[For Purchasers] The Concept of Time Equality / 2022 Performance Details

[For Buyers] Concept of Time Equality / 2022 Performance Details

Hello. This is Suika wa.

Happy New Year!

We look forward to your continued support this year as well.

Many people have adopted the concept of “Time is Equal.” Thank you very much.

※ This article was written for new buyers in line with the New Year greetings. I tried to send a direct link from the gogojungle seller to the buyer via email, but it seems the policy changed and it didn’t work.

Since New Year’s Day midnight, I have attempted several times. I think it will arrive eventually!

Because external links are prohibited, I posted the same content on Investment Navigator. ※ In 2020, it could be delivered instantly…

As the number of users increased rapidly, I summarized the concept of Time is Equal and the 2022 performance details.

Concept of Time is Equal

Since you purchased, as a developer I want to provide at least the value above the EA price.

To that end, I felt it would be good to reiterate the operating philosophy of “Time is Equal.” (If I have written something similar elsewhere, I apologize.)

The basis of operation is,

“If you hold the same amount of time during advantageous time zones, you will be profitable in the long run.”

That is basically it.

A common analogy is,

Suppose there are 10 sticks in a bag in total (6 red, 4 blue).

Take one out; if its color is a hit, you get 1000 yen; if it’s a miss, you lose 1000 yen. After drawing, put it back in the bag and repeat the same process.

—————————————-

Under the above conditions, as long as you know there are 6 red and 4 blue in the bag, you would keep betting on red.

The market is not that simple, but the win rate and the average winning/losing trades of Time is Equal have been operated with the belief that, as in the above example, 6 out of 10 will be red through backtests and forwards.

Until this simple idea stops working, I will not adopt indicators.

2022 Performance Details

The most disappointing thing is to operate without anticipating drawdown (i.e., without expecting monthly losses), so I summarized the logic performance.

Perhaps by narrowing the logic you could suppress monthly losses, but that was not the case (laugh).

※ Cashbacks and trading fees are excluded.

Total: 363,637 yen (3,079 pips)

—————————-

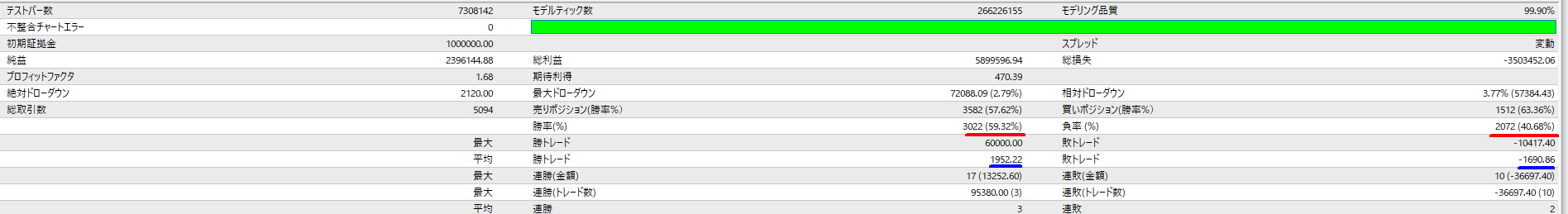

2020: 130,019 yen (985 pips)

2021: 32,926 yen (382 pips)

