The dollar-yen pair that had been on alert, a rebound from the lows is accurate! Caution for further gains, and yet another wave of market instability begins‼

Dollar/yen fell below 105 yen, as everyone warned of downside risk

Personally, I was rather wary of a rebound from the oversold condition.

Previous articleDollar/yen signaled selling at the start of the new year! For now, beware of the rebound!

Last week, amid such caution, a reversal occurred and the pair briefly touched 107 yen.

Now, what will happen next is of interest. In the near term, the dollar/yen faced resistance around 106 yen,

last week it rose to 107 yen and briefly 106 yen appeared to be supported

We should also keep in mind the possibility of another rebound rally.

However, in the long-term trend it has been a selling turn after breaking below 110 yen, so currently

once the rebound runs its course, a resumption of selling is expected, targeting the near-term lows again

to occur.

The stock market crash that began in February this year is settling down somewhat,

The Nikkei Stock Average has recovered from below 21,000, and this week it has returned to the 21,000 level while investors seek the next wave of volatility.

For the time being, market participants will look for a return to trend, testing rebounds, and

as a near-term factor, the domestic "Moritomo" scandal has been a bearish/yen-appreciating catalyst, but the market

has already priced in the news for the time being, and toward the late April scheduled (potentially delayed to May) U.S.–North Korea talks,

development toward realization among China, Korea, Korea peninsula, the United States, and Japan somewhat on the sidelines,

and the U.S.-China trade issue seems to be the blind spot.

Trade issues are being discussed behind the scenes, and concerns have somewhat diminished,

but market participants expect that a possible reversal to the talks with Trump’s possible plot twist could occur,

and must prepare for risk rebounding toward talks,’ creating a situation where a rebound in stocks could occur until the talks materialize, especially seasonally with “Sell in May.”

In the currency market, an adjustment phase for overextended currency pairs is also quite possible.

In some quarters, if North Korea-U.S. talks collapse, there is even talk of a U.S. military strike; in any case, the final phase of the U.S.-North Korea issue is

certainly concentrated around May.

The growing dollar/yen long positions have rapidly decreased (possibly forced out below 105 yen),

and there is a possibility of a volatile market where positions sold at 105–106 yen are liquidated,

short-term demand suggests buying the dip, while long-term suggests seeking selling opportunities.

Therefore, the second wave of upheaval this year is likely to begin around the North Korea talks.

From the blog

★A look at the week ahead! The Tokyo market’s movement of the Nikkei ahead

★Dow Jones625 drop! Don’t panic—wait for the rebound!

We warned about the rebound after the dollar/yen retraced

In the four-hour chart, there is a buying turn, and it may pull back to an overbought signal...

↓↓↓Please check the current chart here↓↓↓

Ask_Ultimate_MAX by “Kawase Rigаi”

It detects signs of a market turning and tells you precisely when to close positions!

★Profit from short-term trades!

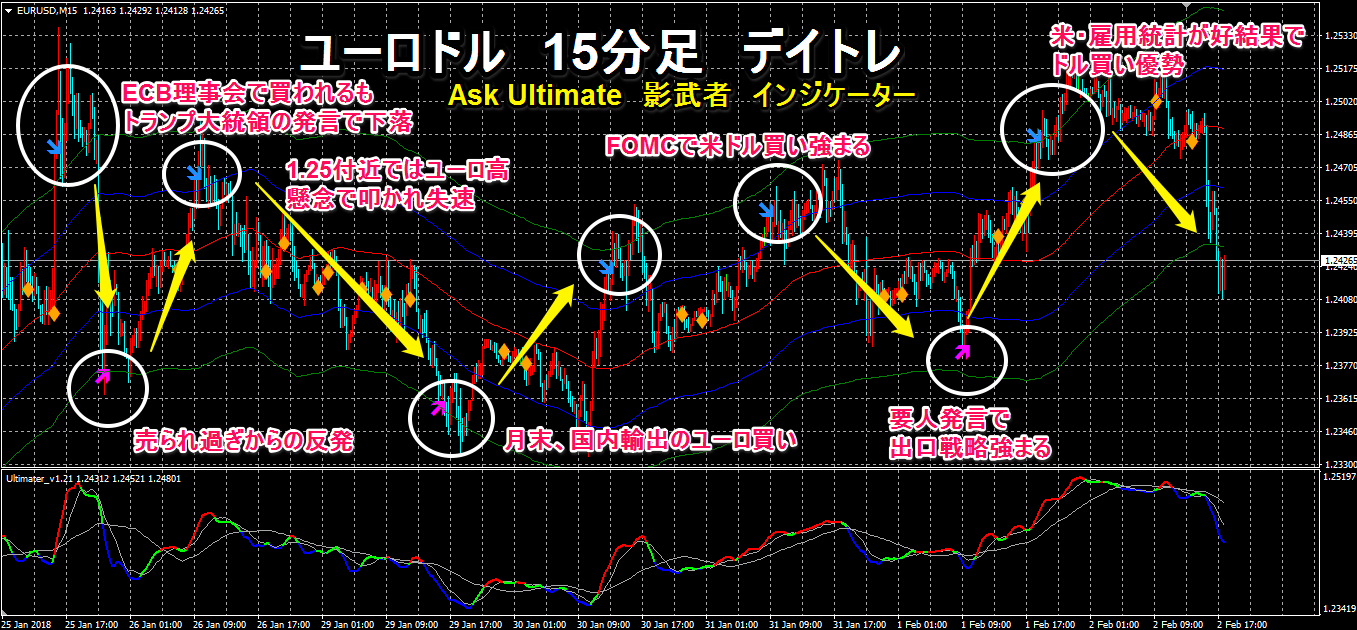

The chart is“Ask Ultimate Shadow”In 15-minute euro-dollar day trading

From the ECB meeting to the U.S. employment data, the market moved in a way that fulfilled buying/selling signals along with events.

Click the image to enlarge!

The indicator is“Ask Ultimate Shadow”/“Kawase Rigai” developed product

★Ask Ultimate MAX/Shadow both allow risk-limiting micro-trades on 15-minute charts!

For details, see below↓↓↓

Dollar/Yen Battle Zone Trade Gift Campaign is strong!

●For each currency pair, entry and exit times are fixed!

●Participant turnover is rapid in each time frame! Capture the day’s market flow!

■ About summer vs winter hours ■ One week ■ One month ■ Market trends for the year

●Trading technique “Tokyo premarket is hot! The Yen market is where the battle starts!”

●Trading technique (long-term position)

●Ask Ultimate MAX / Shadow package

Also a stronger Dollar/Yen Battle Zone Trade indicator as a gift!

“Kawase Rigai” trade technique Ask Ultimate MAX (long-term) / Shadow (short-term) with indicators

What is Battle Zone Trade?