The U.S.-Russia relations face a disastrous situation due to the Syria attack! What the future outlook looks like from the perspective of U.S. stocks ...

Following the joint military action by the US, UK, and France against Syria

the markets at the start of the week are likely to be highly volatile.

U.S. Secretary of Defense Mattis said this is "a one-time incident," but as for near-term market movements,

it may be a temporary movement, but President Trump stated that

"we will respond until the Assad regime stops using chemical substances,"

and appears to intend to repeat military action if chemical weapons are used again.

However, Russia, which has supported the Assad regime, strongly opposes this attack on Syria!

Undoubtedly, U.S.-Russia relations will worsen, and future Russian responses will determine whether

geopolitical risks will widen. It is worth keeping this in view.

Market participants are looking ahead to the weekend with great interest for the start of the week

as risk-off behavior likely leads to a stronger yen and a fall in stock prices.

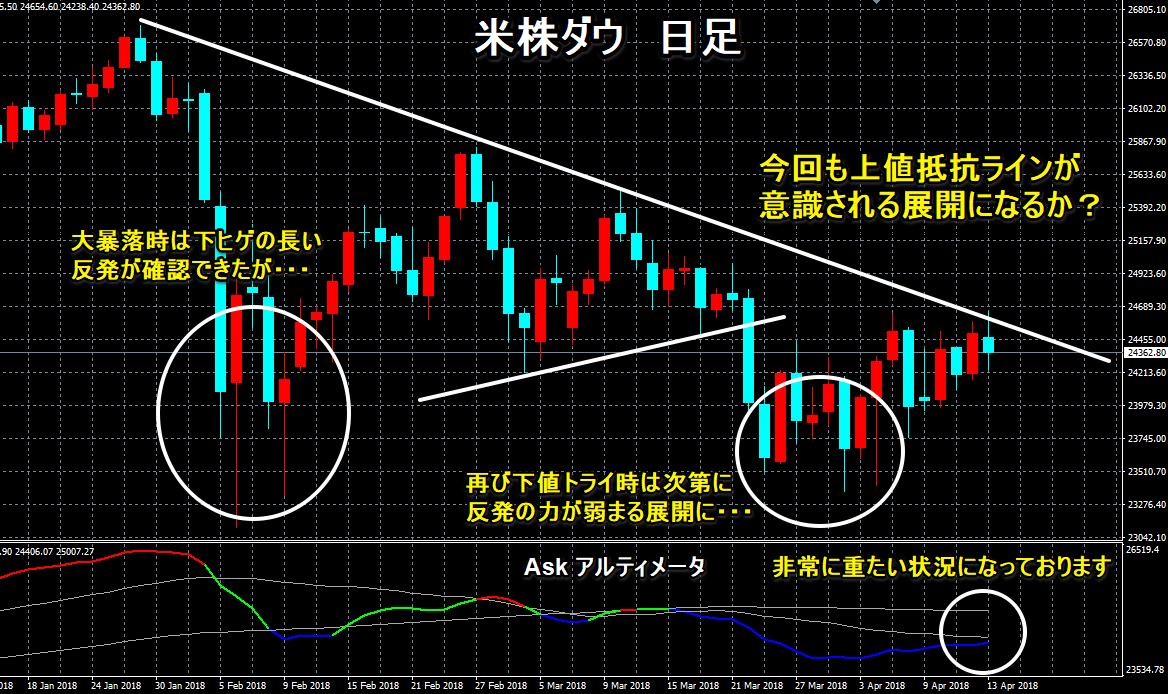

What matters is the current market's technical conditions for transitioning,

as the U.S. stock market's sharp fluctuations since February are still influencing the market

and will likely continue to impact the Nikkei Average and the yen in the future.

From the movement of the Dow, the Nikkei average is staring at a near-term resistance around 22,000–22,500 yen, with the dollar/yen around the 108 yen level

and unless the Dow breaks above its resistance line convincingly, domestic market upside will remain limited.

