised the author most was that simple signals are highly accurate and not influenced by trader subjectivity.

Official backtest results show about 70% win rate, but even experienced discretionary traders often have 50–60% win rate, which suggests

how high the signal accuracy is.

↑ It clearly indicates Tenjo’s accuracy. Even without taking profits on opposite signals, profits can accumulate within the same day, allowing timely profit-taking.

The decline in employment statistics is also indicated accurately. It feels like magic, but the logic is secret.

↑ Applying Tenjo Meijin to USD/JPY in the same period. According to the inventor, the latest signals are “weekends” and “moving against indicators,” so they should be avoided.

As expected, there is no need to hold positions before weekends, and the author didn’t have the courage to oppose the surge during non-farm payrolls.

This is also where Shōtarō-sama’s advice to “stop EA during economic indicators” would be useful.

ーー- The author also trades part-time, but it’s hard to maintain stable profits with discretion alone.

This is a common problem for many traders.

However, “one wins at times and loses at others” is no different from gambling like pachinko or horse racing.

If you use Tenjo Meijin’s signal tool,you can soon say with pride that trading is your job.

Those who have not used Tenjo Meijin can obtain it from the link below.

Chance to get a free notification tool!

To readers of this article, we will present Tenjo Meijin Notification Tool to 10 winners by lottery!

Chance to win a product valued at 30,000 yen!

Notification Tool (smartphone, email, alert notifications) here

After purchasing Tenjo Meijin itself, send a message to the seller with the keyword “I read the interview” to complete the entry!

Entry period isFebruary 1st to February 20th.

Note: This campaign is limited to purchases in February.

Note: The notification tool will not work unless Tenjo Meijin is owned.

Note: Winners will be announced by sending the notification tool.