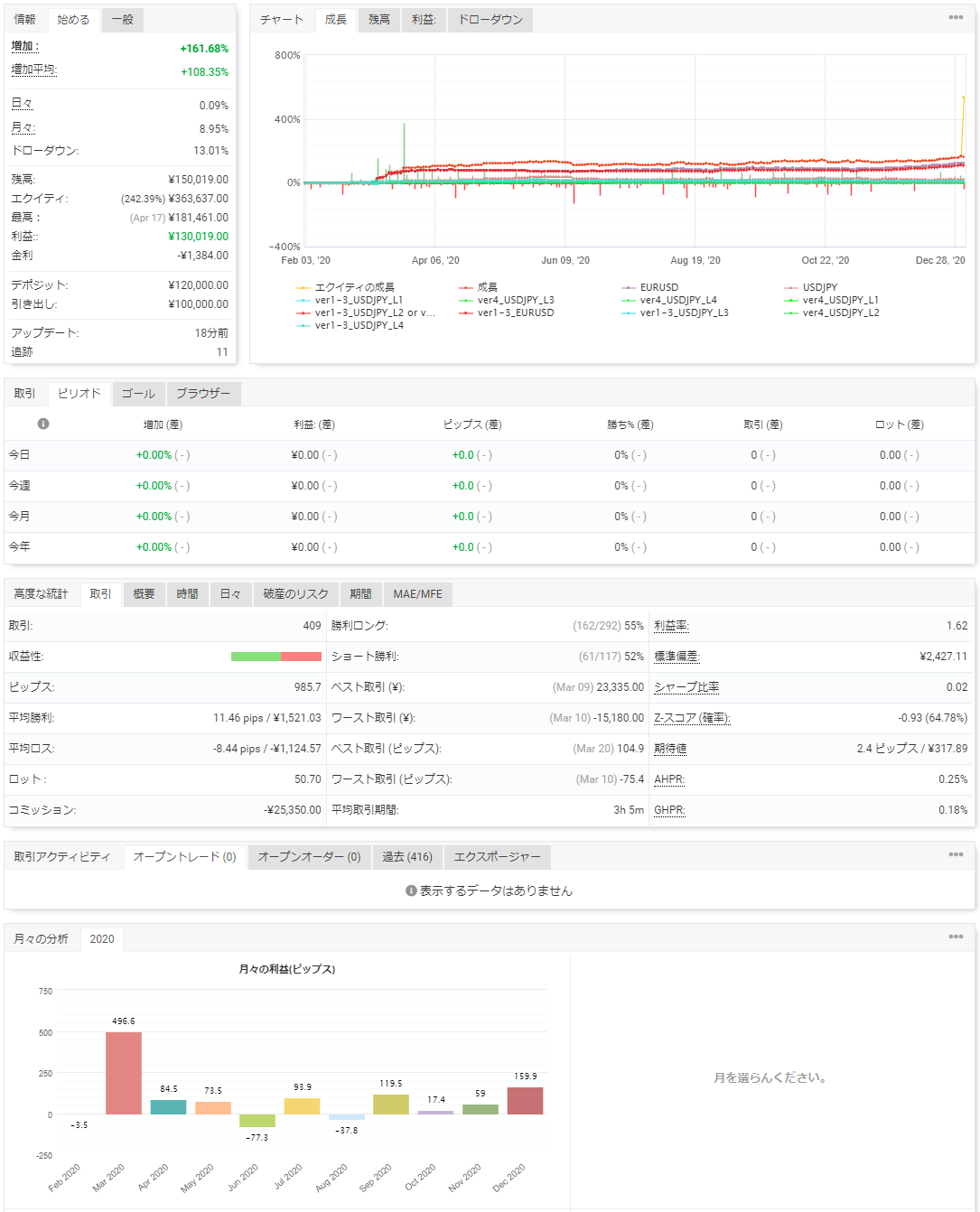

2022: 200,692 yen (1,712 pips)

From here, there are images.

2020

Looking at the image of [Monthly Profit (Pips)], the year has losses in three months (February, June, August).

2021

Looking at the image of [Monthly Profit (Pips)], the year has losses in four months (January, March, April, November).

2022

Looking at the image of [Monthly Profit (Pips)], the year has losses in four months (May, August, September, October).

※ In amount terms, February and August are also losses.

As stated above, there are losing months, but the yearly results are profitable overall.

Furthermore, the annual results by logic for 2022 are as follows.

◆ USD/JPY

Logic 1: 82,160 yen (875 pips, 0.1 lot equivalent to 82,160 yen)

Logic 2: 24,900 yen (271 pips, 0.1 lot equivalent to 24,900 yen)

Logic 3: 34,820 yen (200 pips, 0.1 lot equivalent to 17,410 yen)

