5-Day Intensive Course: Delivering a method that anyone can easily master ~ [Day 2]

From yesterday's trades

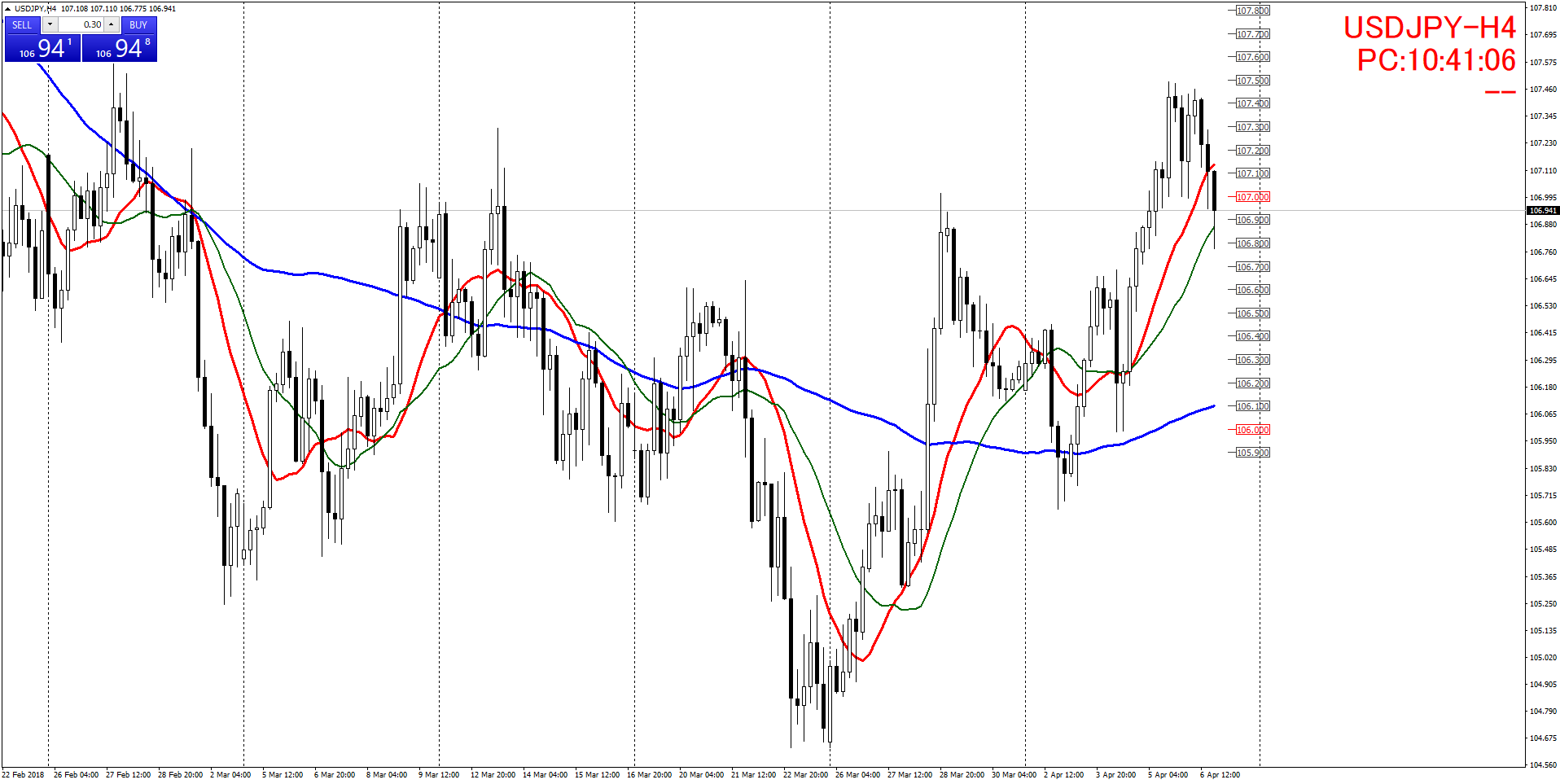

【USDJPY】

Yesterday's 15M, the euro and pound have continued the trend from Monday and are fairly good.

Compared to that, the 5M scalping was +20 PIPs and 25 trades, and this result isn’t very good.

【Intensive Course Day 2】

About entry points

Since I joined a securities company about 40 years ago, I was thoroughly trained in buying on dips and selling on rallies. This is the basis of my entry points.

It's often explained at seminars that there are three trends: an uptrend, a downtrend, and a range.

Unfortunately, with just these three, it’s difficult to make profits. To profit, please consider that there are three for each of uptrends and downtrends. Those three are

Short-term trend — an important trend for finding buy/sell points.

Medium-term trend — I personally define FLD as the medium-term trend. I apply this from 15M to 1H.

Long-term trend — 4H and above, used to see the big overall flow.

Among these, I think a combination of short-term trend + medium-term trend is suitable for general traders.

In the late 1980s around 1990, people in Japan couldn't trade FX publicly, but the first chart I used in America is the one in the photo. It was the era before personal computers, with 13 and 75

SMA and 21 SMA are included. It was centered on the 4-hour chart.

Trading method: when FLD is a buy, you trade when the 21-day line breaks from below to above

when FLD is a sell, you trade when the 21-day line breaks from above to below

This involves a bit of discretion, but it is a combination of long-term and medium-term trends.

At that time, I traded with limit orders of 100 PIPs or more and stop orders of -100 PIPs. It was a swing trade.

From tomorrow, we will look at short- and medium-term trend combinations centered on modern 15M and 30M charts.