5-Day Intensive Course - Delivering a method that anyone can easily master - [Day 3]

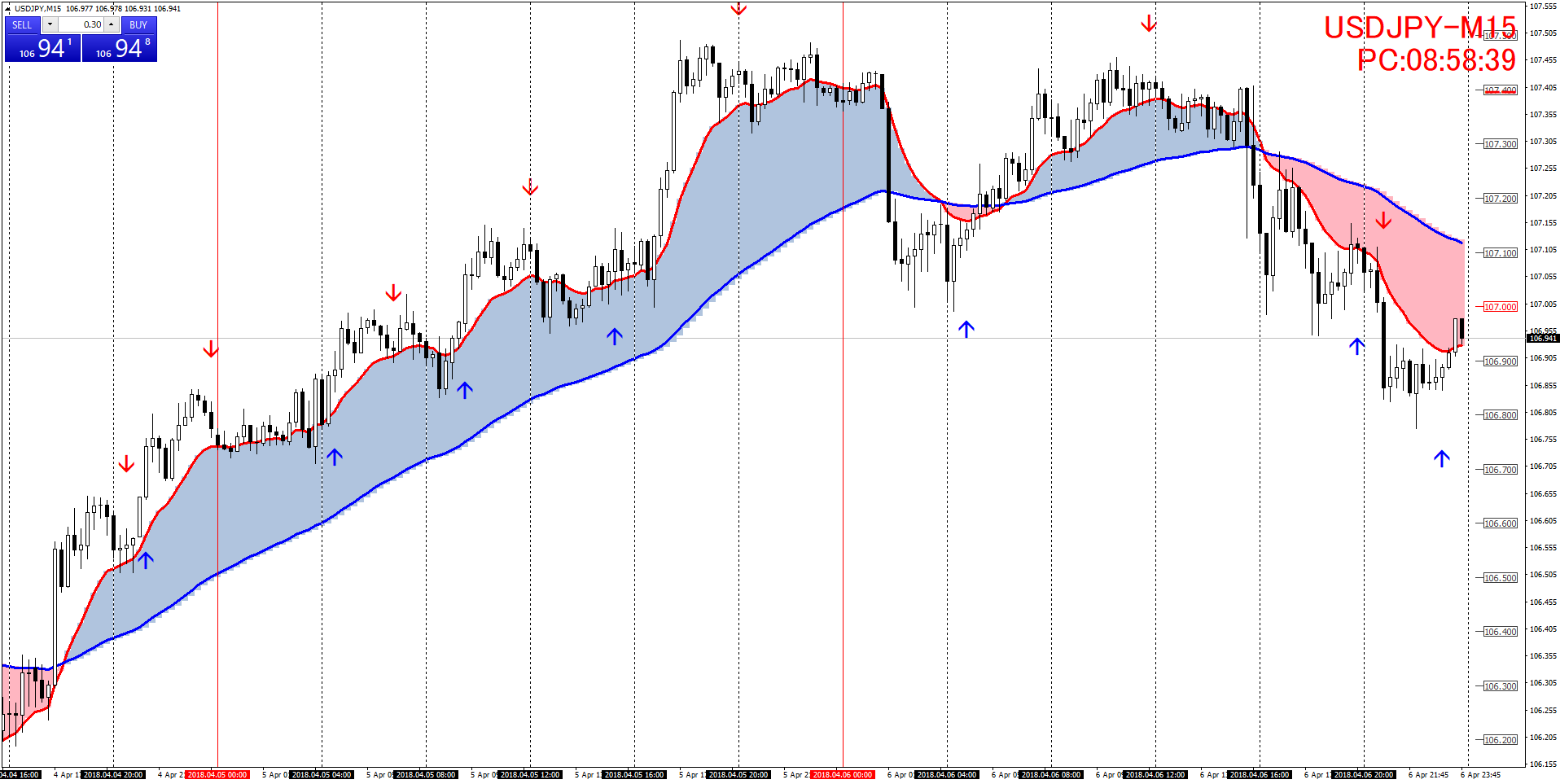

From yesterday's trades【USDJPY】

Yesterday's 15M: the euro/dollar and bond dollar were smooth for three consecutive days.

The 5M scalping was 19 trades with 16 wins for +130 PIP, fairly decent.【Intensive Course Day 3】Today we’ll look at the combination with MACD, which Japanese people love.

What is the indicator that shows the short-term trend? I think one of them is MACD.

When I was in the United States, I heard a lecture by Mr. Apell, who developed MACD, and at that time MACD was being used to look at the direction of the trend.

Now I’ll apply MACD-Crossover_Signal to my FLD. Following the basic principle, blue tones are buy signals and pink tones are sell signals, and I tried trading only buy signals and only sell signals, but FLD is playing a decent role as a filter. It’s still not bad, but I did not adopt it.

I’ll talk about capital division. Once my method is established, I split FX capital into two.

Among them, I calculate margin + 10 consecutive losses to determine the position size to invest. If the 10 consecutive losses are gone, that method is clearly wrong, so I rework the method and trade on a demo for more than a month to confirm profits and then try again, starting with margin + half of the remaining funds, choosing a lot size that can withstand 10 consecutive losses while keeping some margin. I’ll reserve one more batch.× ![]()