[Ultimately discretionary?] A 10-year verification of top celebrities; [Turning the manual strategy into an EA]

I can’t believe just setting stop loss and take profit makes it this stable…

Do you think it’s just a manual, something small you get as a bonus?

However, a sign tool delivers its maximum performance only when there is a “strategy” behind it.

If someone says it’s “all about the strategy,”“So it’s still just discretionary judgment?!” you’re not entirely wrong to think so.

When told it’s discretionary, it’s understandable to feel a lack of trust.

Questions like, can you understand it just by reading a manual, might arise.

So, based on the manual we announced recently,I created an EAusing the strategy.

By “strategy” I meansomething that can be turned into an EAto some extent, so it’s not a big deal,

Of course, fundamental analysis is not performed.

The strategies used are,

・Timing of stop loss

・Timing of averaging down (N) (※)

・Timing of taking profit

※ Some dislike averaging down, but under proper capital management and with mitigated leverage, the replication is highly reliable.

There are onlythreetypes!

On the other hand,

・No fundamental analysis

・Trade even on ahead of data releases, holidays, and during shocks

Is there any intention to win? A completely hands-off approach!

And the result is…

Stunningstability!

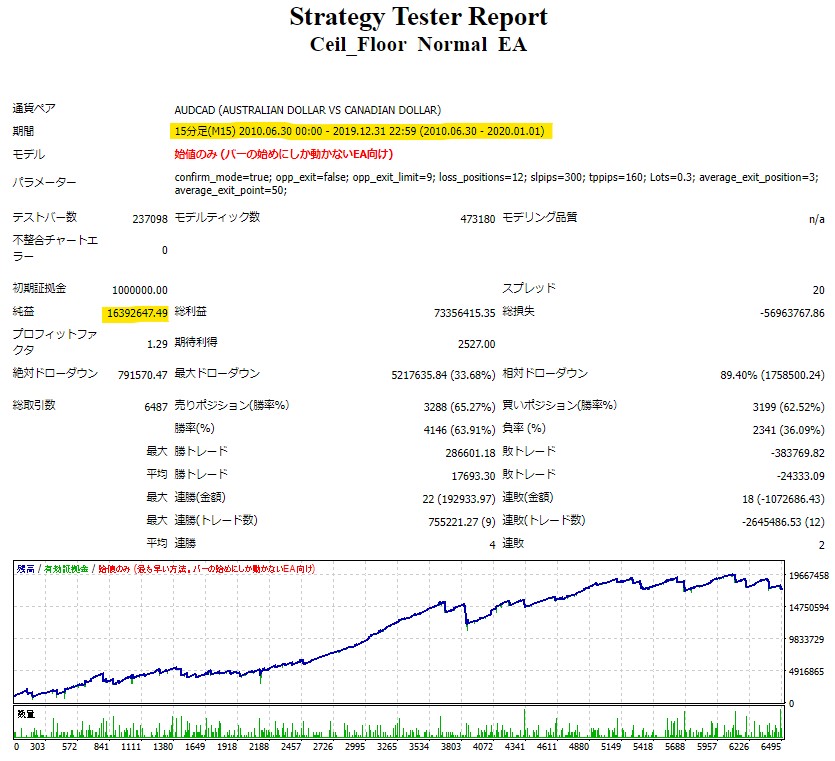

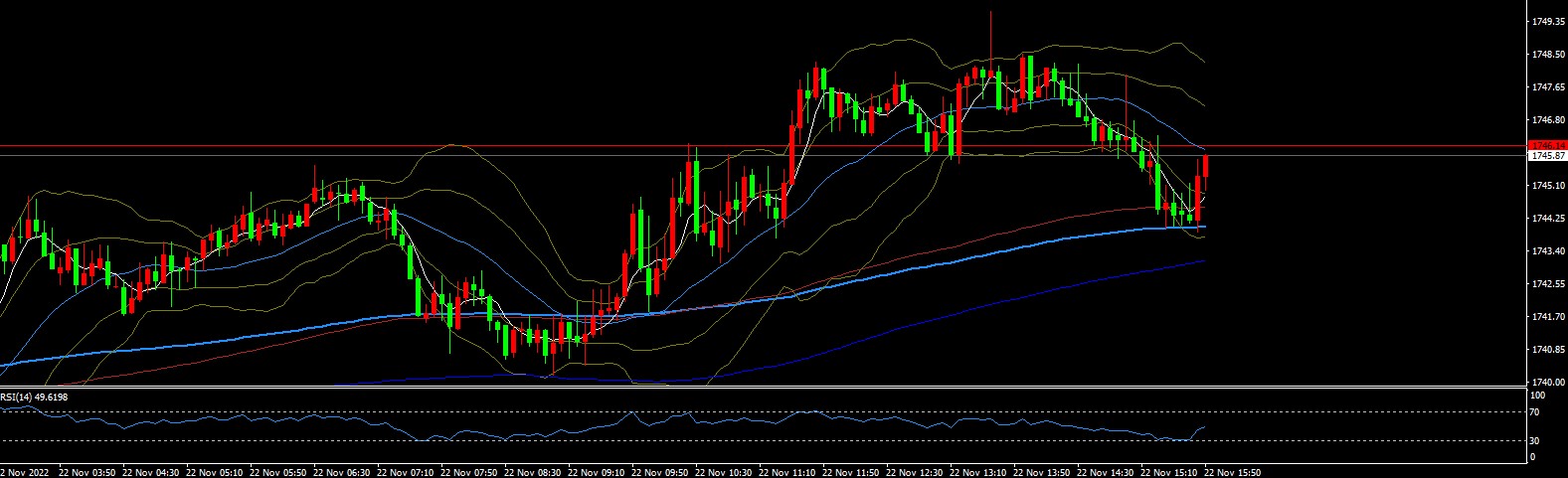

↑↑ AUDCAD, tested over ten years from 2010 to 2020!

By applying the strategy appropriately, long-term operation becomes stable as shown.

If you incorporate trends and fundamental analysis, which are hard to judge with an EA, performance can be multiplied many times.

Alternatively,not taking positions before employment data releasesor trading only in the direction of the trend,

are simple thingsto avoid unnecessary losses,and thus profits can be far higher than such an EA.

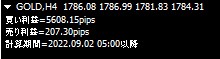

Also, we verified other currency pairs as a precaution.

AUDUSD ten years (2012–2022, up to today)

GBPUSD seven years (2015–2022, up to today)

In particular, recent performance is high and profits are continuing in real time.

By the way, the pound has also been traded through Brexit. The initial drawdown is the Brexit-driven trend, but

this too is managed well by the strategy to avoid losses.

There are many indicators or sign tools advertised as “winning,” but

the indicators that prove they could win are very rare.It’s

when you ask for details, the answer is often “it depends on discretion.”

If it’s all about discretion, you wouldn’t know whether a sign tool will win until you buy it,

and asking in the community every time a sign appears would be endless.

Discretion is indeed a factor, but

when using a sign tool, you want discretion to be about 20% and signs about 80%.

Also,studying the sign tool itself can be necessary, and it can be so complex that

you may become confused about what the correct method is!

Tenda Meijin calculates every indicator with internal variables and displays a sign that

“incorporates everything.”.

Thus, even a simple sign can clearly show the right answer.

If you’re going to buy, shouldn’t you choose a tool that can win?

Get a free “Strategy Manual” that proves its effectiveness

Limited-time availability of the automatic tool password

The automatic tool based on the EA used for verification is available to a limited number of people!

Moreover, purchases are valid only until the end of December!We will never sell it again!