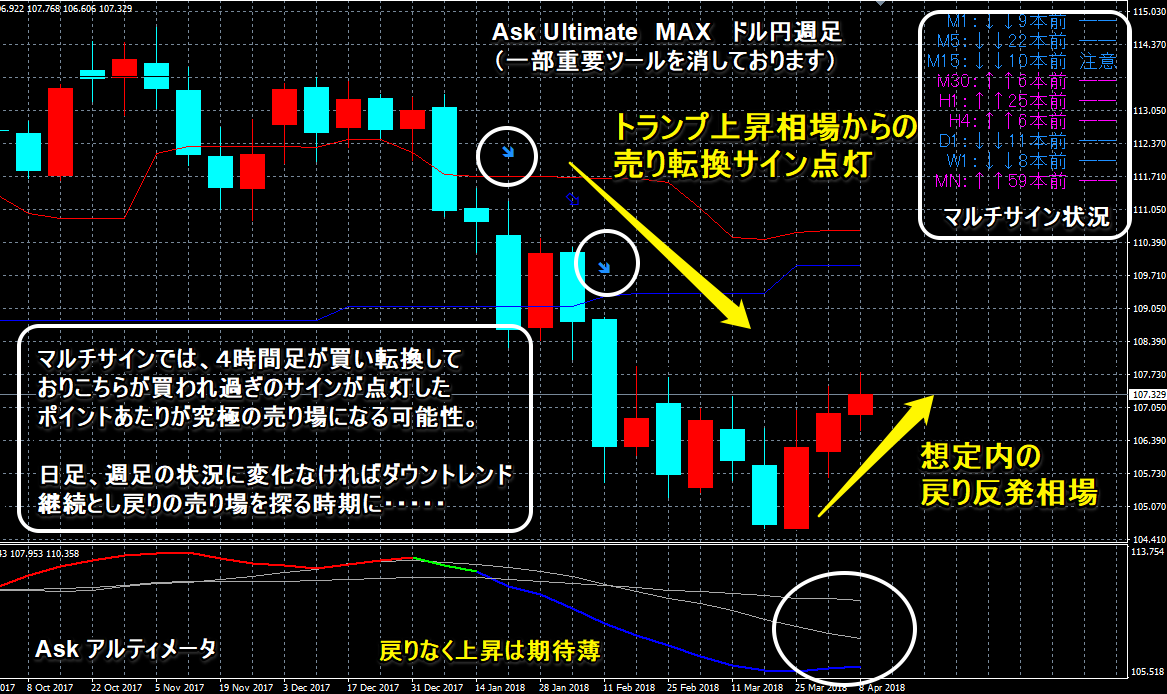

Looking at the dollar/yen in isolation, after briefly falling below 105, it has rebounded from an oversold state, but mid-term, once it dips below 110, a downtrend begins

and there is a possibility of testing recent lows again. In the short term, domestic and international negative factors

may push prices down, but if they rebound and test the recovery, this movement could weaken, so be careful.

Some articles have suggested that a fall below 105 could even bring 100 into view,

but personally I have been noting comments warning about a sharp rebound.

From Market Compass, published February 18, 2018

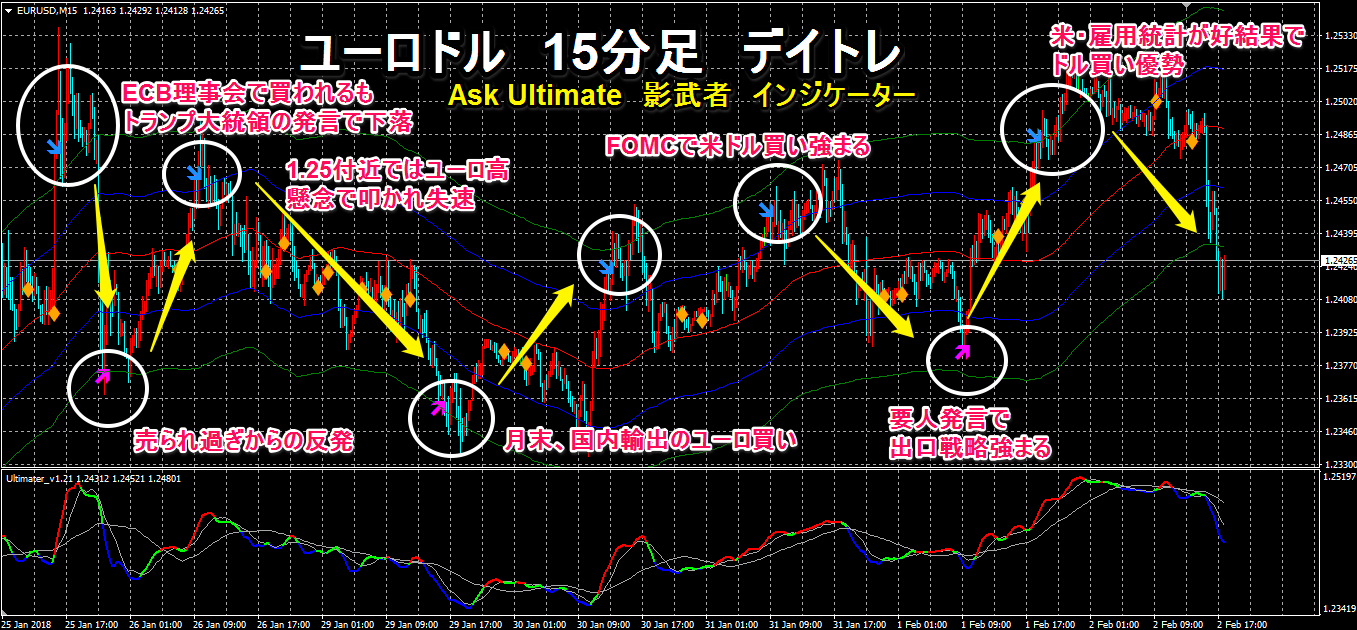

★Charts“Ask Ultimate - Shadow Warrior”Euro-Dollar 15-minute day trading

This ranges from the ECB meeting to the U.S. employment data. The price movements have processed signals with the events!

Click the image to enlarge! The indicators are“Ask Ultimate - Shadow Warrior”/“Foreign Exchange Strangle” development product

★Ask Ultimate MAX / Shadow Warrior are both set for 15-minute charts

to trade with reduced risk in finer detail!

For details, see here↓↓↓

★Strong in USD/JPY! Battle Zone Trade Giveaway Campaign!

● Each currency pair has fixed entry and settlement times!

● At each time band, participants rotate rapidly! Capture the market flow for the day!

■ About the summer and winter time zones ■ One week ■ One month ■ Annual market trends

● Trading technique: "The Tokyo morning session is hot! This is where the battle with the yen starts!"

● Trading technique (long-term position)

● Ask Ultimate MAX / / Shadow Warrior bundle product

Additionally, a Battle Zone Trade indicator for USD/JPY!

“Foreign Exchange Strangle” trading technique, Ask Ultimate MAX (long-term) / Shadow Warrior (short-term) with indicators