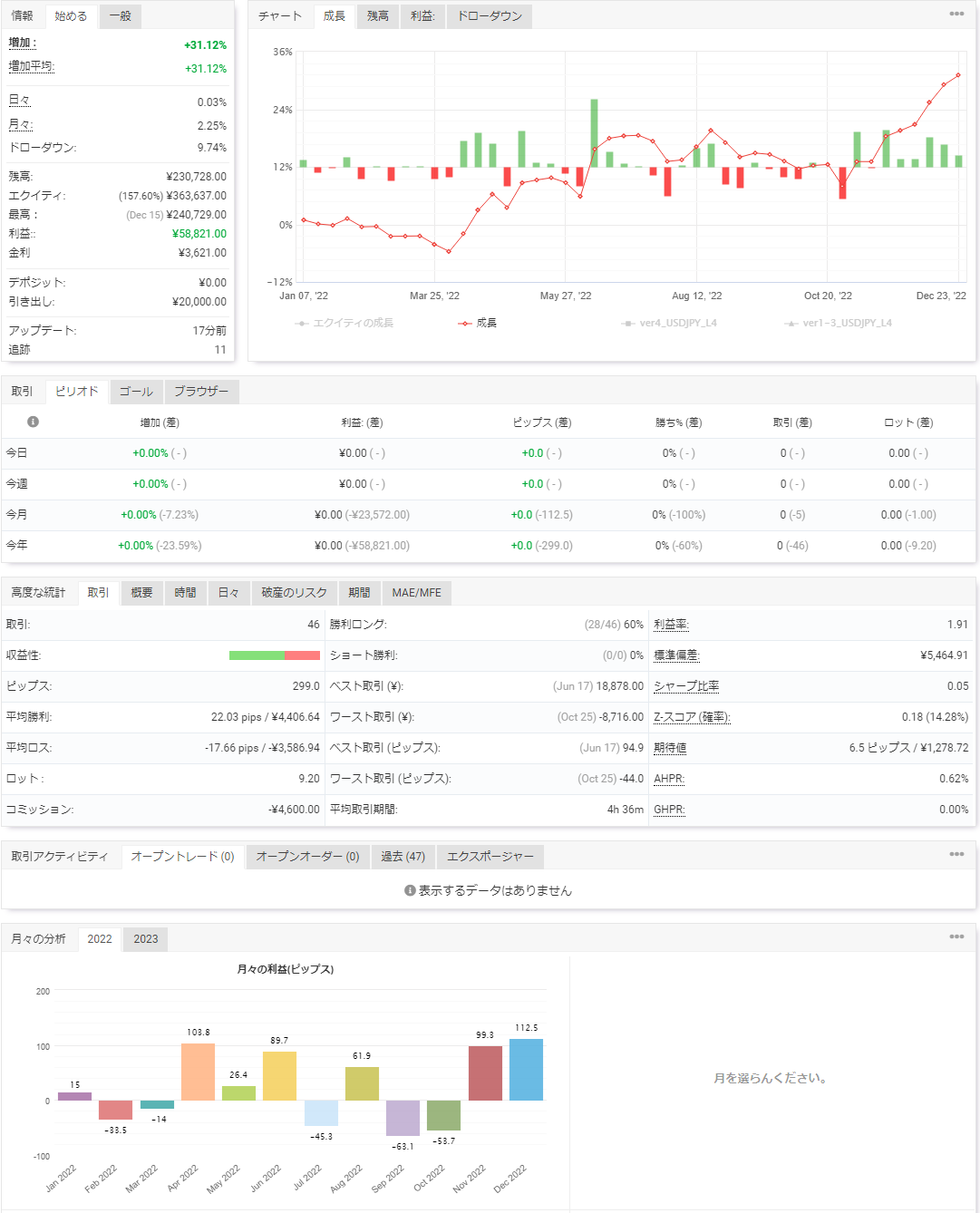

Logic 4: 58,821 yen (299 pips, 0.1 lot equivalent to 29,410 yen)

◆ EUR/USD

Buy only: -9 yen (66 pips, 0.1 lot equivalent to -9 yen)

From here, there are images.

USD/JPY_Logic1

USD/JPY_Logic2

USD/JPY_Logic3

USD/JPY_Logic4

EUR/USD

I checked whether turning off the logic that is pulling us down and stabilizing (reducing monthly losses) could help.

However, although each logic has monthly losses, it is clear that we can win on an annual basis. I personally think Logic 3 is a bit questionable, but I don’t think it’s necessary to turn trading off.

※ Since EUR/USD was updated to ver4.0 around August, I will operate with the expectation of a strong performance in 2023.

Regarding 2022 Performance (USD/JPY)

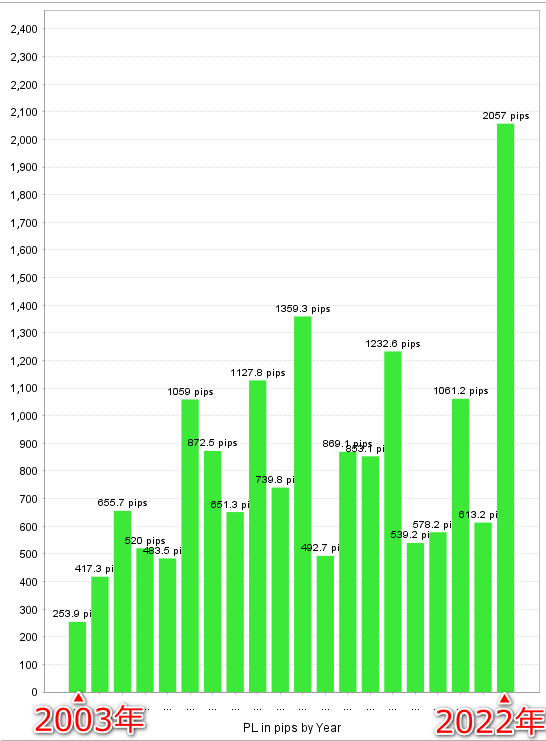

The image below is a backtest of USD/JPY from May 5, 2003, to December 31, 2022, using USDJPY_ver4.

From the graph below, this year’s performance seems a bit too good to be true.

In 2023, aiming for 400–700 pips for the year without being greedy would be as expected.

※ Any upside in performance is welcome, but I hope no one makes a big loss when increasing the lot size.