This year's biggest US event! For now, the US dollar materials seem to be finished...

This year's big event had been expected to be the U.S. presidential election, but the surprise of the UK’s Brexit has occurred and it seems this year's European currencies have already ended early in terms of market activity. Of course, with Brexit affecting other currencies as well, the yen has strengthened, and the USD/JPY has also fallen below 100 yen.

Even now the market remains unsettled, but originally this year was supposed to move around the U.S. presidential election, so for USD/JPY it seems difficult to move until after the U.S. election event has passed.

Looking at the monthly chart, this month shows a strong likelihood of ending with a bullish candle, and as long as the current cloud upper bound on the Ichimaki (Ichimoku) is being supported, there is a tendency for buying near the 100 yen level or below 100 yen in the future.

However, if there is movement that pushes into that monthly cloud, next year the USD/JPY could see the lower bound of the cloud around 98 yen, so it is prudent to keep an eye on a potential market reversal.

In the U.S. presidential election, while Clinton is favored, over the weekend the FBI announced it would resume investigation into Hillary Clinton's use of a private email server during her tenure as secretary of state, leading to a sharp drop in the dollar in New York markets. With two weeks left until the election day, there is still plenty of caution about buying dollars.

In any case, once the election is over, there will be Thanksgiving and year-end trading, so I want to monitor whether the dollar/yen will attempt higher prices in the year-end and New Year trading.

What interests me is that the U.S. stock Dow had seemed to be collapsing at one point but has again held around the 18,000 level, suggesting the potential to test higher once more, or as long as it holds around 18,000, there is no particular concern; but if this starts to break down, it could quickly become a harsh season for the Nikkei and USD/JPY as well.

Technically, in the long-term trend-strength indicator “Ask_Ultimate MAX,” there are changes on the daily chart and a fresh buy signal has begun to light up for the first time in a while. As long as the Ichimoku Cloud upper bound on the monthly chart remains supported, I would like to buy on dips. If the euro/yen remains around 100 yen and the AUD/JPY stabilizes in the 80 yen area, it could provide momentum for yen selling as well.

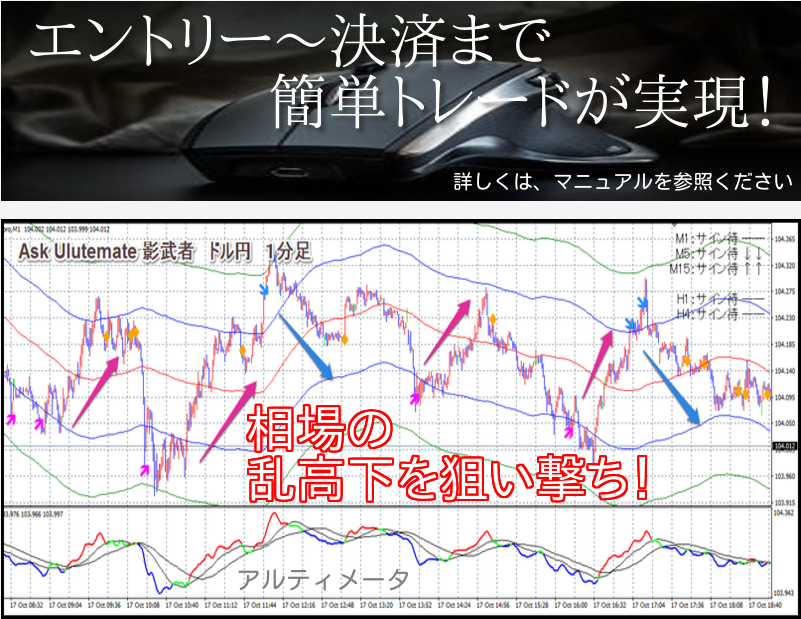

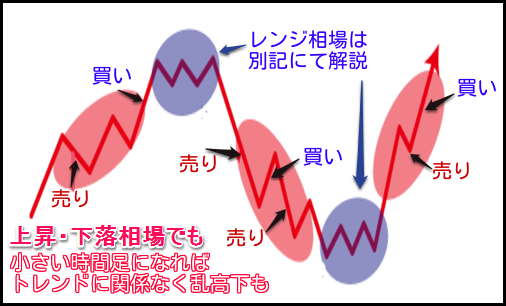

Currently, we are offering a pre-sale of “Ask_Ultimate Kagemusha (Shadow Warrior)” released on 11/2 to customers who have previously purchased from the Ask series. A pre-sale password is required. Please note that after 16:00 on 11/2, general sales will commence.

× ![]()